Tea partiers shut down the government, and all they get is a T-shirt?

- Share via

If I were an entrepreneur in Washington, I’d be racing to print a bunch of T-shirts that said, “My tea party Republican shut down the government, and all I got was this lousy income verification mandate.”

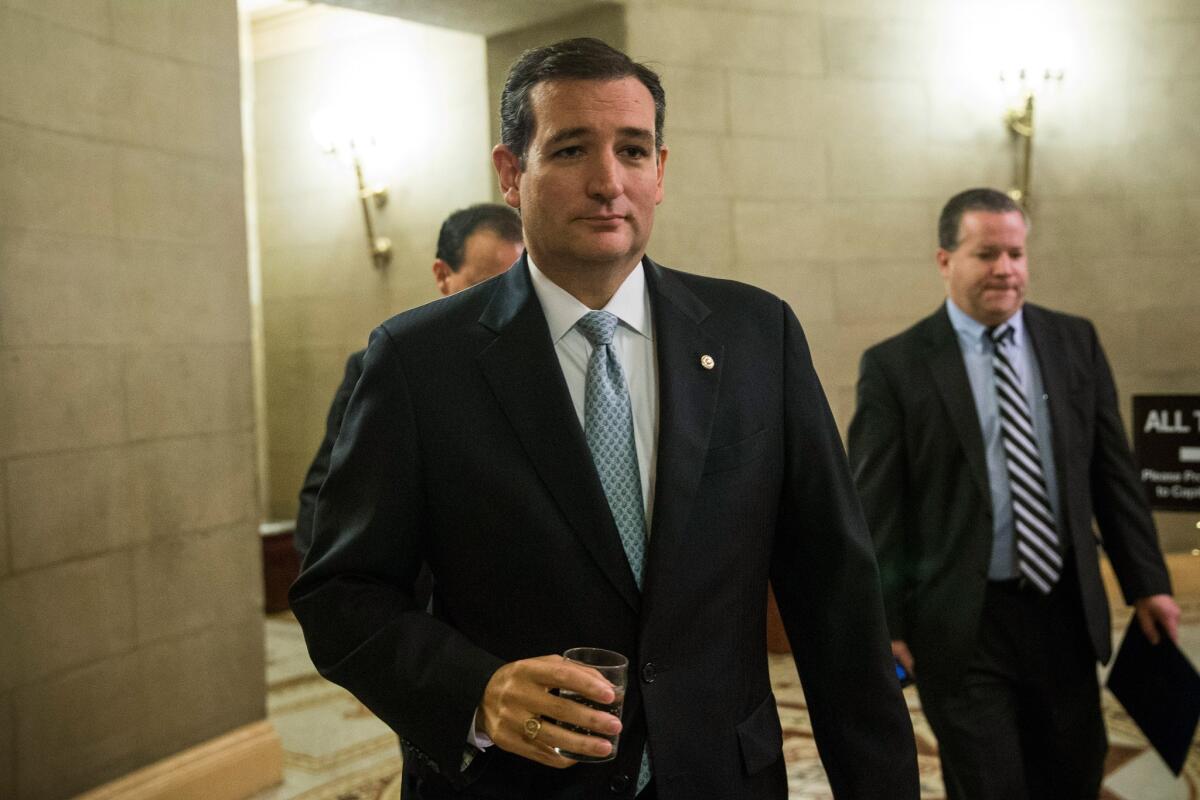

OK, so maybe that’s not so snappy. But the point is a good one: After precipitating a government shutdown in a quixotic attempt to derail the 2010 healthcare law (better known as Obamacare), Sen. Ted Cruz (R-Texas) and his fellow tea party Republicans came away with a relatively minor change in the statute ... and nothing else. No funding cuts, no delays, no exemptions.

The change concerned how the government will guard against people fraudulently obtaining the health insurance subsidies the law created for low- and moderate-income Americans. Under the law, those subsidies are available only to citizens and lawful residents whose employers do not provide affordable coverage and who earn 133% to 400% of the federal poverty level (currently, a little less than $11,500 for a single individual).

PHOTOS: Tea party backlash: Protest signs to cheer you up

Critics of the law have asserted that the new federal and state exchanges will issue subsidies on an “honor system,” with no verification of eligibility. That would invite large-scale fraud if it were true -- but it isn’t.

The government’s goal is to verify eligibility automatically by checking various federal and state databases to determine an applicant’s immigration status and income. The Department of Health and Human Services issued a regulation this summer dictating how this will be done by the new insurance exchanges run by the federal and state governments. Among other things, the rule requires the exchanges to verify applicants’ income against their tax returns and Social Security records, and if those aren’t sufficient, to check the wage reports compiled by Equifax. If all that fails on any given application, the exchange must demand an explanation or documentation from the applicant.

The only thing approaching an honor system is when an applicant claims an income that is more than 10% less than what IRS and Social Security records indicate, there’s no Equifax data available and the applicant cannot provide a reasonable explanation for the discrepency. Although the federally run exchanges will require all such applicants to submit documents to support their claims, the regulation allows state exchanges to require documentation just from a statistically significant sample of those applicants.

The one real weak spot in the process is in verifying that the applicant doesn’t have access to affordable coverage at work. That’s because the Treasury Department delayed for a year the requirement that employers report which workers are offered affordable insurance plans, and thus are ineligible for federal subsidies.

Still, the system gives subsidy applicants the same presumption of honesty (at least when it comes to that aspect of their eligibility) that the IRS routinely gives taxpayers when it comes to withholding or estimated taxes. Those who succeed in fooling the system on the front end will still face enforcement on the back end. The data that the IRS will collect in 2015 will help the feds to identify those who received improper subsidies, either because their incomes were higher than they claimed or their employer had offered them affordable health coverage.

Which brings us to the bill to reopen the government and keep the Treasury Department from defaulting. It includes a modified version of HR 2775, a bill the House passed in September to bar premium subsidies until the inspector general at HHS certifies that “there is in place a program that successfully and consistently verifies” that applicants meet the law’s “household income and coverage requirements.”

The new version requires the secretary of HHS to certify that the exchanges verify applicants’ eligibility before the subsidies can start to flow. It also requires HHS to reveal to Congress the details of the exchanges’ verification procedures by Jan. 1, the day subsidized coverage becomes available. Finally, it orders the HHS inspector general to report to Congress by July 1 on the effectiveness of those procedures and other safeguards against inaccurate and fraudulent applications.

The Obama administration sharply criticized HR 2775 last month, saying the pre-certification requirement from the inspector general would make it hard to open the exchanges as scheduled on Oct. 1. It also said the bill was unneeded because “the secretary of Health and Human Services has already put in place an effective and efficient system for verification of eligibility for premium tax credits and cost sharing reductions.”

A spokeswoman for HHS declined to comment Wednesday on the new income verification provision, saying the department had not yet had a chance to review it.

ALSO:

McConnell delivers; Boehner can’t

Tea party wants to take America back -- to the 18th century

Follow Jon Healey on Twitter @jcahealey and Google+

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.