JPMorgan’s answer to Apple Pay and other mobile wallet apps: Chase Pay

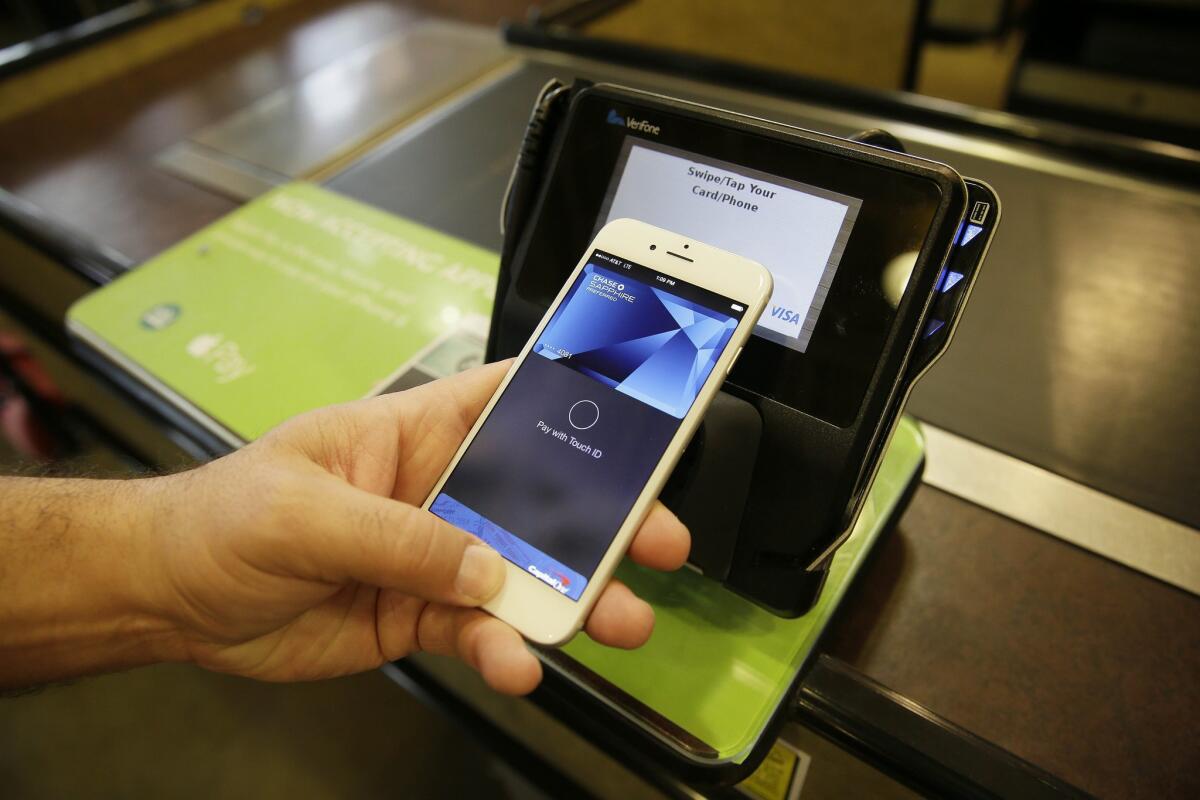

Eddy Cue, Apple Senior Vice President of Internet Software and Services, demonstrates the Apple Pay mobile payment system at a Whole Foods store in Cupertino, Calif. JPMorgan Chase is launching a smartphone-based payment system of its own.

- Share via

Apple Pay, Android Pay, Samsung Pay and, coming soon, Chase Pay.

Next year, JPMorgan Chase will launch a smartphone-based payment system of its own, one built to rival the mobile wallet apps already offered by Apple and others.

But Chase Pay, announced Monday at a Las Vegas payments trade show, has one big selling point: It could actually make it cheaper for businesses to accept payments, potentially giving merchants a reason to encourage customers to use the system.

Payments made with other mobile apps are processed using the same networks used in credit and debit card transactions. That means whether you pay for coffee by swiping a Visa card or by tapping your iPhone, your coffee shop is paying Visa to use its network.

SIGN UP for the free California Inc. business newsletter >>

Not so with Chase Pay. Two years ago, Chase announced it had inked a 10-year deal that essentially gives it direct access to Visa’s network. That means one fewer toll collector between customer and merchant.

“Each intermediary will have a piece of that payment. By removing them, we’re able to pass along savings to merchants,” said Chase spokeswoman Patricia Wexler.

To accept Chase Pay, merchants will have to be customers of Chase’s payments processing business. Because both the merchant and customer are using the bank’s network instead of an outside network, each transaction should cost less, if only by a few cents.

Those transaction costs are paid by merchants, and Chase is betting the lower fees will get merchants to promote Chase Pay.

Merchants who use the system won’t be liable for fraudulent purchases, another potential cost-saver. Gavin Michael, head of digital for Chase consumer banking, said Chase can offer that protection because it has control of the transaction on both sides.

When Chase Pay rolls out sometime in the middle of next year, customers will be able to pay using a Chase Pay app, which will display a bar code that can be scanned at a cash register -- similar to Starbucks’ in-app payment system. Chase Pay will work with nearly every smartphone -- unlike competing offerings from Apple, Android and Samsung.

Chase Pay will also link up with retailers’ websites, and some merchants -- restaurants, for instance -- will allow customers to pay by snapping a picture of their receipt using the Chase Pay app.

Chase Pay will be accepted at members of the massive MCX consortium of merchants -- including retail giants Wal-Mart, Target and Lowe’s.

Twitter: @jkoren

MORE BUSINESS NEWS

Air Force’s plan for new stealth bomber could give Southland a boost

Target to open two smaller-format stores in L.A.

Suddenly, yearly gains for major U.S. stock indexes appear possible

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.