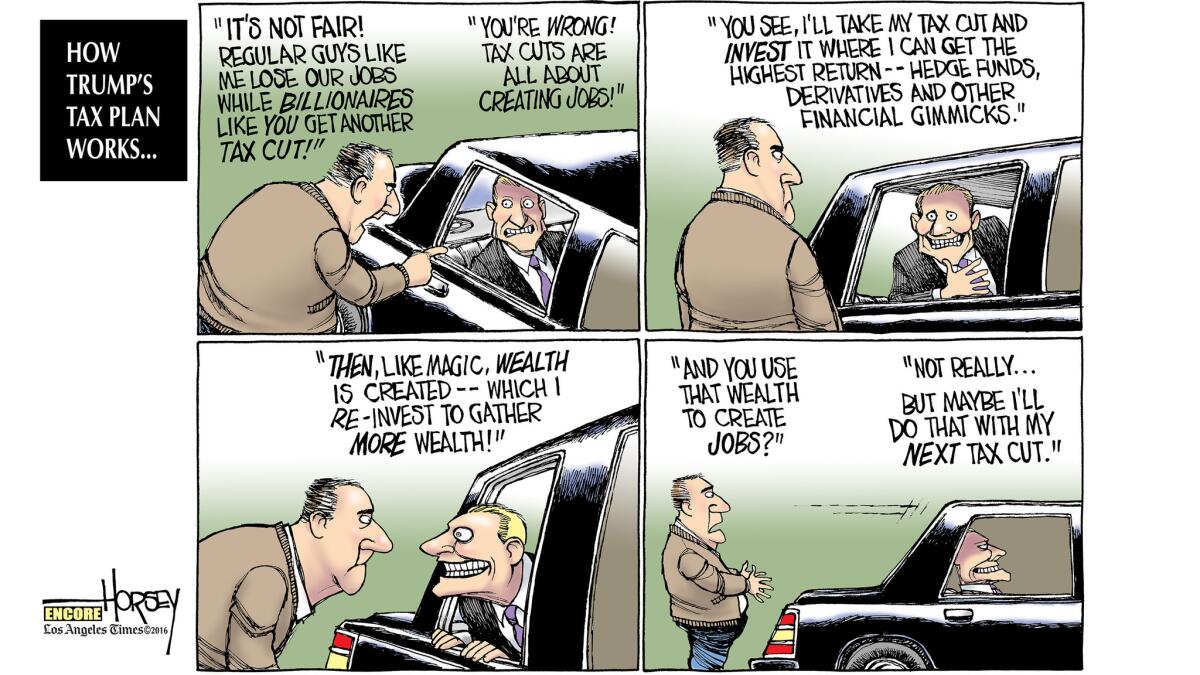

Trump’s tax scheme serves the rich, not working-class white guys

- Share via

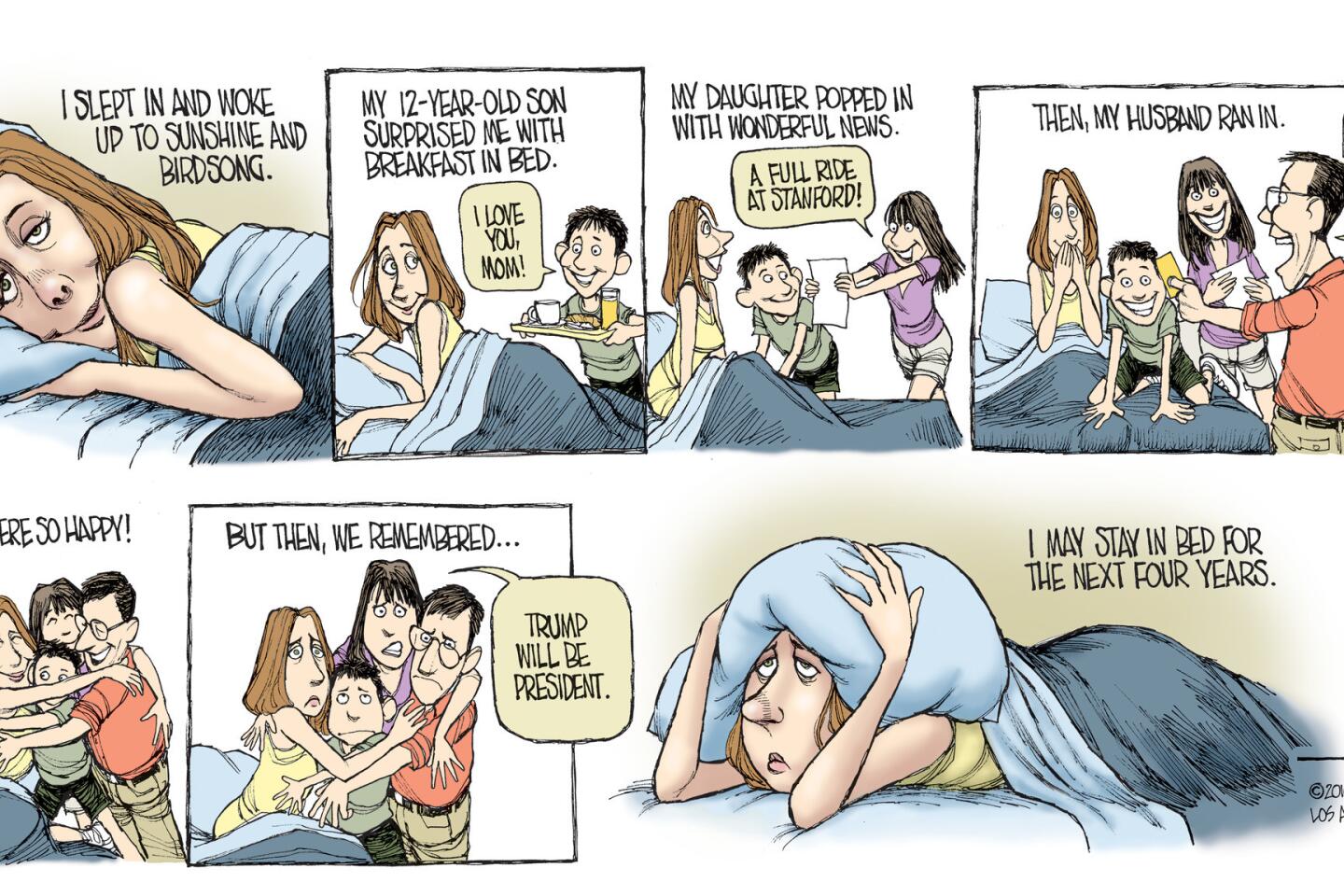

I ’ve got a cowboy friend who plans to vote for Donald Trump, the same choice being made by millions of other working-class white men. Outside of my job, I generally avoid political arguments, but I did tell my friend that I am pretty certain he and other voters like him will end up very disappointed by the real estate mogul if he should become president. Despite his boasts, Trump is no champion of the working class.

