Wide Shot: Neil Young and the slow-motion Spotify boycott over Rogan

- Share via

Welcome to the Feb. 1, 2022, edition of the Wide Shot newsletter about the business of entertainment. If this was forwarded to you, sign up here to get it in your inbox.

For those following certain parts of Twitter during the last week, it would have been easy to come away with the impression that Spotify was facing a mass exodus of artists protesting COVID-19 vaccine misinformation on Joe Rogan’s immensely popular podcast.

When Neil Young pulled his music from the Swedish streamer over its airing of “The Joe Rogan Experience,” he invited others to join him. Fellow Canadian rocker and polio survivor Joni Mitchell followed suit in solidarity (the friends share the same manager and record label). Few others did.

The exit of Young and Mitchell was enough to get Spotify Chief Executive Daniel Ek to release a lengthy statement on Spotify’s “critical role to play in supporting creator expression while balancing it with the safety of our users.” He didn’t mention Rogan by name.

The company agreed to publish its “platform rules” and add content advisories to episodes that discuss COVID-19, though it appeared to set a high bar for what it considers misinformation. It’s unclear whether Spotify’s response will be enough to quell the turmoil and relieve pressure on other artists to act.

But so far, the response to Young’s call has been largely muted among recording artists.

Sure, there was E Street Band guitarist Nils Lofgren, who said he was working with labels to strip Spotify of his music, and podcaster Brené Brown, who said she was pausing the release of new episodes. But the real chart-toppers who could truly shake things up — such as Taylor Swift and the Weeknd — haven’t gone anywhere.

Though Peter Frampton and David Crosby voiced support for Young, their albums remain available for Spotify’s millions of subscribers.

The reasons why more artists haven’t abandoned Spotify include a stew of political hesitancies, music ownership complications and business incentives. The issues speak to the trickiness of the debate over COVID-19 misinformation, free speech, music rights and the role of Spotify in the modern music industry.

Some artists may not necessarily agree with Young and Mitchell that pressuring Spotify to dump Rogan is the right thing to do, according to music industry insiders. Mass-market pop artists may not want to alienate fans by appearing to participate in a campaign to censor Rogan, whose podcast is Spotify’s most popular.

Ek’s statement and the disclosure of Spotify’s content moderation policies may not satisfy its most ardent critics, as they appear to set a relatively high bar for what it considers to be unacceptable misinformation about the coronavirus vaccines.

As former Billboard editorial director Bill Werde put it on Twitter, “Eh, it’s a start.”

Spotify said it won’t allow creators to claim that COVID-19 is a hoax or that the vaccines were “designed to cause death.” It won’t let hosts encourage listeners to drink bleach as a remedy or call for so-called COVID parties. But the misinformation that gets bandied about on Rogan’s show is typically more subtle than that.

Rogan himself, in a video posted on Instagram Sunday, defended his decision to invite guests such as Robert Malone, a scientist and physician whose positions questioning the safety and efficacy of mRNA vaccines have been blasted by medical experts.

But he said he would try to do better and “balance” out controversial guests by bringing on experts more in line with the mainstream scientific consensus on vaccinations.

“There’s freedom of speech, and some have said that although they disagree with what’s said on Rogan’s podcast, it’s an over-reaction to just cut the cord, especially if Spotify will add a disclaimer or warning,” said Los Angeles music business attorney Bill Hochberg.

If Spotify follows through with its commitment to add content advisories, that might be good enough for some artists.

Head over to our larger story for the full analysis of the state of the boycott.

Stuff we wrote

— Nicolas Cage meditates on movies, music and what makes him happy. Glenn Whipp profiles the “Pig” star, who talks about working outside Hollywood’s mainstream: “I had a couple of flops in a row, so I was no longer invited.”

— At Sundance, Abigail Disney calls out corporate greed. Beginning with Disney. “The documentary film producer and philanthropist has done what the company her grandfather Roy O. Disney founded with her great-uncle Walt has been doing for nearly a century: She made a movie,” Josh Rottenberg writes.

— Buying on the dip. Netflix’s stock got a boost after Bill Ackman’s hedge fund Pershing Square invested during the streamer’s slump. Netflix’s co-CEO Reed Hastings also bet on the company, buying $20 million worth of shares.

