Here’s our look at the Trump administration and the rest of Washington.

- Share via

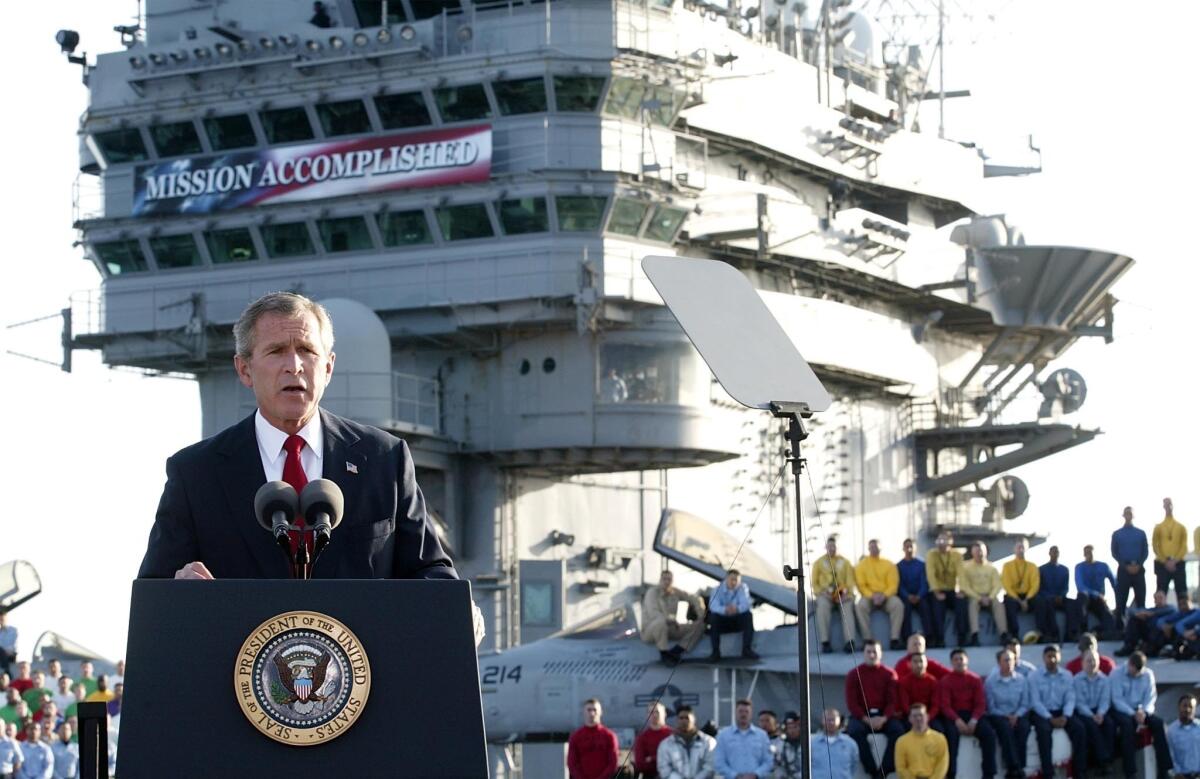

Wait — did the president really say, ‘Mission Accomplished’?

President Trump on Saturday morning thanked his allies in a tweet that declared the airstrikes on Syria “perfectly executed,” but he might have wished he’d stopped there.

Instead, he ended his message with the phrase, “Mission Accomplished!” That’s a line that might have a previous president shaking his head.

On May 1, 2003, President George W. Bush declared an end to major combat in Iraq under a “Mission Accomplished” banner aboard the USS Abraham Lincoln. That war, which began in March 2003, grew into a prolonged conflict that didn’t end until 2011.

In 2008, the White House said it had “paid a price” for the backdrop.

- Share via

Auditor says Pentagon is censoring key data on the war in Afghanistan

The Pentagon is blocking the release of data showing how much of Afghanistan’s territory lies outside government control, censoring a key metric used to gauge progress in the 16-year war, a watchdog agency said Tuesday.

The Special Inspector General for Afghanistan Reconstruction, an auditing agency established by Congress, said in its latest report that the Pentagon instructed it not to release unclassified data on how many districts and people are controlled or influenced by insurgent groups.

“This is the first time SIGAR has been specifically instructed not to release information marked ‘unclassified’ to the American taxpayer,” the head of the agency, John F. Sopko, wrote in a letter.

Sopko also said the U.S.-led military coalition, for the first time since 2009, classified information about the size and attrition rates of the Afghan security forces, important indicators of progress in building up army and police forces on which the U.S. already has spent $70 billion since 2002.

The decision to withhold more information from congressional oversight and the public comes amid growing violence in Afghanistan and an intensifying combat mission involving a greater number of American troops.

Following a series of bombings in Kabul that left at least 136 people dead in 10 days, President Trump signaled on Monday that he was focused on trying to win the conflict militarily, saying, “We don’t want to talk with the Taliban.”

But data released by SIGAR since 2015 have shown how the insurgents have gained ground against Afghan security forces. In its previous quarterly report, the watchdog said that only 57% of Afghanistan’s 407 districts were under Afghan government control or influence as of August 2017, the lowest level of control since it began tracking the statistic in December 2015.

The steady decline in government control “should cause even more concern about its disappearance from public disclosure and discussion,” Sopko wrote.

The watchdog also accused the Pentagon of overstating the impact of its efforts to combat drug cultivation and trafficking, among the Taliban’s main sources of revenue. The Pentagon touted airstrikes that destroyed 25 drug labs in November and December, saying it eliminated nearly $100 million of Taliban revenue.

“The labs being destroyed are cheap and easy to replace,” SIGAR said. “According to some estimates, they only take three or four days to replace.”

- Share via

Women journalists shunted to rear for Pence’s visit to Western Wall

Vice-President Mike Pence’s 48-hour visit to Israel stumbled into a public storm Tuesday when female reporters covering his final stop at Jerusalem’s Western Wall were penned behind four rows of their male colleagues.

White House officials told stunned journalists that the arrangement emanated from a request made by the Western Wall rabbi, Shmuel Rabinowitz, and followed “Western Wall rules.”

Some women journalists said they could not recall such treatment in the past.

In a statement to Israel’s Channel 10 news, the Western Wall Heritage Foundation said it “was exactly as it was during the visit of the U.S. president to the Western Wall last May.” Later in the day, in a statement to the newspaper Haaretz, the foundation blamed the United States embassy in Tel Aviv and Israeli security officials for the segregation, and announced they would reexamine the way they handle such events.

Women who covered previous VIP visits said the Pence arrangements were significantly more onerous than previous visits, when male and female journalists were separated but not offered substantially different work conditions.

The arrangement reflected procedures at the Western Wall, Judaism’s holiest site, where on regular days, men have access to two thirds of the area available for prayer.

Tal Schneider, the diplomatic analyst for Globes, a financial newspaper, protested that the separation of men and women “may be valid for the requirements of Orthodox prayer, but no one is praying here. We are here to work.”

“I don’t appreciate being restricted in my ability to work because I am a woman,” she said. “The discriminatory attitude towards women is infuriating and is unbefitting of a modern country.”

Yael Freidson, the Jerusalem affairs correspondent for Yediot Ahronot, Israel’s widest circulation newspaper, said she worried that her editors could choose male colleagues for the next assignment, knowing they would have better access.

Before Pence arrived, journalists were herded onto a specially constructed platform in the middle of the Western Wall’s esplanade, with women guided to the right behind a white fence, and men, many carrying cameras, directed to the left, where they had more than double the space.

Towards the end of the vice president’s 10-minute visit, male journalists were permitted into the VIP tent where he received a gift from Rabinowitz, while the women remained in their enclosure.

None of the men publicly protested the treatment of their female colleagues.

Israel’s Association of Women Journalists filed a formal complaint with Justice Minister Ayelet Shaked, herself a woman.

- Share via

Former Sheriff Joe Arpaio, after his pardon from Trump, says he’ll run for Senate in Arizona

Former Arizona Sheriff Joe Arpaio, who last year was pardoned by President Trump in a case stemming from his enforcement tactics aimed at immigrants, announced Tuesday he will run for the open Senate seat in his home state.

“I am running for the U.S. Senate from the Great State of Arizona, for one unwavering reason: to support the agenda and policies of President Donald Trump in his mission to Make America Great Again,” Arpaio, 85, said on Twitter.

He’ll enter a Republican primary for the seat being vacated by Republican Sen. Jeff Flake.

Last summer, Trump pardoned Arpaio, who was convicted in July of criminal contempt for violating a federal court order to stop racially profiling Latinos.

It was Arpaio’s roughly quarter-century as sheriff that gave him a national reputation for his tough treatment of people suspected of being in the country illegally. Repeated court rulings against his office for civil rights violations cost local taxpayers tens of millions of dollars.

In the early 1990s, Arpaio directed construction of a tent city for immigration detainees, a measure he said was intended both to alleviate overcrowding and to underscore his aggressive enforcement measures. But it was open to the burning Arizona sun, and drew widespread criticism.

After Trump entered the presidential race in July 2015, Arpaio invited him to Phoenix to talk about a crackdown on illegal immigration. He endorsed Trump just before the first votes in the Iowa caucuses in 2016 and frequently spoke out on behalf of Trump’s campaign.

- Share via

President Trump ends controversial voter fraud commission

President Trump signed an executive order late Wednesday ending the voter fraud commission he launched last year as the panel faces a flurry of lawsuits and criticism from Democrats and Republicans alike.

Trump signed the order disbanding the commission “rather than engage in endless legal battles at taxpayer expense,” White House Press Secretary Sarah Huckabee Sanders said in a statement.

