Weinstein brothers return to their roots, reunite with Miramax

- Share via

Harvey and Bob Weinstein are getting the reunion they’ve long sought — and moviegoers could end up getting sequels to such older favorites as “Shakespeare in Love,” “Swingers” and “Rounders.”

The brothers’ film company, Weinstein Co., has struck a production and distribution deal that reconnects them to Miramax, the company they founded in 1979 and built up with such critically acclaimed movies as “sex, lies and videotape” and “Reservoir Dogs” before selling to Walt Disney Co. in 1993.

Under terms of the 20-year agreement, the companies will collaborate on new content as well as projects that mine Miramax’s library. The deal encompasses film, television and live stage productions.

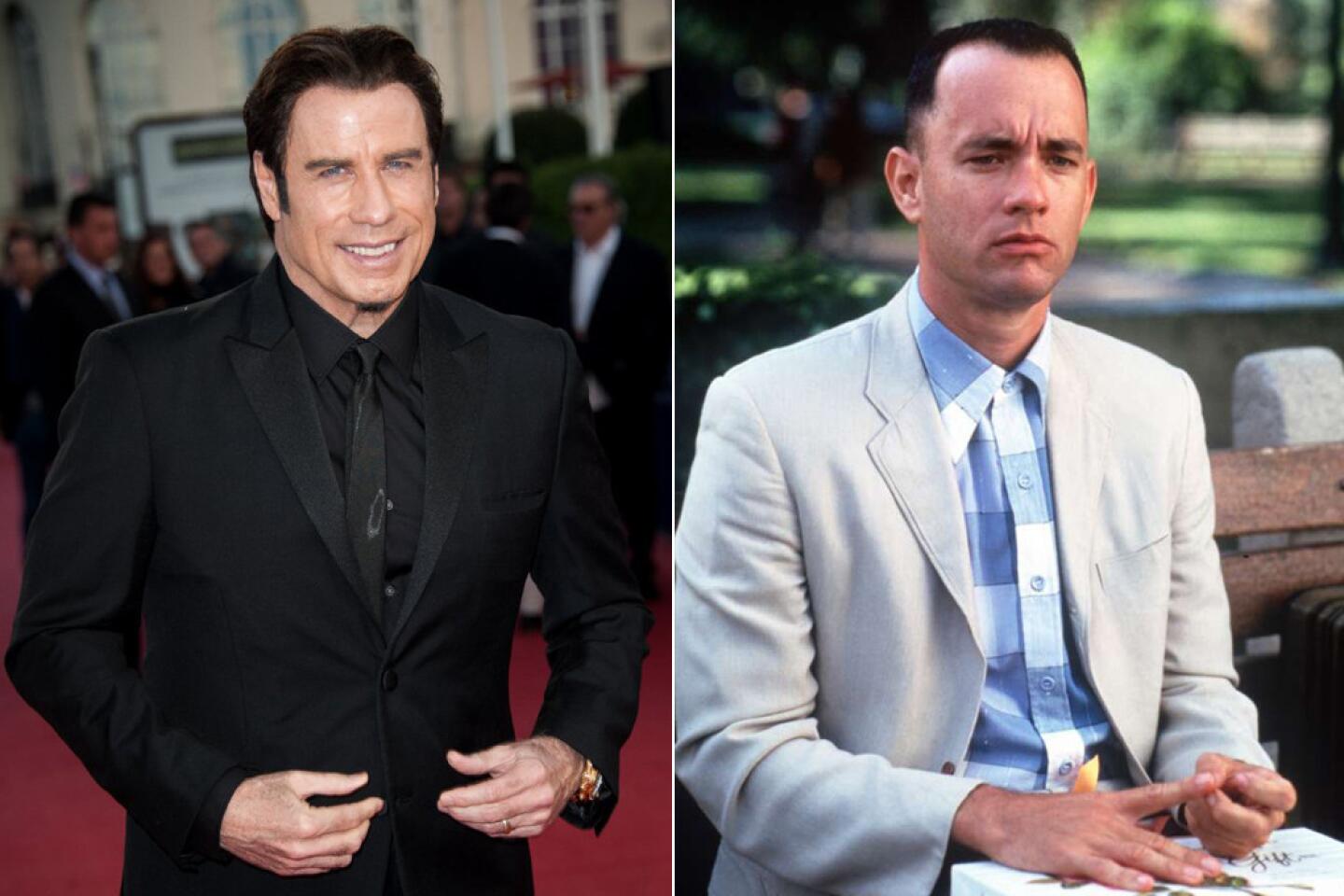

PHOTOS: Billion-dollar movie club

“It’s wonderful to reunite the brothers Weinstein with the library,” said Jason E. Squire, a film business professor at the USC School of Cinematic Arts. “Its really a full-circle sort of experience. That hasn’t happened too often in the history of the movie business.”

