Opinion: Jobs aren’t in the Republicans’ tax plan, but rights for fetuses and hits to the middle class are

- Share via

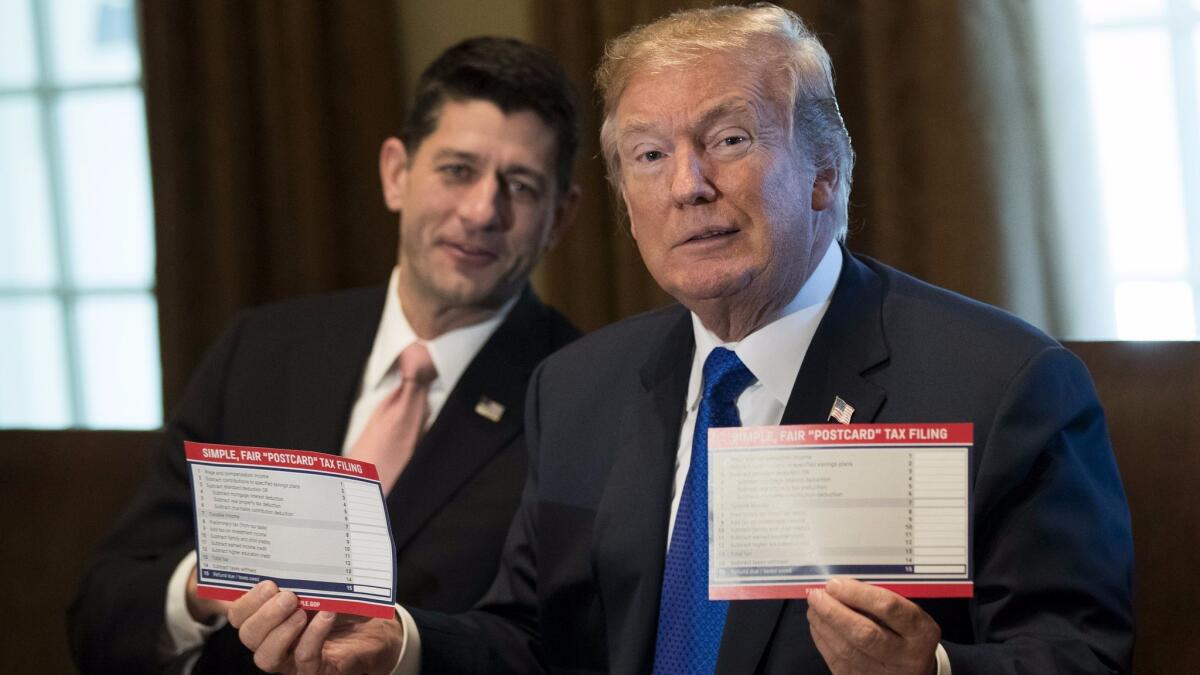

To the editor: The House Republicans’ tax plan — called the “Tax Cuts and Jobs Act” — is out, and clocking in at 429 pages, there’s not a word in it about jobs (except for multiple references to the title). More insidiously, there are effective tax increases hidden underneath misleading sub-section titles. (“House Republicans unveil the wrong tax overhaul,” editorial, Nov. 3)

Read the bill and you will see no more student loan deductions; no more medical expense deductions; limitations on employee health savings accounts; taxes to be imposed on employer contributions to plans; no more state and local income tax deductions; university endowments will be taxed; reductions to spending increases on Medicare and Medicaid; and reductions to charitable deductions.

The bill has references to the applicability of provisions of the act to “unborn children of homo sapiens at any stage of development” (page 93) and, two pages from the end, has a section titled, “Churches permitted to make statements relating to political campaign in ordinary course of religious services and activities.”

To say this is a gift to the middle class is a joke. If this passes, the joke will be on us.

Julie Werner-Simon, Santa Monica

..

To the editor: When I was still teaching, I fought against the “dumbing down” of expectations and curricula. Given the Republicans’ proposed tax plan, it is obvious that the federal government plans to continue this dumbing down by eliminating the deduction for student loan interest.

Why is it that people wrongly associate Republicans with fiscal responsibility?

— Bruce Stenman, Prundale, Calif.

Higher education provides society with an educated population, but at an extremely high cost to those who must finance school through loans. Taking away the deduction on student loan interest paid further penalizes those who are becoming educated, increasing the likelood that more young adults will pass on college.

It makes sense, given that the administration seems to prefer sheep as opposed to thinking citizens. Where is the shame?

Susan Snookal, Chino

..

To the editor: That the state of California is poorly run is no reason why the federal government should allow a deduction for state taxes. It is not the federal government’s job to control a state’s spending.

California, like many other Democratic-controlled states, needs to be more responsible to its citizens.

Bob Guarrera, Laguna Niguel

..

To the editor: The GOP tax plan is based on lies.

In 1943 corporations paid $9.6 billion in taxes, individuals paid $6.5 billion, and Social Security taxes netted $3 billion. In 1980, prior to Reaganomics, corporations paid $65 billion and individuals $244 billion, and another $158 billion was collected for Social Security.

By 2010 the imbalance shifted even further, with corporations paying $191 billion and individuals paying $899 billion, and $865 billion was collected for Social Security.

What should be happening is that tax loopholes for corporations and wealthy individuals and hedge funds are closed. Why is it that people wrongly associate Republicans with fiscal responsibility when the current federal debt was created thanks to policies pushed by past Republican presidents that will be greatly exacerbated by President Trump?

Bruce Stenman, Prunedale, Calif.

..

To the editor: Perhaps I don’t understand the thinking expressed by Republicans in their new tax plan.

The state of California withholds income tax from my paycheck, so I never see that money. Their plan will have me pay federal taxes on money I have never seen.

Ending this deduction will allow my heirs to avoid estate taxes on unlimited amounts of money instead of the current limit of $5.5 million for individuals.

Unfortunately, I have bad news for my heirs: This new tax break isn’t going to do them any good.

Bob Wicks, Brea

Follow the Opinion section on Twitter @latimesopinion and Facebook

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.