The Presidential Advisory Commission on Election Integrity, created by executive order in May with the stated goal of restoring confidence and integrity in the electoral process, has faced a barrage of lawsuits in recent months over privacy concerns, as the commission sought personal data on voters across the country.

- Share via

Congress returns to work with slimmer GOP majority to accomplish Trump’s agenda

Congress returns to work this week with unfinished business on spending, immigration and other crucial issues, but with an even narrower GOP majority that will make it tougher to move on President Trump’s agenda.

The House and Senate will convene Wednesday, swearing in the newly elected Democratic senator from Alabama, Doug Jones, and Minnesota’s Tina Smith to replace a fellow Democrat, Sen. Al Franken, who is resigning as the latest high-profile public figure sidelined by allegations of sexual misconduct. The change gives Republicans only a one-seat margin in the Senate.

Trump, fresh off passage of the GOP tax cuts bill, is pushing lawmakers to pivot quickly on his new year priorities of infrastructure investment and immigration, as well as his foreign policy agenda.

But another legislative victory seems far off. Republicans have struggled to hold their majority together and Congress first must tackle critical stalled agenda items that leaders punted to 2018.

- Share via

Trump threatens to cut off U.S. aid to Palestinians

President Trump on Tuesday angrily threatened to cut off U.S. aid to Palestinians as punishment for what he called their failure to show “appreciation or respect” to the United States.

Writing on Twitter, the president compared the Palestinians to Pakistan, a nuclear-armed ally that abruptly drew his ire this week and a similar threat to drastically curtail aid.

He accused the Palestinians of recalcitrance in what he described as their refusal to negotiate a peace deal with Israel.

Palestinian officials have said they can no longer use Washington as a broker to restart peace talks with Israel following Trump’s Dec. 6 decision to overturn decades of U.S. policy and recognize the disputed city of Jerusalem as the capital of Israel, and ultimately to move the U.S. Embassy there.

The Palestinians also claim part of Jerusalem as the capital of an eventual independent state. Until now, the United States and most of the world agreed the city’s political status was a matter to settle in final peace talks.

The United Nations General Assembly overwhelmingly condemned any effort to recognize Jerusalem as Israel’s capital, and the Palestinian leadership said it would not meet with Vice President Mike Pence, who had planned a trip to the region. That trip is on hold.

“[W]e pay the Palestinians HUNDRED [sic] OF MILLIONS OF DOLLARS a year and get no appreciation or respect,” Trump wrote on Twitter. “[W]ith the Palestinians no longer willing to talk peace, why should we make any of these massive future payments to them?”

In response to Trump’s tweet, Hanan Ashrawi, a senior Palestinian official, issued a statement saying: “Palestinian rights are not for sale. By recognizing Occupied Jerusalem as Israel’s capital Donald Trump has not only violated international law, but he has also singlehandedly destroyed the very foundations of peace and condoned Israel’s illegal annexation of the city.”

“We will not be blackmailed,” she said. “President Trump has sabotaged our search for peace, freedom and justice. Now he dares to blame the Palestinians for the consequences of his own irresponsible actions!”

The United States does not pay large amounts of money directly to the Palestinian Authority, the government that rules over parts of the Palestinian West Bank. Instead, most money goes to the U.N., refugee or aid agencies and even Israel to pay for roads, welfare, schools, security and other Palestinian projects.

The U.S. ambassador to the U.N., Nikki Haley, said Tuesday that the administration was planning to cut off one of those organizations, the U.N. Relief and Works Agency, until the Palestinians “return to the negotiating table.”

UNRWA, which receives around $300 million annually from the U.S., for years has been the lifeline to hundreds of thousands of Palestinian refugees living in the West Bank and the Gaza Strip. It was not clear if Haley was threatening to cut all U.S. support for the agency.

Special correspondent Noga Tarnopolsky in Jerusalem contributed to this report.

- Share via

The White House stops short of calling for government overthrow in Iran

President Trump wants Iran to give its citizens “basic human rights” and “stop being a state sponsor of terror,” his top spokeswoman said, but the White House stopped short of calling for a change of government in Tehran.

“If they want to do that through current leadership, if that’s possible, OK,” White House Press Secretary Sarah Huckabee Sanders told reporters.

Sanders praised the “organic popular uprising,” which she said the widespread protests in Iran represented. The protests grew out of years of “years of mismanagement, corruption, and foreign adventurism have eroded the Iranian people’s trust in their leaders,” she said.

Earlier Tuesday, Trump called Iran’s government “brutal and corrupt” and wrote in a tweet: “The people have little food, big inflation and no human rights. The U.S. is watching!”

Trump also blamed President Obama for “foolishly” giving Iran money that he said went to fund terrorism. The money he referred to were funds belonging to Iran that had been frozen by the U.S. and were released as part of the deal in 2015, which blocked Iran’s development of nuclear weapons.

- Share via

Retirement of Utah Sen. Orrin Hatch clears the way for a Mitt Romney revival

The retirement of Utah’s senior senator, Orrin G. Hatch, opens the way for a widely expected Senate bid by Mitt Romney, the Republicans’ 2012 presidential nominee and a frequent critic of President Trump.

Although Romney previously served for two terms as governor of Massachusetts (and was raised in Michigan, where his father was governor and his mother ran for the Senate), he comes from a prominent Mormon family with strong ties to Utah. He also served as chief executive of the 2002 Salt Lake City Olympics. He’s viewed as a strong candidate for the Senate seat.

Romney’s criticisms of Trump, however, could prompt a challenge in a Republican primary. Trump was widely reported to have tried to convince Hatch to run for a seventh term, in part to head off a Romney candidacy.

Last month, Romney and Trump were on opposite sides of one of the biggest political fights of the fall — the battle over the Senate seat from Alabama. The president strongly supported Roy Moore, the Republican candidate who had been accused of sexual misconduct by several women. Romney called Moore “a stain on the GOP.”

On Tuesday, Romney tweeted praise for Hatch, but did not immediately reveal his own plans.

- Share via

Utah Republican Sen. Orrin Hatch announces he’ll retire at end of term, rather than seek reelection

- Share via

U.S. calls on Iran to unblock social media sites amid protests

The Trump administration is calling on Iran’s government to stop blocking Instagram and other popular social media sites as Iranians are demonstrating in the streets.

Undersecretary of State Steve Goldstein says the U.S. wants Iran to “open these sites.” He says Instagram, Telegram and other platforms are “legitimate avenues for communication.”

The United States is encouraging Iranians to use virtual private networks, known as VPNs. Those services create encrypted links between computers and can be used to access blocked websites.

Goldstein says the U.S. is still communicating with Iranians in Persian through State Department accounts on Facebook, Twitter and other platforms. He says the U.S. wants to “encourage the protesters to continue to fight for what’s right.”

Goldstein says the U.S. has an “obligation not to stand by.”

- Share via

Trump blasts Democrats in advance of immigration meeting

The day before a meeting of administration officials and congressional leaders on outstanding legislative business, President Trump accused Democrats of “doing nothing” to hammer out an immigration deal to protect from deportation people brought to the country illegally as children.

“Democrats are doing nothing for DACA — just interested in politics,” Trump wrote in a Tweet on Tuesday morning, referring to the Deferred Action for Childhood Arrivals program by its acronym.

House Minority Leader Nancy Pelosi and Senate Minority Leader Charles E. Schumer along with the Republican leaders, House Speaker Paul D. Ryan and Senate Majority Leader Mitch McConnell, are scheduled to meet on Wednesday at the Capitol with Trump’s legislative director, Marc Short, and budget director, Mick Mulvaney.

The White House on Tuesday said the meeting is to discuss separate spending caps on military and domestic programs. Yet the Democrats insist the discussion also must include a variety of legislative issues that Trump and Congress punted into the new year — on immigration, the budget, healthcare and more.

That stance reflects Democrats’ leverage: Republicans need Democratic votes to pass a government-funding bill and avert a federal shutdown when the current funding expires Jan. 19. Democrats especially want separate legislation replacing the Obama-era DACA program; Trump in September ordered a phase-out of the program, beginning March 6, and called on Congress to act before then on an alternative way to address the plight of the group.

However, Trump has demanded that any alternative must be part of a package including both money for a border wall and immigration limits. Democrats are opposed.

- Share via

Pakistan hits back after Trump accuses its leaders of ‘lies and deceit’

Pakistan lashed out Monday after President Trump accused its leaders of “lies and deceit” and suggested the United States would withdraw financial assistance to the nuclear-armed nation it once saw as a key ally against terrorism.

U.S. Ambassador David Hale was summoned to the Foreign Ministry to discuss the president’s statement, U.S. Embassy spokesman Richard Snelsire said. Pakistan lodged a strongly worded protest, according to two foreign office officials who spoke on condition of anonymity because they were not authorized to speak publicly.

Pakistan’s prime minister, Shahid Abbasi, called a Cabinet meeting for Tuesday and a meeting of the National Security Committee on Wednesday to discuss Trump’s New Year’s Day tweet.

It was the president’s latest broadside against Pakistan after a speech in August in which he demanded its leaders crack down on the safe havens enjoyed by Taliban militants fighting U.S.-backed forces in neighboring Afghanistan.

- Share via

Trump again cheers on Iran protests

President Trump expressed renewed support Sunday for protesters in Iran, declaring that “people are finally getting wise as to how their money and wealth is being stolen and squandered on terrorism.”

In a tweet from his Florida estate, Mar-a-Lago, the president said the nationwide economic protests that began on Thursday – and have taken on wider political overtones as they have grown in size --- were a signal that Iranians “will not take it any longer.”

The president’s earlier hailing of the protests drew condemnation from Iran’s government. A Foreign Ministry spokesman called his comments “deceitful and opportunistic.”