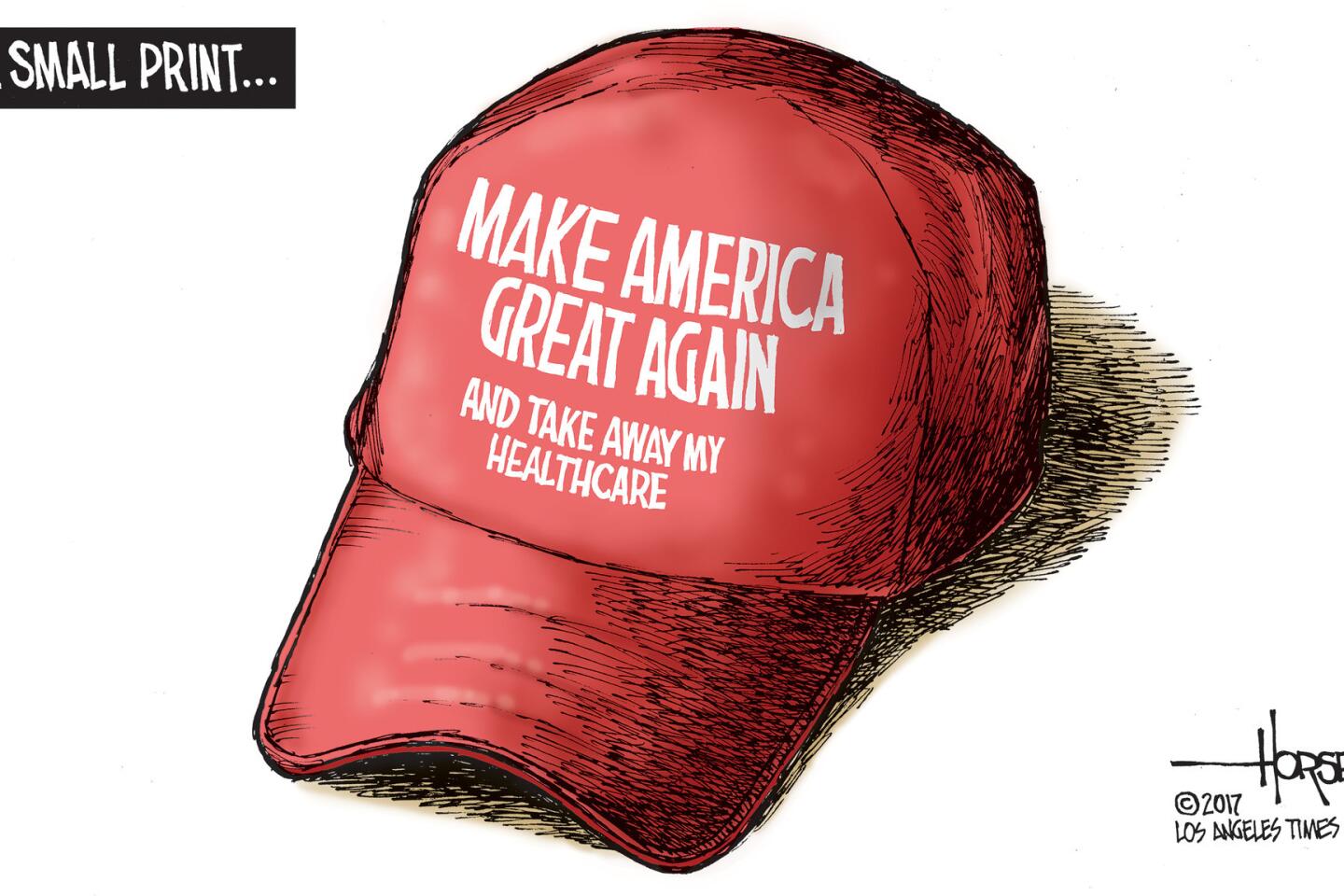

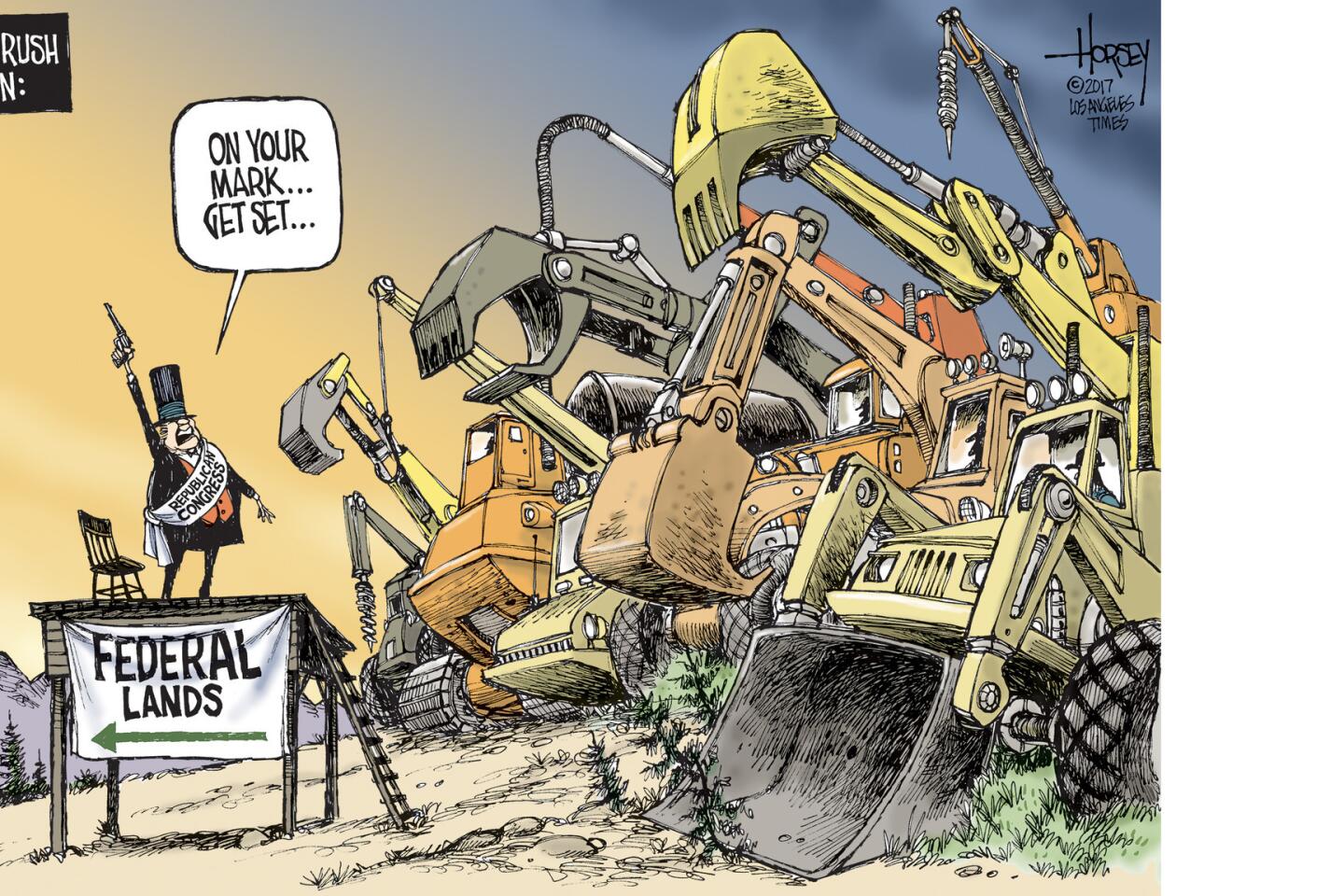

Trump’s latest tax proposal is proof of that. It is nothing more than a reconstitution of the standard Republican trickle-down economics that have benefited big corporations and a wealthy few for more than a generation while leaving American workers — including quite a few cowboys — mired in economic stagnation.

