‘Wall Street Whiz Kid’ charged with running financial scams out of L.A. bars and luxury apartments

- Share via

David Bloom — a twice-convicted con man infamous for scamming dozens of wealthy New Yorkers out of millions — has been arrested, accused of bilking at least a dozen Angelenos out of tens of thousands of dollars after he promised to make them rich by selling them stocks he didn’t own, authorities said.

Bloom, 59, was charged with nine counts of grand theft and nine more counts of fraud while selling securities, court records show. Los Angeles police took him into custody around 4 a.m. Monday, and he is being held in the 77th Street lockup in lieu of $500,000 bail, according to jail records.

Police allege Bloom told neighbors and new friends he made at local bars and restaurants that he could get them in on the ground floor of trendy stocks that hadn’t gone public yet, including Coinbase and Soho House. But Bloom’s accusers, some of whom invested well over $10,000 with him, said they never saw profits. And the more they asked him about the stocks’ performance, the scarcer he became.

The alleged L.A. scam mirrored the one that made Bloom quasi-famous in the first place.

Raised on Manhattan’s Upper East Side, Bloom grew up accustomed to wealth. In his early 20s, he purchased million-dollar paintings, a Manhattan condo, a Long Island beach house and an Aston Martin, the favored car of James Bond, court records show, funding that lifestyle with cash from clients of his Greater Sutton Investors Group.

Approximately 140 people, including Bloom’s grandmother, together invested more than $15 million with him. Despite convincing marks that his firm’s clientele included Bill Cosby and members of the Rockefeller family, Bloom was not a financial advisor, and he didn’t invest in anything but his own comforts, according to published reports.

‘Wall Street Whiz Kid’ David Bloom allegedly attempted to turn dozens of L.A. luxury apartment dwellers into his newest set of marks.

Eventually, federal prosecutors caught on, and Bloom was nicknamed the “Wall Street Whiz Kid” by New York tabloids after pleading guilty to mail and securities fraud in 1988. He was sentenced to eight years in federal prison and barred from taking part in the securities industry for life.

He pleaded guilty to running a similar scam, for considerably less money, on restaurant staff and bartenders in Midtown Manhattan in the late 1990s. He pleaded guilty to larceny and violations of business law in 2000, according to the Manhattan district attorney’s office. Prosecutors alleged he had bilked 10 people out of at least a combined $50,000, court records show. He served approximately five years in prison.

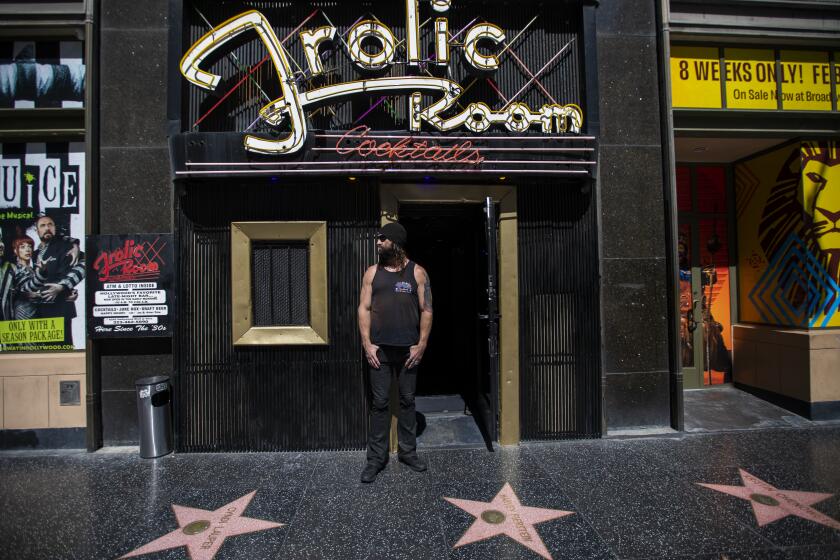

Last year, The Times chronicled a series of grifts Bloom was accused of running in L.A. Far removed from the Hamptons and wealthy Manhattan social circles he’d once haunted, Bloom largely hunted for targets in a historic Franklin Village apartment complex and the Frolic Room dive bar along the Hollywood Walk of Fame, according to police and accusers.

Once again, his accusers said, Bloom claimed he had connections to power and allegedly reeled in people by promising to serve as the conduit to make their dreams a reality. One Frolic Room regular said he rushed to finish a screenplay after Bloom offered to pass it along to Netflix CEO Ted Sarandos. At least a dozen bar patrons said they believed Bloom could get them tickets to Super Bowl LVI at SoFi Stadium, only for Bloom to disappear hours before kickoff, claiming his sister had died in a car crash. She hadn’t.

The Times has made several attempts to contact Bloom, all of which were unsuccessful. It was not clear if he had retained a defense attorney and the district attorney’s office did not immediately respond to a request for comment Monday.

For Caroline D’Amore, the hook was set when Bloom said he could connect her to A.C. Gallo, the CEO of Whole Foods.

The 39-year-old reality TV star and actress had found success with her company Pizza Girl, which makes jarred organic pasta sauces sold in high-end supermarkets. But when the COVID-19 pandemic hit, sourcing proper ingredients became near impossible, she said. Following a divorce, D’Amore moved into the Villa Carlotta, where she met Bloom near the historic complex’s first-floor pool.

Other accusers have described the pool as Bloom’s primary hunting ground, where he’d approach people armed with information about their aspirations.

