Congress should act now on student loans

- Share via

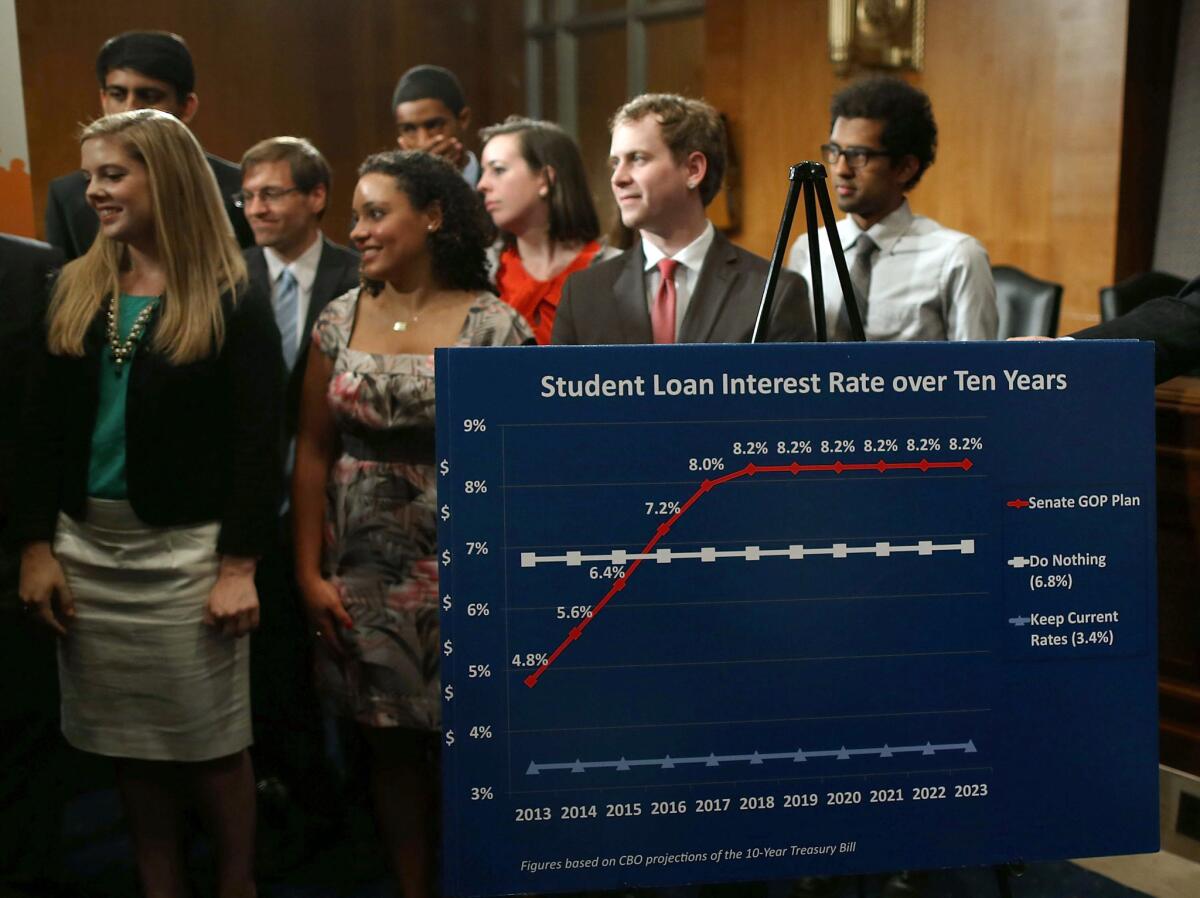

In the latest episode of Congressional Groundhog Day, lawmakers are caught once again in a partisan stalemate with time running out. This time, the interest rate on the most popular form of student loan will double if Congress fails to act by July 1. That’s an outcome no one wants. The twist is that, instead of picking another fight with Democrats over how to cover the cost of the program, Republicans are backing a long-term solution that’s similar to one President Obama proposed in his latest budget. Obama and his fellow Democrats, however, are now holding out for a more comprehensive deal that addresses other higher-education programs.

There’s a compromise within reach that will put the loans on more sustainable footing without turning them into a profit center for the federal government. Rather than postponing the day of reckoning, lawmakers should move to the obvious middle ground.

With tuition and student debt climbing, Congress agreed in 2007 to give college and graduate-school students a better deal on government-issued loans. Instead of adjusting interest rates every year to reflect the ups and downs in the market for government bonds, they fixed the rate at 6.8%. And for lower-income students who qualified for subsidized loans (that is, loans with no interest charges until six months after the student leaves school), they lowered the rate gradually to a rock-bottom 3.4%. But to reduce the measure’s cost, the interest-rate cut applied only to loans issued before June 30, 2012.

VIDEO: Don’t get in over your head with student loan debt

After weeks of squabbling, Republicans and Democrats agreed days before last year’s deadline to hold the rate steady for one year while a more durable approach was developed. The House has approved one; its bill would return to the variable-rate days of yore. But Democrats are balking, arguing that the interest-rate issue should be considered alongside tuition increases and other college-affordability issues.

As much as Congress needs to address the bigger picture, there’s no reason not to enact a long-term solution on interest rates now. Stopgap measures force students and their parents to guess whether they’ll be able to afford to stay in school past the coming year. That’s unreasonable and unfair.

VIDEO: Obama decries rising cost of college education

The House bill has real flaws, most notably a formula for interest rates that would quickly turn the program into a multibillion-dollar moneymaker for the feds. It also would revert to the old practice of having the interest rate on outstanding loan balances adjust annually, which would only lead to more defaults if rates rise as expected in the coming years. Nevertheless, as the administration acknowledged earlier this year, tying interest rates to the federal government’s low cost of borrowing is the right way to go. The Senate should pass its own version of the president’s proposal, then work out the differences with the House without delay.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.