Powerhouse agency owner Endeavor appears set to raise $600 million in IPO

- Share via

After much anticipation, Endeavor Group Holdings Inc., owner of the powerful WME talent agency, appears set for an initial public offering this fall, with a valuation of $8 billion.

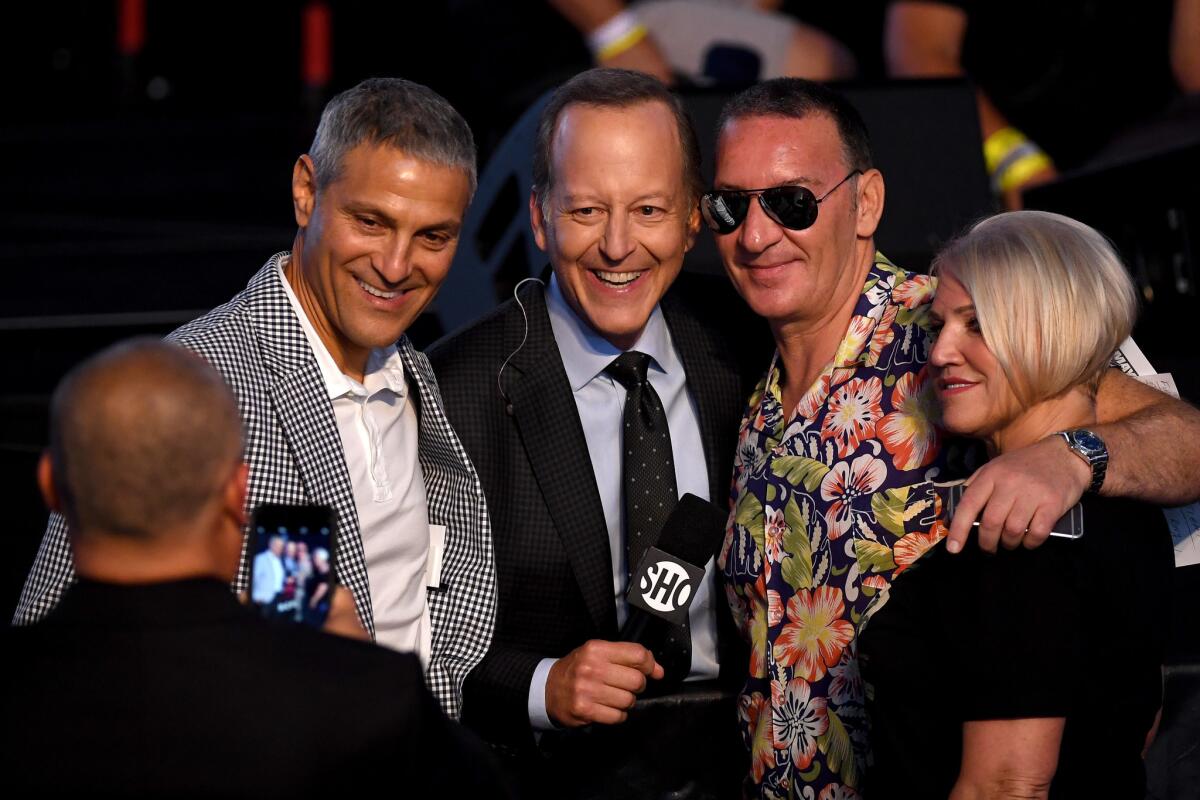

According to a filing with the U.S. Securities and Exchange Commission on Monday, the global entertainment company headed by co-chairs Ari Emanuel and Patrick Whitesell expects to raise some $600 million, with an offer of 19,354,839 shares at an estimated price of $30 to $32 per share.

Endeavor, which in recent years has acquired William Morris Agency, IMG and the Ultimate Fighting Championship, initially filed its IPO paperwork with regulators in May, just as the feud between talent agencies and the Writers Guild of America was heating up. The sides have been sparring over packaging fees and agency-related companies financing TV programming and films.

The WGA in March blasted the IPO plan, saying it “only strengthens the call for the conflicted and illegal practices of the major talent agencies to end.”

Endeavor executives don’t deny that conflicts exist. However, they argue, the issues are managed by having third-party lawyers present during negotiations and by securing better deals for creatives.

Endeavor, based in Beverly Hills, has aimed to become involved in all aspects of entertainment, whether it’s representing talent, investing in TV shows such as “Killing Eve” or selling experiences to audiences.

The company did not respond to a request for comment.

Backed by private equity firm Silver Lake Partners, Endeavor was originally expected to have launched its public offering this summer but reportedly postponed those plans in order to finalize its acquisition of On Location Experiences, a hospitality and live-events company, for as much as $700 million.

In anticipation of the upcoming offering, in August, the company released its second-quarter filings, reporting its year-over-year revenue was up 33% from $780.7 million to $1.04 billion over the three-month period that ended in June.

Endeavor would be the first talent agency to go public and, as such, has been the subject of much speculation, in large part because of the heavy debt load the company is carrying and the volatile nature of many of its businesses. Its long-term debt totaled $4.6 billion with liabilities of $7.2 billion and cash on hand of $830.9 million, the company reported last month.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.