Following an overnight report of the first two fatalities stemming from the protests, Trump raised some eyebrows by expressing concern over human rights violations as authorities move to crack down on the demonstrations. During his first year in office, the president has shown scant inclination to press foreign governments to respect the fundamental rights of their citizens.

“The USA is watching closely for human rights violations!” Trump said in his tweet Sunday.

Some domestic critics have pointed to the president’s inclusion of Iranian nationals in his travel ban, suggesting he was more interested in bashing the Tehran government than in supporting freedom of speech in Iran.

Even some of the president’s allies said that supporting the protesters on social media did not amount to making policy. Sen. Lindsey Graham (R-S.C.) said he had urged Trump to give a national address laying out his Iran strategy.

“President Trump is tweeting very sympathetically to the Iranian people,” Graham said on CBS’ “Face the Nation.”

“But you just can’t tweet here. You have to lay out a plan.”

- Share via

Australian diplomat’s tip a factor in FBI’s Russia inquiry

An Australian diplomat’s tip appears to have helped persuade the FBI to investigate Russian meddling in the U.S. election and possible coordination with the Trump campaign, the New York Times reported Saturday.

Trump campaign advisor George Papadopoulos told the diplomat, Alexander Downer, during a meeting in London in May 2016 that Russia had thousands of emails that would embarrass Democratic candidate Hillary Clinton, the report said. Downer, a former foreign minister, is Australia’s top diplomat in Britain.

Australia passed the information on to the FBI after the Democratic emails were leaked, according to the Times, which cited four current and former U.S. and foreign officials with direct knowledge of the Australians’ role.

“The hacking and the revelation that a member of the Trump campaign may have had inside information about it were driving factors that led the FBI to open an investigation in July 2016,” the newspaper said.

White House lawyer Ty Cobb declined to comment, saying in a statement that the administration is continuing to cooperate with the investigation now led by special counsel Robert Mueller “to help complete their inquiry expeditiously.”

Papadopoulos has pleaded guilty to lying to the FBI and is a cooperating witness. Court documents unsealed two months ago show he met in April 2016 with Joseph Mifsud, a professor in London who told him about Russia’s cache of emails. This was before the Democratic National Committee became aware of the scope of the intrusion into its email systems by hackers later linked to the Russian government.

The Times said Papadopoulos shared this information with Downer, but it was unclear whether he also shared it with anyone in the Trump campaign.

- Share via

Trump offers fresh support for protesters in Iran as demonstrations continue

President Trump again offered support Saturday for anti-government protesters in Iran, where a third day of demonstrations, the largest in years, spilled across the country amid fears of a crackdown.

“Oppressive regimes cannot endure forever, and the day will come when the Iranian people will face a choice. The world is watching!” Trump wrote on Twitter.

Trump took a break from playing golf near his Mar-a-Lago resort in Florida to tweet clips from his speech to the United Nations General Assembly in September when he called for Iranian democratic reforms.

Iranian authorities warned of potential violence as the street demonstrations, which began over economic conditions, swelled into frustrations with the theocratic rule of Supreme Leader Ayatollah Ali Khamenei.

Trump has maintained a hawkish stance toward Iran, sharply criticizing the landmark nuclear disarmament accord that Tehran reached with then-President Obama and five other nations in 2015.

In October, Trump declined to certify the accord to Congress although the U.N. nuclear watchdog agency says Iran is complying with it.

Several conservative GOP senators signaled their support for Trump’s position and backed the protesters in Iran. Others in Congress did not immediately respond, however, amid conflicting reports over who had organized the demonstrations.

“Even after the billions in sanctions relief they secured through the nuclear deal, the ayatollahs still can’t provide for the basic needs of their own people,” said Sen. Tom Cotton (R-Ark.), a Trump ally and opponent of the nuclear deal.

“We should support the Iranian people who are willing to risk their lives to speak out against it,” he added.

Trump initially tweeted his support on Friday night. White House spokeswoman Sarah Huckabee Sanders issued a statement at that time as protests spread.

“There are many reports of peaceful protests by Iranian citizens fed up with the regime’s corruption and its squandering of the nation’s wealth to fund terrorism abroad,” Sanders said. “The Iranian government should respect their people’s rights, including their right to express themselves. The world is watching.”

- Share via

When it comes to U.S.-Russia relations, ‘it takes two to tango,’ Kremlin says

The deteriorating relationship between the United States and Russia is one of the biggest disappointments of 2017, Russian President Vladimir Putin’s spokesman told reporters today.

Russia would like to rebuild relations between the two adversaries, but “it takes two to tango,” Dmitry Peskov said today during a conference call with the press.

“We want and are looking for good mutually beneficial relations based on mutual respect, mutual trust with all countries, primarily with European ones, including the United States, but it is necessary to dance tango, as they say.”

Peskov blamed the ongoing anti-Russian “Russophobia” in Washington for playing a major role in blocking the two countries from moving forward in their relationship. U.S. investigations into the Trump presidential campaign’s alleged collusion with the Kremlin during the 2016 U.S. election and accusations that the Kremlin tried to interfere with the electoral process continue to cast a dark shadow over the relationship, he said.

Peskov told reporters that Moscow was “perplexed” by the investigations. The Kremlin has continued to deny having any involvement with the Trump campaign or doing anything to interfere with the American election.

“This is definitely a U.S. domestic affair, but in this case it naturally hurts our bilateral relations, which is regrettable,” Peskov said.

Relations between the U.S. and Russia have been categorized as the worst they’ve been since the end of the Cold War. This year, Washington and Moscow have engaged in a diplomatic tit-for-tat in which both sides have been forced to reduce diplomatic staff, embassy properties have been repossessed by the hosting countries and visa services have been interrupted. The U.S. diplomatic mission to Russia shrank from 1,200 personnel, including some Russian local staff, to just over 450 across all its three consulates and embassy in Moscow. In the U.S., Russia was forced to vacate its San Francisco consulate.

Moscow has also blamed anti-Russian sentiments on the recent decision by the International Olympic Committee to ban Russian teams from wearing their tricolor uniforms or flags during the upcoming games in South Korea. The international body accused some of the Russian national teams of doping.

- Share via

U.S. and Turkey resume reciprocal issuing of visas but frictions remain

The United States and Turkey began issuing reciprocal visas again on Thursday, more than two months after normal visa service was suspended in a dispute over the arrest of two U.S. diplomatic staffers in Istanbul — the latest friction between the two nominal allies.

The State Department said it was lifting the visa restrictions after it was assured by the Turkish government that U.S. Embassy employees would not be arrested when performing their official duties.

But the Turkish Embassy in Washington denied assurances were offered “concerning the ongoing judicial processes,” and suggested that the arrests were legal and justified.

“It is inappropriate to misinform the Turkish and American public that such assurances were provided,” the embassy said in a statement.

The dispute has aggravated the already tense relationship between the United States and Turkey, which is a member of the NATO military alliance. The two countries have clashed over U.S. support for Kurdish rebels in Syria and over Turkey’s demands that the U.S. extradite a Turkish cleric who lives in rural Pennsylvania.

After a failed coup attempt killed more than 250 people in July 2016, Turkey’s autocratic president, Recep Tayyip Erdogan, launched a harsh crackdown on his political opponents, arresting or firing tens of thousands of teachers, police, journalists, military officers and others.

Erdogan accused Fethullah Gülen, an Islamic educator and former political ally, of orchestrating the coup. Gulen, who has lived in a compound in the Pocono Mountains, has denied any involvement.

The Justice Department has so far denied Turkey’s repeated demands to extradite Gulen.

Erdogan raised the issue again at the White House in May, but his visit ended in a public relations disaster when his security guards brutally beat peaceful protesters outside the Turkish ambassador’s residence.

Two Turkish employees of the U.S. Consulate in Istanbul were arrested this fall for alleged ties to the 2016 coup attempt. The U.S. responded by suspending most visa services at its missions in Turkey in October. The Turkish government reciprocated in November.

State Department officials said they have repeatedly demanded more information about any formal charges against the two employees. They reiterated on Thursday that “serious concerns” about the allegations remained.

- Share via

Trump: China caught ‘RED HANDED’ allowing oil to reach North Korea

President Trump isn’t taking a holiday vacation from Twitter. In one of three tweets early on Thursday from his West Palm Beach golf club, he charged that China was “caught RED HANDED” allowing oil shipments to reach North Korean ports.

Pronouncing himself “very disappointed,” Trump in effect was acknowledging the failure of his months-long effort to convince China to clamp down further on energy shipments going to the isolated country, which relies heavily on Beijing, as a way to pressure North Korea to abandon its nuclear weapons program.

Trump’s tweet came after a South Korean newspaper published what it said were U.S. spy satellite images of Chinese ships selling oil to North Korean ships.

The United Nations Security Council, which includes China, has voted repeatedly to restrict fuel shipments to North Korea. Trump asked Chinese President Xi Jinping in November to cut off North Korea’s oil supply entirely, the American ambassador to the U.N., Nikki R. Haley, said at the time.

It is unclear if Trump’s admonishment of China was based on news reports or classified information he received from U.S. intelligence officials. There was no daily intelligence briefing on Trump’s public schedule Thursday. He is expected to return to Washington next week after spending the Christmas holiday and New Year’s Eve at his Mar-a-Lago resort in Palm Beach, Fla.

- Share via

President Trump again falsely claims he’s signed more bills than any president

After another morning at his Florida golf club, President Trump visited firefighters and paramedics at a West Palm Beach firehouse and praised his own performance as president, including with a false boast.

Trump touted his administration’s work to roll back government regulations and cut taxes and claimed credit for the stock market hitting record highs. He also said he’s signed more bills into law than any other president, which isn’t true.

