Estate-Tax Burden Cancels Muppets Deal With Disney

- Share via

The prospect of enormously high estate taxes forced the cancellation of plans for Mickey Mouse and the Muppet’s Miss Piggy to tie the knot, industry analysts and sources familiar with the negotiations said.

The children of Muppet creator Jim Henson, who died in May, would have faced a 55% inheritance tax on the sale of the company to Walt Disney Co., said Jeffrey Logsdon, an entertainment analyst with Seidler Amdec Securities.

“The estate tax situation became so onerous to the children that they were unable to renegotiate the deal in a more tax-advantaged fashion,” Logsdon said.

Disney agreed in 1989 to acquire the licensing and publishing businesses of Henson Associates Inc. The company planned to make extensive use of the Muppet characters at Disneyland in Anaheim and its other theme parks.

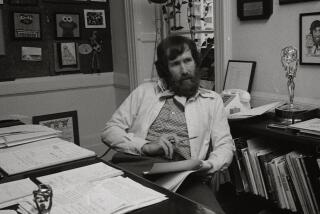

The deal called for Henson to enter into an exclusive 15-year production agreement with Disney. The deal was reported to be valued around $150 million. But Henson’s death from pneumonia at age 53 had cast a shadow over the deal, and Disney and Henson Associates said Thursday they ended their negotiations.

Sources said that although Disney had offered to increase its purchase price for the company and suggested other tactics to reduce the tax burden, the two sides were unable to reach an agreement.

Henson, creator of the beloved Muppet characters such as Miss Piggy and Kermit the Frog, is survived by his five children, ranging in age from 19 to 30.

Officials for Disney and Jim Henson Productions declined to comment.

“My guess is the next news coming from this company is when they have some news on production plans,” said Susan Berry, a spokeswoman for Henson Associates.

Production ventures with Disney, which were in the works before Henson died, will continue.

Those projects include a comedy on dinosaurs to be shown on ABC television, a 3-D Muppet film to be shown at Disney’s movie theme park in Florida, a stage show at the theme park and a cable TV show called “Jim Henson’s Mother Goose Stories.”

Asked if Disney might be interested into forging a future production agreement with Henson Associates, spokesman Erwin Okun said, “Certainly we would if both parties are amiable, but that’s without Jim Henson, so it would be under a different basis.

“It’s too early to say,” he added.

Although the Henson deal would have been a plus for Disney, the Burbank-based company known worldwide for its cartoon characters and theme parks will not suffer significantly without it, Logsdon said.

The main advantage to Disney would have been the long-term creative alliance with Henson and his Muppet puppets, he said.

“They could have grown and cross-pollinated that line,” he said, “but I don’t see Disney being stifled creatively at all.

Since Henson’s death, the company has been run by Henson Associates President David Lazer. In addition, two of Henson’s children are involved in the company, one as a puppeteer and director and one mainly in the Sesame Street operations.

Henson’s Sesame Street characters, including Big Bird, Bert and Ernie and Cookie Monster, were not included in the Disney agreement. The Sesame Street characters are all licensed long-term to The Children’s Television Workshop, producer of the television show.

The Muppets were expected to make their debut this year, joining the Disney characters in welcoming guests to Disneyland. There were also plans for a stage show and Main Street parade using the Muppet characters at the park.

Times staff writer Chris Woodyard contributed to this report.

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.