For many unemployed workers, jobs aren’t coming back

- Share via

The U.S. economy will eventually rebound from the Great Recession. Millions of American workers will not.

What some economists now project — and policymakers are loath to admit — is that the U.S. unemployment rate, which stood at 9.6% in August, could remain elevated for years to come.

The nation’s job deficit is so deep that even a powerful recovery would leave large numbers of Americans out of work for years, experts say. And with growth now weakening, analysts are doubtful that companies will boost payrolls significantly any time soon. Unemployment, long considered a temporary, transitional condition in the United States, appears to be settling in for a lengthy run.

“This is the new reality,” said Mark Zandi, chief economist at Moody’s Analytics. “In the past decade we’ve gone from the best labor market in our economic history to arguably one of the worst. It’s going to take years, if not decades, to completely recover from the fallout.”

Major employers including automakers and building contractors were at the core of the meltdown this time around. Even when the economy picks up, these sectors won’t quickly rehire all the workers they shed during the downturn.

Many small businesses, squeezed by tight credit and slow sales, similarly aren’t in a hurry to add employees. Some big corporations are enjoying record profits precisely because they’ve kept a tight lid on hiring. And state and local governments are looking to ax more teachers, police officers and social workers to balance their budgets. Meanwhile, U.S. legislators have shown little appetite for a new round of stimulus spending.

It all points to a long slog for the nation’s unemployed. In May, a record 46% of all jobless Americans had been out of work for more than six months. That’s the highest level since the government started keeping track in 1948, and it’s about double the percentage of long-term unemployed seen during the brutal recession of the early 1980s.

Jobless Americans such as Mignon Veasley-Fields of Los Angeles don’t need government data to tell them that something has changed. A former administrative assistant at an L.A. charter school, she has searched fruitlessly for employment for more than two years. She’s losing hope of ever working again.

“If I were 18, I’d say, ‘I can bounce back.’ But I’m 61,” said Veasley-Fields, a dignified woman with graying, close-cropped hair. “It’s really scary. It’s like someone just put a pillow over your head and smothered you.”

Laid off in June 2008 from her $45,000-a-year post, Veasley-Fields at first wasn’t overly concerned. A college graduate, she had always enjoyed steady employment, including a long stint as a research manager at consulting firm McKinsey & Co. She crafted a crisp resume, networked through job clubs and navigated online employment sites like the seasoned researcher that she is.

But weeks stretched into months, with hundreds of unanswered job applications. California’s jobless rate in July stood at 12.3%, the third-highest in the nation, behind Nevada and Michigan. Veasley-Fields’ unemployment benefits have run out, her credit cards are maxed. She fears losing the tidy mid-Wilshire District bungalow where she and her 77-year-old husband are raising two granddaughters. Above all, she’s stunned that a middle-class life that took decades to build could unravel so quickly. She recently visited a food bank to secure enough staples to feed the girls.

“I’m just hanging on a thread,” she said.

Veasley-Fields suspects her age isn’t doing her any favors. Indeed, 50.9% of unemployed workers 55 to 64 have been out of work at least 27 weeks. That’s the highest percentage of long-term employment for any age group.

But young workers are suffering too. In August, the unemployment rate for workers 16 to 24 was 18.1%.

Research has shown that economic downturns can stunt the prospects of these new entrants to the job market for a decade or longer. Some college graduates unable to find jobs in their chosen fields are forced to trade down to lower-skilled, often temporary work. That translates into puny wages, missed opportunities and a slower climb up the career ladder.

The challenge is even tougher for those with less education. Juan Trillo, 23, was laid off from his $8-an-hour maintenance job two years ago. Trillo, who didn’t finish high school, said he now finds himself competing against seasoned veterans for entry-level work.

He recently rode the bus from his home in Boyle Heights to interview with a company that administers professional exams. The job would consist mainly of rudimentary tasks like handing out tests and collecting them. Trillo, who sports a thin mustache and neatly trimmed hair, wore his nicest clothes — slacks, a tie and a fresh dress shirt. What he saw when he arrived made his heart sink.

“There was a waiting room full of people, all kinds of people, a lot of older people and a lot of them were college graduates. And I’m not,” he said.

Trillo said he thought the interview went well but hasn’t heard back from the recruiter. In the meantime he’s studying for his high school equivalency exam and scouring online job sites, applying for as many as a dozen positions a week.

His parents, both immigrants from Mexico, let him live rent-free in their half of a cramped duplex. His father works long hours driving a big rig. His mother is a caretaker for an elderly couple. They’ve been supportive, always offering encouragement. That, Trillo said, sometimes stings worse than a rebuke.

“I don’t really even feel like a man, because I have no work,” he said.

For the U.S. labor market to regain all the jobs it had when the recession started in December 2007, employers would need to boost their payrolls by 7.6 million positions. That figure doesn’t include the roughly 125,000 jobs a month the country must create just to keep up with new entrants into the labor force.

To get the national unemployment rate back to 5%, where it was before the downturn, would require the economy to generate about 17 million jobs — or about 285,000 a month for five straight years — according to Heidi Shierholz, a labor economist at the Economic Policy Institute in Washington.

To appreciate the enormity of that employment hole, consider that U.S. employers have shed 283,000 jobs since May.

Ask economists to project which industries might spark robust job creation and the news isn’t encouraging for America’s 14.9 million unemployed workers.

