Markets soar after midterm election results signal gridlock — something businesses won’t mind

- Share via

Reporting from Washington — Gridlock is good. And bipartisanship could be even better.

That was the message Wednesday from Wall Street, where the stock market soared after the uncertainty of the contentious midterm election ended with the most widely expected result: a Democratic takeover of the House and Republicans retaining the Senate majority.

A divided Congress probably means a stalemate for the next two years on major policy matters. And that was just fine with investors, who pushed the Dow Jones industrial average up more than 500 points — as well as for businesses that already have received a large tax cut and sweeping relaxation of regulations under President Trump and a Republican congressional majority.

But Trump and House Democratic Leader Nancy Pelosi (D-San Francisco) raised the prospect of working across the political aisle on rebuilding America’s crumbling infrastructure — a high priority of corporate America — and even a possible deal to provide more tax cuts targeted at the middle class.

“So it really could be a beautiful, bipartisan type of situation,” Trump said Wednesday.

Despite Trump’s contention last week that Democratic victories would lead to a stock market crash, the Dow gained 545.29 points, or 2.1%, to 26,180.30 after a broadly based daylong rally.

The Standard & Poor’s 500 index had a similar percentage jump while the technology-heavy Nasdaq composite was up about 2.6%.

“Mostly it’s a big sigh of relief in that the midterm elections are behind us and a surprise didn’t happen,” said Michael Arone, chief investment strategist at asset manager State Street Global Advisors, who called the gains a “relief rally.”

The Republican tax cuts that took effect this year and reduced federal regulations have boosted the U.S. economy, and the election results are unlikely to change its trajectory. Although growth is projected to slow in the next two years as the fiscal stimulus fades, that’s an outcome that had been expected even if the GOP maintained control of the House.

Full 2018 midterm election results »

“The business community couldn’t have imagined in [its] wildest dreams having a president as sympathetic to their cause in general as President Trump,” said Mark Hamrick, senior economic analyst at financial information website Bankrate.

“You would require both houses of Congress [to go Democratic] to essentially override all of that legislatively and you don’t have that,” he said.

Even though Democrats opposed the-tax cut legislation because much of it was focused on corporations and the wealthy, the party won’t be able to do a large-scale rollback of the cuts given that Republicans retained control of the Senate and Trump would veto such a bill anyway.

Democrats seize the House and Republicans bolster Senate majority in Trump-driven midterm vote »

But at a White House news conference Wednesday, Trump said he’d be open to raising tax rates on corporations and/or the wealthy in exchange for a deal with Democrats on middle-class tax cuts. Trump had floated the idea of a middle-class tax cut in the waning days of the campaign.

“If the Democrats come up with an idea for tax cuts … I will absolutely pursue something even if it means some adjustment” in the new lower rates, he said. The corporate rate was slashed to 21% from 35%, and the top individual tax rate was reduced to 37% from 39.6%.

Pelosi told reporters Wednesday that the new House majority would “strive for bipartisanship” and said she had talked with Trump on election night about working together on building and renovating highways, bridges, airports and other infrastructure. She also said she hoped to work with him on lowering the cost of prescription drugs.

“We believe that we have a responsibility to seek common ground where we can,” she said at a Capitol Hill news conference. “Where we cannot, we must stand our ground. But we must try.”

Trump said Wednesday he was open to working on those issues with a big caveat — there will be no deals if House Democrats try to investigate him and his administration. Democratic investigations became more likely after Trump forced out Atty. Gen. Jeff Sessions on Wednesday.

Some business sectors could face tougher scrutiny as House Democrats gain the power to hold hearings and subpoena corporate executives.

Wall Street in particular could find itself in the crosshairs as Rep. Maxine Waters (D-Los Angeles), one of Washington’s most outspoken critics of big banks, is expected to become chairwoman of the House Financial Services Committee.

“We expect the top executives at the biggest banks will be called several times over the next two years to testify before House Financial Services,” Jaret Seiberg, an analyst with brokerage and investment bank Cowen & Co., wrote in a research note Wednesday.

“In addition, incoming House Financial Services Chairman Maxine Waters will investigate how the biggest banks interact with consumers and businesses,” he said. “We believe Wells Fargo is most exposed on this front given the never-ending controversies surrounding the bank.”

Despite the San Francisco bank’s continuing troubles shaking off its unauthorized-accounts scandal and other consumer abuses, shares of Wells Fargo & Co. closed up 3 cents to $53.58.

Waters is one of Trump’s fiercest critics and has called for impeachment. Trump in turn has criticized Waters frequently, calling her “low IQ.”

For investors, the midterm election results could be a best-case scenario.

