Teacher pension fund investments could fall short, Brown says

- Share via

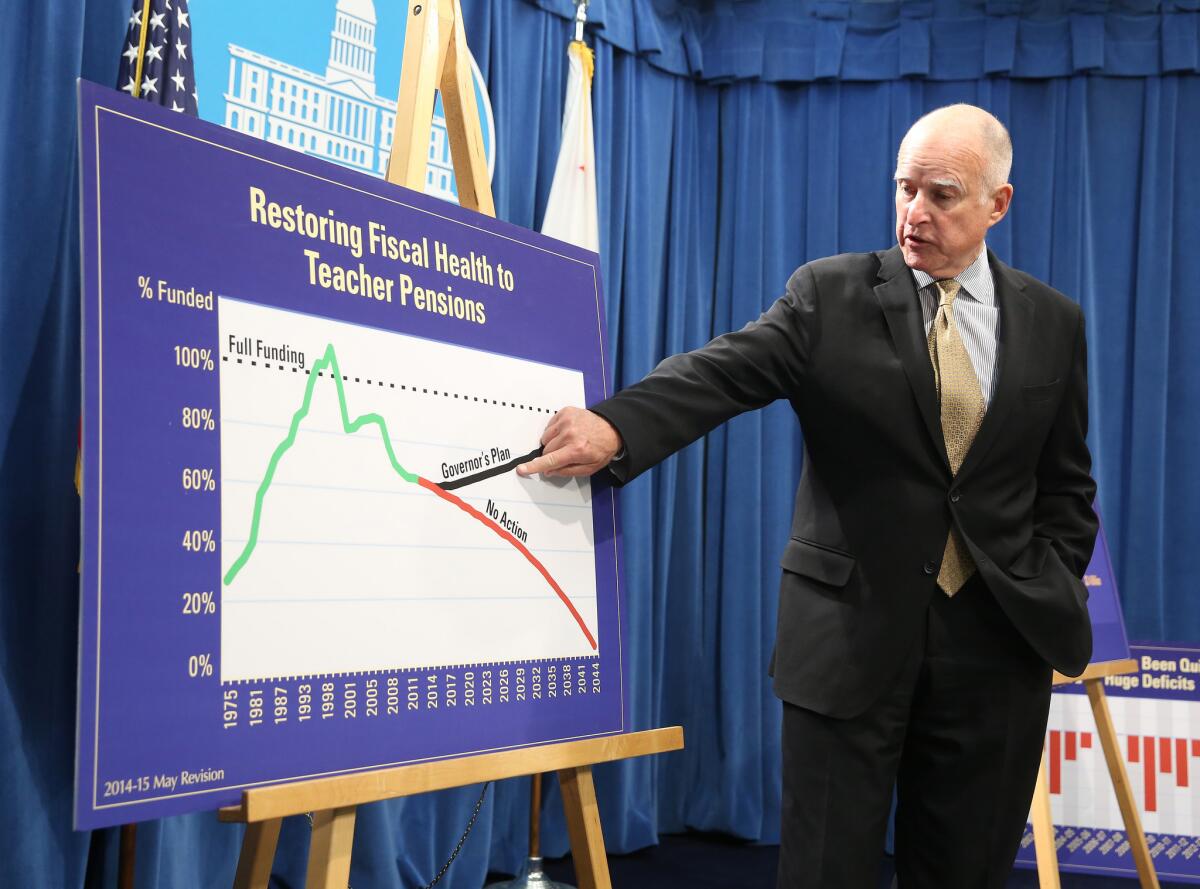

Reporting from Sacramento — When Gov. Jerry Brown released his plan for repairing California’s troubled teacher retirement system, his calculations assumed the pension fund would see investment returns of 7.5% over the next three decades.

But on Wednesday, Brown said it’s “highly unlikely” the fund will hit that target “on average, forever.”

“We have plenty of pension challenges ahead,” Brown said in a speech during a California Chamber of Commerce breakfast.

If the pension fund doesn’t meet the 7.5% goal for investment returns, Brown’s plan won’t be enough to fix the retirement system’s $73.7-billion shortfall.

The governor’s proposal, released earlier this month, would require the state, schools and school employees to contribute more to the pension fund, with schools bearing the brunt of the costs.

The teacher retirement system’s investment target is set by pension officials, and the fund has averaged 7.5% over the last 20 years. However, the number remains a source of criticism from people such as David Crane, a Stanford University lecturer who was bounced from the pension fund’s board by Democratic lawmakers during Gov. Arnold Schwarzenegger’s administration.

Crane called the estimates “unrealistically high,” noting that they’re more optimistic than targets set by investor Warren Buffett.

Retirement benefits make up most of California’s $340 billion in long-term costs.

“It’s a lot of stuff,” Brown said Wednesday. “And that assumes nobody gets healthier and lives longer.”

He joked, “God help us if medical technology has some breakthroughs and these people who are retiring don’t live to 80, but they live to 100.”

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.