A credit history can keep a lid on doubt

- Share via

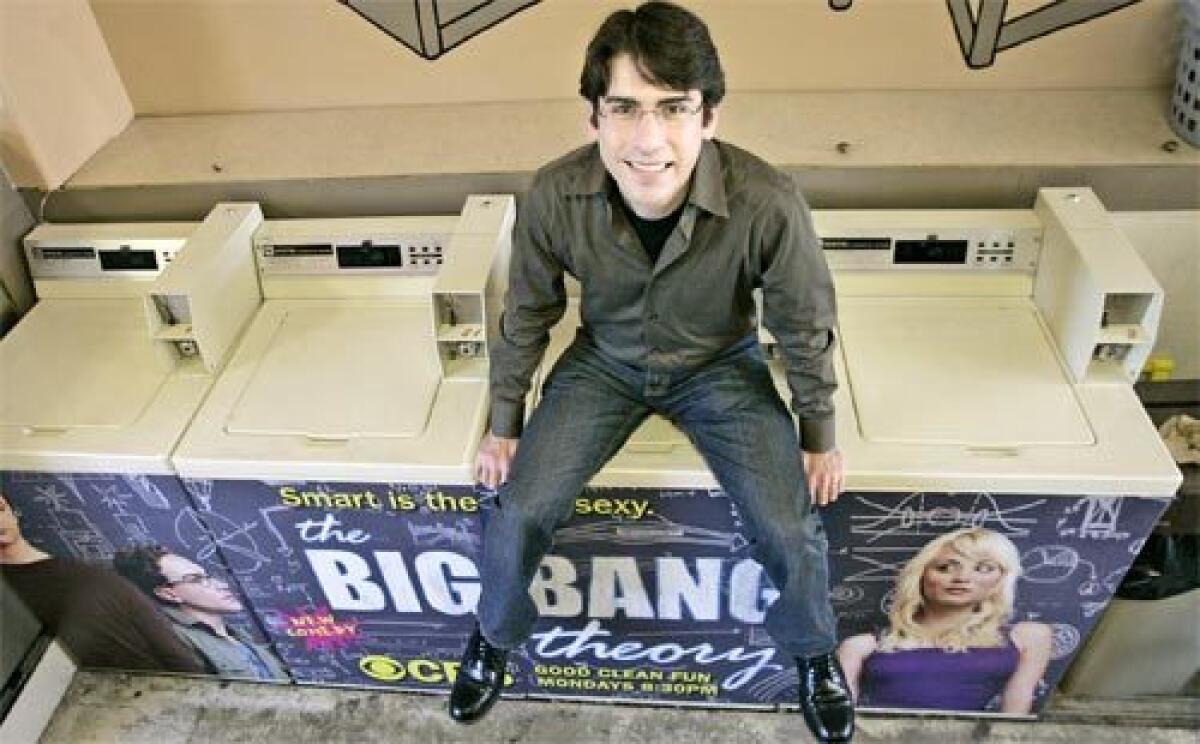

Graphic artist and advertising specialist David Kessler had a brainstorm while staring at the white surfaces in his apartment laundry room, waiting for the spin cycle to end.

“I’m looking at a sea of white and all of a sudden said, ‘Oh my God! These could have ads all over them.’ ”

It took two years to build a database of laundromat owners that his company could sell advertising to for display on machines, but Kessler is convinced that Laundromedia Inc. of West Los Angeles is perched to clean up. Still, the process would have been smoother if Kessler had been aware of the need for a separate business credit report when he was trying to sign up his first vendor, a printing company.

“Even though I had formed this company, incorporated of course, to protect my personal assets and credit, [the deal] was still contingent on my personal credit history,” Kessler said.

Next time, the company will be prepared to ask to be considered on the strength of its own credit, he said. That will be easier now that the business received its first payment from its first client, CBS Corp., on Friday. The media giant advertised its new series “The Big Bang Theory” on a colorful ad splashed across the fronts of four washing machines in five laundromats.

“The company will have its own credit history, starting today,” Kessler said.

Bringing up the subject of your small-business credit score during the holidays may seem Scrooge-like, but the season of spending is probably a good time to keep tabs on that vital number.

Just like your personal credit score, your commercial credit score can take a hit if you rack up more year-end bills than your business will be able to pay on time. Yet many small-business owners are unaware that credit reporting companies may keep separate tabs on the spending habits of their enterprise.

Unlike the widespread awareness of personal credit scores and their roles in important financial events such as getting a loan and landing a job, knowledge of small-business credit tracking and its use is still growing.

“It’s early in the learning curve,” said Marc Kirshbaum, president of the Business Information Solutions group at the Costa Mesa office of Experian, one of the three major credit-reporting companies.

New small-business owner Ronnie Shugar is also learning lessons about the importance of business credit.

Self-financed, his Sherman Oaks-based Da Vinci Pharmaceuticals didn’t need bank loans to launch its Simply Gargle product last year. But Wal-Mart Stores Inc. and the other large retailers that signed on this year -- and that will help push annual sales to an expected $4 million -- required a check of his business credit history before ordering any of the four gargle formulas that retail for $6.99 a dozen.

“They want to make sure if they give you orders you are not going to fold, that you’ll be able to fill them,” Shugar said.

Even the freight companies the retailers work with based his shipping rates on his business credit score, Shugar said. Most used Dun & Bradstreet, the long-standing giant in commercial credit reporting.

Today a small-business owner can’t assume that a D&B report is the only source to which a potential creditor will turn. In recent years, major players in the world of consumer credit, including Experian and Equifax Inc., have entered the small-business credit arena.

Credit rating companies used to overlook small businesses because they come and go more quickly than large, stable businesses, tend to deal with smaller suppliers who might not report their payment history, and don’t typically have formal credit managers to work with credit reporting firms.

Experian, for example, has collected consumer credit information for a century and got into business credit in the 1970s. But it’s been only in recent years, as technology has made it easier to find and compile useful data on the multitude of small businesses, that the company, based in Dublin, Ireland, has begun to pay closer attention to that area.

Experian’s efforts, and those of the other major credit reporting bureaus such as Equifax of Atlanta, have been driven in part by the expanding number of companies that are targeting the small-business market.

Equifax too has boosted its small-business data and products in the last several years.

Last week, Equifax announced an extension through 2012 of its contract to manage the 6-year-old Small Business Financial Exchange it runs, and supplies data to, for large financial services companies and leasing companies.

Experian recently launched a separate site, at www.businesscreditfacts.com, to teach small-business owners about business credit reports and scores.

And this week the company unveiled a business-credit product that packages contractors’ credit information with public information on the status of their licenses, bonds and insurance. The service is free this month.

Experian released a study last year showing that taking into account both the personal credit history of a small-business owner and the firm’s commercial credit strength gave a more accurate idea of the risk that the firm would be significantly late paying its bills.

Though the trend to boost and package their growing hoard of small-business data in new ways may help the credit reporting companies sell more credit reports, it also underscores the need for a small-business owner to get up to speed on the subject.

RELATED STORY Quiz: Test your knowledge of business credit reporting and scoring. Page C7

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.