The presidential race has been replete with statistics and data tossed out by the candidates that purport to show something threatening or wrongheaded about their opponent’s policies. Typically, they don’t just make up their numbers; instead, they take research produced by someone else (often an ideologically friendly source), then apply their own spin. And in many cases, that spin takes the statistic so far out of context, it becomes misleading at best. Here are six examples of numbers frequently cited by the Obama and Romney campaigns that voters should either ignore or take with a very large grain of salt. --Jon Healey

Six numbers to ignore from the presidential campaign

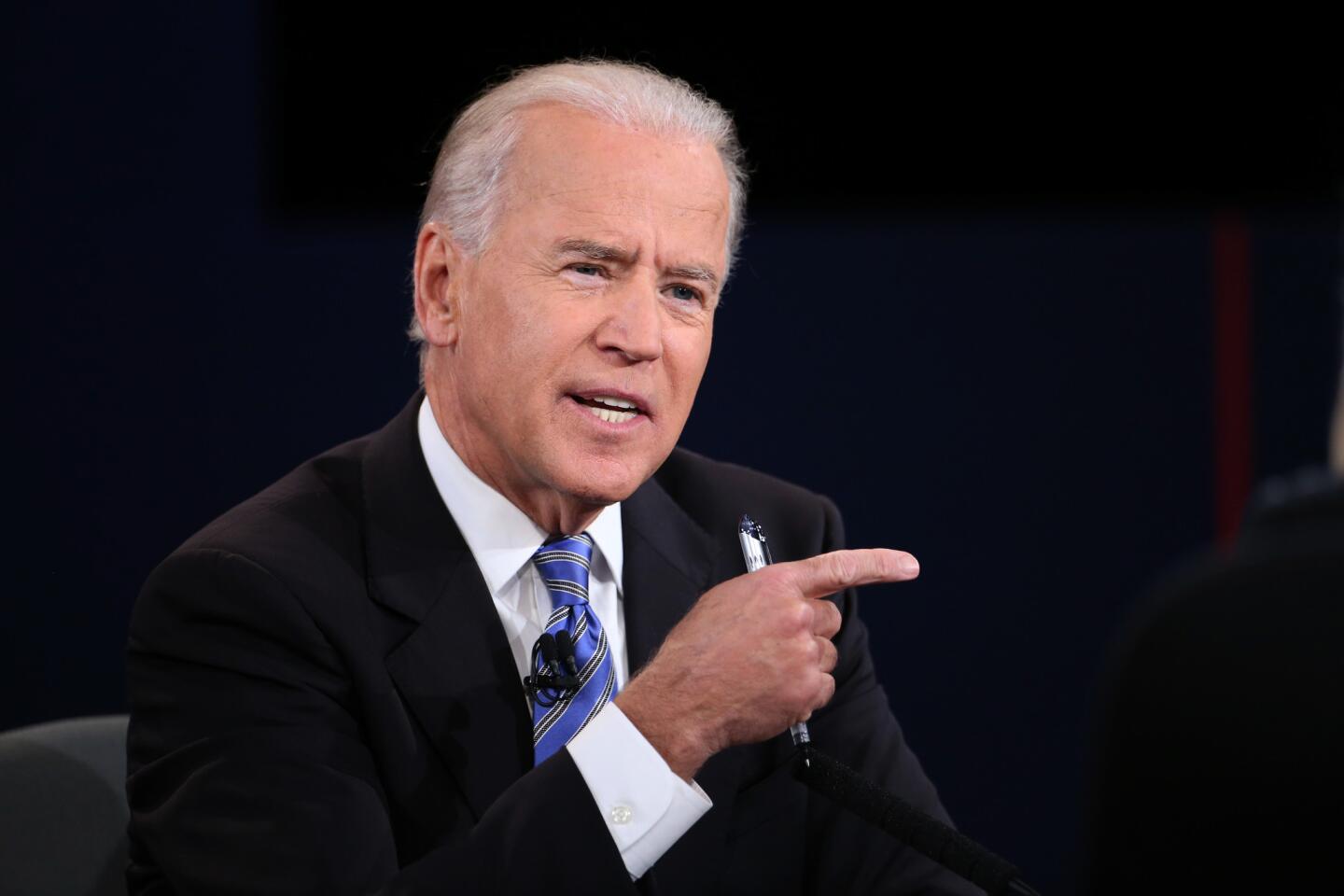

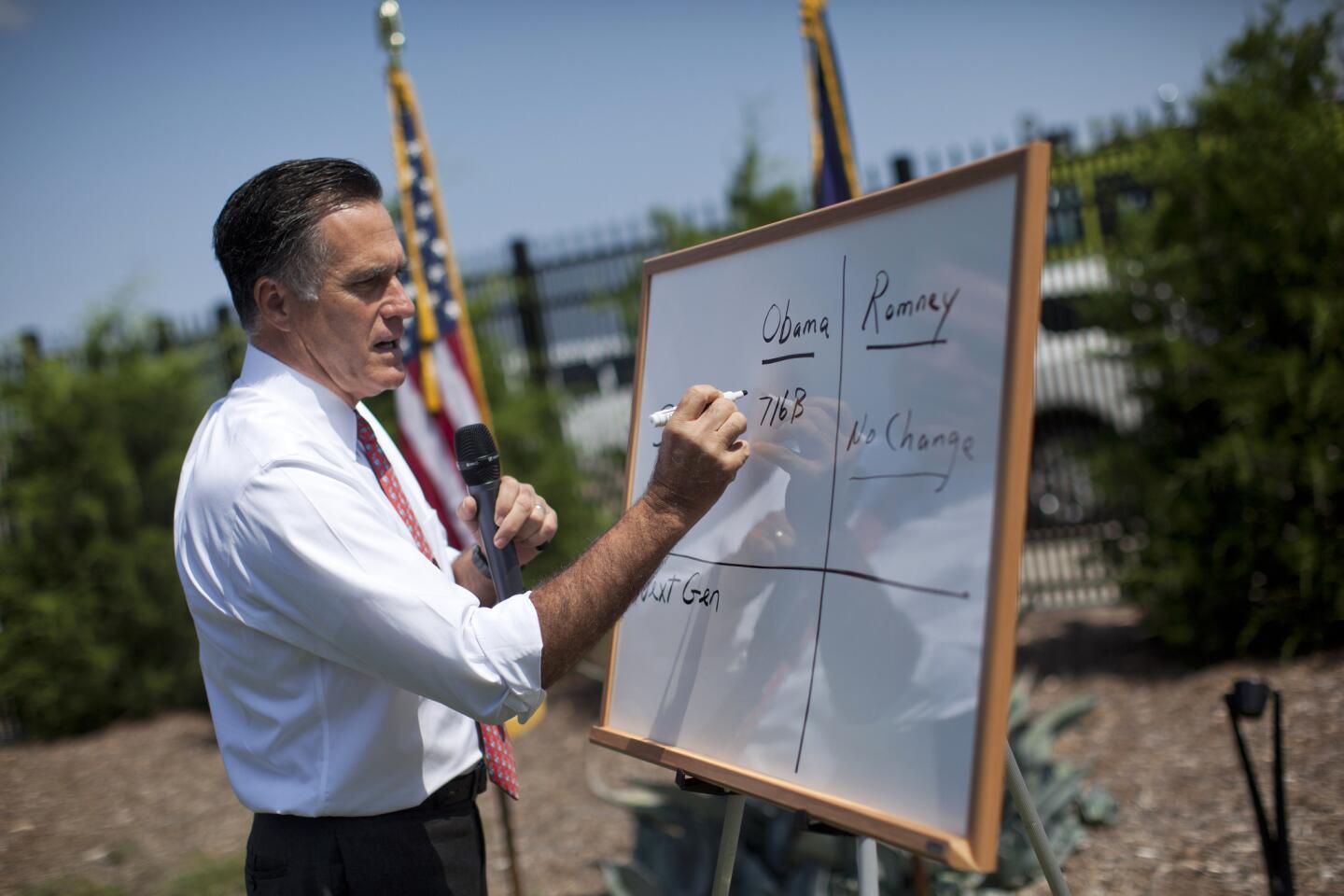

President Obama has repeatedly said that the Medicare “voucher” plan proposed by GOP vice presidential nominee Paul Ryan would raise seniors’ costs by $6,400 a year. The figure comes from a study by the liberal Center on Budget and Policy Priorities, which used projections from the Congressional Budget Office to estimate out-of-pocket costs that future retirees would face under the budget Ryan proposed -- a year and a half ago. Yes, Mitt Romney endorsed that budget earlier in the campaign, but Ryan has changed his proposal significantly, and Romney has his own plan for Medicare. According to the Romney campaign, that plan would provide subsidies large enough to cover the cost of at least two different insurance plans offering at least as much coverage as traditional Medicare. (Pablo Martinez Monsivais / Associated Press )