Sectors that traditionally have led the nation out of recession — including home building and financial services — are laboring amid a housing glut and a credit freeze. The U.S. auto industry, long under assault by foreign manufacturers, just completed a brutal downsizing. Outsourcing of call centers and other service jobs to places such as India is growing too. Meanwhile, U.S. productivity grew steadily through 2009 and into the first quarter of this year, in part because many employers have replaced people with technology and are working their existing staffs harder.

“It’s going to take a long time to get back,” economist Shierholz said. The nation is looking at “eight or nine years of elevated unemployment, and we just haven’t seen anything like that.”

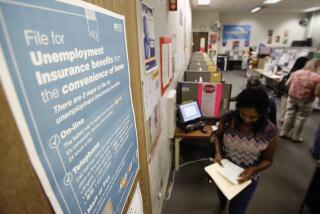

The U.S. safety net wasn’t designed to withstand such a strain. The extent and duration of unemployment benefits vary by state, but 26 weeks is typical. Several federal extensions have increased that to 99 weeks in California and other hard-hit states. Even so, an estimated 3.5 million Americans will have run out of benefits by the end of the year. About 180,000 Californians have already fallen off the rolls.

There are few other places to turn. Applications for federal food stamps and state programs such as CalWorks, which provides temporary assistance to families with children, are up sharply in recent years. But because asset limits for applicants are so strict, many of the unemployed don’t qualify.

Veasley-Fields, the unemployed secretary, is now considering applying for Social Security benefits when she turns 62. That will mean reduced benefits in her later years. But with the job market so poor and retraining opportunities limited for someone her age, she said she may have no choice. Others are coming to the same conclusion. A record 2.74 million seniors applied for Social Security in 2009; more than 70% of them sought early benefits.

Desperation is growing, said Ofer Sharone, an assistant professor at MIT’s Sloan School of Management who has spent the last year interviewing dozens of long-term jobless workers.

“The U.S. is clearly not equipped to deal with this high level of unemployment,” Sharone said. “People are running out of benefits, health insurance, retirement and pensions.”

Many are turning to traditional networks of family and friends.

Two years ago, Southern California native Ryan Payne was a mergers and acquisitions associate at a Manhattan investment bank earning a base salary of $140,000 a year. Then came the Wall Street meltdown. As one of the newest members of his firm, he was among the first to go when the layoffs came. Saddled with $100,000 in student loans and consumer debt, the 33-year-old moved back in with his parents in Malibu. He now trades commodities online from his home computer.

Handsome and genial, Payne uses his ample free time to exercise and pursue whims such as improv comedy. He formed a club of other jobless professionals that he cheekily named the Westside Unemployment Appreciation Team. Members, known as “enlightened slackers,” gather occasionally for low-cost outings and a few laughs.

But in more reflective moments, Payne, who holds an MBA and a law degree, admits he’s not where he thought he’d be at this time of his life.

“I live with my parents and I drive a Saturn,” he said. “I need to figure out how I contributed to this.… I need to get some core, organic sense of success back.”

Turmoil on Wall Street and in the nation’s banking and mortgage industries has hammered financial services workers. Nearly 800,000 have lost their jobs since employment in that sector peaked in December 2006.

Other classes of employees have experienced outsized pain as well. More than 1 million clerical and administrative workers have lost their jobs in the downturn. Some of those positions won’t return even when the economy improves. To reduce labor costs, companies increasingly are requiring employees to handle their own calls, appointments and travel arrangements with the help of smart phones and laptop computers rather than secretaries.

Mary Bueno lost her $44,000-a-year job as an office manager early last year. The 52-year-old has sent out hundreds of resumes and worked online job sites, but found little on offer besides domestic work.

She has burned through her savings and retirement nest egg trying to hang on to the Bellflower home she shares with her young son. Her 26-year-old daughter, a bank teller, recently moved back home to help out with the bills. Bueno has no health insurance, so when she needed to see a doctor her daughter paid the tab. Bueno said she’s blessed to have such good children. But she’s humbled. And scared.

“No one wants to rely on someone else, especially your kids,” Bueno said. “You want to be the one who’s there for them.”

Bueno is now considering switching careers, maybe pursuing her dream of becoming a substance abuse counselor.

Bernie Doyle, 54, just wants to get back on a building site.

Before he was laid off in 2009 he made nearly $90,000 a year as a construction supervisor on high-end apartment projects in San Diego. He bought a 26-foot boat that he and his wife, Suz’Ette, took out nearly every weekend. He had a sense of pride each time he finished a job on schedule.

“They’ll slap me on a job and it’s nothing but bare dirt. By the time I leave, the thing is built,” said Doyle, his accent betraying his New England roots. “I love it. I live it. I like the pressure. I like dealing with people. I like getting the job done on time.”

But the hangover from the nation’s building binge is likely to last for years. There are simply too many empty dwellings and too few buyers.

Doyle figures he has applied for more than 100 jobs, including an apartment building handyman and a Home Depot salesman.

“I’ve had two interviews,” he said. “I didn’t get either one.”

With depression mounting, he once shut off his telephone for three days, stopped checking his e-mail and isolated himself from friends. He’s since turned the phone back on but remains discouraged. He now smokes two packs of cigarettes a day. The boat he and his wife used to cruise every weekend is now up for sale. He can no longer afford the payments.

“I never thought I’d be in a spot like I am now, not in a million years,” Doyle said. “I guess a lot of other people feel like that too.”

alana.semuels@latimes.com

Times staff writers Tiffany Hsu, Nathan Olivarez-Giles, Stuart Pfeifer and Ronald D. White contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.