Op-Ed: Tax policy is a bore, until they take your Social Security and Medicare away

- Share via

Procrastinators race to the post office on Tax Day to postmark their tax returns or file for extensions. Sensible people use Tax Day as a time to consider their financial picture for the year ahead. But this April, in light of how Congress radically rewrote our tax obligations for 2018 onward, Tax Day might also profitably serve as an occasion for citizens to contemplate the tax health of the nation.

This checkup requires examining both taxes and government spending. We quickly see that budget deficits — how much spending exceeds revenues — are extremely large and growing at a disturbing rate. The nonpartisan Congressional Budget Office estimates that the 2019 deficit will be just shy of $1 trillion. That is a roughly 50% jump in the deficit from its 2017 level — extraordinary, considering we’re in good economic times.

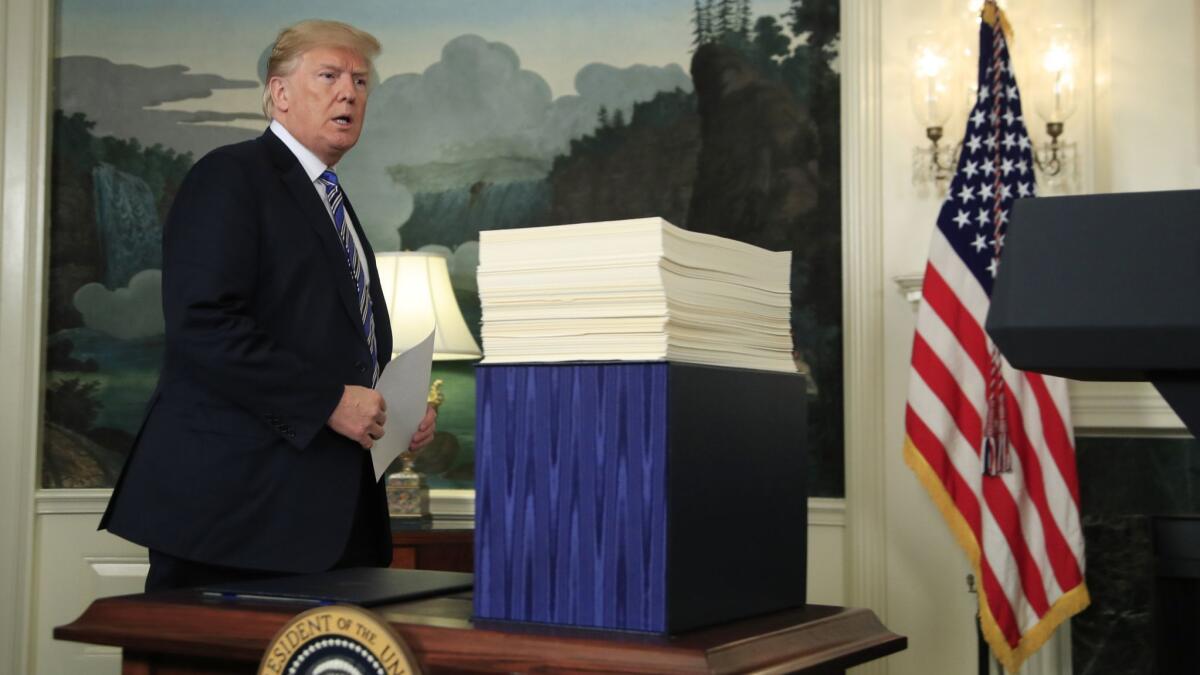

Tax cuts do not pay for themselves — not the Trump tax cuts, nor in any other case in modern U.S. practice. So we face only two possible courses of action: Either we tax ourselves more, or we dismantle the social safety net (in particular, Social Security, Medicare and Medicaid) that protects Americans from destitution or disability. Which is the right direction for our country to pursue?

One political movement has its answer at the ready: Slash the safety net.

Tax cuts do not pay for themselves — not the Trump tax cuts, nor in any other case in modern U.S. practice.

Five fellows at the conservative Hoover Institution recently laid bare in a Washington Post opinion piece how the Tax Cut and Jobs Act of 2017 was just the first step in a two-step dance. The full tango goes like this: Note that our deficits are unsustainable. Blame “entitlement spending” (code for Social Security and Medicare) rather than tax cuts. Demand cuts to social spending on the pretext that some imaginary iron laws of reduced tax collections and deficit concerns require it.

This agenda aims to asphyxiate the working class through the dismantling of the social insurance programs on which most Americans rely. But the tax tourniquet is a political creation, not an economic necessity. When compared with wealthy peer economies, the United States today already is the lowest-taxed country as a percentage of GDP. The tax cuts going into effect this year will reduce federal tax collections still further, to levels substantially below the 50-year average of federal tax revenues as a percentage of GDP.

There is no law of economics that says record-low tax revenues are the prerequisite to a thriving economy. What we actually need, like it or not, are more tax revenues to fulfill our promises to support our fellow citizens. To do so does not require any radical ideas or bankrupting the middle class. We can raise several trillion dollars of new revenue over the next decade with some straightforward moves.

Eliminating the wage cap on Social Security contributions, for example, would by itself keep Social Security solvent for decades to come. Eliminating the tactics used by many pass-through business owners to evade payroll and “net investment income” taxes would also restore fairness and bring in hundreds of billions of dollars in revenue.

The new tax act’s reduction in the top tax rate to 37% (and then only on money earned above $600,000) was an irrational gift to the most affluent Americans that undermined the principle of shared sacrifice that motivated the progressive income tax. The top rate should be no less than 40% and should apply to any joint-return income above $250,000. The estate tax also needs an overhaul to make it functional, rather than simply an income-generating device for clever trust and estates lawyers.

The U.S. did need business tax reform. But what Congress delivered went far beyond any economic rationale: a corporate tax rate of 21%, immediate expensing (write-offs) of all investments and the continued deductibility of most business interest expenses. The upshot? The new law subsidizes rather than taxes capital investments. In other words, the tax act subsidizes firms that buy robots over firms that hire new workers. A 25% business tax rate combined with a phase-out of interest expense deductibility would yield a more economically neutral system that still would be highly competitive on the world stage. And the new law’s 20% deduction for income earned by owners of pass-through businesses is nothing but a giveaway to the country club gentry, estimated to cost nearly $500 billion in forgone taxes over the next decade.

Finally, a carbon tax — charged on fossil fuels — of $25 per metric ton will generate about $1 trillion over 10 years. This can fund important public infrastructure projects, and by discouraging fossil fuel consumption, support efforts to address global warming.

Tax policy is a bore, until they come to take your Social Security and Medicare away. Yes, our federal budget deficit trajectory is unsustainable, but the reason is not profligate or unexpected social spending. Tax Day is as good as any other to reflect soberly on the price our country will pay for systematically undertaxing itself.

Edward Kleinbard, a professor at the USC Gould School of Law, was chief of staff for Congress’ Joint Committee on Taxation.

Follow the Opinion section on Twitter @latimesopinion and Facebook

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.