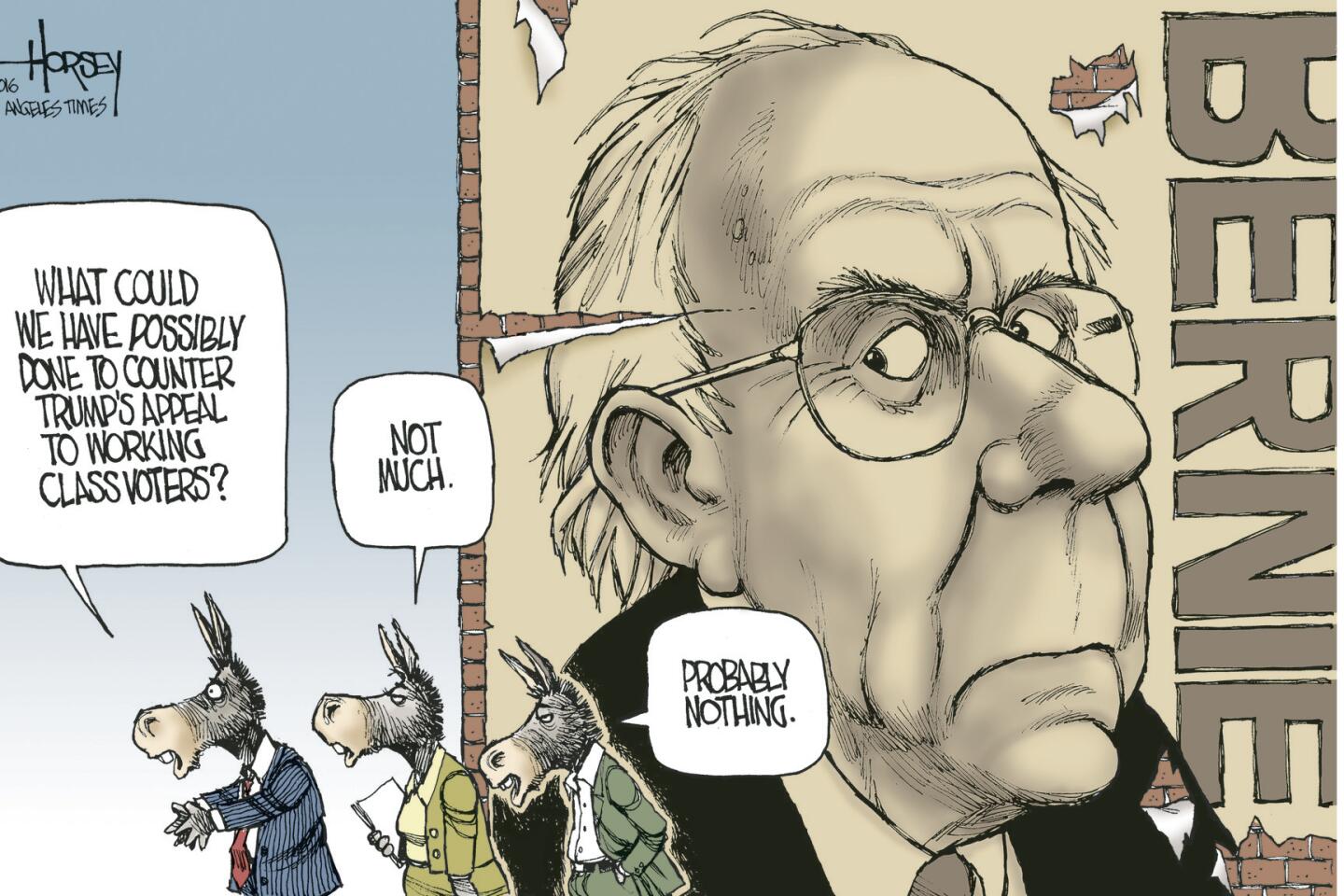

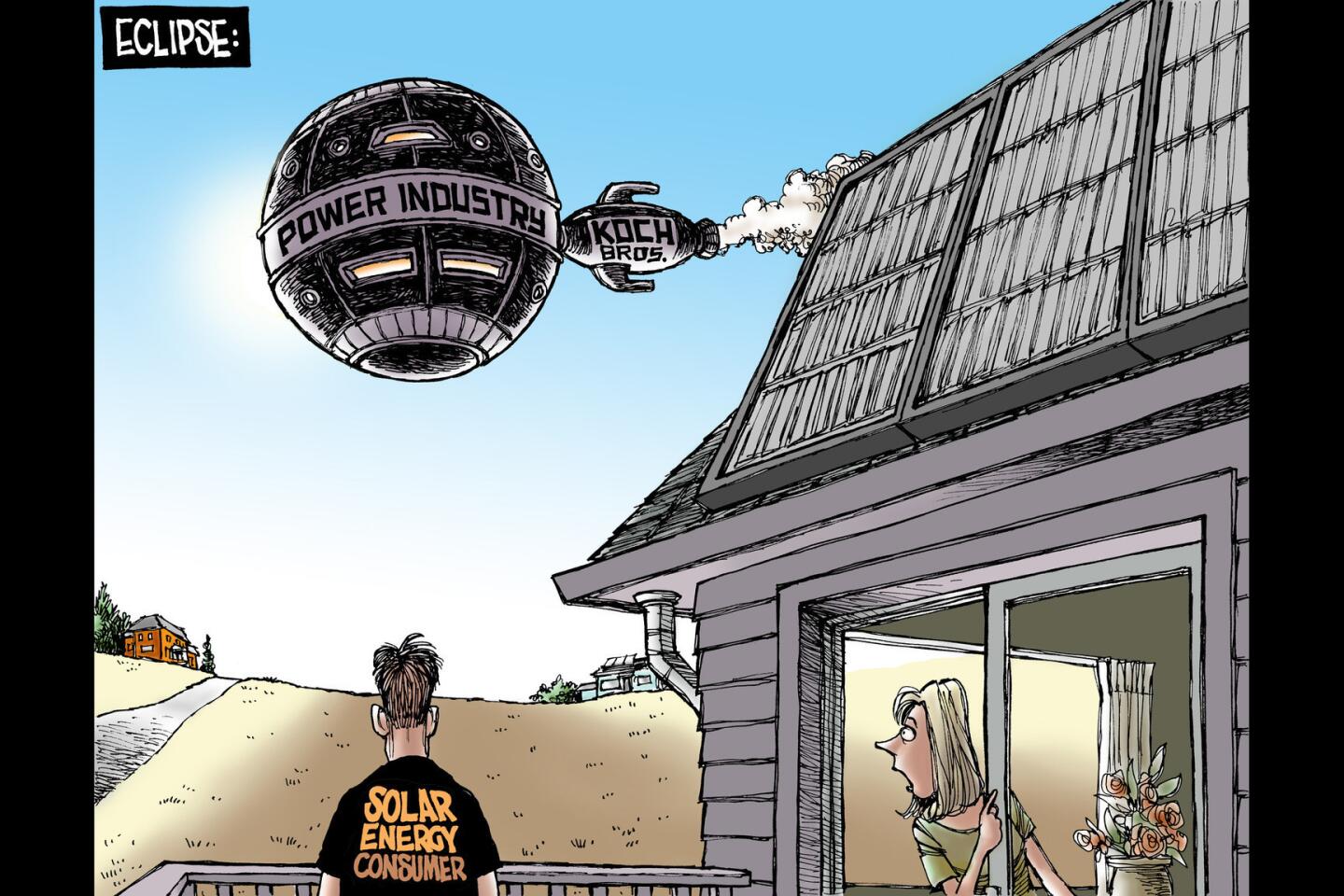

Anyone who has heard a Bernie Sanders speech knows that the richest one-tenth of 1% of Americans now own as much wealth as the combined wealth of the lower 90% of this nation’s people. Rather than trickle-down, there has been a dramatic trickle-up effect in recent decades as a tiny few have gathered to themselves more and more of the fruits of an economy from which working people have received less and less. This phenomenon has been enhanced by several rounds of Republican tax cuts for the rich that promised more jobs and better pay but never delivered.

