Nationwide Health Moving Offices to Newport Beach

- Share via

Pasadena-based Nationwide Health Properties Inc. said Monday that it will relocate its headquarters to Newport Beach this week and launch an ambitious plan to increase the number of nursing homes and other health-care properties it owns.

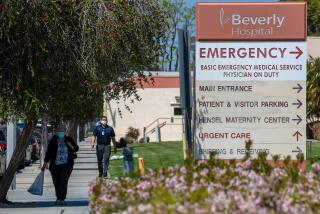

Nationwide, formerly known as Beverly Investment Properties Inc., is a publicly traded real estate investment trust that owns 82 nursing homes in 26 states and a rehabilitation hospital in Arizona. It recently paid off major bank debt and raised cash for its expansion

“My goal is to do $100 million of investments a year in health-care properties,” said R. Bruce Andrews, who was hired last fall as the trust’s president and chief executive officer.

Andrews said that being a Newport Beach resident for the last 12 years “clearly had a bearing” on Nationwide’s move to Orange County. But he said the main reason was that he was able to get an office for the trust’s six-person staff across from John Wayne Airport.

“Pasadena is pretty remote for getting into and out of airports,” he said. “For the most part, we’re traveling to look at possible acquisitions and also to review current holdings.”

Andrews said he is looking for a mix of acute-care hospitals, probably in the $30-million to $40-million range, and nursing homes in the $3-million to $4-million range. By law, a real estate investment trust can only be passive investors in land and cannot manage the property.

“Nationwide looks like a pretty healthy company that could stand a little more leveraging,” said Jack Oldham, a partner with the Kenneth Leventhal & Co. accounting firm in Newport Beach. “But that’s what got them into trouble in the first place.”

Nationwide, which changed its name last year, had a $120-million line of credit from a group of banks headed by First Interstate Bank. Nationwide was having some trouble paying off the credit, and First Interstate was worried that the trust was relying too much on Beverly Enterprises Inc. in Pasadena as operators of most of what was then 109 facilities, Andrews said. The bank wouldn’t lend the trust more money to buy additional properties.

Last year and early this year, Nationwide sold 26 facilities, raised $42 million in a new stock offering and completed a $33.5-million, 10-year bond sale. The effort allowed the company to pay off the bank line, reduce its overall long-term debt to $39 million and still have $20 million left over for more investments, Andrews said.

As part of its business restructuring, he said, Nationwide picked up a $40-million line of credit from a group of banks led by Wells Fargo Bank. It will start looking for new operators of health-care facilities, he said, and reduce its reliance on Beverly Enterprises, which now operates 68 of Nationwide’s facilities.

Beverly Enterprises, a huge nursing home owner-operator, had formed Nationwide as a real estate investment trust and owned 80% of it. In 1985, it took the trust public, kept 5% of it and wound up with an agreement to manage the trust.

But the nursing home company fell on hard times in recent years, and its woes affected the trust’s income. The trust’s directors ended the control agreement in late 1988 and looked into the possibility of selling out, Andrews said. They decided instead to stay in business and hired Andrews to operate the trust.

Andrews, 50, had worked for 17 years at American Medical International Inc., rising to chief financial officer and, later, to chief operating officer before leaving in 1986. An investor group that included AMI’s chairman, Harry J. Gray, and First Boston Corp. bought the firm last October and moved it to Dallas. Andrews also has managed two private companies in the electronics and home improvement fields.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.