Harvey Weinstein told The Times that he is excited to have access to the “many jewels in the library,” adding that there is value not just in Miramax’s completed films but also in its many development projects.

“There are hundreds of scripts to decipher and remember, and find out why they were loved in the first place,” he said.

Weinstein said that he wants to make sequels to some of Miramax’s movies, including the 1998 Matt Damon poker drama, “Rounders.” The follow-up would center on a card game in which “one of the most beautiful French girls in the world is the stakes,” he said.

“I never have made a sequel ever; my brother has made all the sequels,” he said. “I’d like to have at least a ‘2’ in my epitaph.”

ON LOCATION: Where the cameras roll

The brothers from Queens sold Miramax, which they had named after their parents, Miriam and Max, to Disney in 1993 for about $60 million. They remained involved with it until 2005, when they departed after a bitter dispute with Disney over creative control, and formed Weinstein Co.

In 2010, the Weinsteins tried to buy Miramax back from Disney but lost out to a $663-million bid from a group of investors led by Colony Capital, the private equity firm headed by Thomas J. Barrack Jr., and Qatar Holding, the investment vehicle of the Qatari royal family.

Miramax’s owners, who also include actor Rob Lowe, have not focused on making new films but instead have sought to exploit the company’s rich film library of about 750 movies, cutting digital distribution deals with outlets such as Netflix and Hulu.

Although Miramax has said this business has been lucrative, the company’s direction has been a disappointment for Hollywood’s creative community, which hoped Miramax, under new ownership, would be revived as the major moviemaking concern it had been.

Barrack said he had been “chasing Harvey for a long time,” adding that Miramax under Colony-Qatar ownership was inexperienced making movies, whereas Harvey Weinstein is “a nuclear physicist who could weave tapestries” with film projects.

