Investment scam suspect dies in French custody

- Share via

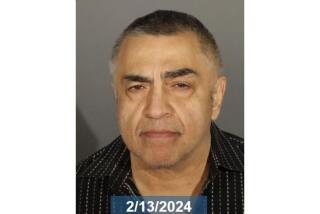

Former Sherman Oaks money manager Bruce Fred Friedman has died in French custody while awaiting extradition to Los Angeles on charges related to an alleged $228-million investment scam.

An official at the U.S. Embassy in Paris confirmed Friedman’s death Monday but declined to say when or how he died. Friedman, 62, had been in a French prison since his arrest there in 2010.

Federal prosecutors in Los Angeles had accused Friedman of defrauding hundreds of people by promising to invest in real estate but instead spending it on luxury cars, expensive homes, jewelry and travel for himself.

He also gave hundreds of thousands of dollars to charity. The Dodgers were so impressed by Friedman’s gifts to the team’s charity that they invited him to throw out a ceremonial pitch during an exhibition game against the Boston Red Sox at the L.A. Memorial Coliseum in 2008.

Thom Mrozek, a spokesman for the U.S. attorney’s office in Los Angeles, said prosecutors probably would move to dismiss charges against Friedman once they received a death certificate.

Patricia Hank, a Calabasas resident who said she invested her entire $300,000 retirement account with Friedman’s company, Diversified Lending Group, said losing that money devastated her financially.

“All I can say is, I’m not sorry,” Hank said of Friedman’s death. “That was my entire retirement.”

Prosecutors had accused Friedman of falsely claiming that his company made significant profit by leasing out apartments and making real estate loans. He offered “guaranteed” returns of up to 12% annually and said some investments were insured.

Investors said the sales pitch seemed legitimate because returns were not large enough to raise a red flag. Some victims were so swayed by the sales pitch that they took out second mortgages in an effort to add a second source of income.

But Friedman didn’t own the investment properties he claimed to own and instead used money from later investors to pay returns to early investors, prosecutors said.

Acting at the request of the Securities and Exchange Commission, a judge froze Friedman’s assets in 2009 and appointed Los Angeles attorney David A. Gill as a receiver to try to recover money for investors.

Gill said he did not expect Friedman’s death to have a significant effect on his efforts to recover some of the investors’ money.

“We continue to try to realize money for investors from property and claims that we have been able to locate and recover,” Gill said in an email to The Times. “We will shortly be making an initial distribution to investors and hope that we can distribute more at a later date.”

Special correspondent Kim Willsher in Paris contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.