“We have signed more legislation than anybody,” Trump said, standing in front of a rescue vehicle inside the fire station.

“We have more legislation passed, including — the record was Harry Truman a long time ago, and we broke that record, so we got a lot done,” Trump said.

An analysis by GovTrack, a website that tracks bills in Congress, shows that Trump has signed the fewest bills into law at this point than any president in more than 60 years, back to Dwight D. Eisenhower.

- Share via

Trump administration urges Russia to reinstate monitors in Ukraine, ‘lower violence’

Secretary of State Rex Tillerson asked Russia on Wednesday to reinstate its military personnel at a monitoring station in eastern Ukraine intended to quell escalating bloodshed.

In a telephone conversation with his Russian counterpart, Sergei Lavrov, Tillerson also urged Russia to “lower the level of violence” and underscored the Trump administration’s “concern” over increased fighting in Ukraine, the State Department said in a statement.

Russia last week withdrew its monitors from the Joint Center on Coordination and Control, which is tasked with verifying a much-violated ceasefire between Ukrainian forces and Russia-backed separatists. Moscow cited what it called restrictions and “provocations” from Ukrainian authorities that made it impossible for the observers to do their jobs.

Washington has accused the pro-Russia forces of being responsible for many of the truce violations.

Late last week, the State Department also announced plans to provide Ukraine with lethal defensive weapons, including Javelin anti-tank missiles, a decision that angered Moscow.

The State Department statement did not say whether the weapons deal came up in Tillerson’s conversation with Lavrov.

The two also discussed North Korea, its “destabilizing nuclear program” and the need for a diplomatic solution “to achieve a denuclearized Korean peninsula,” the statement said. Russia has offered to serve as a mediator between Washington and Pyongyang, but direct talks do not seem likely at this point.

- Share via

U.S. sanctions two more North Korean officials for ballistic missile program

The Trump administration announced sanctions Tuesday against two more North Korean officials for their alleged role in Pyongyang’s expanding ballistic missiles program.

The Treasury Department “is targeting leaders of North Korea’s ballistic missile programs, as part of our maximum pressure campaign to isolate [North Korea] and achieve a fully denuclearized Korean Peninsula,” Treasury Secretary Steven T. Mnuchin said in a statement.

The nuclear-armed country tested an intercontinental ballistic missile last month that U.S. officials said appeared capable of reaching New York or Washington, a significant milestone in the country’s growing arsenal.

The Treasury Department identified the two North Korean officials as Kim Jong Sik, who “reportedly is a key figure” in the ballistic missile program and led efforts to switch missiles from liquid to solid fuel (which makes them easier to hide before launch), and Ri Pyong Chol, who was “reported to be a key official” in the development of intercontinental ballistic missiles.

The sanctions block banks, companies and individuals from doing any business with the targeted officials. It also allows the U.S. government to freeze any American assets owned by the officials.

On Friday, the United Nations Security Council unanimously voted to add more sanctions on North Korea, its third round this year. The new measures order North Koreans working abroad to return home within two years, and ban nearly 90% of refined petroleum exports to the country.

In a statement published Sunday by North Korea’s state-run KCNA news agency, the foreign ministry denounced the new U.N. sanctions as “an act of war.”

“We define this ‘sanctions resolution’ rigged up by the US and its followers as a grave infringement upon the sovereignty of our Republic, as an act of war violating peace and stability in the Korean Peninsula and the region and categorically reject the ‘resolution,’” it said.

- Share via

Salt Lake Tribune calls on Sen. Orrin Hatch to not seek reelection in scathing editorial

Perhaps the most significant move of Hatch’s career is the one that should, if there is any justice, end it. The last time the senator was up for reelection, in 2012, he promised that it would be his last campaign. That was enough for many likely successors, of both parties, to stand down, to let the elder statesman have his victory tour and to prepare to run for an open seat in 2018. Clearly, it was a lie.

- Share via

Christmas Eve, Trump on Twitter: New attacks on FBI official, decrying ‘Fake News’

President Trump launched a Christmas Eve attack on FBI Deputy Director Andrew McCabe, whom he accuses of favoritism toward his former opponent, Hillary Clinton, and also returned to a longtime favored theme, excoriating the news media for failing to sufficiently extol his accomplishments.

Trump, who is spending the holidays at his Florida resort, Mar-a-Lago, also sent Christmas greetings to deployed military personnel, praising them for success in the fight against terrorism.

The early-morning swipe at McCabe followed a flurry of tweets attacking the deputy FBI chief on Saturday. McCabe, who has been a lightning rod for Republican attacks on the FBI, is expected to retire early in the new year.

Critics say the president and his allies are in the midst of a systematic campaign to denigrate the FBI and special counsel Robert S. Mueller III, who is looking into potential collusion by the Trump campaign in Russia’s attempts to sway the 2016 presidential election.

In a pair of statements on Twitter, Trump again expressed scorn regarding news coverage of his administration. For months, the president has been particularly critical of reports regarding the Russia investigation and more recently has repeatedly complained he does not receive enough credit for a booming stock market.

In his video conference message to troops overseas, the president made apparent reference to the fight against the militants of Islamic State, who over the last year have lost most of the territory they previously controlled in Iraq and Syria, including former strongholds in Mosul and Raqqah.

“We’re winning,” Trump told military personnel deployed in Qatar, Kuwait, Guantanamo Bay and aboard the guided missile destroyer Sampson.

Reporters traveling with the president heard his address, but were ushered from the room before he took questions from the troops. The president often breaks with longtime custom and makes politically charged statements at events in which he addresses military personnel.

- Share via

Trump’s Wells Fargo tweet cited in court hearing as reason to remove Mulvaney as CFPB acting chief

A recent tweet by President Trump about possible penalties against Wells Fargo & Co. was cited during a court hearing Friday as a reason for removing White House official Mick Mulvaney as acting director of the Consumer Financial Protection Bureau.

The attorney for Leandra English — the bureau’s deputy director who has said she is the rightful acting head — said Trump’s tweet showed he was trying to exercise improper influence over the independent consumer watchdog.

“I think that [tweet] shows you this isn’t just some hypothetical concern,” the attorney, Deepak Gupta, told Judge Timothy J. Kelly of the U.S. District Court for the District of Columbia during a nearly two-hour hearing.

- Share via

Trump administration recognizes Honduran president’s reelection

The Trump administration on Friday formally recognized the incumbent president of Honduras, conservative Juan Orlando Hernandez, as the winner of a bitterly contested presidential election held last month.

In a statement, the State Department congratulated Hernandez while also acknowledging widespread irregularities in the Nov. 26 vote and calling for a “robust national dialogue” to overcome political discord in the Central American country, a close ally of the administration.

The Organization of American States, which monitored the election, said it was so flawed that only a new round of voting could establish a “fair and transparent” outcome. But the U.S. rejected that determination.

Uproar over the contest led to demonstrations in Honduras that left numerous civilians dead after state security forces opened fire on the protests. Activists and others voiced criticism Friday of the administration’s decision.

Rep. Jim McGovern (D-Mass.), a leading Democratic voice on Central American issues, said he was “angry and deeply disturbed” by the State Department decision.

“The recent elections in Honduras were deeply flawed, chaotic and marred by numerous irregularities,” McGovern said. U.S.-Honduran cooperation on matters such as drug-trafficking, violence and immigration requires “a credible, legitimate government that has the support of its people,” in Honduras, McGovern said.

Hernandez’s victory also was controversial because it was the first time a sitting president was allowed to run for re-election, barred until now by the Honduran Constitution.

- Share via

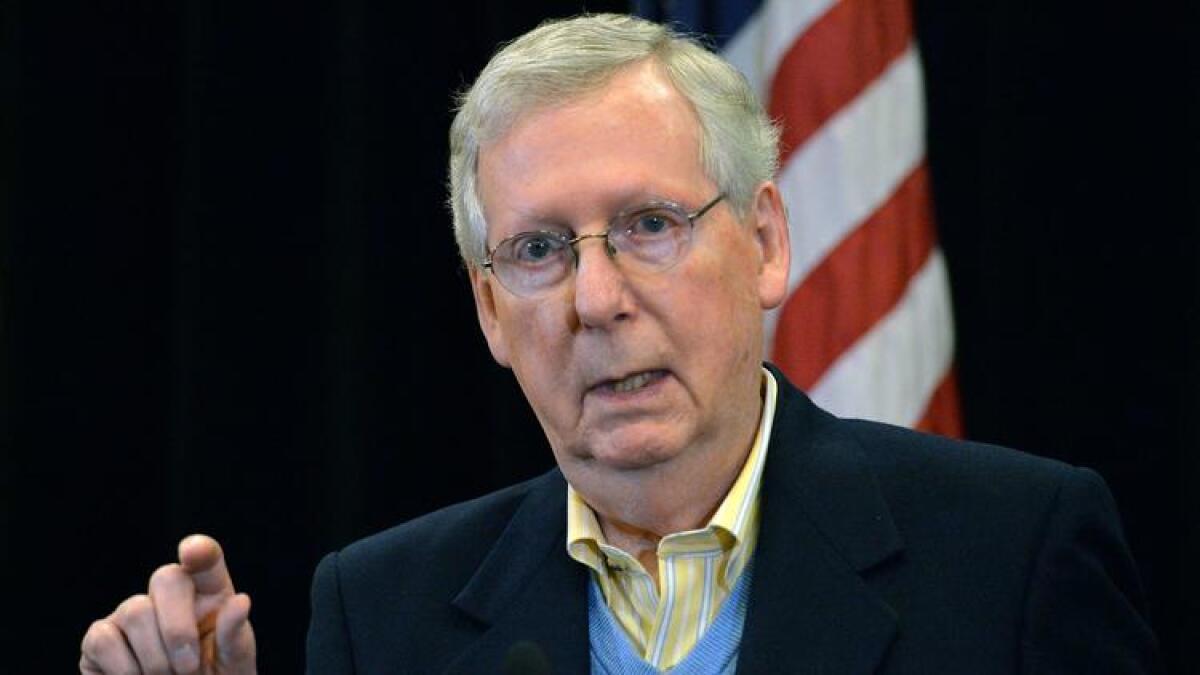

Senate Leader Mitch McConnell says fixing DACA is ‘no emergency’ until March

Senate Majority Leader Mitch McConnell said Friday he’s committed to allowing a vote on a bill for so-called “Dreamers” in January, but sees no rush to resolve the deportation threat posed by President Trump’s decision to end a program protecting immigrants brought to the country illegally as children.

