News Corp. to take up to $1.4-billion write-down in publishing

- Share via

Underscoring the troubled financial health of print media, News Corp. said it would record a non-cash impairment charge of $1.2 billion to $1.4 billion during the current fiscal quarter to reflect diminished value of its publishing assets.

The company, which owns the Wall Street Journal, New York Post, the Times of London, the Australian and the HarperCollins book publishing house, made the disclosure Friday afternoon in a filing with the Securities and Exchange Commission.

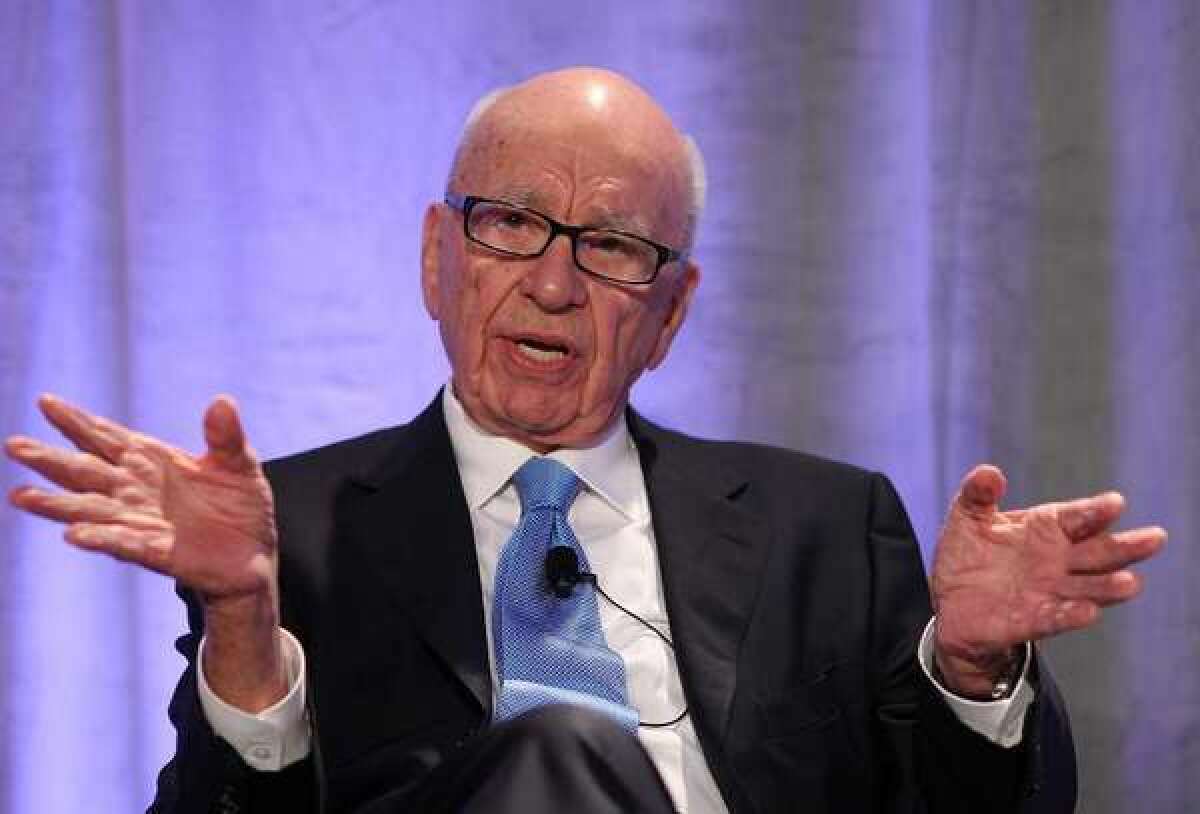

The goodwill and impairment charge was revealed ahead of the planned breakup next month of Rupert Murdoch’s $76-billion media empire.

News Corp. is preparing to divide into two separate publicly traded companies: 21st Century Fox, which will boast the lucrative TV networks and Fox movie and television studio. The spun-off company, which will consist of the newspapers, book publishing, a nascent educational materials business and TV channels in Australia, will take the name News Corp.

In its SEC filing, News Corp. did not identify the titles that had suffered the greatest losses in value. However, the company said its vast portfolio of newspapers in Murdoch’s native Australia were responsible for a major portion of the write-down.

The Australian papers have been socked financially during the last year amid that country’s weak economy and a declining advertising market.

The company’s U.S. publishing assets also contributed to the reduced outlook in future cash flow. Six months ago, News Corp. revealed that the publishing unit would have suffered a $2-billion loss last year if it had been a stand-alone company.

Previously, News Corp. has written down the value of the Journal after News Corp.’s $5-billion acquisition of parent Dow Jones & Co. in 2007.

The SEC filing was made in advance of a planned investor day next week to provide a financial overview of the soon-to-be stand-alone publishing company.

Earlier Friday, News Corp. identified June 28 as the target date for the split.

News Corp. also said its board had formally approved the breakup, as well as a measure designed to protect the Murdoch family’s control of the companies for at least a year.

Murdoch and his family will retain voting control of the two entities. If another shareholder acquires more than 15% voting stock in either company, existing shareholders -- including the Murdochs -- would be allowed to purchase stock at a discount in an effort to dilute the stake of the threatening investor.

ALSO:

News Corp. board approves company split, set for June 28

With company split, Rupert Murdoch’s pay to reach $28.3 million

News Corp. print holdings would have lost $2 billion as stand-alone

More to Read

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whipp’s must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.