Southern California home sales slowdown deepened in February; agents see busier times ahead

- Share via

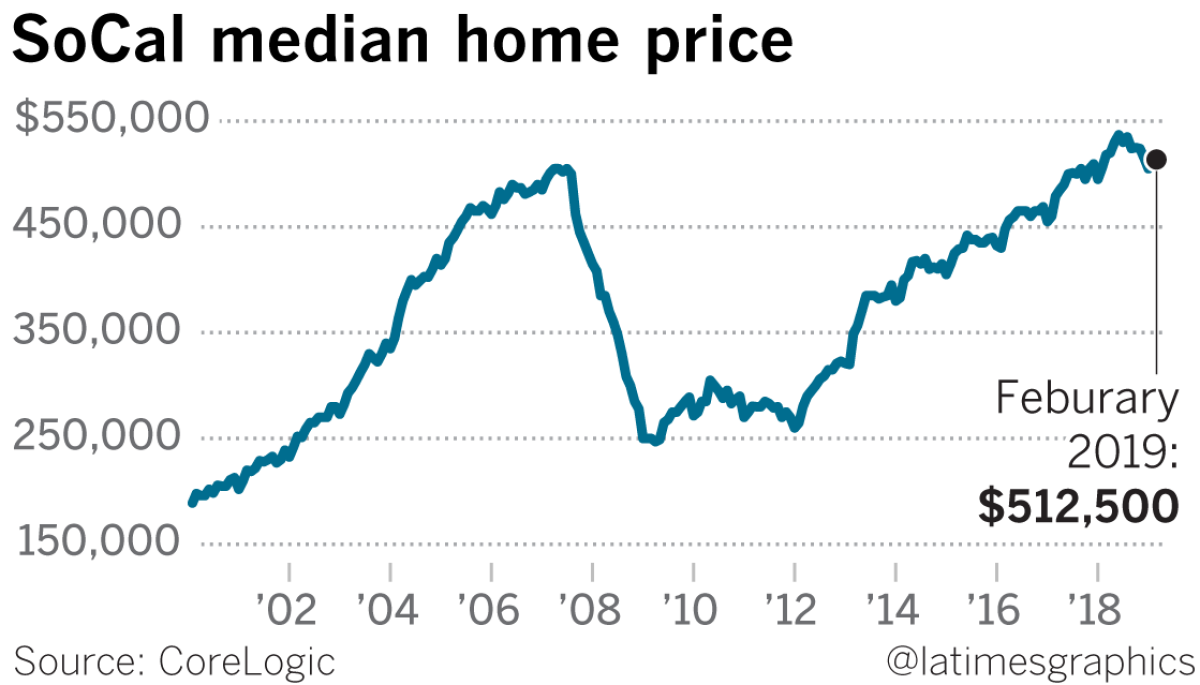

Southern California home prices barely rose in February from a year earlier, as buyers continue to struggle with the high cost of housing, according to a report out Wednesday.