“There isn’t that much of an emergency there,” he said. “There is no emergency until March. We’ll keep talking about it.”

Trump called for phasing out by March the Obama-era program that allows the young immigrants, many of them longtime residents, to get two-year deferrals of any deportation threat so they can legally attend school or work. Beneficiaries must be vetted for security purposes.

Trump told Congress to come up with a legislative alternative for the Deferred Action for Childhood Arrivals program, which President Obama created by executive order, to protect those currently eligible.

A bipartisan Senate group has been working with the White House, but talks stalled this week amid administration demands for curbs on legal immigration flows in exchange for protecting the DACA recipients.

Meanwhile, Dreamers and immigrant advocates stormed the Capitol in recent days pressing for the help promised by Trump and Democratic congressional leaders that failed to materialize in the year’s final legislation.

Advocacy groups say more than 120 immigrants each day are falling out of compliance without DACA renewals, putting them at risk of deportation. The number that is projected to swell to more than 1,000 a day in March.

“We’ve been gridlocked on this issue for years,” McConnell said. “We want to have a signature. We don’t just want to spin our wheels and have nothing to show for it.”

- Share via

President Trump signs tax bill

President Trump on Friday morning signed a sweeping tax-cut measure — his first major legislative achievement — before heading off for a Christmas vacation at his Mar-a-Lago property in Palm Beach, Fla.

The president also privately signed a short-term spending bill to fund government operations through Jan. 19. Congress approved it Thursday, after Republican leaders were unable to bridge differences in their own party as well as with Democrats to get agreement on funding for the full fiscal year. The stopgap bill punts fights on immigration and other issues to January.

The tax bill, approved earlier this week in Congress in largely party-line votes, slashes corporate tax rates from 35% to 21% and also includes a host of other provisions for individuals, all intended to boost the economy.

Critics point to nonpartisan analyses showing that the package, including changes greatly reducing the number of estates subject to taxes, steers the bulk of tax benefits to top earners and the wealthy, including Trump, despite his repeated claims that he’ll take a hit.

Trump signed the bill quietly Friday, but held a public ceremony with Republican lawmakers on Wednesday after the bill’s passage; he also tweeted about the measure extensively. He is expected to hold another public ceremony after the New Year’s holiday.

- Share via

Pelosi urges Ryan to prevent Republicans from curtailing House’s Russia probe

House Democratic Leader Nancy Pelosi sent a letter to Speaker Paul D. Ryan on Friday urging him to ensure the House’s investigation into Russian interference with last year’s presidential campaign is not “cut short.”

“The American people deserve a comprehensive and fair investigation into Russia’s attacks,” wrote Pelosi, of San Francisco, in her letter. “Political haste must not cut short valid investigatory threads.”

The House Intelligence Committee has been probing the issue since March 1, and Democrats have repeatedly warned that Republicans are trying to wrap up its work prematurely. Pelosi said Ryan, a Republican from Wisconsin, should “take urgent action to ensure this investigation can continue.”

AshLee Strong, a spokeswoman for Ryan, said Pelosi simply wants “to see this investigation go on forever” in order to “suit her political agenda.”

“Whether it concludes next month, next year, or in three years, she will say it is too soon,” Strong said in a statement. She added, “The investigation will conclude when the committee has reached a conclusion.”

The committee’s work is led by Rep. K. Michael Conaway (R-Texas). His spokeswoman, Emily Hytha, said he “remains committed to conducting this investigation as thoroughly and expeditiously as possible.”

With more interviews scheduled, the investigation shows signs of extending into next year, Bloomberg reported Friday.

- Share via

Congress votes to avert government shutdown, but Senate fails to pass disaster aid package

Congress approved a temporary spending bill to prevent a government shutdown, but failed to complete work on an $81-billion disaster aid package to help California, Gulf Coast states and Puerto Rico recover from wildfires and hurricanes, as lawmakers scrambled Thursday to wrap up business before a Christmas break.

The stopgap measure continues federal operations for a few more weeks, setting up another deadline for Jan. 19. But it left undone a long list of priorities that members of both parties had hoped to finish this year.

- Share via

Wells Fargo says raises were not linked to tax bill passage — then backtracks

Wells Fargo & Co.’s move to raise its minimum pay to $15 an hour was part of a long-term plan and not related to the passage of the Republican tax overhaul as the company implied, said a bank spokesman, who later backtracked and stated the hikes were a result of the bill’s approval.

The bank was among several large corporations to publicly announce pay raises or new investments immediately following the final House vote in an apparent public relations offensive to boost the popularity of the tax bill

The San Francisco bank had implied the direct linkage to the tax legislation in a news release Wednesday, shortly after Congress passed the tax overhaul, which slashes the corporate tax rate to 21% from 35% starting Jan. 1.

- Share via

Obamacare signups beat expectations, despite Trump administration’s opposition

Despite Trump administration efforts to discourage people from signing up, the number of people enrolling for Affordable Care Act coverage nearly hit last year’s level, the government revealed Thursday.

The 8.8 million people who enrolled in the 36 states that use the federal government’s healthcare.gov system significantly exceeded most forecasts.

The Trump administration stopped most outreach and other efforts this year aimed at getting people to sign up. The president also repeatedly said publicly that Obamacare was “dead.”

Open enrollment continues in California and several other states that run their own healthcare marketplaces. The figures from the federal government indicate that when those states wrap up for the year, the number of people covered by Obamacare will be nearly the same as in 2017.

- Share via

U.N. General Assembly overwhelmingly condemns U.S. policy change on Jerusalem despite Trump’s threats

The United Nations General Assembly overwhelmingly voted Thursday to condemn President Trump’s decision to recognize Jerusalem as the capital of Israel, despite Trump’s threats to punish countries that voted against the U.S. position.

The resolution passed in an emergency session at U.N. headquarters in New York with 128 in favor, nine opposed and 35 abstentions.

The nonbinding resolution demands that Washington rescind its declaration, which included a plan to transfer the U.S. Embassy in Israel from Tel Aviv to Jerusalem in coming years.

The resolution value is mostly symbolic, showing how isolated the U.S. is in the move.

Nikki Haley, the U.S. ambassador to the U.N., warned this week that she would be “taking names” of countries that opposed the U.S., and Trump on Wednesday suggested he might cut U.S. aid to governments that voted in favor of the resolution.

”Let them vote against us,” Trump said. “We’ll save a lot. We don’t care.”

The U.S. recognition of Jerusalem reversed decades of international consensus on the political status of the divided city. Palestinians claim East Jerusalem as their capital in a future independent state.

Palestinian Foreign Minister Riad Malki said the U.N. was facing an “unprecedented test” and that history would remember those who “stand by what is right.”

- Share via

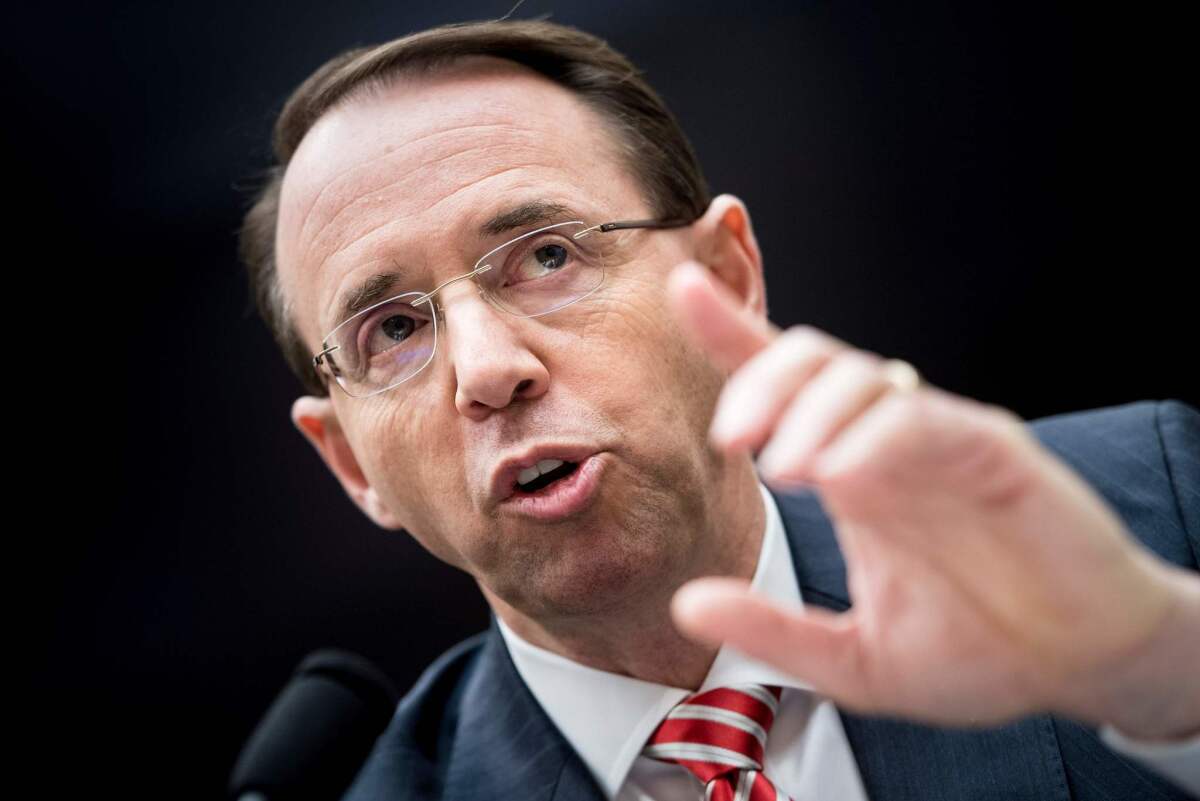

Democrats defend Robert Mueller, saying Russia investigation must be allowed to continue

House Democrats said they will fight Republican attempts to “discredit and undermine” the work of special counsel Robert S. Mueller III, who is investigating whether President Trump’s associates helped Russian meddling in last year’s election.

