Vivendi is looking to sell up to 50% of Universal Music Group

- Share via

Universal Music Group’s parent company plans to sell up to 50% of the venerable record label, looking for a major financial windfall after the rapid rise of online streaming helped revive the once moribund recorded music industry.

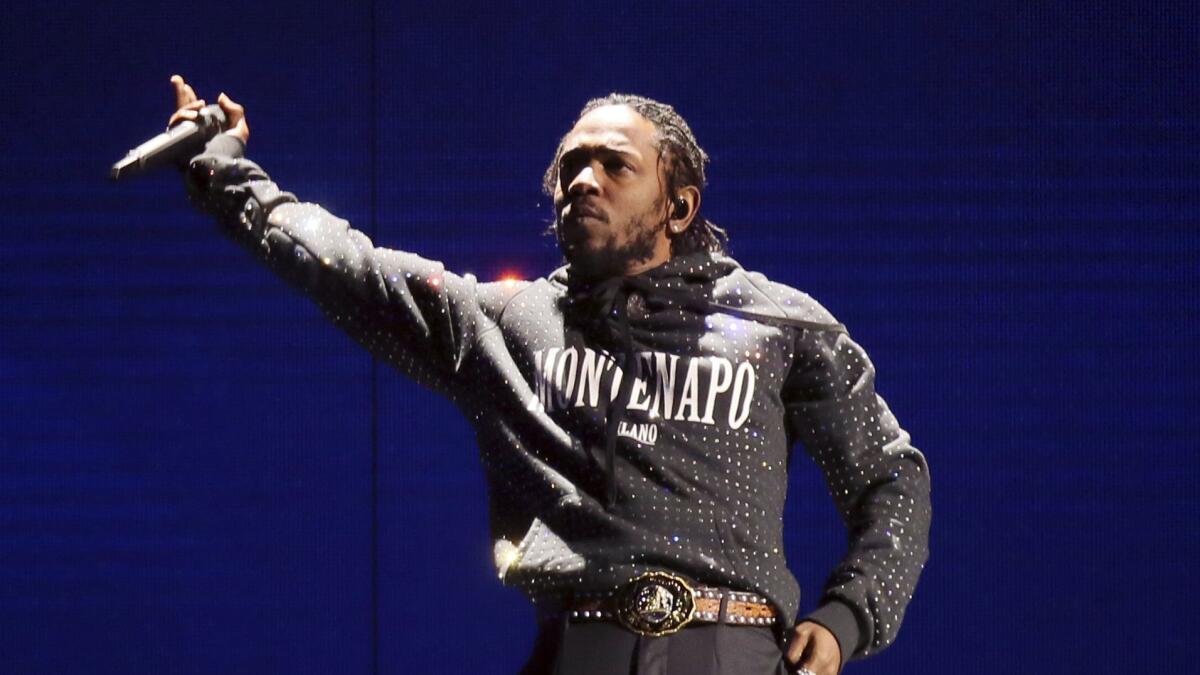

Vivendi SA, the French media conglomerate that owns Universal Music, said Monday it would engage investment banks to sell shares to “one or more strategic partners, in order to extract the highest value” for the label, known for such Grammy-winning artists as Sam Smith and Kendrick Lamar.

A Universal Music spokesman did not immediately respond to a request for comment.

The company in a filing said it had ruled out pursuing an initial public offering in order to cash in on its investment, citing the complexity of making such a move. Vivendi said it will launch its search for partners in the fall and expects to complete a deal in the next 18 months.

Analysts have valued Universal Music at more than $20 billion. Universal is one of the “big three” record labels, competing with Len Blavatnik’s Warner Music Group and Japanese-owned Sony Music Entertainment.

The partial Universal Music sale comes as digital outlets such as Spotify and Apple Music continue to inject new life into an industry that was cratered by illegal downloads at the turn of this century.

Global music revenues increased 8% to $17.3 billion in 2017, according to an April report by industry group IFPI. Sales from streaming increased 41% to $6.6 billion, the group said.

Vivendi said Universal Music posted a strong financial performance in the first half of 2018, with revenues that grew nearly 7% to about $3 billion in the first six months of this year, due to popular releases from Drake, Migos and the “Black Panther” soundtrack. Universal’s operating income was about $416 million, up 14% from the same period of time in 2017.

The potential transaction comes after Stockholm-based streaming music giant Spotify held its initial public offering on Wall Street in April. Spotify is not profitable, but has 83 million subscribers and carries a market value of $33 billion.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.