German Firms Vie for TV Rights Deals

- Share via

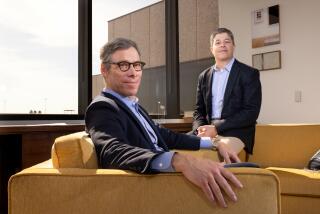

CANNES, France — Jan Mojto, managing director of the Kirch company Betafilm, and Helmut Thoma, chief executive of RTL Plus, have a lot in common. Neither was born in Germany--Thoma comes from Austria and Mojto from Czechoslovakia. Both have a wry sense of humor, are snappy dressers, and both were at the MIP TV market here last week trying to clinch output deals for their German companies with MCA Television.

When Viacom announced a 10-year deal for rights to its programming that could be worth as much as $2 billion with Germany’s Kirch Group last month, Hollywood and Wall Street sat up and took notice. As Thoma put it: “Americans have realized that somewhere in the eastern part of the world there is a place called Germany.”

The Viacom deal is just the latest in a series of large Hollywood-Germany rights deals over which RTL and Kirch have fought. Lately, Kirch has been the winner. Germany, Europe’s strongest economy, had no private television stations 15 years ago. It now has as many channels per capita as the United States. Plans calling for a whole range of digital channels would add to the number. Competition among these channels, and in particular the battle between the 12-year-old commercial broadcaster RTL and 40-year-old broadcaster-distributor Kirch, has helped Hollywood studios triple the revenue from the region in the past five years.

MCA is setting up an auction for broadcast rights to its films and TV shows in Germany at a time of hot competition. So far this year Kirch has signed huge deals--with Viacom and with Columbia for rights worth as much as $900 million.

“This is a huge price to pay for these deals; I don’t really see how they can get the money back,” said Thoma, 56, who was outbid on both packages.

Those two deals came after a Warners Bros. deal last year with RTL worth $219 million over three years, and a $30-million Kirch deal for a range of Steven Spielberg titles from Universal.

*

MCA plans conclude its latest auction in June, and the company has given no hints about who the leading bidder is. In any event, it appears that the winning price will be on a par with the Viacom and Columbia deals.

Thoma thinks RTL’s chances of retaining the MCA rights--which it controls until 1997--are about 50-50.

“Kirch was in a fantastic position as a buyer for so many years that he thought it could never change,” Thoma says of Leo Kirch--owner, founder and chairman of the Kirch Group. “But when we won the Warner deal, he was very shocked and was really in a desperate position--he has changed his strategy 100% and he is willing to spend a lot of money to retain rights to programming.”

Thoma has been with RTL since its beginning as a private channel. RTL, now owned by the newly merged media group Bertelsmann CLT, struggled for its first eight years to find an audience. For the past four years, though, it has been the leading channel in German ratings.

*

RTL has been successful in wresting control of rights to programming from Disney, Warner Bros. and MCA, and sees itself breaking down the 40-year monopoly attained by Kirch.

Leo Kirch, 70, is Europe’s most successful media entrepreneur, and its most secretive. He saw the value of content early on--he began buying up rights to feature film and television programs in 1956. His company is now benefiting from a range of low-cost, long-term output deals.

In so doing, Kirch became the gatekeeper for Americans wanting to sell to Europe--he alone sold to public broadcasters ARD and ZDF, which dominated German broadcasting.

When German television was deregulated in the 1980s, Kirch used his library to partner in a range of broadcasters, including Sat 1 and the pay movie channel Premiere.

At the core of the Kirch Group’s business today is a library boasting of 15,000 hours of feature films and 50,000 hours of television.

(Kirch is a private company whose profit and revenue figures are closely guarded.)

Tales of Kirch’s toughness have become folklore in the television industry.

A U.S. distributor, who did not want to be named, described a meeting with Leo Kirch in Munich. The distributor was negotiating with Mojto and the two had agreed on a price, but the producer did not want to give up all continental European rights to his programs.

When the talks reached a standstill, the men went to see Leo Kirch. As he sat in a darkened room, Kirch, whose eyesight is failing, had Mojto interpret the conversation in German, as Kirch does not like to do business in English. Soon Kirch was banging his desk saying loudly, “Europa, Europa,” indicating that he wanted the European rights. By the time the American had left, Kirch had the rights.

Mojto, 48, acknowledges that Kirch Group is a tough negotiator, but he says much of the group’s reputation is undeserved.

He said Leo Kirch, who can no longer read, has developed amazing powers of memory--that he can rattle off the stars and story lines of television series and say the prices he paid for them and sold them for over the past 20 years.

“Kirch can motivate people and manipulate people and he has great, great charisma,” Mojto said. “He is a great seducer.”

This charisma comes in handy during negotiations such as those with MCA.

Jim McNamara, MCA TV’s president of worldwide distribution, and Greg Meidel, president of the MCA Television Group, met Kirch and his major executives during a five-course dinner in Munich on their way to MIP. “He was sharp and charming, understood everything that was said in English and knew exactly what was going on,” McNamara said.

McNamara said the prices of recent rights deals such as those with Viacom and Columbia are in line with those paid for domestic product in Germany and that MCA’s latest German deal will reflect that.

“Some German productions are being made for a budget of $1.3 million an hour,” McNamara said. “When you understand this and the huge advertising market in Germany, the prices for U.S. product are in line with the market.”

But prices for U.S. product in the German market may well have reached their peak. “Feature films are fantastic, but if you have to pay $2 million per run for a good film--compared to a television movie made in Germany which cost 2 million marks [about $1.32 million], gets the same ratings as a U.S. feature film and which I can run as many times as I like--then it becomes cheaper and more efficient to use German product,” Thoma says.

“The argument for using American product has always been that you get lower ratings than German product, but at lower prices and it brings a young audience,” he said.

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.