Sacramento politicians need the guts to fix California’s money woes

- Share via

SACRAMENTO — California state government’s bank account has dwindled from a nearly $100-billion surplus 18 months ago to a projected $68-billion deficit.

How could that possibly happen?

Three reasons:

- Sacramento politicians haven’t had the guts to fix a very flawed roller-coaster tax system that generates barrels of revenue in good times but goes bust when the economy sours.

- They spend too much money. That’s self-evident. At any rate, they’re spending more than the state is taking in. A lot more.

- All that aside, rising interest rates cooled the economy by increasing borrowing costs. That stifled home buying and business expansions, according to independent Legislative Analyst Gabriel Petek, who projected the $68-billion deficit last week.

The analyst says the state stumbled into the red ink hole partly because the federal government extended the normal tax filing deadline this year from April until November. It wanted to ease life for Californians harmed by last winter’s drenching storms. California followed the feds’ lead and did the same.

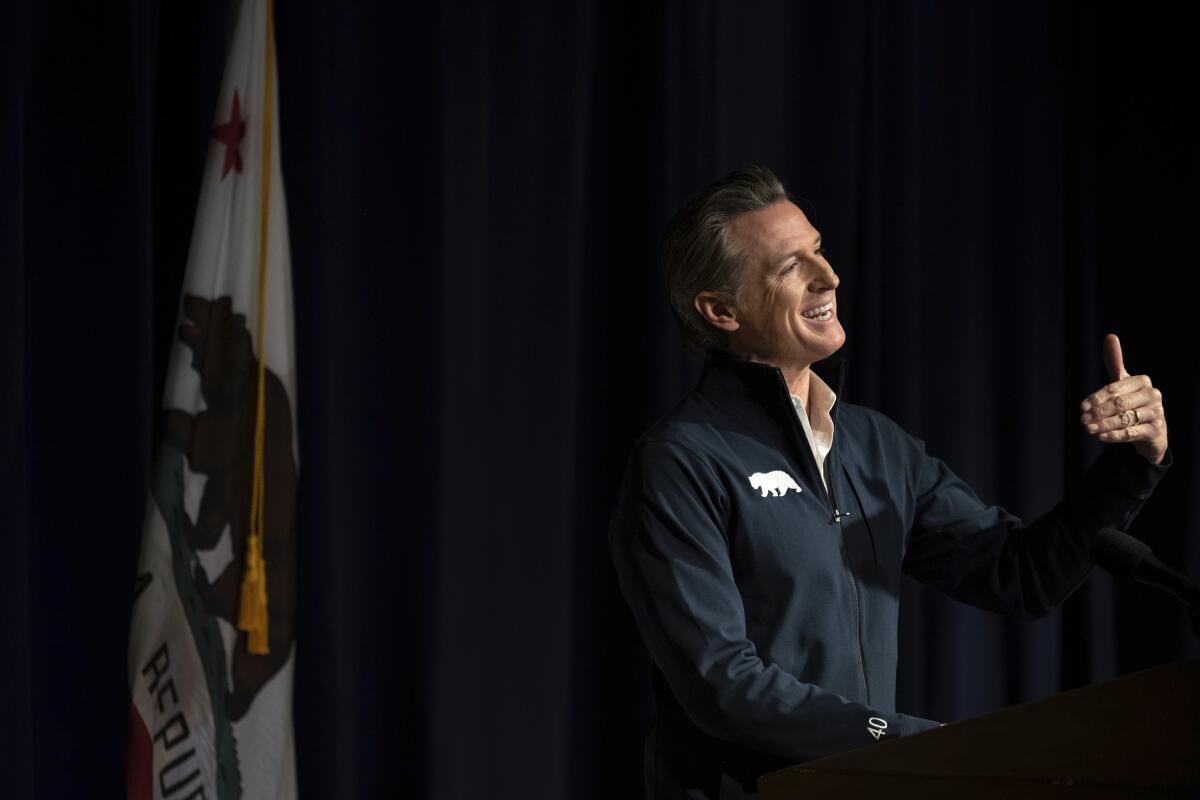

So what? It meant Gov. Gavin Newsom and legislators didn’t know how much revenue they had to spend before the deadline for passing a budget. They needed to enact a spending plan by the start of the fiscal year July 1. But the revenue data weren’t available until tax returns were filed in the fall.