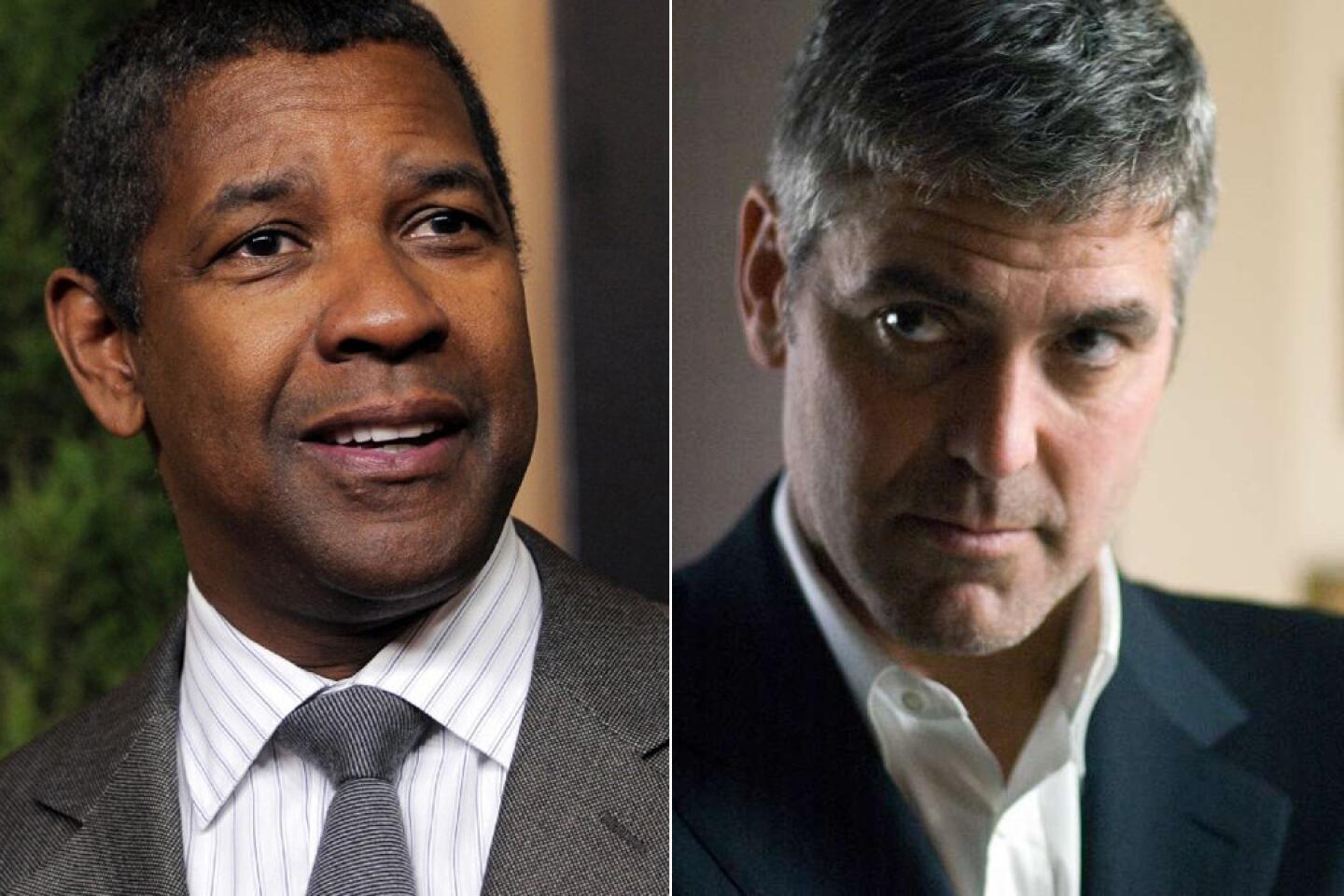

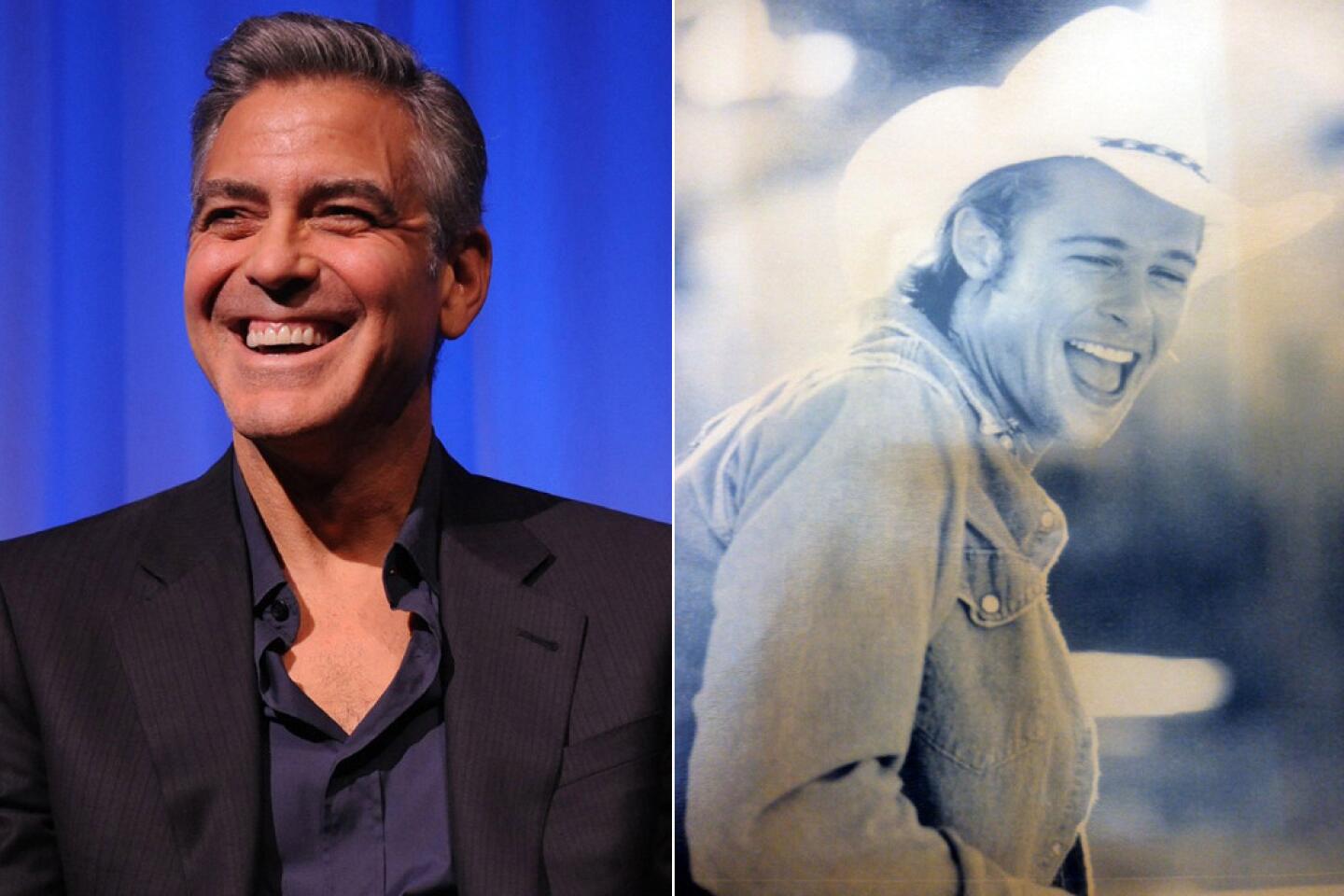

PHOTOS: Celebrities by The Times

What’s more, Barrack said that when the Weinsteins departed Miramax in 2005, they left behind about 250 development projects, “but it was like a Rubik’s Cube” trying to sort through and assess the material.

Barrack said that in a conversation he had with Harvey Weinstein last summer, it was clear that Weinstein Co.’s recent success — it produced the 2012 critical and commercial hits “Django Unchained” and “Silver Linings Playbook” — has put the producer in a position to “focus on other things,” which made the alliance with Miramax possible.

As part of the pact, Weinstein Co. will handle domestic distribution of movies made under the agreement, and Miramax, with headquarters in Santa Monica, will handle international sales of the titles.

The partnership also will involve developing television series based on Miramax films, including “Good Will Hunting” and “Flirting With Disaster.” Weinstein Co. will handle domestic TV distribution, while Miramax will head up international distribution. Production of Miramax-Weinstein projects would begin as soon as early next year.

Harvey Weinstein said he was excited about the possibility of a TV show based on “Swingers,” the 1996 Vince Vaughn comedy about a group of friends trying to make it as actors in L.A.

PHOTOS: Greatest box office flops

But some observers question the new venture’s focus on movie sequels and TV shows based on existing properties. USC’s Squire said that there would be an appetite for the remakes but acknowledged the trickiness of finding success with a sequel.