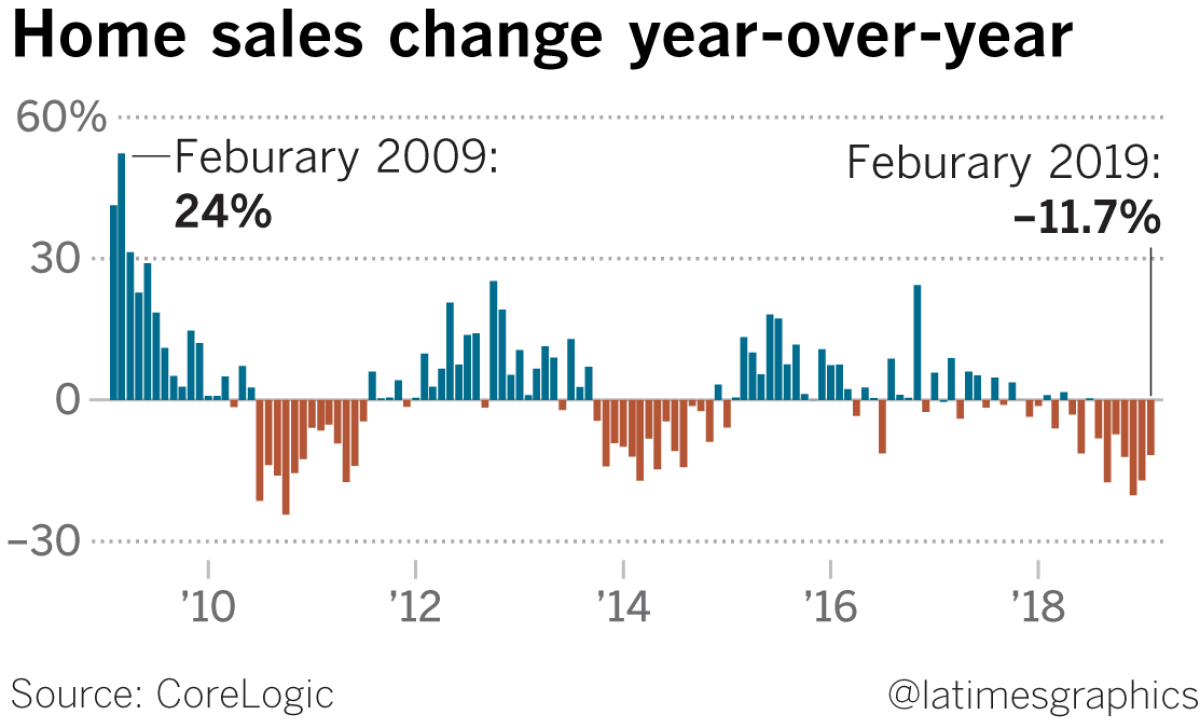

The six-county region’s median price — the point where half the homes sold for more and half for less — increased just 1.2% to $512,500 last month, real estate firm CoreLogic said. Sales plunged nearly 12%.

The pullback comes after years of steady price increases put homeownership out of reach for many families. A recent drop in mortgage rates is bringing people back into the market, agents and mortgage brokers said, though demand is still subdued compared with recent years.

“[Buyers] are just being more cautious where they are putting their dollars,” said San Fernando Valley real estate agent Deanna Medina.

Sales have now fallen for seven straight months, swelling inventory and forcing sellers to trim their asking prices.

The regional median is $24,500 below its all time high of $537,000 reached in June. Last month, prices dropped 1.4% compared with a year earlier in expensive Orange County. Los Angeles County recorded a gain of just under 1%.

On Tuesday, further evidence of the slowdown emerged when the S&P CoreLogic Case-Shiller index was released. It provides a delayed look at home prices, but is considered more accurate because it takes into account changes in the types and sizes of homes sold.

The index showed home prices in Los Angeles and Orange counties rose 2.9% in January from a year earlier, but that was far less than the 8.2% increase recorded in April — a high point for the last several years.

For now, in individual counties, sales are falling and the median price is barely moving.

- In Los Angeles County, sales dropped 11.8% from a year earlier, while prices rose 0.9% to $585,000.

- In Orange County, sales dropped 17.1% and prices fell 1.4% to $700,000.

- In Riverside County, sales dropped 8.9% and prices rose 1.7% to $381,500.

- In San Bernardino County, sales dropped 13.8% and prices were unchanged at $335,000

- In Ventura County, sales dropped 12% and prices rose 1.8% to $565,000.

- In San Diego County, sales dropped 8.1% and prices rose 2.6% to $549,000.

Economists generally don’t foresee a housing crash, even if some expect prices to turn slightly negative before incomes catch up.

Economic growth is predicted to slow this year, and compared with last decade, home building is subdued and lending standards are tighter — two facts experts say decreases the likelihood that a bubble has formed.

What happens next will depend on how willing, or able, people are to bid up home prices.

February’s data tally deals that closed escrow, reflecting shopping and deals that were signed during the partial government shutdown in January and late December — an event that real estate agents noticed sapped buyer confidence. Since then, the government has reopened and mortgage rates have continued to fall from their November high of 4.94%.

By last week, the average rate on a 30-year fixed mortgage had fallen to 4.28%, according to Freddie Mac. The reduction is enough to save $157 on a monthly mortgage payment for a $500,000 house.

Jeff Lazerson, president of Laguna Niguel mortgage brokerage Mortgage Grader, said the drop in rates, coupled with more homes on the market, has “a landslide of loans coming in”— so much that he hired another worker. But despite the surge, buyers haven’t yet been willing to aggressively overbid.

“I haven’t seen anything come across my desk in several months where someone paid above asking price,” he said.

Derek Oie, an Inland Empire real estate agent, characterized the current market as “vanilla.” A bit hotter than a few months ago, but a far cry from the days when packed open houses and multiple offers were commonplace.

“It’s just a very, very normal market,” he said.

Follow me @khouriandrew on Twitter

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.