To help rein in healthcare costs, give ‘narrow networks’ a try

- Share via

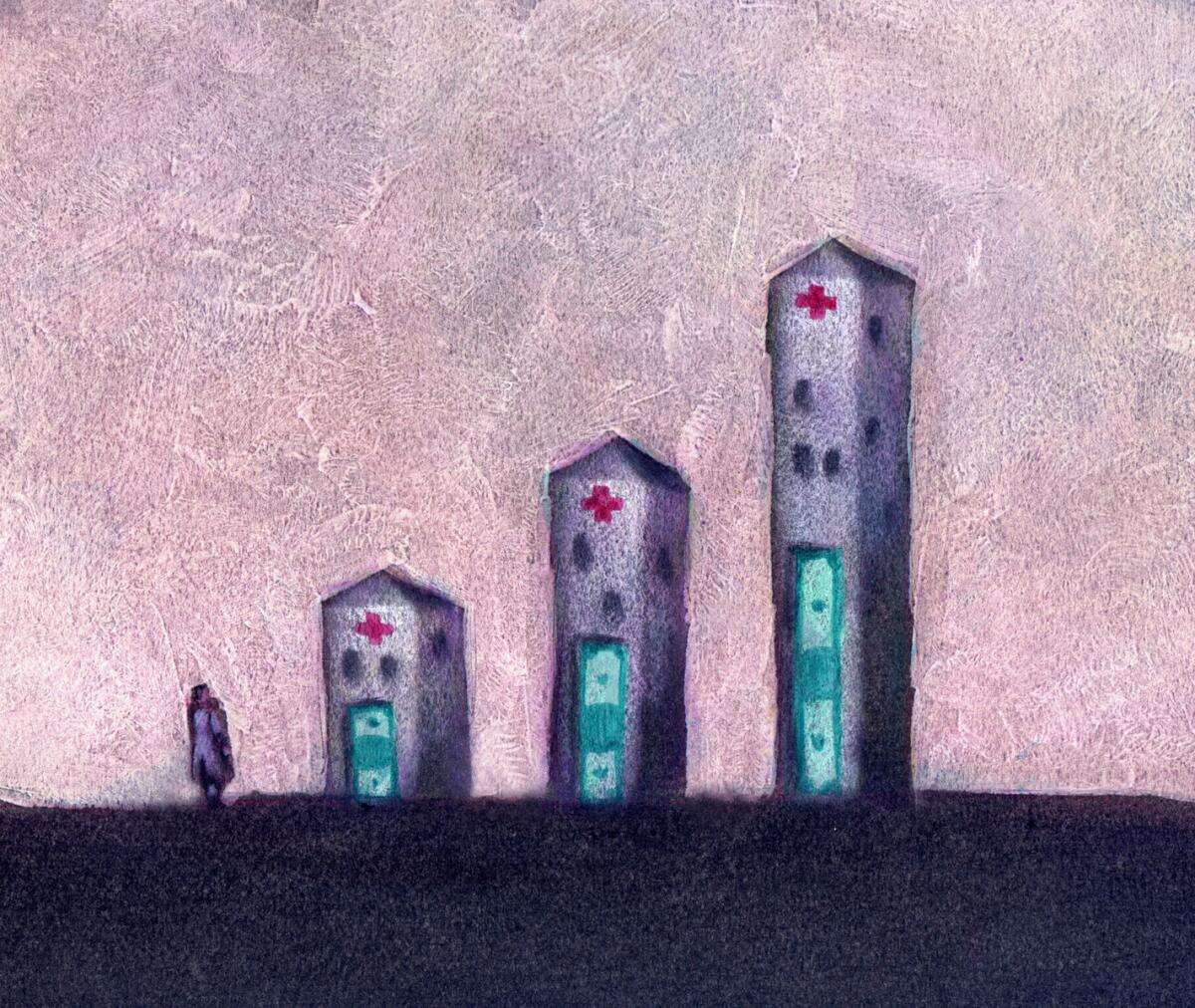

In an effort to cut costs, many insurers in the new state health insurance exchanges are offering plans with “narrow networks” that include fewer doctors and hospitals — particularly the costlier ones with famous names, such as Cedars-Sinai. The trade-off has sparked complaints from some policyholders who’ve had trouble seeing their favorite doctor or, in some cases, any doctor in the right specialty. Although regulators have to address those issues, narrow networks can actually be a good thing for patients if done the right way.

Insurers started limiting their customers’ choice of providers long before the Affordable Care Act passed in 2010, steering patients to preferred doctors and hospitals through restrictive HMOs or more inclusive — and popular — PPOs. But aside from the occasional high-profile dust-up, such as Blue Shield’s spat with UCLA Medical Center in 2012, insurers hesitated to exclude providers from their networks when costs went up. Instead, they just passed on the increases to their customers in the form of higher premiums.

What’s different now is that the state exchanges give consumers their first real opportunity to choose between wider networks and lower premiums. In states such as California, where the plans on the exchange have standardized benefits, one of the few ways left for insurers to compete is through the composition of their networks. By excluding high-cost doctors and hospitals, insurers here have found that they can cut premiums by 10% or more.

Of course, they wouldn’t try to peddle narrow networks if they didn’t think the public wanted them. In focus groups conducted last year, insurers found that most consumers chose lower premiums over broader networks. It’s not an irrational choice; researchers have found no more than a tenuous connection between the prices charged by providers and the quality of their work. But narrow networks are more likely to appeal to people who are relatively healthy, not to those who are ailing and who rely on an existing team of doctors to treat them.

The shift to narrower networks has been rockier than it should have been. Covered California, the state’s exchange, struggled to provide accurate lists of the provider networks included in each plan being sold. Although it’s no mean feat technologically to compile such lists, they are absolutely crucial to consumers. And the federal government didn’t do enough in the first year to make sure the plans insurers were selling through the federally managed exchanges had an adequate supply of doctors, specialists and hospitals in their networks. Washington recently announced that it will increase its oversight of the plans’ networks in the future.

Still, having narrower networks as an option is a step toward a more competitive and efficient healthcare system. If consumers move en masse toward less-expensive plans, the message to high-cost medical practices will be clear: Efficiency matters. That’s an important part of the process of slowing the growth of healthcare costs.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.