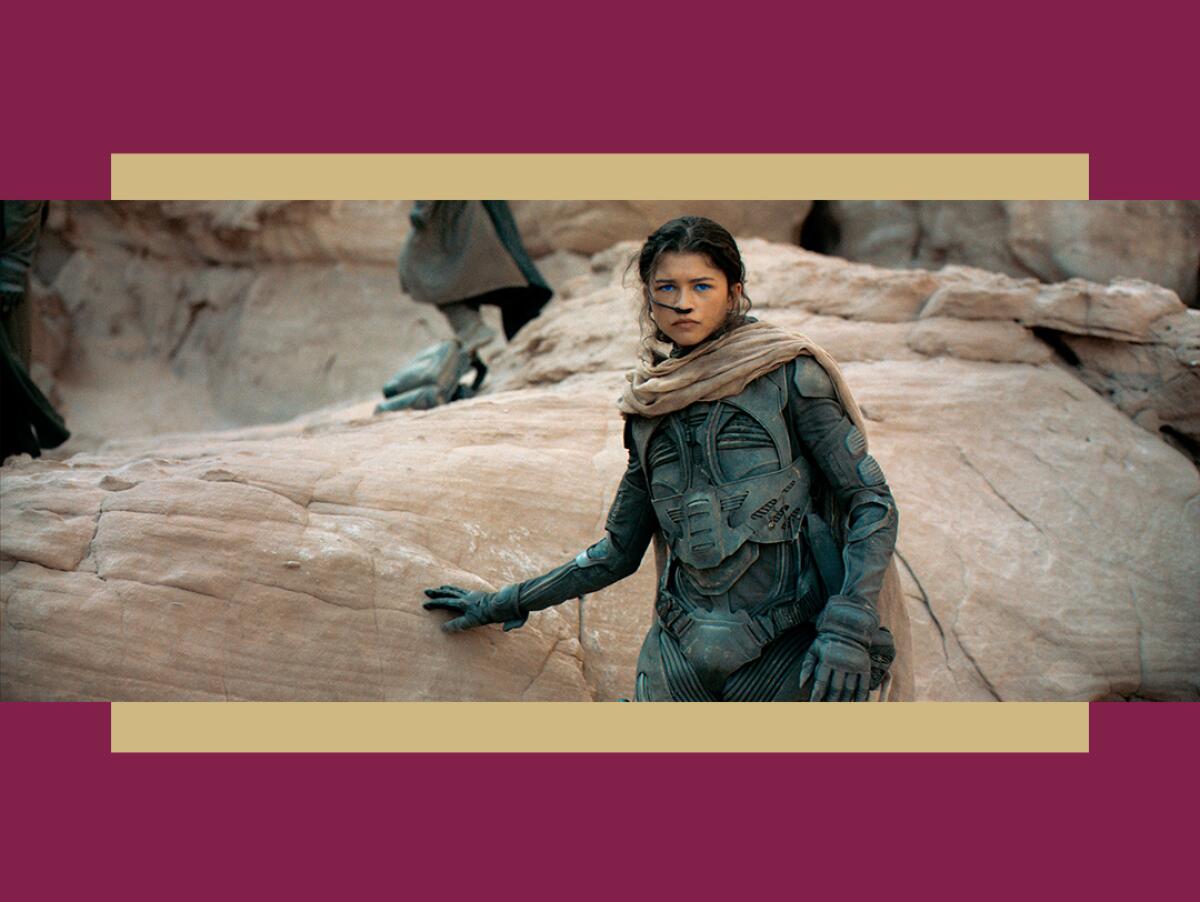

— “Dune” deal. Legendary Entertainment is getting a $760-million investment from Apollo Global Management.

Jason Kilar on HBO Max

I spoke with WarnerMedia Chief Executive Jason Kilar after parent company AT&T reported quarterly earnings last week. The company previously disclosed that HBO and HBO Max reached 73.8 million subscribers at the end of the year, exceeding its earlier guidance of 70 million to 73 million.

After a wobbly launch in May 2020, HBO Max has arguably become one of the top challengers to Netflix, which recently reported disappointing subscriber projections. We asked in last week’s edition whether Netflix’s struggles imply broader challenges for the streaming business.

I asked Kilar about the future of streaming, movies, gaming and his own job at WarnerMedia after the company is merged with Discovery, pending regulatory approval.

How do you ensure that, during the land grab for consumer attention, these services actually make money?

For the record:

12:15 p.m. Feb. 1, 2022An earlier version of this newsletter quoted WarnerMedia CEO Jason Kilar saying the company generates “millions of dollars in cash flow.” He said “billions.”

I’ll start by saying that we generate billions of dollars in cash flow today. Our mission is straightforward, which is, we move the world through story. And that’s a very simple-to-say sentence, but boy is it hard to deliver on day in and day out. And so I want you to know that it’s been a very carefully constructed strategy over 99 years.

Streaming is really important. There’s no doubt about it. It’s our fastest-growing business. I believe it’ll be our biggest business. But it’s not our only business, and I think that’s really important. Because if you’re going to invest tens of billions of dollars in stories, beloved characters and worlds, the strategic thing to do is to meet audiences where they want to be met. And not everybody on the planet is saying, “Streaming, and only streaming.”

And so yes, streaming is important. But we’ve got channels, we’ve got a very big games business, we’ve got a theatrical business, we have digital collectibles as a business, we have consumer products. These are carefully considered strategies that literally kind of have gone back decades. And so the answer to your question is, I’m really glad that we have a diversified business.

There’s the cost of content, and then there’s setting a price that people were willing to pay. How are you looking at those two factors?

We spent a lot of time thinking about, not just the number of subscribers that we have, but also what’s the revenue that we proudly earned from customers each and every month? In the U.S., it’s been us and Netflix, and everyone else is very, very far behind in terms of the revenue that’s generated from streaming. And that’s a very helpful dynamic, because the more revenue you generate, the more resources you have to invest in stories.

