Mega ships bring benefits and challenges to ports of L.A. and Long Beach

- Share via

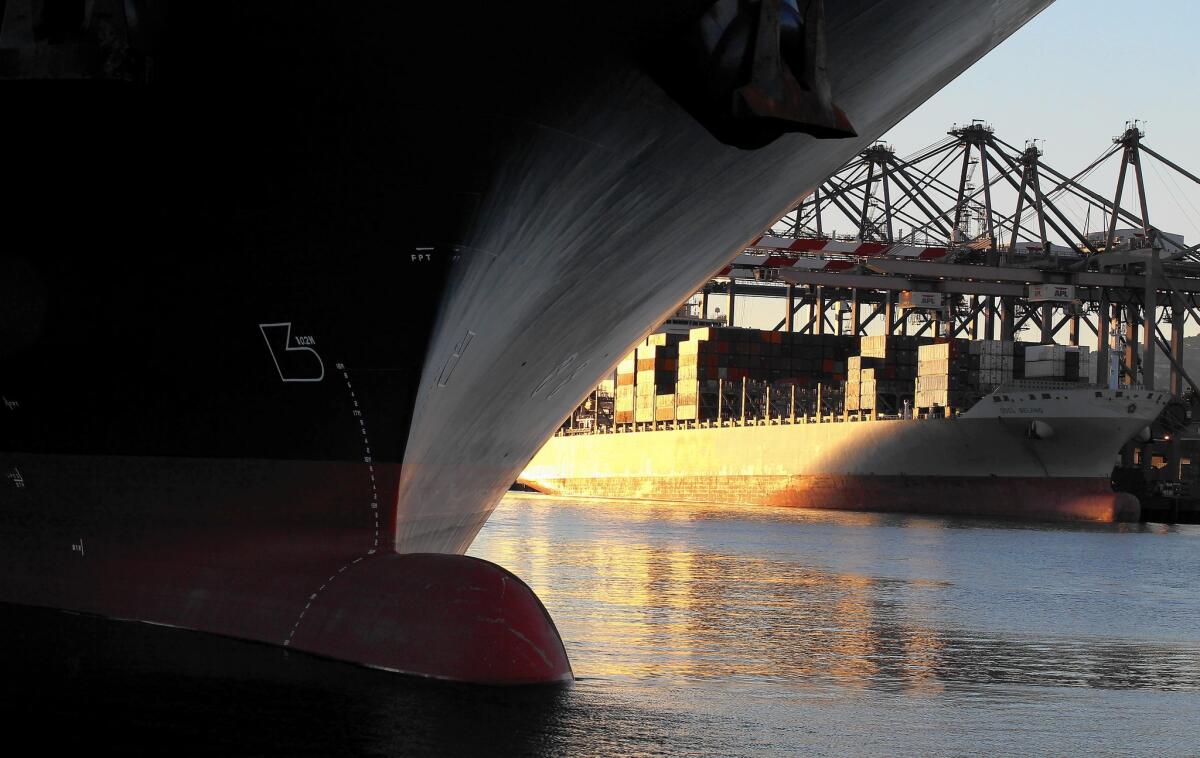

The largest container ship ever to unload in North America arrived at the Port of Los Angeles on Dec. 22. Four days later, an even bigger one showed up: the CMA CGM Benjamin Franklin, a ship just about as long as the Empire State Building is tall.

The advent of the two mega ships — capable of carrying twice as much as the largest ships arriving five years ago — is a sign of the rapid changes underway in the global shipping industry as ocean carriers seek to cut costs through economies of scale.

Now that revolution has landed on U.S. soil, with the ports of Los Angeles and Long Beach the first to benefit and also to contend with the challenges such ships bring.

The rapid increase in the size of the average ship already has posed problems for many U.S. ports, where infrastructure improvements such as deeper channels and larger cranes have come more slowly than in Asia or Europe. Bigger vessels bring larger cargo volumes all at once, stressing each link in the supply chain, including the dockworkers who unload the ships and the truck drivers and rail carriers that ferry goods throughout the country.

Join the conversation on Facebook >>

“Everything has been built around what the status quo is now, and you’re upping the ante here,” said Jim Blaeser, a maritime analyst at global consulting firm AlixPartners.

The new mega ships, which can cost more than $150 million each, have docked at Asian and European ports for roughly the last five years. But shipping companies are now looking to use them more on the transpacific trade routes between Asia and the United States, a bright spot compared with European routes despite slower economic growth in China.

The Benjamin Franklin is expected to call again at the Port of Long Beach in February and may also unload at the Port of Seattle, according to officials at both ports.

Since the Great Recession crippled global trade, the shipping industry has gone through waves of cost-cutting and consolidation. In an effort to gain market share and efficiency, companies raced to build larger ships that could move more goods on less fuel. Remarkably low borrowing costs made the building boom that much easier.

But that strategy backfired as the growing supply of vessels outstripped demand. A November report from Moody’s Investors Service estimated that global container ship capacity through the end of 2015 would increase 8% to 10% but demand would grow only 3% to 4%.

That disparity has caused cargo rates to fall, while revenue for the top 15 publicly traded shipping carriers is still off about 16% from a 2008 peak, according to an industry analysis by AlixPartners.

