How the final tax bill will affect four tax returns. The highest earners get the biggest break

Now, that details of the final tax plan are out, we’ve re-crunched the numbers to see how those same readers would have fared. (Dec. 20, 2017) (Sign up for our free video newsletter here http://bit.ly/2n6VKPR)

- Share via

Earlier this month, The Times reviewed tax returns submitted by a handful of readers to see how the House and Senate tax plans would have affected their 2016 taxes had they been law at the time.

Now, that details of the final plan are out, we’ve re-crunched the numbers to see how those same readers would have fared.

The plan would give a big tax cut to corporations, eliminate a key element of Obamacare and make other sweeping changes that together are expected to add more than $1 trillion to the federal deficit over the next decade.

Most would see the same tax cut or increase as they would have under the previous Senate-approved version, but some would get an even bigger tax cut.

The highest earners in our earlier story, Anett Seifert, 33, and her husband David Amejka, 39, would have gotten a tax cut worth thousands of dollars under either previous plan.

They’ll get an even bigger cut under the new version.

They don’t own a home and don’t pay property taxes or mortgage interest, so they aren’t hurt by the new plan’s limitations on those popular deductions. Their taxable income stays about the same under all versions of the plan, but the latest and final version has the lowest marginal rates.

Though they’ll still pay as much as 24% on some of their income — the same bracket they were in under the earlier Senate plan — they’ll owe that rate on a smaller slice of their pay.

Under the Senate plan, they would’ve paid 24% on more than $50,000; under the final version, they’ll pay that rate on about $28,000.

In all, the plan would have cut their 2016 tax bill by $6,115 — a savings of $500 more than under the Senate plan and nearly $1,000 more than under the House plan.

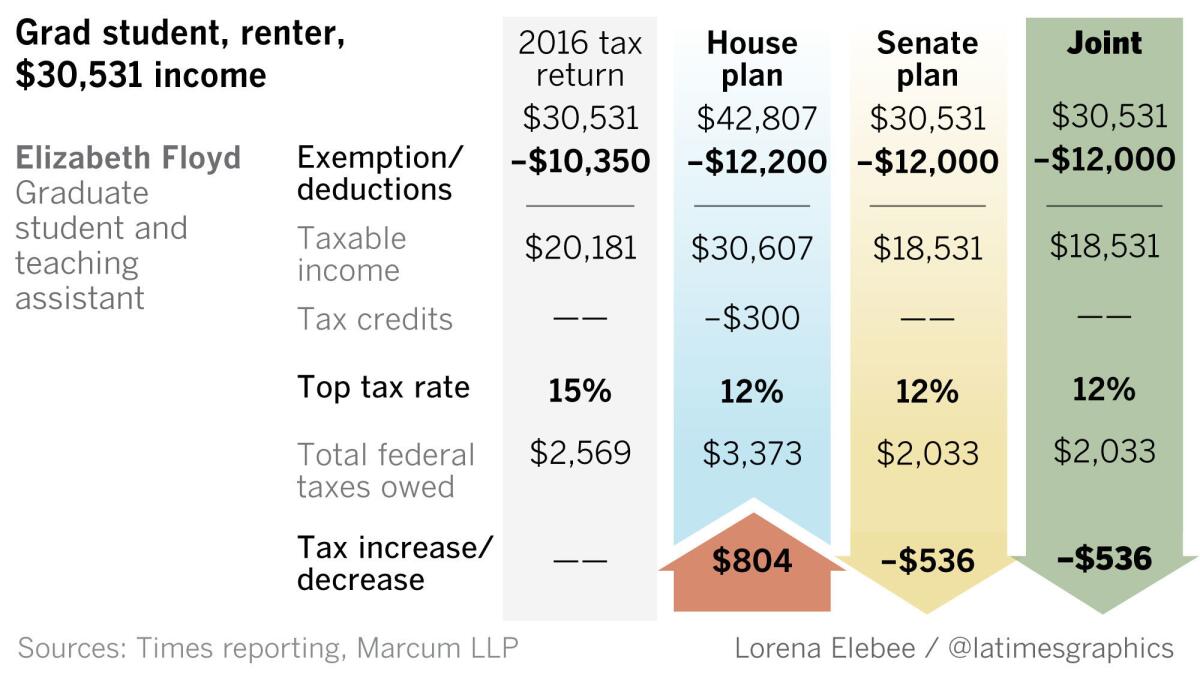

Elizabeth Floyd, 30, a graduate student at UC Santa Barbara, was worried about the version of the tax plan approved by the House last month because it would have counted tuition reductions as taxable income.