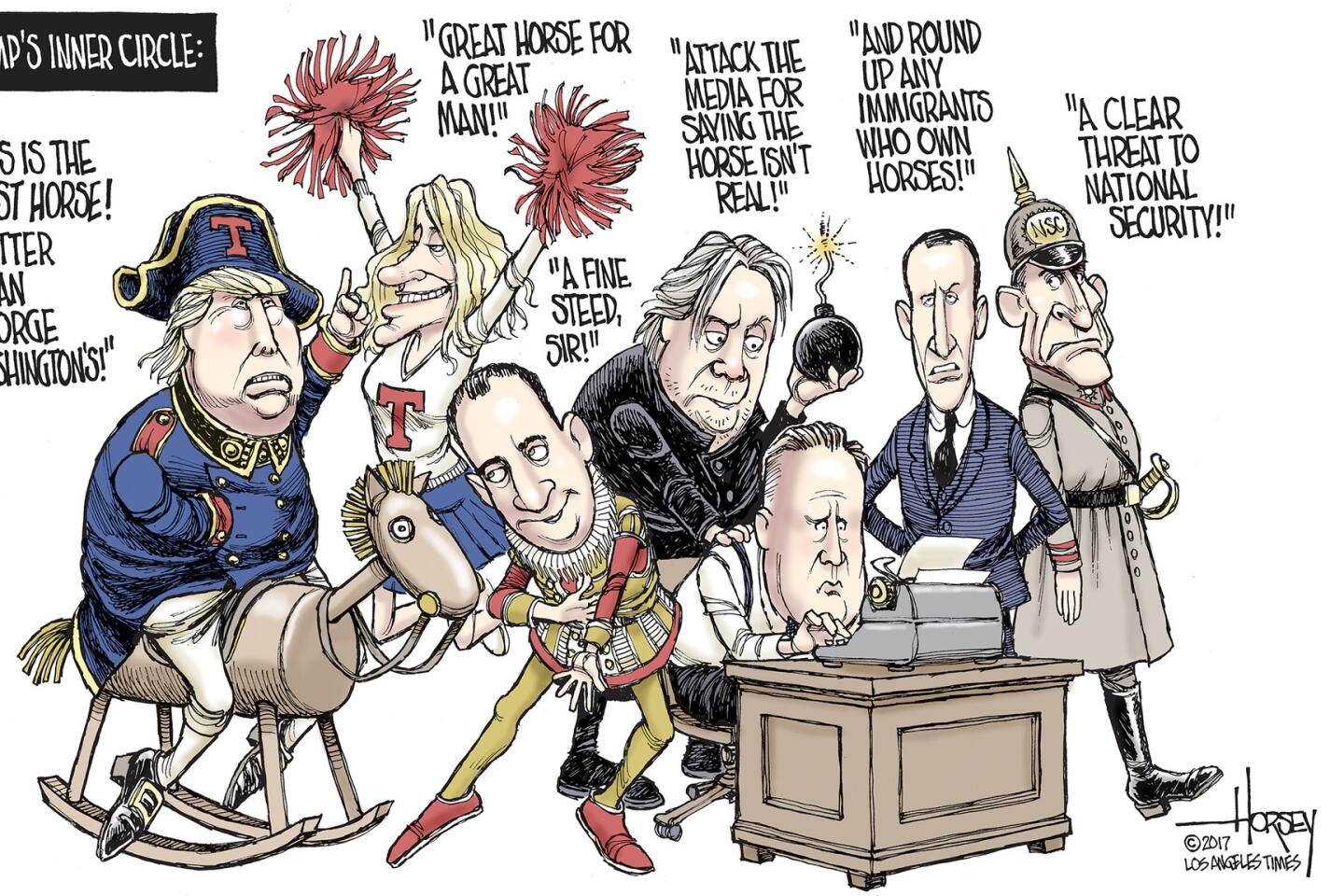

Finally, in this election, voters have displayed a deep anger directed at the unfairness of this country’s current economic arrangements. Trump has helped stoke this anger and it has driven his successful campaign for the GOP presidential nomination. He has promised to fix a rigged system. His tax plan, however, just continues the con job.

It is bad enough that what the nominee and his economic advisors propose is another windfall for a small number of extravagantly rich people and big corporations — a lowering of tax rates that many economists predict will drive up the federal debt by trillions of dollars. Adding insult to that injury is that the benefit to Donald Trump and his businesses would be huge — to expropriate one of Trump’s signature words.

First, as a wealthy man, Trump would get a nice payoff from his proposal to cut the top income tax rate. Then, he and his heirs would receive an enormous gift through the elimination of the federal tax on inherited wealth for couples who have assets of $10.9 million or more. As if that were not enough, Trump would receive enormous tax savings from the provision of his scheme that sharply reduces the tax rate for so-called “pass-through” entities, businesses that pay no corporate taxes but whose owners pay a personal rate based on the profits of their enterprises.

