Media company downsizing

Consumers demand smaller packages of cable channels

- Share via

As more consumers demand smaller packages of cable channels, pay-TV distributors including Dish Network and Verizon FiOS have responded by creating “skinny bundles” with pared-down channel offerings at lower price points. The skinny trend threatens the biggest profit center for many entertainment companies: cable programming fees.

Major media companies that own the bulk of the channels soon might find themselves on a forced diet, shedding channels that have small audiences. No one knows for sure what channels ultimately might get cut, but television's high-stakes game of “survival of the fittest” is already underway.

Here is a look at the media companies and the channels they own:

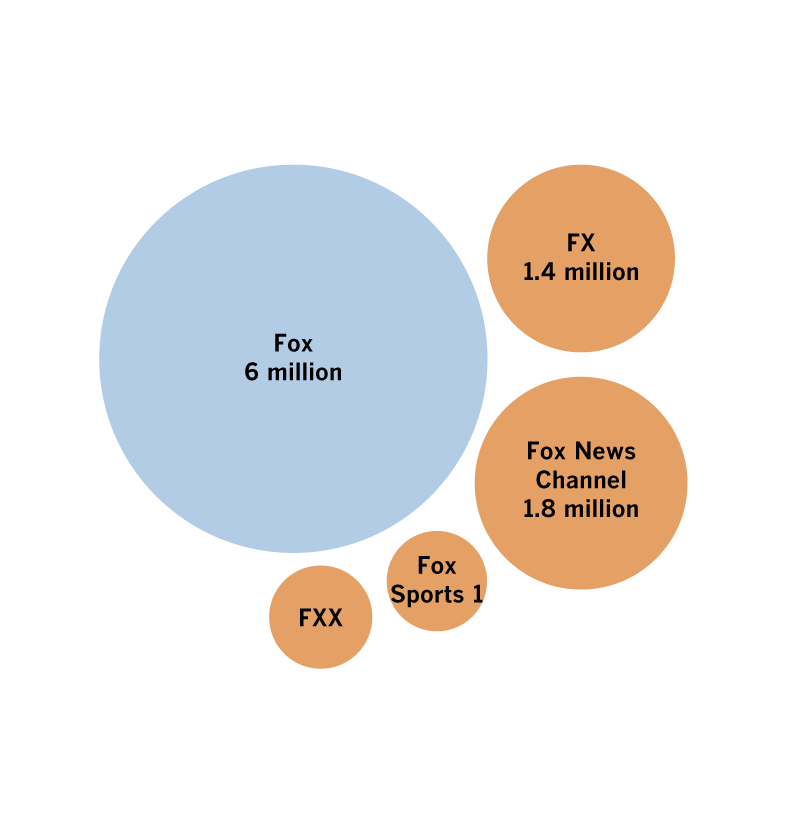

Average viewership in prime-time in the Sept. 2014–May 2015 television season for selected channels

Walt Disney Co.

Disney has extracted high programming fees on the strength of ESPN and the Disney Channel.

NBCUniversal

NBCUniversal boasts one of the largest cable portfolios, with several strong channels and some that struggle.

CBS Corp.

CBS boasts the No. 1 broadcast network but has fewer cable channels than competitors.

*CW is jointly owned by CBS and Time Warner (Warner Bros.). Pop is a joint venture between CBS and Lionsgate.

21 Century Fox

Fox has firepower with FX, Fox News Channel and sports networks that include Prime Ticket and Fox Sports West.

Time Warner Inc.

Time Warner launched HBO Now streaming service and bulked up its TBS and TNT channels with sports.

Viacom Inc.

Viacom was a leader with MTV, VH1, Nickelodeon and Comedy Central but lately has struggled to maintain its younger audience.

Univision Communications

Univision is the nation’s largest Spanish-language media company and has recently added new cable channels

Sources: Company filings and Nielsen Co.

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.