That hyper-competitive environment is what led French shipping company CMA CGM to lay the groundwork for sending mega ships to the West Coast. The trip by the Benjamin Franklin was arranged by an alliance that included United Arab Shipping Co. of Dubai and China Shipping Container Lines of Shanghai, part of an industry trend toward vessel-sharing agreements to ensure that the large ships are full.

Marc Bourdon, president of CMA CGM America, said his company is “systematically under pressure” to drive down costs as much as possible. The only way that can be achieved, he said, is through larger ships.

“If you’re looking at the L.A.-Long Beach port complex, there’s enough cargo to justify this vessel,” Bourdon said of the Benjamin Franklin, which left Los Angeles for Oakland on Tuesday night. “But the infrastructure has not been up to the job.”

SIGN UP for the free California Inc. business newsletter >>

In addition to Los Angeles, Long Beach and Oakland, the ports of Seattle and Tacoma also have terminals large enough to accommodate such ships. The Canadian Port of Prince Rupert in British Columbia expects to be able to handle such vessels by 2017, followed by the Port of Vancouver early next decade.

The Benjamin Franklin is expected to call again at the Port of Long Beach in February and may also unload at the Port of Seattle, according to officials at both ports. Bourdon said the company could start regularly running such mega ships across the Pacific by the end of next year.

Beginning in October, executives with the company and the Port of Los Angeles started discussing the possibility of berthing a ship such as the Benjamin Franklin, which has a capacity of 18,000 TEUs, a measurement for the size of shipping containers. Before last week, the largest ship to dock in Southern California held 14,000 TEUs. The Maersk Edmonton, which arrived in Los Angeles a few days before the Benjamin Franklin, had a capacity of 15,000 TEUs.

To prepare for the arrival, officials with the port, the shipping line and the dockworkers’ union said they had been coordinating for weeks to ensure that the cargo could be unloaded without disrupting the normal work flow. That involved pre-staging rail cars at the port and coordinating with truck drivers to avoid bottlenecks on the docks.

Here’s a sense of the ship’s volume: If all the containers on a fully loaded vessel were lined up end to end, they would stretch from Santa Monica to Santa Barbara. The ship was about 80% full when it arrived at the Port of Los Angeles, said Bobby Olvera Jr., president of the San Pedro Bay chapter of the International Longshore and Warehouse Union.

Over four days, dockworkers in Los Angeles unloaded about 11,200 containers carrying furniture, garments, electronics, automotive parts, toys and other retail products.

Gene Seroka, executive director of the Port of Los Angeles, said the port had an unusual amount of detail about the ship’s cargo — how it was stowed, where it was going — almost two weeks before it arrived. That compares to a typical lead time of less than two days, he said.

“We had a real good view of how much cargo was going to go on the rail and how much on the dock,” Seroka said. “We don’t always have that.”

On larger ships, that information is especially valuable because many shipping companies have formed alliances to keep vessels fully loaded. With cargo from multiple shipping lines on board the Benjamin Franklin, the unloading and sorting process was much more complicated for longshoremen on the docks.

“It’s like a jigsaw puzzle,” Olvera said. “You’re seeing larger ships, and you’re also seeing more combinations of cargo on those ships.”

Olvera said the union and port officials were involved in discussions as the cargo was being loaded in China and South Korea — something he said should become the norm.

Bourdon, of the shipping line, agreed. “Not only is it possible, but it must happen,” he said.

The arrival of larger ships could also give West Coast ports an advantage over East Coast and Gulf Coast ports such as New York/New Jersey and Houston, which have tried to grab larger slices of trade with China.

Most of that cargo moves to the eastern United States through the Panama Canal, but that channel is constricted by size. The existing locks can handle ships that carry about 5,000 TEUs; even after an expansion is complete next year, the newly widened canal will only be able to accommodate vessels carrying up to 13,000 TEUs.

Experts said it will be challenging for the ports to maintain the level of planning and coordination that went into the arrival of the Benjamin Franklin. Paul Bingham, a trade economist with Economic Development Research Group Inc., said the ship arrived at a downtime between Christmas and New Year’s Day. That meant there wasn’t a lot of pressure from customers needing speedy delivery.

“This is not normal operating conditions, to be able to set up and prepare for this vessel call,” he said. “It’s extremely unlikely that this could be sustained routinely.”

The trip by the Benjamin Franklin was arranged by an alliance that included United Arab Shipping Co. of Dubai and China Shipping Container Lines of Shanghai, part of an industry trend toward vessel-sharing agreements to ensure that the large ships are full.

Nonetheless, Bingham said Southern California ports are under immense pressure to prove that congestion issues are being addressed. Early this year, ports along the West Coast faced huge backlogs amid a contract dispute between the dockworkers’ union and shipping lines — one that led to a partial shutdown of the ports in February.

Even before that, the ports had been struggling with other logistical challenges stemming from the larger ships and alliances.

“There’s a lot of signaling going on here,” Bingham said. “But now they’ll be able to say, with some credibility, that a vessel of this size can come to U.S. ports. It’s not just hypothetical anymore.”

Times staff writer Andrew Khouri contributed to this report.

ALSO

Higher pay, hoverboards and vaccinations: Hundreds of new laws in California

Sex-crime charge marks a turning point in the Bill Cosby saga

Texas ‘affluenza’ teen is fighting deportation from Mexico; mother arrives in L.A.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.