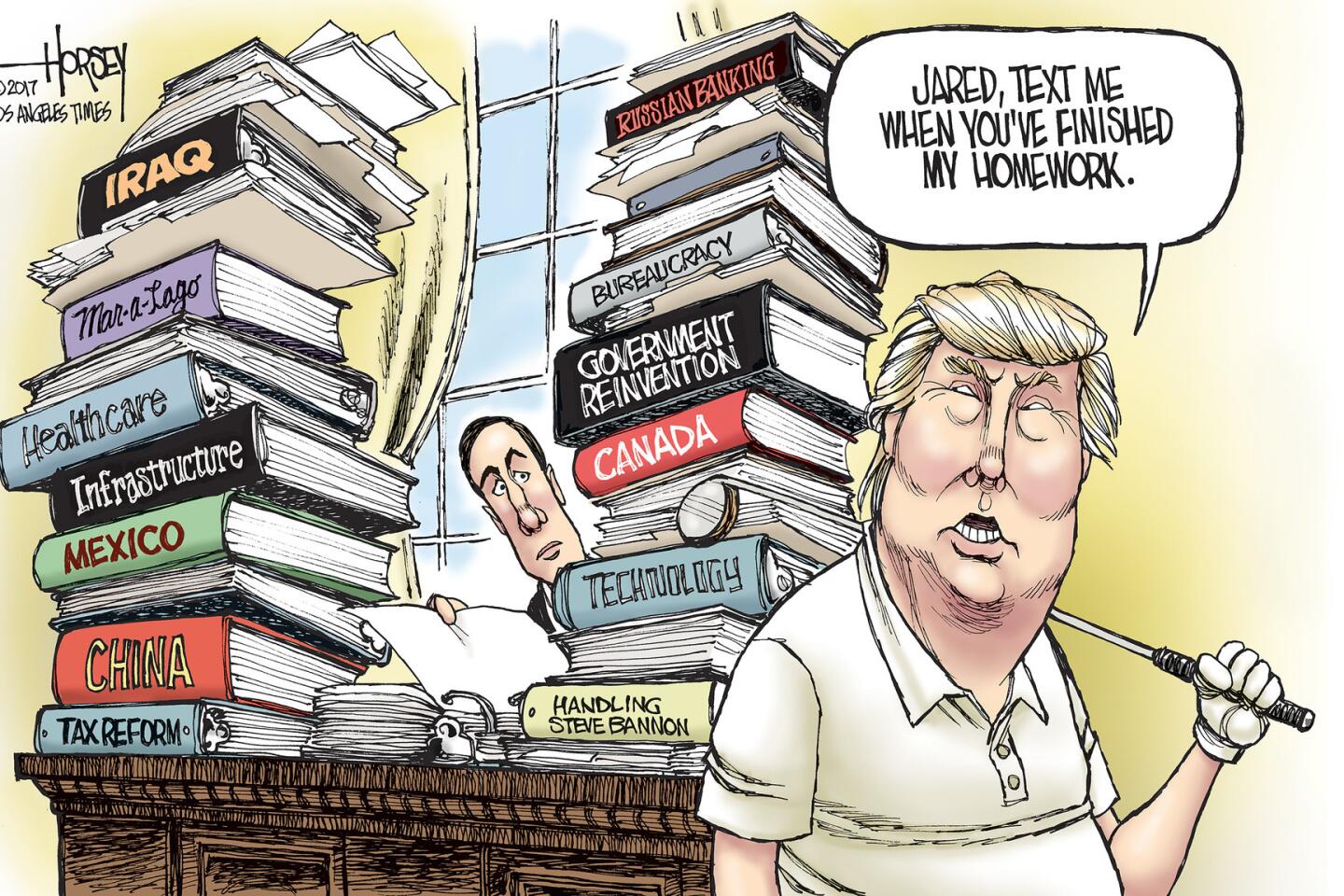

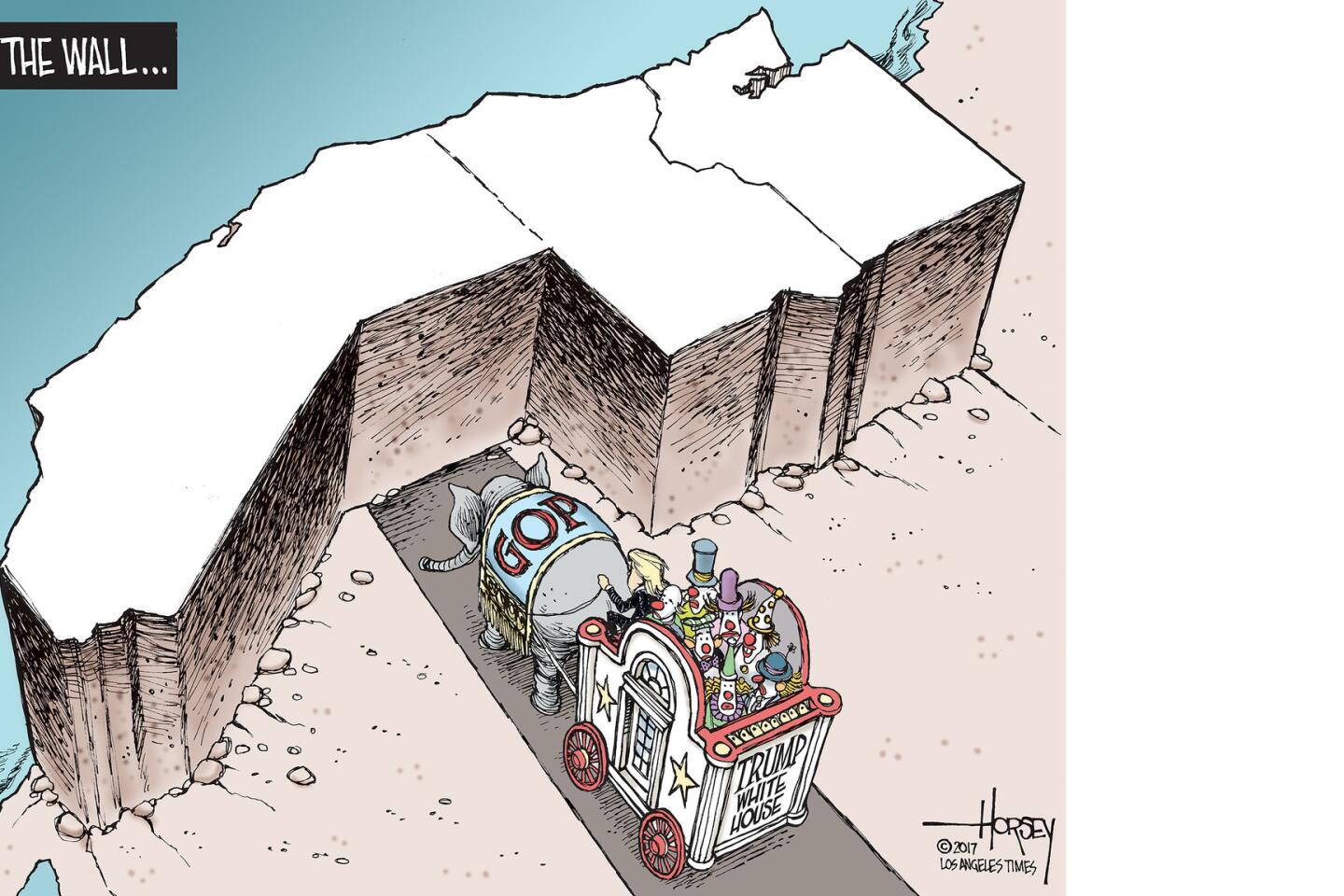

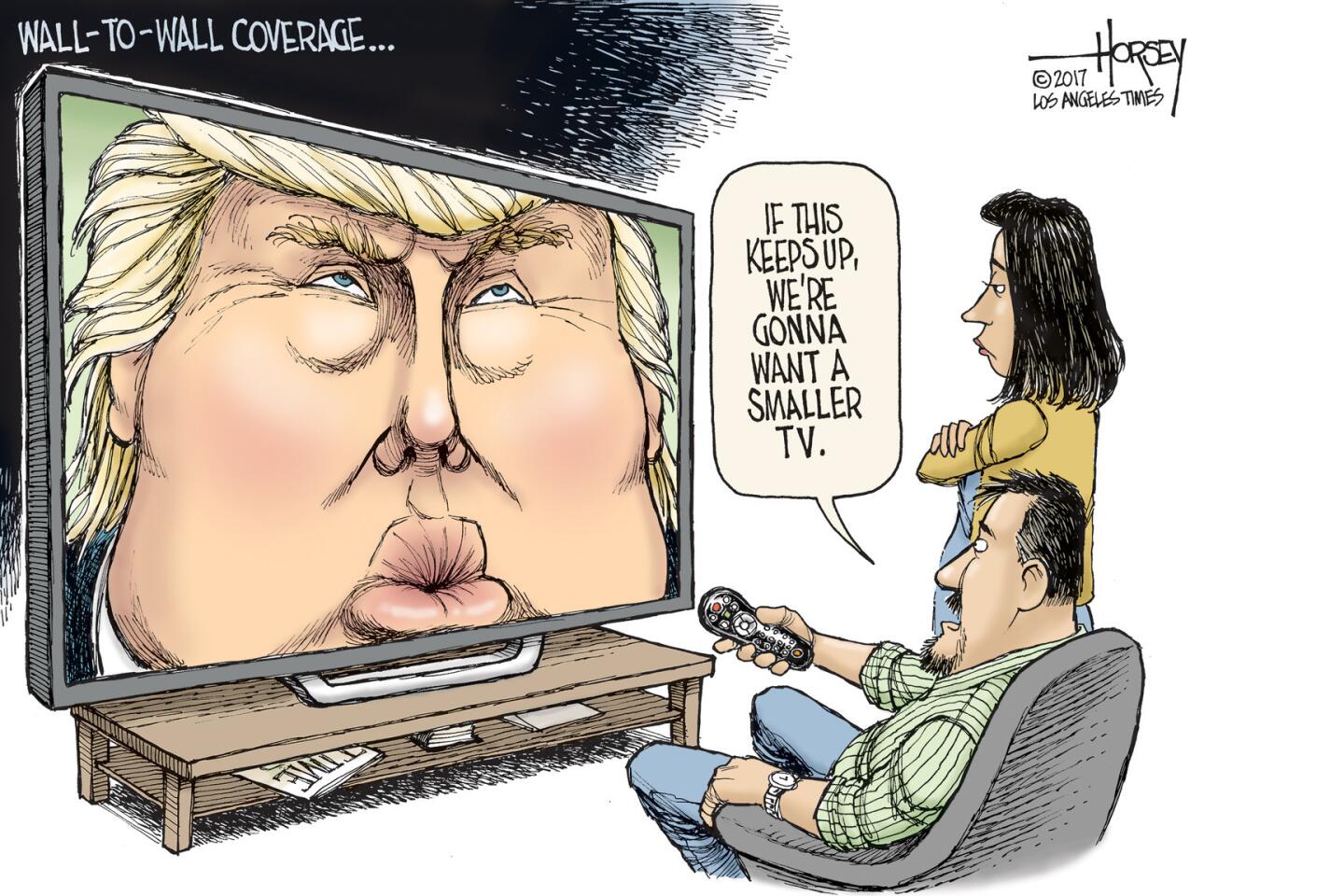

For more than a year as he has campaigned, Trump has offered mostly vague ideas about making better trade deals, getting tough with the Chinese and Mexicans and building a “beautiful wall” on the border, so it has been hard to judge exactly what he would do as president. The one area where he has bothered to offer specifics is tax policy. Those specifics do tell us something about a Trump presidency: He is not the radical reformer he claims to be.

Donald Trump is just another rich Republican who will serve his class, not the middle class and certainly not the working-class white men who are going to give him their votes.

Follow me at @davidhorsey on Twitter

MORE FROM DAVID HORSEY:

Sleek Olympic athletes shame flabby American desk jockeys

Panic in GOP ranks will not stop Trump from being Trump

Trump’s idea of sacrifice is all about amassing more wealth

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.