Revenge of the Nerd WatchersIf there’s anybody...

- Share via

Revenge of the Nerd Watchers

If there’s anybody you would to expect to make a lousy subject for a gossipy book, it’s Microsoft Chairman Bill Gates.

The young billionaire is so work obsessed he is said to boast of his “7-hour turnaround time,” a phrase that comes from the typical length of time between the hour Gates goes home at night and the time he returns to the office in the morning.

Even still, next week marks the publication of the new book “Hard Drive,” an unauthorized biography of Gates by Seattle reporters James Wallace and Jim Erickson.

Among other things, the book provides a rare look into Gates’ personal life and personality quirks.

Needless to say, Redmond, Wash.-based Microsoft is upset, contending that the book contains a number of factual errors.

Some of the revelations:

* Gates once fell down a staircase during a wild party.

* Microsoft employees used to play a card game in which they would grab spoons when they were dealt a particular hand.

* Gates once nicknamed a girlfriend “32-bit.”

* Gates once urged a friend to bypass the valet parking at a hotel because the $12 fee was “not good value.”

Truth in Advertising

The latest offerings from the federal Resolution Trust Corp. are 75 former savings and loan properties scattered across the country that are part of its “National Environmental Portfolio Sale.”

A chance to buy pristine redwood forests? Wetlands? Natural habitats for spotted owls?

Not exactly. According to tiny print in the RTC ads, the sale involves “properties with asbestos and underground storage tanks.”

Agency spokesman Stephen J. Katsanos said the properties either have an existing environmental-related problem or may need to be tested for one.

“ Distressed is not a good word to describe them,” he said. “but you can say they are less than pristine properties.”

Successful Failure

Finishing sixth in last week’s Times 100 list of California companies whose stock price plunged the most last year was a firm with an ominous name: Failure Group Inc. (This in a state where you find such boastful-sounding names as “The Good Guys” and “Superior Industries.”)

Actually, Failure is anything but one. It’s a well-known engineering consulting firm in Menlo Park that specializes in analyzing engineering disasters, product-safety problems and product failures.

Nonetheless, company officials say, the name frequently raises eyebrows when people first hear it.

“I guess we could have called it No More Failure Inc.,” spokeswoman Jo Minola said.

Briefly . . .

Bank of America is exercising an option that expired last week allowing it to invest $380 million for a 50% stake in the partnership that owns its San Francisco headquarters . . . Cultured honor: Ohio last week honored Daniel Carasso, sometimes called America’s “Father of Yogurt” . . . Operators who answer a toll-free number for questions about BankAmerica’s acquisition of Security Pacific are called “merger representatives.”

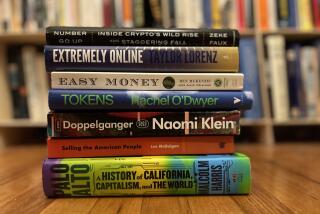

More to Read

Sign up for our Book Club newsletter

Get the latest news, events and more from the Los Angeles Times Book Club, and help us get L.A. reading and talking.

You may occasionally receive promotional content from the Los Angeles Times.