Top CEOs downgrade economic growth forecasts, expect to spend less

- Share via

Reporting from Washington — Top U.S. chief executives slightly downgraded their economic growth forecast and fewer said they expected to increase investments in their businesses amid uncertainty over whether Congress will reinstate some key corporate tax provisions, according to a survey released Tuesday.

Despite those concerns, the second-quarter economic outlook index from the Business Roundtable rose to 95.4 from 92.1 in the first three months of the year, the trade group said.

------------

FOR THE RECORD

An earlier version of this post said 48% of chief executives said they expected to increase capital spending in the lastest survey and 44% said they would do so in the first-quarter survey. In fact, 44% said they planned to increase spending in the current survey and 48% said the planed to do so in the first-quartrer survey.

------------

The index rose because of improvement in CEO expectations for increased sales and hiring over the next six months.

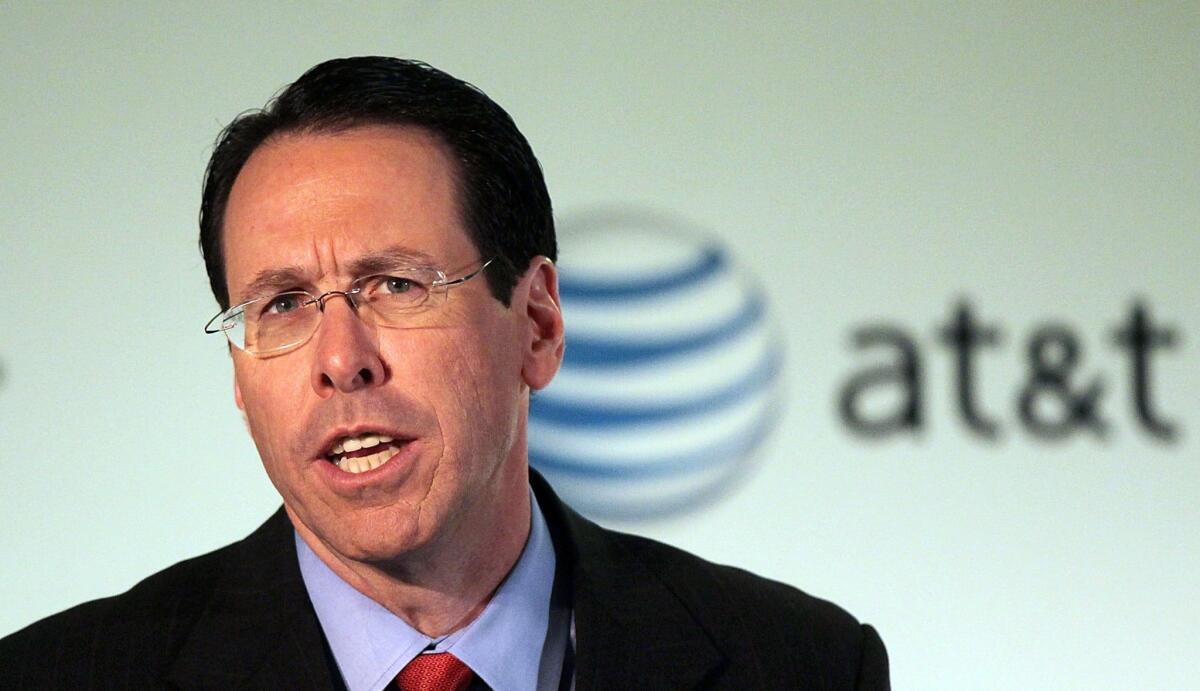

But AT&T Inc. Chief Executive Randall Stephenson, who chairs the organization, said a drop in the percentage of business leaders expecting to increase their capital spending was a major concern.

About 44% of chief executives said they expected to increase such spending over the next six months. In the first-quarter survey, 48% said they expected to increase investment.

The decline was driven by the expiration on Dec. 31 of some temporary tax provisions, such as a 50% bonus on depreciation write-downs and a tax credit for research and development costs.

Congress is expected to extend those measures retroactively, but has not acted yet.

After the economy contracted in the first quarter, CEOs reduced their forecast for annual growth this year to 2.3% from 2.4% in the previous survey.

The downgrade came after the International Monetary Fund on Monday reduced its U.S. growth projection to 2% this year from an April forecast of 2.8%.

“CEO expectations for both investment and growth remain well below the potential of the U.S. economy and below what we should be experiencing at this stage of a recovery,” Stephenson said.

He called on Congress to extend the expired corporate tax provisions to remove uncertainty.

“It’s really unclear to the business community when those extenders or if those extenders will get passed, and that’s what I think you’re seeing manifesting itself in this greater pessimism about investment,” Stephenson said.

Follow @JimPuzzanghera on Twitter.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.