“He kind of knew the right things to say when he first approached me,” said D’Amore, who appeared in “The Hills: New Beginnings” and is a part of Gordon Ramsay’s “Food Stars.” “He had heard about my company ... he had actually bought some of the sauce at the grocery store next door and he had just confided in me at some point about his ex-wife and how he was heartbroken.”

Bloom also said the two had a mutual friend — Ron Burkle, the owner of Soho House, the global members-only social club. Unbeknownst to D’Amore, Bloom was already telling other Villa Carlotta residents that he could help them buy shares in Soho House before it went public.

D’Amore actually knew Burkle through a mutual friend, but she said it never occurred to her to contact him and check Bloom’s story.

“I never thought that somebody would make that up,” she said. “I just thought it was such a random person to name-drop.”

Weeks later, Bloom told D’Amore that Gallo wanted to talk to her about selling Pizza Girl sauces in Whole Foods outlets throughout the country. In Bloom’s apartment, someone purporting to be Gallo got on the phone and talked excitedly about Pizza Girl, D’Amore said.

“He knew all about my history, growing up in the restaurants. He was just very excited about my company and I was ecstatic,” she said.

The man who said he was Gallo promised to invest $2 million in Pizza Girl and scheduled a meeting in Austin, Texas, at Whole Foods’ national headquarters. But Bloom warned the investment would take time to come together, and he offered her an investment opportunity to keep her afloat until that windfall came to fruition. He offered to get her in on the “ground floor” of Soho House’s initial public offering, she said.

Thinking about the moment she decided to write Bloom a check, D’Amore’s face scrunched in fury. Bloom attended her daughter’s birthday party. He said he loved her, comparing her to a “kid sister,” and knew she had just gone through an expensive divorce, D’Amore said.

“He knew I wasn’t rich, and that’s what’s really upsetting,” she said.

With some help from friends, D’Amore paid Bloom $35,000 for Soho House shares. He promised the investment would net a return of more than $850,000, she said.

Then, D’Amore set off for her dream business meeting in Austin, and everything fell apart. The meeting with Gallo never materialized and Bloom kept canceling his flights to join her in Texas, providing an ever-changing string of excuses.

Five days went by until Bloom said he’d fly out to Texas, according to D’Amore. Then she received a call from a fellow Villa Carlotta resident, who mentioned Bloom was at his favored poolside area, hosting a barbecue.

D’Amore finally typed the words “David Bloom, scammer” into her phone, and came across news articles about the crimes of the “Wall Street Whiz Kid.”

Back in L.A., she connected with other Villa Carlotta residents who had invested with Bloom and started to fear they’d been duped as well.

“Everybody thought it was a special deal for them,” she said. “He really makes you feel like you’re his best friend.”

Weeks later, D’Amore led at least four other people who had invested with Bloom to his doorstep. She said he denied all wrongdoing but promised to return their investments if they were unhappy.

Bloom moved out of the Villa Carlotta a month later. Los Angeles Police Capt. Al Lopez, who leads the division investigating Bloom, said some victims have gotten partial refunds from Bloom but detectives and victims both suspect he simply paid them off with funds pilfered from others.

Bloom was initially arrested last August on suspicion of grand theft. But the case has lingered in review at the Los Angeles County district attorney’s office for nearly a year.

A frustrated D’Amore organized a small protest in downtown L.A. earlier this year calling for Bloom to be prosecuted. Asked about the delays in filing recently, Laura Jane Kessner, who heads the district attorney’s office’s charge evaluation division, said the case was “complicated” and required an extensive review.

In the year since Bloom’s last arrest, D’Amore says she’s been contacted by others who say he tried to swindle them.

Among them was Sean Kushner. A life coach who helps people with addiction issues, Kushner said he met Bloom at a Hi-Ho Cheeseburger in Marina del Rey a few months ago. At first he was amused by the quirky older man babbling about stocks and insisting he knew Kazunori Nozawa, the master sushi chef behind the Sugarfish chain.

“Within 20 minutes of meeting him, he starts talking about how he goes at 4 a.m. with Kazunori to look at the fish at and Kazunori checks the eyes of a fish and that’s how he knows what a good fish is,” Kushner said.

Once the topic of Kushner’s profession came up — and the fact that he sometimes works with celebrity clients — Bloom asked to exchange numbers. When Kushner revealed he was struggling to find a home in L.A.’s high-priced housing market, Bloom said he wanted to help his new friend because he was a “good person” for aiding others with addiction struggles.

Bloom promised to get Kushner into a million-dollar home as long as he could provide a portion of the down payment up front. Suspicious, Kushner held off. The longer he waited, the more absurd Bloom’s boasts got: He promised to fly Kushner’s family to the famed Hotel du Cap Eden-Roc in France. He canceled meetings with Kushner because he needed to fly up to the Bay Area for a fundraiser for President Biden.

Eventually, a Google search led Kushner to a New York Post aggregation of previous coverage of Bloom.

Kushner immediately cursed out Bloom over text for allegedly trying to rob him. Bloom politely asked Kushner to stop contacting him, according to messages reviewed by The Times.

“He’s an absolute sociopath,” Kushner said.

While many of Bloom’s accusers have spoken to The Times on the condition of anonymity out of embarrassment or fear that news of their gullibility could harm them professionally, D’Amore has been insistent about using her acclaim and voice to hound Bloom.

“The reason these people get away with it is because people are too afraid to admit that they were scammed,” she said. “I’m willing to be the face ... You know what? We’re not the ones that need to be embarrassed.”

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.