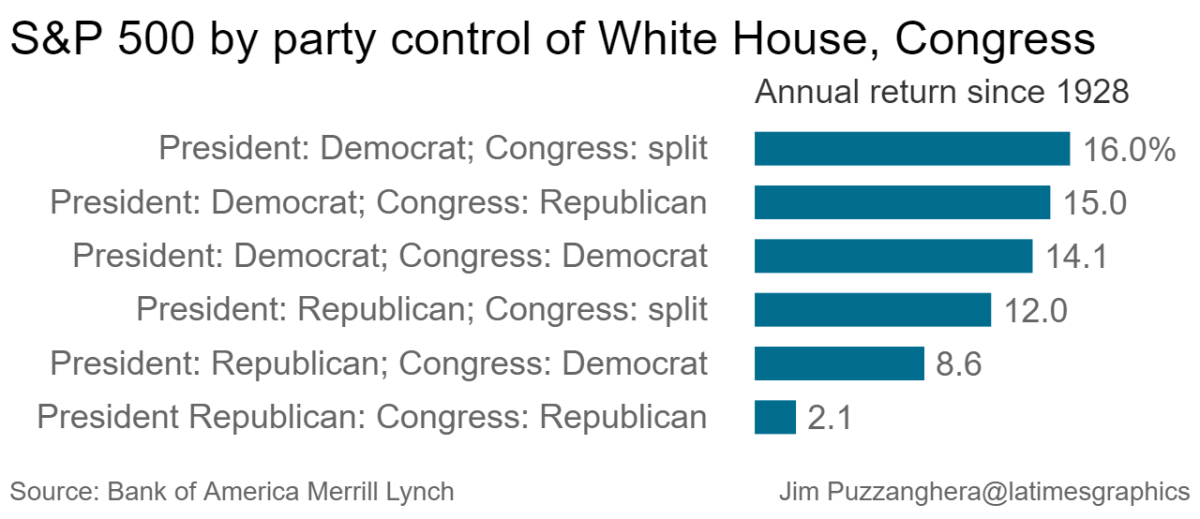

A pre-election analysis by Bank of America Merrill Lynch investment bank showed that the annual returns of the S&P 500 are better under a divided Congress than when Republicans control the White House and Capitol Hill.

“Markets generally do well under gridlock,” the Bank of America Merrill Lynch report said. Since 1928, the S&P 500 has had an annual return of 12% with a Republican president and split control of Congress. That exceeds the returns when a Republican president has had either a full Republican or Democratic Congress, the report found.

Overall, the average returns of the S&P 500 have been better in the year after a midterm election, no matter the Washington power makeup, than in other years in the political election cycle, according to the report. Average returns in the year after a midterm election have been more than 20% since 1952.

Despite the split party control, modest infrastructure legislation is one potential area of action, the report said. But agreeing on how to fund it could be difficult.

“Republicans want most of the money to come from private enterprise, allowing firms to collect rents, user charges and fares from the public,” said Ian Shepherdson, chief economist at Pantheon Macroeconomics.

That model was used in the United Kingdom but abandoned recently because it was found to have increased costs given that it’s more expensive for the private sector to borrow money compared with governments. Democrats prefer an infrastructure bill that is mostly funded by the federal government, so a deal is unlikely, Shepherdson said.

The president and newly energized Democrats also are expected to spar over the financial industry.

Mostly small and midsize banks already got some regulatory relief in bipartisan legislation passed by Congress last spring that rolled back parts of the landmark 2010 Dodd-Frank law. And Trump has appointed key financial regulators who are more friendly toward the industry.

However, there could be political pushback on further regulatory relief, including a proposal before the independent Federal Reserve to loosen regulations governing large banks.

“No matter what voters decide … the banking agencies will continue to advance a deregulatory agenda,” Seiberg said.

On Wednesday, Rob Nichols, president of the American Bankers Assn., cited this year’s banking deregulation bill as a “solid bipartisan foundation around banking policy” that he hoped the incoming Congress could build on.

But that doesn’t mean it will be smooth sailing for the financial industry with a Democratic House.

Waters has proposed legislation that would allow regulators to break up big banks that “repeatedly harm consumers,” such as Wells Fargo, and could call in executives for high-profile hearings on their activities.

Congress also must approve the renegotiated North American Free Trade Agreement with Canada and Mexico. Political views on trade reflect geography more than politics, but some key House Democrats have been critical of the deal, and that could complicate its passage.

“The bar for supporting a new NAFTA will be high,” Rep. Richard Neal (D-Mass.), who is expected to be the new chairman of the House Ways and Means Committee, said recently. Analysts said Democrats could try to use passage of the trade deal as leverage with Trump, who has made enacting the pact a high priority.

The midterm results also could affect the political dynamics of the broader trade war with China, although many House Democrats have been outspoken opponents of Beijing.

Twitter: @JimPuzzanghera

UPDATES:

2:05 p.m.: This article was updated with Wells Fargo’s closing share price.

1 p.m.: This article was updated with the close of markets.

11:10 a.m.: This article was updated with comments from President Trump and Rep. Nancy Pelosi and afternoon stock market results.

9:05 a.m.: This article was updated with the latest stock market results, comments from Rep. Richard Neal and additional details

7:15 a.m.: This article was updated with the latest stock market results and additional details.

This article was originally published at 6:35 a.m.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.