Their solution was to blindly overestimate the taxes the state would collect.

If they’d known the revenue flow was slowing, mitigating steps could have been taken: spending cuts, tapping reserves, internal borrowing.

“The [tax filing] delay really messed us up,” says H.D. Palmer, Newsom’s budget spokesman. “If we’d had that cash data on hand in spring like normal, it would have required solutions to close the gap and we’d have a much smaller problem today.”

OK, but they could have had the foresight to act long before spring. On Newsom’s watch starting in 2019, annual state spending has jumped by 53% — more than $100 billion from the $203-billion budget he inherited from Gov. Jerry Brown to $311 billion currently.

But overspending is only part of the problem. There’s another part that neither Republicans nor most Democrats want to talk about: a volatile tax system that overreacts to economic changes.

Gov. Gavin Newsom said his staff has been working with Democrats in the Legislature on the state’s healthcare minimum wage law in light of budget concerns.

Less money came in than expected because of California’s warped tax system. It relies mostly on wealthy-income taxpayers — regardless of whether they’re having a good or bad year. The system functions like a yo-yo, performing erratically depending on whether the economy is booming or busting.

Specifically, the state feeds off taxes on rich people’s capital gains, especially their stock earnings. Sometimes stocks tumble. And capital gains become investment losses.

The top 1% of earners pay nearly 50% of the state income tax. And the top one-tenth of 1% pay 28%.

“These lucky folks get a lot of their income from capital gains and stock options,” Palmer says. “It turns out that 2022 was not a great year for the financial market. The Nasdaq dropped 33%, the biggest drop since the Great Recession in ‘08. The Nasdaq is relevant because of California’s high-tech economy.”

The top 10% of earners — with taxable incomes above $200,000 — kick in roughly 80% of the tax. California has a very progressive tax system, with the lower 60% of earners paying only around 2%.

The legislative analyst says the state took in $26 billion less than expected in the last fiscal year — ”a severe revenue decline.” And he forecasts a “serious” $68-billion deficit through the next fiscal year.

Personal income tax receipts were 22% — $19 billion — less than forecast just from April through November, Palmer says.

Putting this in perspective, the personal income tax supplies two-thirds of the state general fund. Back in 1950, when our tax system was stable, the income tax accounted for only 10%. Then, the sales tax was the main revenue source, feeding 60% of the general fund. Today it’s just 16%.

A big reason the sales tax has diminished in importance is that we’ve become less of a retail economy and more of a service economy. But we’re one of the few states that don’t tax services. Our tax system is stuck in the mid-20th century and should be modernized.

What’s needed is to reduce income tax rates at all levels and extend the sales tax to services.

Healthcare minimum wage expected to cost $4 billion in first year as California budget deficit looms

Gov. Gavin Newsom approved a healthcare minimum wage that will cost $4 billion amid California budget deficit

That doesn’t mean taxing haircuts, lawn mowing and baby sitting. But we could tax labor on car repairs, as parts already are. Tax Lakers tickets and concerts. More important, tax attorney, accountant and interior designer fees — services used mostly by big business and the wealthy.

But that thought scares politicians. Most would love to vote for an income tax cut. And it would require only a simple majority vote of the Legislature. But extending the sales tax to services would necessitate a two-thirds vote. That would take strong gubernatorial and legislative leadership. And it has never materialized. Too politically risky.

Former state Controller Betty Yee, a Democrat who’s running for governor, advocated such tax reform for years but backed off.

“People focus on one aspect without looking at the entire system and then just beat me up for wanting to tax services,” Yee told me. “It’s very hard for people to put their arms around the entire system.”

So Newsom and the Legislature will probably cut school funding, trim some other spending, tap into savings, borrow internally and shamefully deploy fiscal gimmickry to “balance” the next budget.

And our tax system will continue to perform erratically.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.