“There is an organized effort by Republicans, in concert with Fox News, to spin a false narrative and conjure up outrageous scenarios to accuse special counsel Mueller of being biased,” Rep. Maxine Waters (D-Los Angeles) said.

Trump has said he has no plan to fire Mueller, but Democrats are alarmed by escalating criticism of the special counsel’s work.

“Why is the president afraid of the facts and the truth?” Rep. Dan Kildee (D-Mich.) said.

He added, “No matter what the facts are, we’re satisfied if the investigation is complete.”

A letter of support signed by 171 Democratic members of Congress will be sent to Deputy Atty. Gen. Rod Rosenstein, who appointed Mueller, a former FBI director, and oversees his investigation.

Rosenstein has defended Mueller in the face of Republican criticisms.

- Share via

U.S. blacklists Myanmar army general who it says oversaw atrocities against Rohingya Muslims

The Trump administration on Thursday blacklisted a Myanmar army general who it said oversaw human rights abuses committed by security forces against Rohingya Muslims.

Imposing economic sanctions against the general, Maung Maung Soe, was the toughest action the United States has taken in response to a brutal army offensive that Secretary of State Rex Tillerson has described as ethnic cleansing.

In a statement, the Treasury Department said it had examined “credible evidence of Maung Maung Soe’s activities, including allegations against Burmese security forces of extrajudicial killings, sexual violence and arbitrary arrest as well as the widespread burning of villages.”

The Rohingya are an ethnic and religious minority of about 1 million people in predominantly Buddhist Myanmar, also known as Burma. The United Nations says that more than 640,000 Rohingya have fled the country since August, after the army launched “clearance operations” in response to attacks carried out by a Rohingya insurgent group against security forces.

Rohingya refugees in crowded camps in neighboring Bangladesh have described horrific violence by Myanmar forces, including mass rapes, summary executions and children being burned alive.

The aid group Doctors Without Borders estimates that 6,700 people were killed in the first month of the operation. Myanmar authorities deny committing atrocities and say that only a few hundred “fighters” were killed.

Maung Maung Soe was chief of the army’s Western Command, which carried out the offensive. He was transferred from his position last month, according to news reports.

He was one of 13 individuals worldwide who were blacklisted Thursday under a new U.S. law that gives the Treasury Department authority to target officials for human rights abuses and corruption. Others included former Gambian President Yahya Jammeh; Gulnara Karimova, daughter of the late Uzbekistan dictator Islam Karimov; and Artem Chaika, son of Russia’s prosecutor-general.

“Today, the United States is taking a strong stand against human rights abuse and corruption globally by shutting these bad actors out of the U.S. financial system,” said Treasury Secretary Steven T. Mnuchin.

The sanctions freeze any assets Maung Maung Soe holds in the United States and bars Americans from doing business with him. It is also a sign of how quickly U.S. relations with Myanmar have soured.

Under the Obama administration, the United States forged closer ties with the former military dictatorship and eased economic and political sanctions as the country began implementing democratic reforms.

But Myanmar, which does not regard the Rohingya as citizens, has lashed out at the international community over the current crisis. It has jailed journalists, blocked access to affected areas in the western state of Rakhine and this week barred a U.N. human rights investigator from entering the country.

Rohingya activists said the U.S. action would not have much effect on a country that survived under economic sanctions for years.

“It is the whole military institution that has a policy to persecute these people,” said Nay San Lwin, a Rohingya activist and blogger in Germany. “According to the U.S.’s own definition, the army is carrying out ethnic cleansing. They have a responsibility to protect these people. Sanctions on one person are really not enough.”

- Share via

‘Dreamers’ will have to wait until next year for Congress’ long-promised protections

A promised year-end deal to protect the young immigrants known as Dreamers from deportation collapsed Wednesday as Republicans in Congress — fresh off passage of their tax plan — prepared to punt nearly all remaining must-do agenda items into the new year.

Congressional leaders still hope that before leaving town this week they can pass an $81-billion disaster relief package with recovery funds for California wildfires and Gulf Coast states hit during the devastating hurricane season. But passage even of that relatively popular measure remained in doubt as conservatives balked at the price tag.

Rather than finish the year wrapping up the legislative agenda, the GOP majorities in the House and Senate struggled over their next steps.

- Share via

Chants of protest drown out any caroling this holiday season at the Capitol

Outside the U.S. Capitol, the lights on a towering Christmas tree are flipped on each evening, giving the Engelmann spruce a festive twinkle; inside the marble halls, wreaths and garlands decorate doorways and alcoves ahead of the holidays.

But the spirit of the season has been punctuated by other sights: a Jumbotron parked across from the Capitol reflecting pool broadcasts images of young immigrants who face deportation; Little Lobbyists, children with complex medical needs, were featured in a recent news conference; protesters filed into the visitor galleries to shout against the Republican tax plan.

While it’s beginning to look a lot like Christmas at the Capitol, it’s also shaping up to be a holiday season of protest.

- Share via

Tax bill simplifies filing for some but complicates it for others — and don’t count on that postcard

A priority of the Republicans’ tax overhaul was simplification, and they drove home the point this fall with an omnipresent prop: a red-white-and-blue postcard.

“We’re making things so simple that you can do your taxes on a form the size of a postcard,” House Speaker Paul Ryan (R-Wisc.) said last month, pulling one from his jacket pocket as he and Republican leaders unveiled their bill.

They gave a couple of the cards to President Trump at a White House meeting a few hours later and flashed them often during news conferences and TV interviews in the coming days.

- Share via

Top U.N. human rights official reportedly won’t seek reelection

The top United Nations official for human rights, who has frequently criticized the Trump administration, has reportedly decided not to seek a second term, saying his work had become untenable.

Zeid Raad Hussein, the U.N. high commissioner for human rights, notified his staff in an email that was obtained by several news outlets, including Agence France-Presse.

Staying when his four-year term is up for renewal at the end of August “might involve bending a knee in supplication,” AFP quoted Hussein’s email as saying.

Hussein is a Jordanian prince who has criticized, among other things, President Trump’s attempts to ban visitors or refugees from six predominantly Muslim countries.

The news comes a day before the U.N. General Assembly is expected to vote on a nonbinding resolution condemning the Trump administration’s formal declaration of Jerusalem as the capital of Israel, a decision that went against international consensus.

Nikki Haley, the U.S. ambassador to the U.N., has warned she will be “taking names” of those who vote against the United States on Thursday.

Trump echoed that sentiment Wednesday, voiced support for Haley and implying to reporters that he would consider cutting off U.S. aid to countries that vote against the U.S.

“Well, we’re watching those votes,” Trump said. “Let them vote against us. We’ll save a lot. We don’t care.”

On Monday, the United States lost a Security Council vote 14-1 on a binding resolution that would have required Washington to rescind its declaration. Haley then vetoed the resolution.

- Share via

Top Democrat warns Trump not to fire Mueller or interfere with his investigation

Sen. Mark Warner of Virginia, one of the top Democrats involved in the congressional inquiries into Russian interference in last year’s election, said Wednesday that any attempt by President Trump to interfere with the separate criminal investigation would be a “gross abuse of power.”

Warner, who is vice chairman of the Senate Intelligence Committee, delivered his warning from the Senate floor as Republicans escalate their criticism of special counsel Robert S. Mueller III and his team of prosecutors and FBI agents.

Some Democrats believe Trump is laying the groundwork to fire Mueller even though the president has publicly denied it. Mueller was appointed in May after Trump fired FBI Director James B. Comey.

“In the United States of America, no one, no one is above the law, not even the president,” Warner said. “Congress must make clear to the president that firing the special counsel or interfering with his investigation by issuing pardons of essential witnesses is unacceptable and would have immediate and significant consequences.”

Some Democrats say the White House may try to in effect short-circuit the Mueller investigation by replacing Deputy Atty. Gen. Rod Rosenstein, who is the only official empowered to fire Mueller.

Rosenstein recently told Congress that the special counsel is acting “appropriately” and that he would not dismiss Mueller without just cause.

- Share via

‘We have essentially repealed Obamacare,’ Trump says after tax bill passes

President Trump is celebrating Republicans’ passage of the tax overhaul bill as a two-fer: On Wednesday, in addition to tax cuts, he checked off his promise to repeal Obamacare, pointing to a provision in the bill to end the penalty on Americans who don’t get health insurance.

“We have essentially repealed Obamacare,” Trump told reporters during a Cabinet meeting at the White House.

Other provisions of the 2010 Affordable Care Act are still in place, and Trump and congressional Republicans failed completely on the “replace” half of their vow to “repeal and replace” the program.

