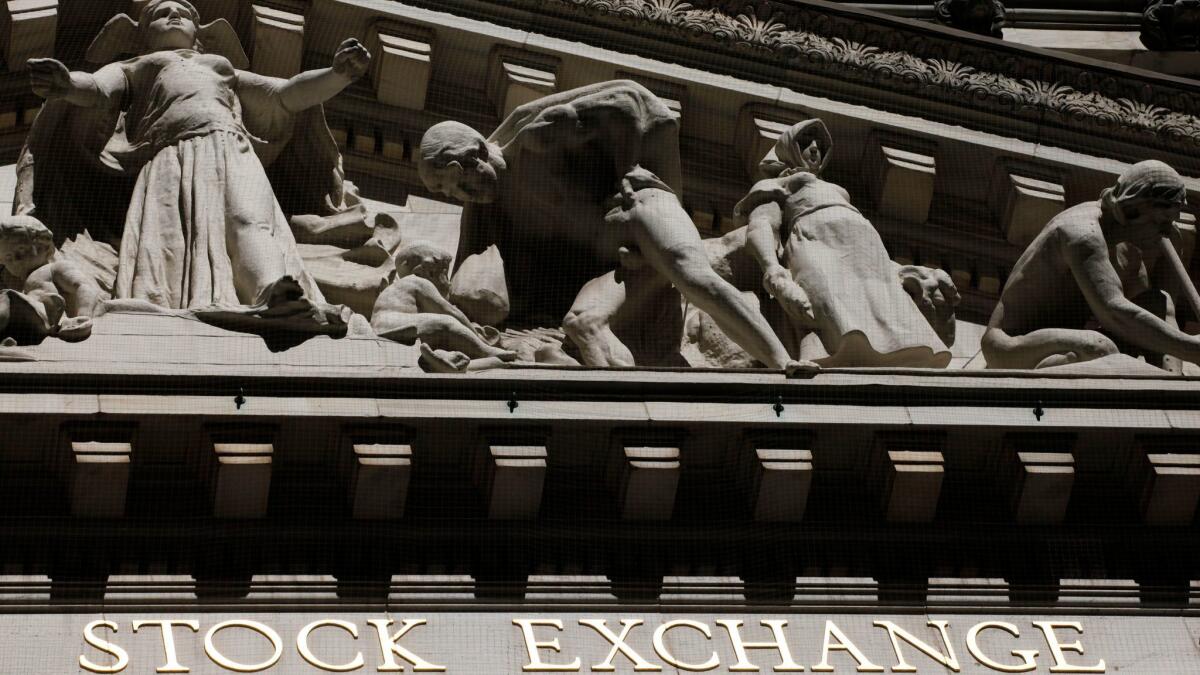

Stocks rise to new records, lifted by banks and retailers

- Share via

U.S. stocks reached record highs Tuesday as banks kept rising and retailers climbed after some encouraging job data.

It was the second straight day that bank stocks made big gains as bond yields pushed higher, which enables banks to charge higher rates on loans. Retailers rose after the Labor Department said job openings and hiring both grew in July, and more people quit their jobs to take new ones. That left investors hopeful that people will shop and spend more.

Chemicals company DowDuPont climbed after making changes to its breakup plans, as activist investors had urged. Apple’s newest iPhones didn’t generate much excitement on Wall Street.

The bond market is “moving back to a comfort zone,” said Matt Toms, the chief investment officer for Voya Investment Management’s fixed income business. “Just enough growth, just enough inflation, but not too much of either.”

The Standard & Poor’s 500 index rose 8.37 points, or 0.3%, to 2,496.48. The Dow Jones industrial average rose 61.49 points, or 0.3%, to 22,118.86. The Nasdaq composite rose 22.02 points, or 0.3%, to 6,454.28.

The S&P 500 also set a record Monday, and the Dow finished a fraction of a point above the record it set in early August. The Nasdaq surpassed the record it set Sept. 1.

The Russell 2000 index of smaller companies got a bigger boost from the job openings report and jumped 8.64 points, or 0.6%, to 1,423.46.

Bond prices fell. The yield on the 10-year Treasury note rose to 2.16% from 2.13%. That helped banks. Bank of America stock shares gained 2.5% to $23.95. Citizens Financial Group advanced 3% to $34.48. As income-seeking investors went for bonds, companies that pay big dividends — such as utilities and real estate investment trusts — didn’t do as well as the rest of the market.

Stocks were coming off their best day since late April. They rose Monday as Hurricane Irma weakened without doing as much damage as some forecasts predicted. Investors were also relieved that tensions between the U.S. and North Korea didn’t get any worse after a national holiday there.

DowDuPont, which was formed when two of the world’s largest chemical companies combined in August, made some changes to its breakup plan after pressure from activist investors. DowDuPont will ultimately break into three public companies. One will focus on agriculture, one on material science and one on specialty products. Tuesday’s changes concern the latter two companies.

DowDuPont shares rose 2.5% to $68.52.

Job openings posted by U.S. employers rose 0.9% to 6.2 million in July, the Labor Department said. That’s the highest on record dating to 2000. Hiring also increased and more people quit their jobs, which often means they were leaving for jobs that pay better.

That helped smaller, domestically focused companies and retailers. Gap jumped 6.4% to $27.61. Victoria’s Secret parent L Brands advanced 3.9% to $39.36.

Apple’s stock gyrated as the company announced its newest iPhones and updates to other products. The iPhone is the source of most of Apple’s revenue, and some investors have been worried that supply constraints will slow down its sales. Apple was down early in the day, climbed as much as 1.5% as it made its announcements, and then ended the day down 64 cents at $160.86.

Energy companies climbed as benchmark U.S. crude rose 16 cents to $48.23 a barrel. Brent crude, the standard for international oil prices, rose 43 cents to $54.27 a barrel.

Wholesale gasoline rose 2 cents to $1.66 a gallon. Heating oil stayed at $1.74 a gallon. Natural gas rose 5 cents to $3 per 1,000 cubic feet.

Gold fell $3 to $1,332.70 an ounce. Silver fell 1 cent to $17.89 an ounce. Copper fell 3 cents to $3.04 a pound.

The dollar rose to 110.11 yen from 109.34 yen. The euro edged up to $1.1970 from $1.1962. The British pound climbed to $1.3293 from $1.3173, its highest level in a year. That move came after inflation figures came in stronger than analysts expected, which left investors thinking the Bank of England may raise interest rates sooner than they anticipated.

Germany’s DAX rose 0.4%. The CAC 40 in France gained 0.6%. The British FTSE 100 slipped 0.2%. In Japan, the Nikkei 225 gained 1.2% as the yen weakened again. South Korea’s Kospi edged up 0.3%. The Hang Seng of Hong Kong was little changed.

UPDATES:

2:45 p.m.: This article was updated with closing prices, context and analyst comment.

1:25 p.m.: This article was updated with the close of markets.

This article was originally published at 7 a.m.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.