“You never know if a project is going to be any good until you can judge a screenplay,” he said.

Denise Mann, a film professor at the UCLA School of Theater, Film and Television, said that given the Weinsteins’ role in “launching a second indie renaissance” in the 1980s, it is “a little disconcerting” that Miramax’s owners largely appear motivated to work with the Weinstein brothers to exploit their previous commercial successes.

“Do we really need a ‘Swingers 2’ or ‘Shakespeare in Love 2’ from a duo known for taking risks with groundbreaking filmmakers in the past?” she asked.

Reuniting the Weinsteins with Miramax could restore some luster to the firm.

The Qatar-Colony ownership tenure has been tumultuous, peppered with the departure of two key executives and the exit of an owner.

In March 2012, then-Chief Executive Mike Lang left Miramax a little more than a year after assuming his post.

In January, one of the original investors in Qatar and Colony’s group, construction magnate Ron Tutor, sold his interest in Miramax. And in July, Miramax’s then-Chairman Richard Nanula resigned after two websites published video images of a man they identified as the executive having sex with an adult-film actress.

Barrack praised the former Miramax executives and owner.

“All of those people did a great job,” said Barrack, who now serves as the company’s chairman.

More to Read

Sign up for The Envelope

Get exclusive awards season news, in-depth interviews and columnist Glenn Whipp’s must-read analysis straight to your inbox.

You may occasionally receive promotional content from the Los Angeles Times.