News Corp. exiting New Zealand, to divest pay-TV service

- Share via

News Corp. plans to exit New Zealand as part of the company’s larger mission to simplify its sprawling holdings.

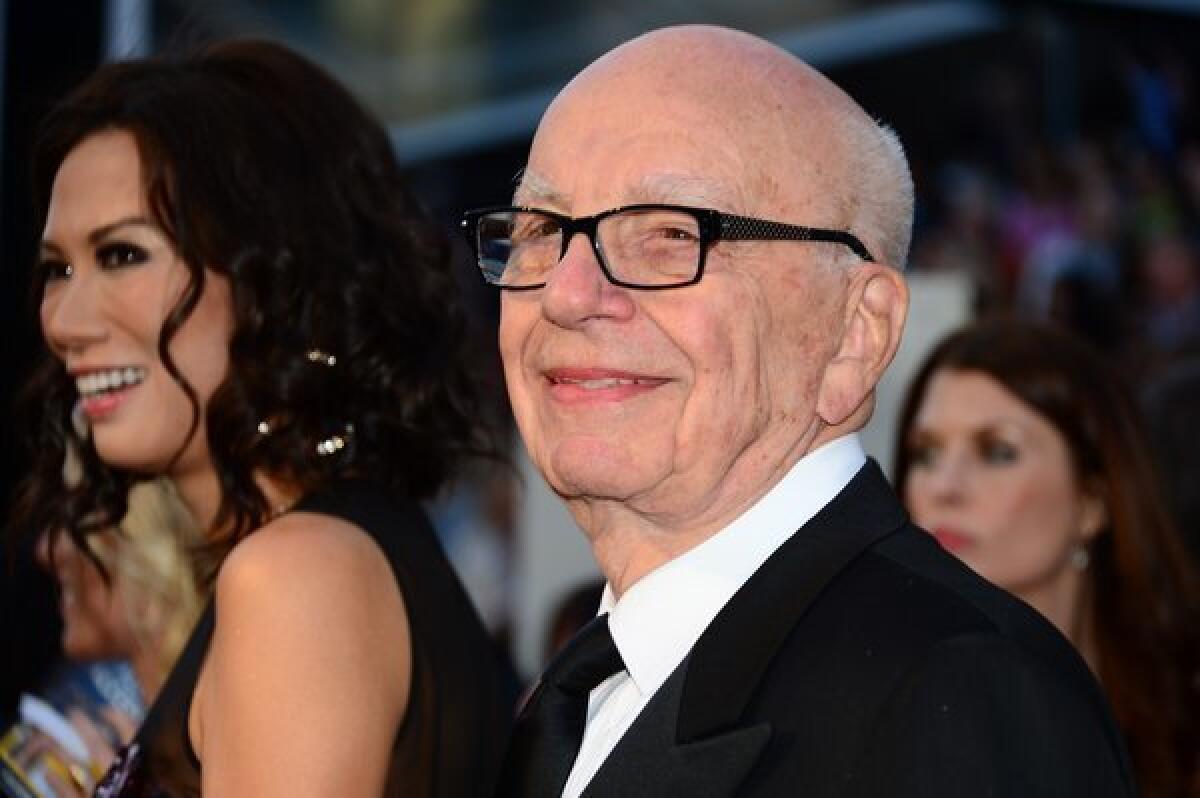

The company, controlled by mogul Rupert Murdoch, announced over the weekend that News Limited, its Australian subsidiary, intends to divest its 44% stake in Sky Network Television Limited, which is the leading pay-TV service in New Zealand.

The shares have a value of about $670 million, according to published reports. The stock is expected to be sold to institutional and retail investors.

News Corp. sold its newspapers in New Zealand years ago, but the company continues to own expansive TV and newspaper holdings in Australia, Murdoch’s native land. The Australian assets are expected to make up a large chunk of Murdoch’s new publishing company when News Corp. splits into two parts later this year.

News Corp. said it has retained Deutsche Bank to underwrite the Sky Network Television transaction. Craigs Investment Partners will help manage the sale.

The Sky Network pay-TV company has nearly 850,000 subscribers.

“We and Sky have always enjoyed an excellent, arms-length working relationship and we expect this to continue unaffected by the sale,” News Corp. Chief Operating Officer Chase Carey said in a statement.

After the transaction was announced, and before trading was halted on Monday, Sky Network Television shares were selling for about NZ $4.80 a share -- below its $5.17 close on Friday, according to the New Zealand Herald.

ALSO:

Rupert Murdoch says L.A. Times purchase not a sure thing

Murdoch sells $40 million in News Corp. voting shares as price soars

News Corp. name goes to publishing company; Thomson named CEO

MORE

INTERACTIVE: TVs highest paid stars

ON LOCATION: People and places behind what’s onscreen

PHOTOS: Hollywood back lot moments

More to Read

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whipp’s must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.