When will the Supreme Court decide the student loan forgiveness case?

- Share via

UPDATE: Supreme Court strikes down Biden’s plan to forgive millions of student loans >>

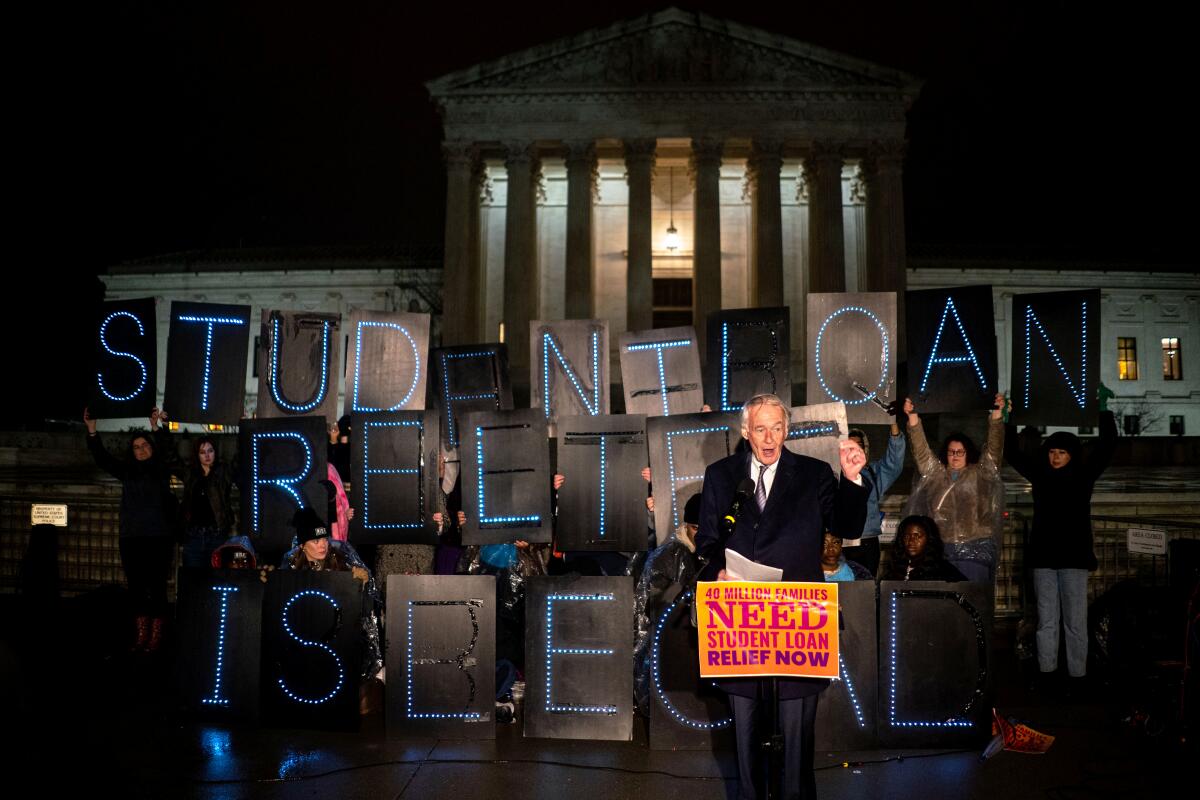

The wait will soon be over for millions of student-loan borrowers: The U.S. Supreme Court is set to release its decision on the Biden administration’s debt relief program Friday morning.

During oral arguments in February, the court’s conservative majority expressed skepticism about the administration’s authority to offer blanket forgiveness to an estimated 45 million people with outstanding federal loans, about 3.8 million of them in California. But the court’s liberal justices suggested that the lawsuits against the program should be tossed out because the plaintiffs had not been harmed by it.

The Supreme Court has ruled against the Biden administration’s blanket college loan forgiveness plan, denying debtors the instant relief the program offered. But they still have better options for managing their debt than they did before the court took up the case.

The high court indicated Thursday that it would issue its final rulings Friday, starting at 7 a.m. (Pacific). In addition to the debt forgiveness lawsuits, the court has yet to issue its decision on a web designer’s challenge to a Colorado anti-discrimination law requiring her to design sites even if they express views violating her religious beliefs — in this case, websites that celebrate same-sex marriages.

If past practice is any guide, the student loan ruling should be issued by 8 a.m. Rather than releasing all the day’s opinions at once, the justices do them one at a time, giving the author of the ruling and any dissents the chance to read aloud a summary of what they’ve written.

As soon as the opinion is announced, it will be available on the Opinions of the Court page of the Supreme Court’s website.

According to the Education Data Initiative, almost 10% of California residents have student loan debt. All told, Californians owe $142 billion, or an average of $37,084 per borrower.

The administration’s program would erase $10,000 in federal student loan debt for every borrower who earned less than $125,000 (or, for couples filing joint tax returns, less than $250,000 per household). The program would forgive an additional $10,000 in debt for qualified borrowers who had received Pell Grants, a form of financial aid for lower-income students.

Regardless of what happens Friday, borrowers with outstanding balances will have to resume their monthly payments in October. The Education Department’s financial aid site, studentaid.gov, is telling borrowers that interest will start to accrue on their loans on Sept. 1, and payments will be due again the next month.

The Education Department says it will send borrowers a billing statement at least three weeks in advance, telling them when their payment is due and how much they owe. So if you haven’t done so already, you should confirm your contact information at the Federal Student Aid website, studentaid.gov.

About The Times Utility Journalism Team

This article is from The Times’ Utility Journalism Team. Our mission is to be essential to the lives of Southern Californians by publishing information that solves problems, answers questions and helps with decision making. We serve audiences in and around Los Angeles — including current Times subscribers and diverse communities that haven’t historically had their needs met by our coverage.

How can we be useful to you and your community? Email utility (at) latimes.com or one of our journalists: Jon Healey, Ada Tseng, Jessica Roy and Karen Garcia.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.