In Trump’s view, however, stripping away the law’s “individual mandate” to get insurance or else pay a tax penalty amounts to repeal of the whole law. Congressional analysts have said that millions of people would lose insurance as a result, either by choice or because they cannot afford it without subsidies, and that premiums would increase for others as younger, healthy people drop coverage.

“We will come up with something much better,” Trump said, adding that block grants to states could be one approach.

By his comments, Trump tacitly acknowledged that repeal of the mandate is likely the best he can do following Republicans’ failure this year to agree on a repeal-and-replace bill.

Looking back on his first year, Trump also boasted of his administration’s efforts against the Islamic State and increased immigration enforcement. He said he had not given up on funding a border wall or tightening immigration law to limit citizens’ ability to resettle foreign relatives in the country. He said he would “very shortly” visit the border with Mexico near San Diego to see wall prototypes that have been built.

He didn’t answer a reporter’s shouted question about how he would personally benefit from the tax bill.

- Share via

House gives final OK to GOP tax plan, sending it to Trump

Congress gave final approval to the GOP tax plan Wednesday, 224-201, after the House took an unusual do-over vote to clear up differences with the Senate-passed bill.

The $1.5-trillion package now heads to President Trump, who plans to sign it into law.

The House had approved the tax bill on Tuesday but was forced to take another vote Wednesday because a couple of provisions in the version it approved were found to be in violation of Senate procedures. Those provisions were dropped before the Senate gave its approval early Wednesday.

Critics complained the Republicans rushed to pass the sweeping tax plan to deliver Trump a year-end legislative victory, but supporters shrugged off the problems as minor.

The tax plan dramatically cuts corporate rates and provides some individual rate reductions, overhauling the tax code for the first time in 30 years.

- Share via

Trump administration effort to block immigrant from having an abortion fails

President Trump’s lawyers rushed to the Supreme Court and U.S. appeals court in Washington on Monday evening to file emergency appeals seeking to prevent an immigrant in detention, dubbed Jane Roe in court, from having an abortion.

That set the stage for a legal showdown on whether the administration can block pregnant minors in custody from choosing to have an abortion.

But the legal clash, which the administration has seemed eager to have, fizzled out Tuesday when the government’s lawyers admitted the “17-year-old unaccompanied minor” in their custody was actually 19. They said they had obtained her birth certificate and realized she was not a minor after all.

As a result, Roe, who is 10 weeks pregnant, will no longer be held in a detention center for immigrant minors, and will not be subject to an administration policy that tries to prevent minors in immigration detention from having abortions.

Administration lawyers told appeals court judges Tuesday night that Roe was being sent to a facility for adults and likely would be released until her immigration status can be resolved.

In a brief order, the D.C. Circuit Court agreed to put the case on hold, but told government attorneys to confirm that “she will be permitted to obtain an abortion.”

The administration had earlier tried to delay another young woman, referred to in court as Jane Poe, from having an abortion, but officials relented on Monday because she was 22 weeks pregnant and nearing the time limit for a legal abortion.

- Share via

Senate panel rejects Trump’s pick to lead Export-Import Bank, a leader in the effort to shut it down

A Senate committee on Tuesday rejected President Trump’s nominee to lead the Export-Import Bank, extending the chaos at the embattled agency whose job is to help U.S. companies sell their goods abroad.

Two Republicans joined all Democrats on the Senate Banking Committee in voting against former Rep. Scott Garrett (R-N.J.) to be the bank’s president.

Garrett had been a vocal critic of the Ex-Im Bank and a leader of a conservative effort that shut the bank down for five months in 2015 by blocking its congressional authorization. He and other bank opponents branded the bank’s aid as crony capitalism.

- Share via

Congress proposes $81-billion disaster aid package, including funds for California wildfires

Congress is set to consider an $81-billion disaster aid package that includes wildfire recovery money for California and other Western states as well as hurricane relief with a price tag reflecting a year of record-setting natural calamities.

The legislation, the text of which was released late Monday, would provide almost twice as much as the $44 billion the White House sought last month to cover relief efforts along the Gulf Coast and in the Caribbean.

Republican congressional leaders added more money after California lawmakers objected that the administration had failed to include help for areas damaged by wildfires and Democrats protested that the overall amount President Trump asked for was insufficient.

- Share via

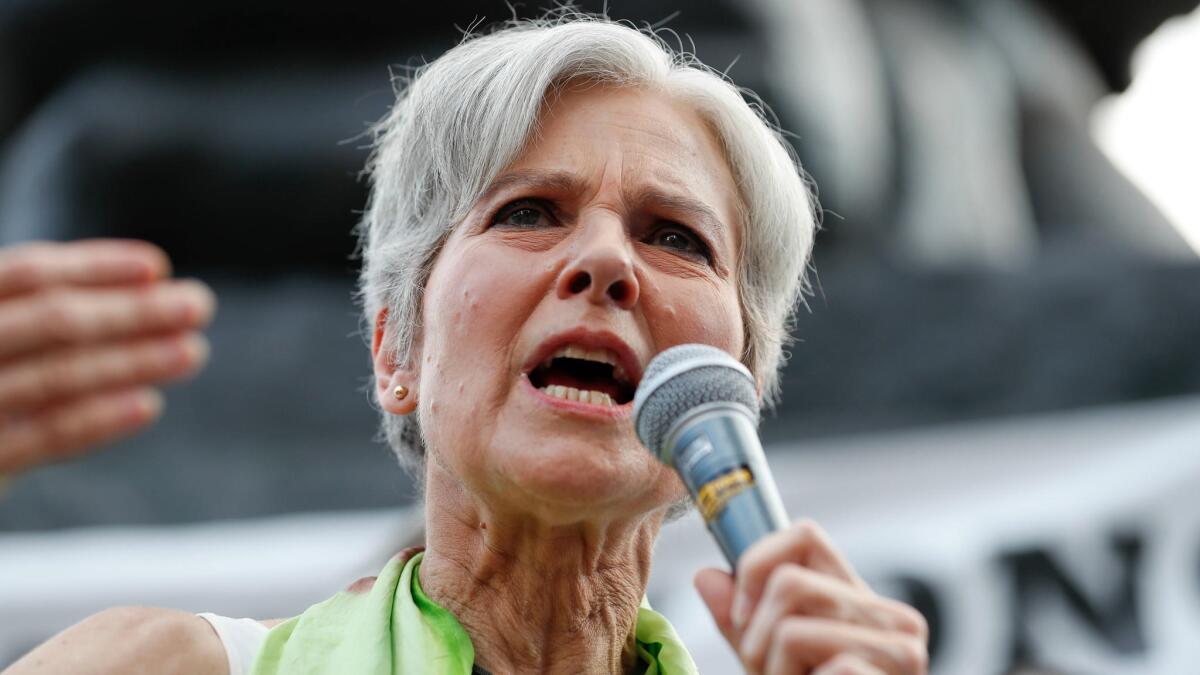

Senate investigating Green Party candidate Jill Stein in Russia probe

The Green Party’s 2016 presidential nominee says she’s cooperating with a request for documents from a Senate committee probing Russian meddling in the U.S. election.

Jill Stein has acknowledged attending a 2015 event in Moscow celebrating the anniversary of a state-sponsored Russian news organization. The event has attracted investigators’ attention because former national security advisor Michael Flynn also attended and sat beside Russian President Vladimir Putin.

Stein says in a statement Tuesday she’s sharing “all communications relevant” to the Senate Intelligence Committee’s mission.

The Massachusetts physician says she accepted an invitation to attend the Moscow event and that her campaign did not receive payment or reimbursement for the trip.

Stein received about 1% of the popular vote in the 2016 election.

- Share via

White House blames North Korea for worldwide ‘WannaCry’ cyber attack

The White House officially blamed North Korea on Tuesday for the cyberattack in May known as WannaCry that infected hundreds of thousands of computers in 150 countries, affecting healthcare, financial services and vital infrastructure.

Thomas P. Bossert, assistant to the president for homeland security and counter-terrorism, noted in a briefing with reporters that the “consequences were beyond economic.” He warned that North Korea’s “malicious behavior is growing more egregious.”

Bossert did not specify what evidence American officials have to blame North Korea, citing security issues, but he cited the country’s prior attacks as revealing hallmarks of how Pyongyang and its network of hackers operates. He said other allied countries had joined the United States in making the determination.

The administration did not announce any penalties on the regime, which is already subject to severe sanctions over its nuclear program.

“They want to hold the entire world at risk,” Bossert said of North Korea’s rulers, referring to the nation’s nuclear and missile provocations as well as its alleged cyberattack.

Given its isolation and international sanctions, North Korea is desperate for funds. Bossert said the country did not appear to make much money on the ransom attack, as word spread that paying a ransom did not result in getting computers unlocked. Its primary goal, he said, was spreading chaos.

Bossert and Jeanette Manfra, assistant secretary of homeland security for cybersecurity and communication, said the United States, through a combination of preparation and luck, escaped the worst of the attack, as a patch to the malware was found before U.S. companies and other interests were severely crippled.

However, Manfra said, “We cannot be complacent.” Bossert added, “Next time we’re not going to get so lucky.”

Manfra praised Microsoft and Facebook for their efforts to combat WannaCry and to block more recent attempts to hack U.S. systems. She and Bossert urged more cooperation and information-sharing from American and multinational companies, arguing a united front is vital to protecting against bad actors who do not differentiate between government and business.

Bossert rejected criticism that the the Trump administration has more aggressively called out North Korean cyberattacks than it has Russia’s meddling in the 2016 election. He said the administration has continued the national emergency initiated by President Obama.

