Editorial: Medi-Cal benefits were cut in the Great Recession. It’s time to restore them

- Share via

When the last recession plunged the state government into a multibillion-dollar hole, California lawmakers were forced to cut deeply into numerous valuable programs just to make ends meet. Many of those cuts were penny-wise and pound-foolish, however, especially the ones in safety-net programs like subsidized child-care that helped low-income families stay in the workforce. So as the economy improved, lawmakers and former Gov. Jerry Brown slowly pieced the state’s safety net back together again.

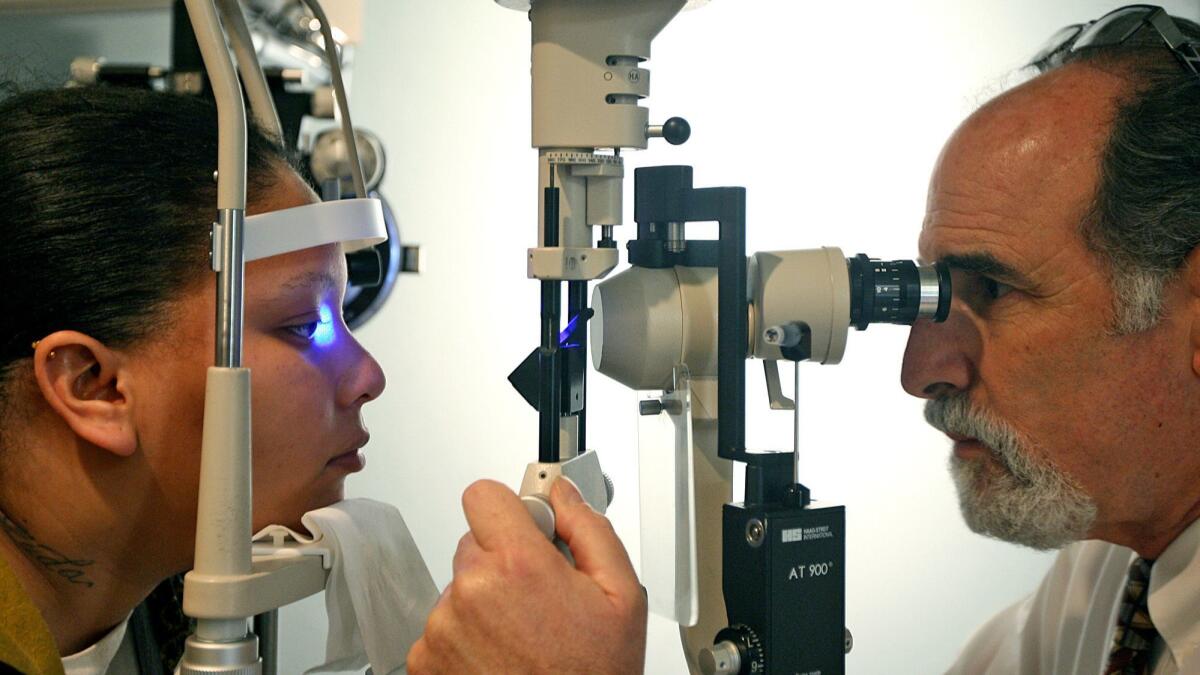

But some important benefits have yet to be restored, a full decade after the recession ended. A good example is the subsidy Medi-Cal eliminated for eyeglasses. The program will pay when poor Californians visit an optometrist to find out how bad their vision is, but won’t help cover the cost of the glasses or contact lenses they may need to drive a car, operate a machine or read a manual — in other words, things they may need to do in order to hold a job.

Similarly, Medi-Cal no longer covers speech therapy, audiology, podiatry or incontinence supplies — the sort of treatments and supplies that can enable people living at or below the poverty line to be more productive and, potentially, start climbing up the income ladder.

Many of those cuts were penny-wise and pound-foolish, especially the ones in safety-net programs like subsidized child-care that helped low-income families.

In the big scheme of the state budget, these are not expensive programs. Plus, if they were added back, the federal government would cover roughly two-thirds of the tab. Restoring vision coverage would cost the state about $22 million a year, and restoring all of the lost benefits would be about $34 million.

On the other hand, those are annual expenses, not one-time costs. And the state has other, expensive healthcare needs and wants. Two of the biggest are proposals aimed at achieving universal coverage in California by making health insurance more affordable for moderate-income Californians and extending Medi-Cal to immigrants living in the state illegally.

Make no mistake — universal coverage would be good for all Californians, including those who already have insurance. Beyond the strong moral argument for providing treatment to everyone who needs it, there are good economic and public health reasons for bringing every resident under the insurance umbrella and providing timely, efficient care.

The steps required to make coverage available and affordable to all Californians, however, would cost the state $6 billion or more per year. And while Sacramento has been riding a wave of budget surpluses, the state can’t afford to have its obligations grow faster than its economy. That’s a recipe for disaster in the next downturn. As Gov. Gavin Newsom warned on Wednesday about the current extended economic expansion: “What we’re experiencing right now is simply without precedent in modern American history and it is not a new normal. Any time people talk about the new normal, that’s when things collapse.”

Enter the Fray: First takes on the news of the minute »

So it makes sense for the state to continue to advance cautiously on the healthcare front, restoring cuts before offering new benefits and looking for ways to pay for expanded coverage. One good idea on the revenue front is Newsom’s proposal to impose new state tax penalties on adult Americans who don’t sign up for health coverage, replacing the federal penalties that Congress eliminated in 2017.

That’s a twofer: The penalties would encourage younger, healthier Californians not to go uninsured, and they would raise money to help pay for premium subsidies to moderate-income families who would otherwise have to spend too high a percentage of their monthly income on insurance. It’s not clear, however, that Newsom’s proposal would generate enough money to cover the full cost of the subsidies.

One possible answer is to renew the tax on managed-care organizations that is set to expire at the start of the next fiscal year, July 1. The tax, which generates money for Medi-Cal that the federal government then matches, raises about $1.5 billion a year. When combined with the state funds Newsom has proposed to spend, that would be more than enough to cover the subsidies’ cost and help extend Medi-Cal to more Californians. The Trump administration had pushed back on such taxes, and Newsom didn’t seek to renew the state’s version for fear of jeopardizing other healthcare-related assistance the state is seeking from the feds. But with the administration approving Michigan’s proposal for a tax similar to California’s, the door seems open for the state to continue the levy, as it should.

Follow the Opinion section on Twitter @latimesopinion and Facebook

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.