A veteran of guaranteed income, she has some advice for L.A.’s new recipients

- Share via

Georgia Horton grabbed the hem of her dark blue dress and awkwardly threw one leg and then the other over a concrete bench at the top of Kenneth Hahn State Recreation Area.

“This is where I take all the reporters,” she said, flashing a sarcastic smile while getting comfortable at the picnic table. “It’s peaceful, right?”

I had to laugh.

In the months since I wrote about Horton during the darkest days of the pandemic, she said she has met with a parade of reporters, all wanting to know about her participation in the Compton Pledge guaranteed income program.

And she keeps telling her story.

How she grew up poor in Bakersfield and was abused as a child. How she spent decades in prison, found religion and became an evangelist. How she moved to Compton after being released and struggled to make ends meet when the economy shut down over COVID-19.

And how the few hundred dollars that she now receives every month — no strings attached — has taken her from the brink of eviction to a budding career as a motivational speaker with her own nonprofit.

With each telling, Horton has further embraced her role as a spokeswoman for guaranteed income. “A poster child,” she likes to joke.

But she knows it’s not just her story. It’s that in the months she has been telling it, several mayors have been making a big show of launching publicly funded guaranteed income programs in their own cities.

The Los Angeles City Council moved forward a plan to provide families with cash assistance across the city. The application period opens Friday.

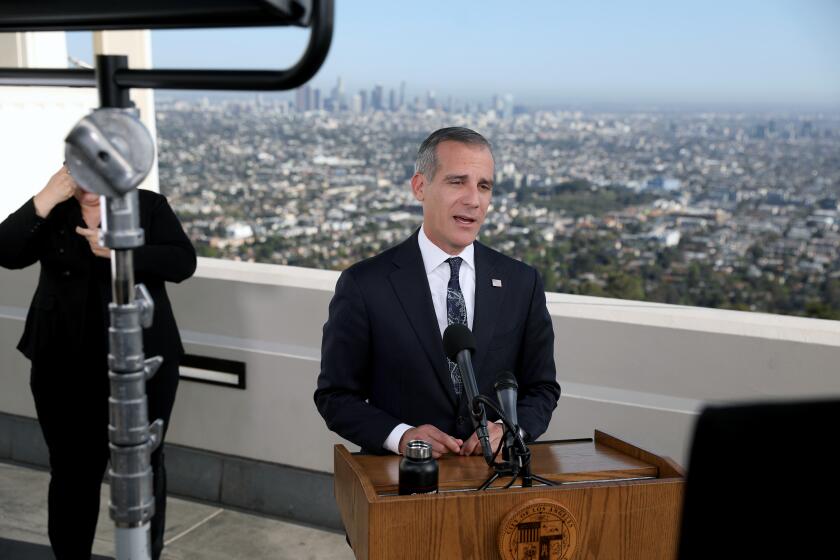

Los Angeles is just the latest, with Mayor Eric Garcetti last week announcing more details for the Basic Income Guaranteed: L.A. Economic Assistance Pilot, or BIG: LEAP. Some 3,200 low-income households will get $1,000 a month for one year. Applications are being accepted now.

Also last week, Chicago announced that it would start distributing monthly payments to low-income residents, too, with Mayor Lori Lightfoot bragging that her city will have “the largest pilot program in the country.”

Indeed, each successive announcement seems designed to one-up the last, with cities clearly competing with one another to be seen as giving out the most money to the most people.

Yes, it’s shameless virtue signaling. But it’s also testament to how what started in 2019 as a controversial experiment in Stockton under then-Mayor Michael Tubbs has quickly morphed into one of the most politically popular — and effective — tools for managing the economic upheaval of the pandemic. That’s why mayors like to talk about it.

What mayors talk about less is how their frenzy over guaranteed income has spawned a new industry — from nonprofit leaders and consultants who tout best practices at symposiums to organizations that help cities select recipients, run their programs and collect data.

For example, there’s the Fund for Guaranteed Income. Led by Nika Soon-Shiong, the daughter of Los Angeles Times owner Patrick Soon-Shiong, it’s the charity behind the donor-funded Compton Pledge and has been tapped by Chicago to help manage its program.

There’s also the academic Center for Guaranteed Income Research, which is working with Los Angeles and many other cities that have started programs under Tubbs’ Mayors for a Guaranteed Income.

Horton shakes her head in amazement at how complicated guaranteed income has become and how removed it has become from people. Though grateful for the steady stream of cash through the Compton Pledge, she is worried about what comes next for those who have come — and will come — to depend on it.

“Y’all are bragging about how much you’re giving,” she said, talking about the mayors and their speeches. “But what’s going to happen when it’s over?”

::

The question of sustainability is one that critics often pose about guaranteed income, even though early research has shown that such programs can help lift Americans out of poverty for good.

Still, some cities aren’t taking any chances.

In L.A., for example, those selected for BIG: LEAP will be referred to agencies that provide financial coaching. Other guaranteed income programs, including in the Bay Area, are offering the same. Participation is optional.

Horton admits she did many things the hard way, including figuring out on her own how to start her nonprofit, Georgia Horton Ministries.

But once she filed the paperwork — using money saved from her monthly Compton Pledge stipend — it led to a slew of new speaking engagements, including from the Word Network and T.D. Jakes Ministries. She also has written a book, which tells her story of overcoming trauma.

With COVID-19 ravaging essential workers, there’s no better time to study how cash infusions can help people trapped by poverty and systemic racism.

“With that transition came a whole lot of different responsibilities,” she explained. “But it came with a whole different mindset, too.”

It’s that new mindset that Horton hopes L.A.’s coming class of guaranteed income recipients will adopt sooner rather than later. Ever the evangelist, she ticked off the lessons that she has learned.

First, start a savings account to fight the urge for instant gratification.

“There’s never going to be a good time to save in your mind — in that poverty mindset — because need is always going to be present,” Horton said. “If you’re waiting to save absent of need, you’ll never save. So now you have to decide: If I have lived without this for so much time, then why can you not live without this now?”

Second, keep your old friends, but make new ones.

“Bring in somebody that is thinking on the level of where you want to go. Because what’s gonna happen is, while you’re bringing in somebody that’s thinking on that level, then when you’re conversing with them, you’re getting new ideas.”

And third, don’t forget about self-care, both mental and physical, to avoid impulse buying.

“In the midst of this pandemic, to help you make better decisions with your funding, do some inner self-care to change how you feel in a healthy way,” she said. “If you don’t, then you’re going to find some kind of outer something to bring in to try to feel better.”

That is Horton’s story and, as long as people keep asking, she’ll keep telling it.

More to Read

Get the latest from Erika D. Smith

Commentary on people, politics and the quest for a more equitable California.

You may occasionally receive promotional content from the Los Angeles Times.