- Share via

GOP lures some mountain bike groups in its push to roll back protections for public land

When their vision of creating a scenic cycling trail through a protected alpine backcountry hit a snag, San Diego area mountain bikers turned to an unlikely ally: congressional Republicans aiming to dilute conservation laws.

The frustrations of the San Diego cycling group and a handful of similar organizations are providing tailwind to the GOP movement to lift restrictions on the country’s most ecologically fragile and pristine landscapes, officially designated “wilderness.”

Resentment of these cyclists over the longstanding ban on “mechanized” transportation in that fraction of the nation’s public lands presents a political opportunity for Republicans eager to drill fissures in the broad coalition of conservation-minded groups united against the GOP environmental agenda.

- Share via

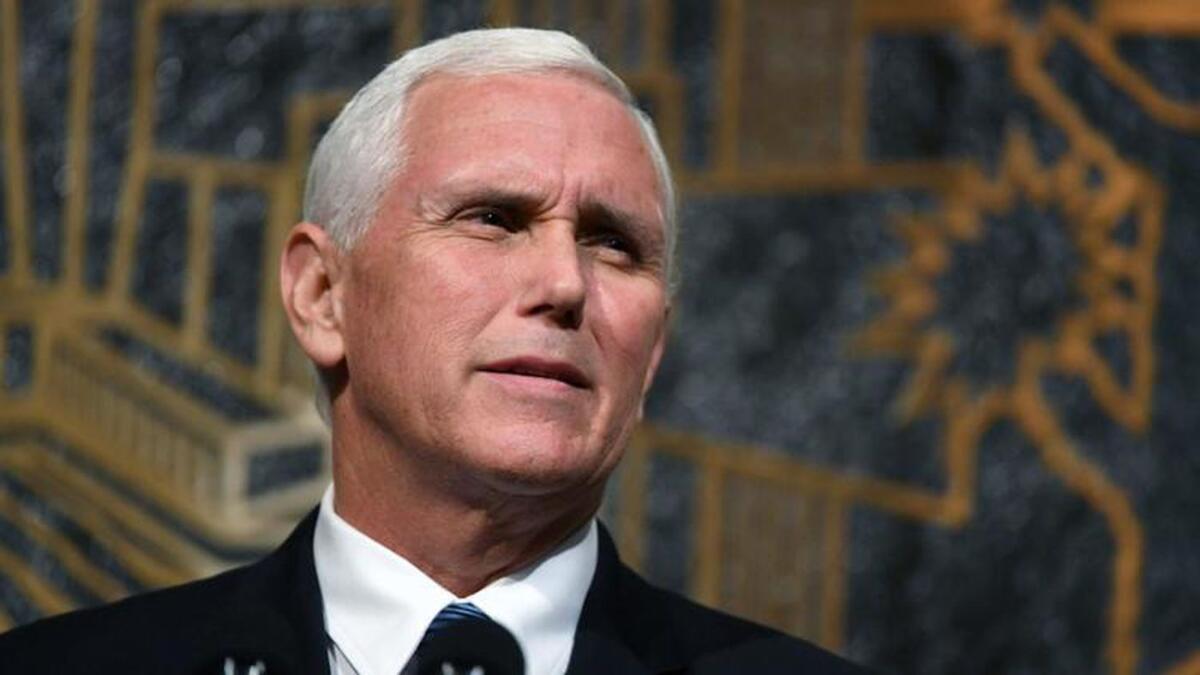

Vice president postpones Israel trip a second time in case his vote is needed to pass tax cut bill

Vice President Mike Pence is delaying his trip to Egypt and Israel for a second time in case he is needed to break a tie in the Senate for the tax bill that is expected to pass narrowly this week.

Two White House officials confirmed the changed schedule, which they say is unrelated to to protests in the region over the administration’s decision to recognize Jerusalem as Israel’s capital.

Pence had initially been scheduled to leave last Saturday. Late last week, the White House moved the trip back a few days to Tuesday night, in case Pence was needed to break a Senate tie. But Monday, they decided to postpone the trip further, to January, given the possibility of a late Senate vote and the coming holidays.

“He wants to see it through the finish line,” said a White House official, referring to the tax measure that is a centerpiece of the Republican legislative agenda. “We don’t want to leave anything to chance.”

The mid-January dates will allow Pence more breathing room to merge schedules with embassies and hotels, the official said. Trump still plans to address the Israeli Knesset, a high-profile venue to discuss the Jerusalem decision where it is most popular.

- Share via

Trump judicial pick who drew ridicule at hearing withdraws

A White House official says the Trump judicial nominee whose qualifications were questioned by a Republican senator has withdrawn his nomination.

Matthew Petersen, who was nominated by President Trump to the U.S. District Court for the District of Columbia, has been the subject of widespread ridicule since he was unable to define basic legal terms during his confirmation hearing Wednesday.

A White House official says Petersen has withdrawn his nomination and that Trump has accepted the withdrawal. The official spoke on condition of anonymity because the official was not authorized to discuss the development publicly.

Louisiana Sen. John Kennedy pressed Petersen, a former chairman of the Federal Election Commission, who testified he had never tried a case, on his qualifications to the bench.

- Share via

Trump says McCain will return to Washington if needed for tax vote

President Trump said Sunday that Sen. John McCain, who is battling an aggressive form of brain cancer, was returning home to Arizona for the holidays but would come back to Washington if needed to cast a vote on the Republicans’ tax overhaul bill.

The Arizona Republican’s office announced last week that McCain was receiving treatment at Walter Reed National Military Medical Center outside Washington for complications from his cancer treatment. McCain’s daughter Meghan tweeted earlier Sunday that her 81-year-old father would be spending Christmas in Arizona.

The Senate is expected to vote early this week on the tax cut legislation, but the GOP appeared to have secured sufficient support without McCain’s vote.

“John will come back if we need his vote,” Trump told reporters as he returned from a weekend at the presidential retreat at Camp David. “He’s going through a very tough time.”

- Share via

Putin calls Trump to thank him for U.S. help foiling terrorist strike

Vladimir Putin phoned President Trump to thank him for what the Russian president said was CIA help in foiling a terrorist attack, the Kremlin said on Sunday.

White House Press Secretary Sarah Huckabee Sanders confirmed the two leaders’ conversation to reporters. It was the second time that the two leaders had talked in four days; Trump called Putin on Thursday to thank the Russian leader for lauding the U.S. economy.

Putin, in his annual year-end news conference, had praised Trump for a strong performance by the U.S. stock market. Perhaps ironically, given his credit to the CIA’s recent help, Putin at that news event dismissed as “hysteria” the consensus among American intelligence agencies that Russia interfered in the 2016 presidential campaign.

In reporting Putin’s call to Trump on Sunday, the official Russian news agency Tass said Putin thanked his American counterpart for “information shared by the US Central Intelligence Agency” that had helped break up a plot to set off explosives in St. Petersburg’s landmark Kazan Cathedral and elsewhere in the city, which is Russia’s second-largest.

Russian authorities last week had credited their country’s counter-intelligence service, the FSB, for foiling the attacks. They reported that seven people affiliated with Islamic State had been detained in St. Petersburg in connection with the plot. The FSB, the successor organization to the KGB, announced Friday that the group had planned to carry out the attacks on Saturday, and that one of those in custody had confessed to the cathedral bomb plot.

- Share via

Mnuchin: Government shutdown unlikely but could happen

Treasury Secretary Steven T. Mnuchin said on Sunday that a government shutdown this week was unlikely but possible.

A two-week stopgap spending bill passed by Congress earlier this month provided enough funding to keep the government running through Friday. A deadlock on another temporary funding measure would open the door to a possible shutdown.

“I can’t rule it out, but I can’t imagine it occurring,” Mnuchin said on “Fox News Sunday,” suggesting everyone had an interest in avoiding the government grinding to a halt and federal workers going unpaid, especially in the holiday season.

“I would expect that both the House and Senate, Republicans and Democrats, understand if they can’t agree on this, they need to have another short-term extension to move this to January,” the Treasury secretary said. “We can’t have a government shutdown in front of Christmas.”

In May, irate over concessions made to Democrats in hammering out a spending measure, President Trump tweeted that a “good ‘shutdown” might help matters. While both parties agree that a government shutdown involves a degree of disruption that is not beneficial to either side, shutdowns in 1995-’96 and in 2013 mainly caused a backlash against Republicans.

The latest funding measure is to be taken up after a vote on a massive GOP tax overhaul, expected by midweek.

- Share via

Trump transition team says sensitive emails should not have been shared with Robert Mueller

President Trump’s transition team is crying foul over how special counsel Robert S. Mueller III obtained emails for his investigation into Russian meddling in last year’s campaign and possible Trump campaign complicity.

Kory Langhofer, a lawyer for the transition team, sent a letter to Congress on Saturday saying there was an “unauthorized disclosure” of emails.

While the Trump transition is long over, the transition team remains a nonprofit organization. Its emails were hosted by the General Services Administration, a federal agency. Mueller reportedly obtained the emails directly from the agency.

“There are attorney-client communications,” Langhofer said in an interview. “There are executive-privileged communications.”

He added, “What we’re asking Congress to do is to take some legislative action to make sure this never happens again.”

Peter Carr, a spokesman for the special counsel’s office, defended the process for obtaining emails.

“When we have obtained emails in the course of our ongoing criminal investigation, we have secured either the account owner’s consent or appropriate criminal process,” he said.

The letter was first reported by Fox News. A request for comment from the General Services Administration was not immediately answered.

This story has been updated with a comment from the special counsel’s office.

- Share via

Virginia house arrest is ending for Paul Manafort

A federal judge agreed Friday to end Paul Manafort’s house arrest in Virginia, allowing President Trump’s former campaign manager to return to Florida while awaiting trial.