What is going to determine the winners and the losers over the next 10 years is how many people are going to choose to hand over their hard-earned dollars to you for the service that you’re providing them.

How are content costs changing in 2022?

We’re actually going to be investing more in 2022 than we did in 2021 on a cash basis. It’s being done from a position of conviction and belief, based on what we’re seeing over the last 24 months, in terms of consumers around the world choosing to sign up for HBO Max. So you’re absolutely right that there is the cost side of the equation, for sure. But I argue that there is no better company in this industry at translating investment dollars into stories that matter.

I’ve heard that if a film doesn’t do well at the box office, it’s probably not going to do well on streaming either. What are you seeing in the numbers for smaller dramas?

I’m actually going to disagree with your theory. I do believe that in 2022 the theatrical marketplace from a commercial perspective is incredibly different from 2012. You can have a fantastic, subtle drama or romantic comedy, and no matter how well it’s executed creatively, it’s much more difficult to be successful commercially in theaters.

The data I’ve seen is that we’ve had plenty of Imax-worthy movies that have done extremely well in theaters, like “Dune” and “Godzilla vs. Kong,” that have also done extremely well on streaming. However, we also had movies that have not done the same kind of performance that they would have done, say, a decade ago in theaters that did incredibly well on streaming. We have a pay-one movie right now called “The Last Duel” [from 20th Century Studios] that came on the service, and it’s doing really well.

There’s been a lot of movement in the gaming space recently, and Warner Bros. is big in games. What’s the opportunity in gaming as people talk about the metaverse?

When I think about the opportunity for a storytelling company, I think it comes down to creating persistent digital environments that compel audiences to want to spend time in those environments consistently through the course of a week or a month. I get very excited about our position to be able to do that, and we’re planting seeds.

A good example is the Wizarding World of Harry Potter. We have a vision to give kids all over the world the opportunity to claim their dorm room at Hogwarts, on any internet connected device, play a game of Quidditch with any of their friends or go on an adventure into the Forbidden Forest. These are visions that we have not just for the Wizarding World, but also Gotham, Metropolis, Themyscira and Westeros.

Microsoft just announced a deal to buy Activision Blizzard for $69 billion. You don’t see consolidation is a problem for the industry?

I don’t. The choice the consumer is going to make is, what’s the beloved world and what are the beloved characters that they are magnetically attracted to? And last time I checked, Westeros and Gotham City, Metropolis and the Wizarding World are not heading over to Microsoft.

Last question. How do you see your future at the company? Do you have any clarity on that?

I don’t have any answer to share with you. And the reason is really simple, which is because my focus today and in this conversation is all about our results from 2021. There’ll be a point where I’ll comment on myself, but today’s not that day.

Number of the week

Speaking of streaming profits, or lack thereof, Comcast disclosed that its streaming service Peacock lost $1.7 billion in 2021 on revenue of $778 million. The results included $1.5 billion in content spending.

Streaming services typically lose money at first. The service sits at about 9 million paying subscribers out of 24.5 million active monthly accounts. Comcast has been reluctant to lose too much money on Peacock, but its limited spending has held back growth. As we’ve seen with competitors including Netflix, WarnerMedia and Disney, $1.5 billion in content spending is a relatively small fortune.

Comcast executives said spending, revenue and losses would grow for Peacock this year as the cable giant looks to accelerate growth. The company expects to increase content costs to more than $3 billion “with the goal of ramping domestic content spend to $5 billion over the next couple of years.” Comcast expects a loss of roughly $2.5 billion from Peacock this year.

You should be reading ...

— Hollywood sales agents rejoice! Apple CEO Tim Cook says, “We don’t make purely financial decisions” about Apple TV+ content. (Variety) Relatedly, Apple bought the worldwide rights to the Sundance movie “Cha Cha Real Smooth” for $15 million. (Deadline)

— What does David Fincher think of this? The ending of “Fight Club” was changed for the Chinese market, with text explaining that, actually, the police foiled Tyler’s plot after all. (Bloomberg)

— Bob Iger spoke candidly with Kara Swisher about his time at Disney. He gave some vivid quotes on Netflix and the decision to stop arming the company with Disney’s blockbuster movies. (New York Times)

— More gaming industry consolidation. Sony is buying Bungie, the developer of “Destiny” and the original creator of “Halo,” for $3.6 billion. (The Verge)

Shameless plug department

I joined KPCC’s John Horn and Vox film reporter Alissa Wilkinson to talk about the future of movies on WAMU’s NPR show 1A.

Rawr

Every book by Mary Roach (“Gulp,” “Stiff”) makes reading about science fun. Her latest, “Fuzz: When Nature Breaks the Law,” is a delightful and sometimes poignant exploration of what happens when Mother Nature and humanity cross paths in inconvenient ways. The chapter titles alone (example: “Okay, Boomer: Futile Military Action Against Birds”) make “Fuzz” worth thumbing through.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.