Feds sue Corinthian Colleges, alleging predatory lending

- Share via

The U.S. Consumer Financial Protection Bureau sued Corinthian Colleges Inc. on Tuesday, alleging that the ailing Orange County for-profit college operator deceived tens of thousands of students and operated an “illegal predatory lending scheme.”

The lawsuit adds to a lengthy list of legal and regulatory woes for Corinthian, which announced in July that it would sell off 85 of its campuses and close more than a dozen others amid a crackdown by the U.S. Department of Education.

In a federal court filing Tuesday, the consumer protection bureau alleged that Corinthian engaged in a widespread pattern of deception, advertising bogus job placement rates to prospective students and enrolling them in high-interest private student loans.

The case seeks relief for students who have taken out a total of more than $500 million in Corinthian’s private loans since July 2011. Corinthian operates more than 25 campuses across California under the Everest College, WyoTech and Heald brands.

“Corinthian too often turned the American dream of higher education into an ongoing nightmare of financial despair,” said CFPB director Richard Cordray.

A Corinthian spokesman, Kent Jenkins, said in a statement that the company “strongly disputes the allegations” in the complaint, which he said “wrongly disparages the career services assistance that we offer our graduates.” He said the average interest rates for the private loans are “well below market rates” at 9%, and that fewer than 40% of students use the loan program.

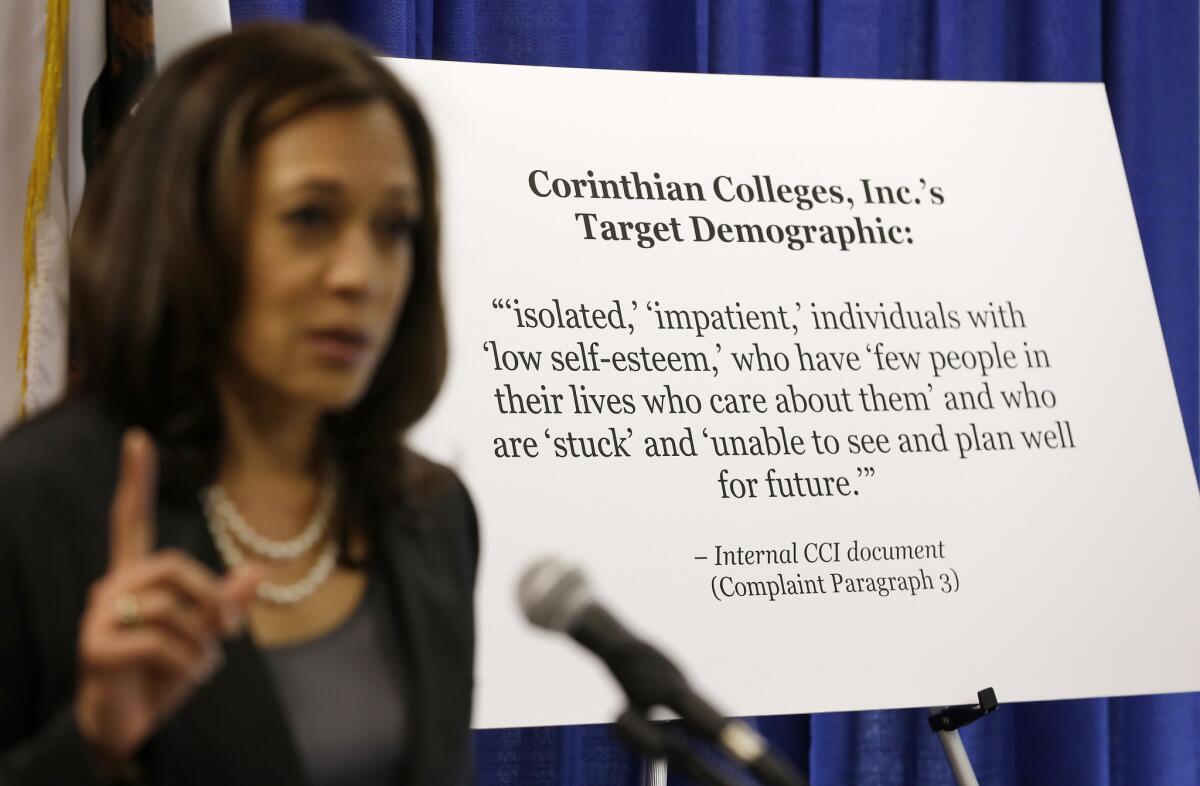

Allegations in the consumer protection bureau’s lawsuit mirror claims made by California Atty. Gen. Kamala Harris, who sued Corinthian in October.

But the federal suit delves more deeply into Corinthian’s private lending program, in which 60% of students defaulted within three years.

Corinthian and other for-profit colleges get the vast majority of their revenue from federal student loans and grants. But federal law requires that colleges get at least 10% of revenue from private sources.

The private lending program, according to the suit, was designed to give Corinthian cash tuition revenue that didn’t come from the federal government.

To come up with that money, the college hiked tuition above federal aid limits, prompting students to seek additional private loans from Corinthian.

The suit alleges that Corinthian required students to pay off some of the loans while still enrolled, and had employees pull them out of classes if they got behind.

The practice was so common at an Everest College campus near Atlanta that students and employees referred to one financial aid staffer as the “Grim Reaper,” according to the suit.

Corintihian spokesman Jenkins said the company had students pay loans while in school to “help them develop the discipline and practice of repaying their federal and other loan obligations.”

Corinthian sold the high-interest private loans to students who were ill-equipped to repay them. More than 57% of Corinthian’s students in 2011 had a household income of $19,000 or less, according to documents referenced in the lawsuit.

The suit seeks relief for students who took out the private loans and additional civil penalties.

Corinthian is also facing investigations into its financial aid and marketing practices by more than a dozen attorneys general. And the company disclosed last month it is facing a potential criminal probe by the U.S. attorney’s office in Los Angeles.

Corinthian is still under intense scrutiny from the U.S. Department of Education, which temporarily halted student aid funding in June amid concerns about job placement fraud.

As part of an settlement with the department in July, Corinthian agreed to sell or close most of its U.S. campuses.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.