That change would have boosted Floyd’s income by more than $12,000 and resulted in a bigger federal tax bill. For grad students at pricier universities, where tuition reductions can be worth $40,000 or more, the effect would have been even greater

But the final version being voted on this week, like the Senate plan approved this month, would not count free tuition as income. That means Floyd would have paid $536 less last year, thanks to a larger standard deduction and lower marginal tax rates.

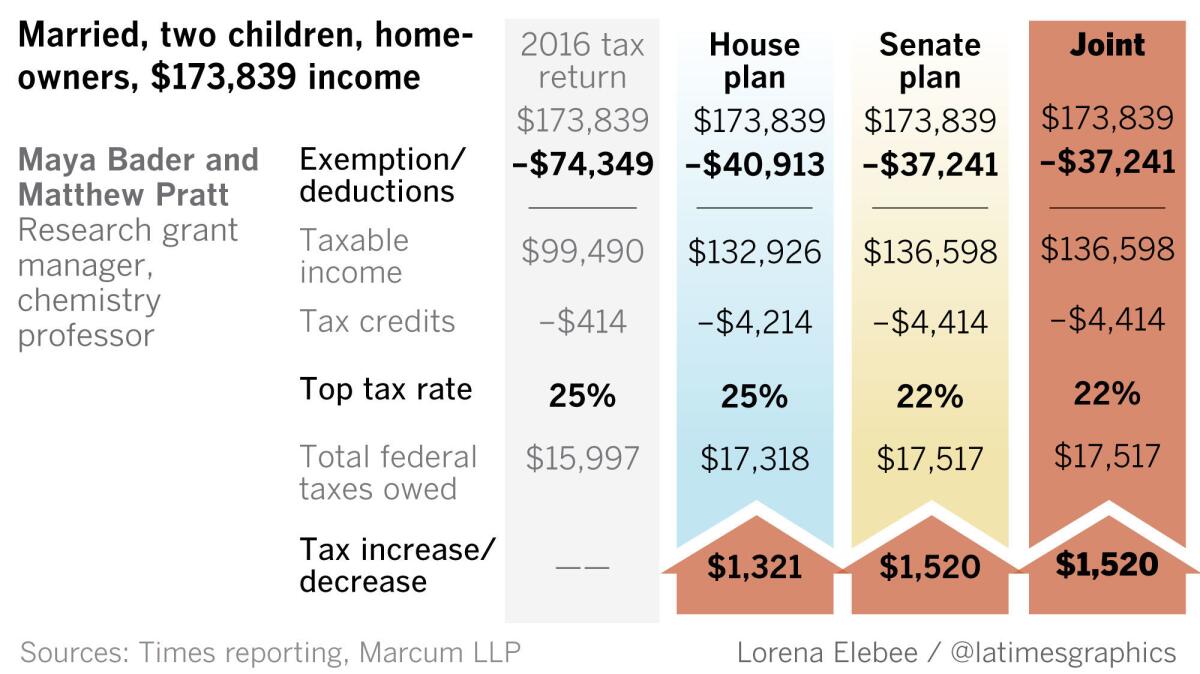

Maya Bader, 39, and her husband Matthew Pratt, 41, bought a new house last year. Between mortgage interest, property taxes and California income taxes, they took more than $58,000 in deductions and ultimately paid about $16,000 in federal taxes last year.

Under either of the previous plans, their taxes would have gone up because of limitations on some of those deductions. The same is true under the joint plan.

The plan allows taxpayers to deduct up to $10,000 in combined property and state income taxes. Earlier plans had called for eliminating the deduction for state income taxes and maintaining the property tax deduction with a $10,000 cap.

But Bader and Pratt, like many Californians who own homes and have good incomes, will still lose. They deducted more than $26,000 in state income and property taxes last year and will see their taxable income climb under the new plan.

They’ll also lose out on a deduction for interest paid on a home equity loan, something the Senate version and the new joint plan eliminates.

It’s not all bad news, though. Richer child tax credits will shave $4,000 off their tax bill. Still, the joint plan would have given them a tax increase of $1,520 last year, identical to the Senate version.

Dontrelle Nettles, 27, would have gotten a tax cut of about $905 had the joint plan been in place last year. That’s the same amount as under the previously approved Senate plan.

For Nettles, who rents his South L.A. home and made about $43,000 last year working for an apparel company, the savings come from a larger standard deduction and slightly lower marginal tax rate.

How we did it: Participants submitted copies of their 2016 federal tax returns, which were shared with accountants at Marcum. The Times and Marcum used income, deduction, family size and filing status from those returns and applied major elements of the tax plans approved by the House and Senate to compile two estimated tax bills for each filer. Analysis of the final, joint version was performed by The Times and reviewed by Marcum. If President Trump signs the tax bill as expected, the changes would take effect in 2018 and not affect tax returns for the 2017 tax year.

Follow me: @jrkoren

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.