President’s Tax Proposals

- Share via

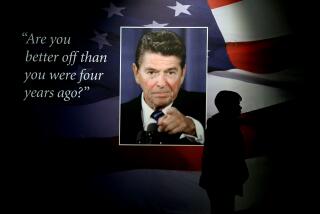

Reagan deserves high marks for his rhetoric and enthusiasm in presenting his tax plan. I cannot, however, agree with his emphasis on fairness, for he tossed a bone to the small taxpayer while preparing a feast for those at the top rungs of our economic ladder.

It distresses me to say this, for I have long been an ardent admirer of Ronald Reagan. But when the tax rate is lowered to a maximum of 17 1/2% for capital gains (long term is now six months) he is helping the speculators, the corporate raiders and the sure-thing big shots who vote themselves stock options that are not exercised until a profit is virtually guaranteed. Is that encouraging investment?

And what is fair about taxing so-called tax-exempt interest of certain Social Security recipients when no one else is so taxed?

While I am still inclined to give Reagan credit for good intentions, I am afraid he has become a captive of Donald Regan, beneath whose breast there beats a stock ticker instead of a heart.

SAMUEL KELLER

North Hollywood

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.