A record 6.6 million Americans seek jobless aid as layoffs mount amid coronavirus

- Share via

WASHINGTON — Soaring layoffs due to the coronavirus pandemic pushed a record 10 million Americans to apply for jobless benefits in the last two weeks, the government said Thursday, raising the specter of an economic crisis so extreme it could end in another Great Depression.

As COVID-19 cases passed the 1-million mark worldwide, the Labor Department figures were the latest evidence of how the global health crisis has crippled a U.S. economy that just a month ago was enjoying a record expansion and half-century low in unemployment.

“To put it bluntly, the U.S. economy went from full speed to full stop — and millions of workers were not wearing seat belts,” said Josh Lipsky, director of global business and economics policy at the Atlantic Council, a nonpartisan think tank.

The avalanche of warning signs catapulted members of Congress and policy analysts to push for a new round of federal relief on top of the $2.2-trillion package passed last week.

At a White House briefing, Treasury Secretary Steven T. Mnuchin said he had spoken with congressional leaders about another bailout plan, but negotiations had not begun. “When the president’s ready and thinks we should do the next stage, we’re ready,” he said.

Mnuchin also pushed back on concerns about delays in sending direct payments of up to $1,200 to many American adults, a key provision of the relief package. He said people who already receive direct deposit payments from the Internal Revenue Service should start getting money the week of April 13.

“This money does people no good if it shows up in four months,” Mnuchin said.

The IRS is also creating an online portal where people can update their direct deposit information and track the status of their payout. Estimates suggest that the IRS has direct deposit information for about 50% of tax filers, or about 60 million people.

The agency is also creating a “simple tax return” that contains only a few questions, including name, Social Security number, dependents and deposit information, to speed up the process for getting money to people who don’t normally have to file taxes. Printed checks could take longer; they are to start running off the week of May 4.

Processing the billions of dollars in emergency loans and other aid approved for businesses knee-capped by the virus and related lockdowns could be even more challenging. The aid may be important when it finally arrives, but for many small businesses especially, rent and mortgage days will have come and gone, experts warned.

Mnuchin encouraged businesses with fewer than 500 employees to call their lenders beginning Friday to apply for payroll assistance offered in the relief package. “You’ll get it the same day” in some cases, he said.

The growing desperation of American business owners and their workers highlights the need for Congress to move quickly on another rescue package, House Speaker Nancy Pelosi (D-San Francisco) told reporters Thursday.

“Whether some in Washington realize it or not, this virus is taking its toll very quickly, and we need to be in front of it,” she said.

House Democrats are preparing outlines of the next tranche of economic aid, which Pelosi said would include a massive infusion of funding for infrastructure projects to generate jobs and a jolt to the economy, including road construction, clean water and a next-generation 911 emergency system.

Lawmakers don’t return to Washington until April 20, and some congressional Republicans are skeptical of additional spending at this time.

But worrisome economic signs related to the coronavirus pandemic have been piling up for days, with more bad news expected Friday, when new data on the nation’s unemployment rate is scheduled to be released.

On Thursday, the U.S. Labor Department reported that 6.6 million people filed for initial unemployment claims in the week ending March 28 — double the record 3.3 million from the previous week.

Separate reports this week indicated that car sales in the U.S. plunged 39% in March, manufacturing fell back into recession, and trade showed early signs of faltering.

But it was the weekly unemployment benefit filings that left economists stunned, eliciting descriptions such as “tectonic,” “cataclysmic” and “eye-watering.”

On Thursday, the nonpartisan Congressional Budget Office said it expected unemployment to rise above 10% and economic growth to fall by 28% annualized in the second quarter. The CBO projections also included the possibility of future outbreaks of the COVID-19 virus.

“To account for that possibility, social distancing was projected to diminish by only three-quarters, on average, during the second half of the year,” the CBO director, Phillip Swagel, wrote in a blog post. He said the CBO expects job losses and business closures to last for some time, with the jobless rate at 9% at the end of 2021.

The lockdowns and business closings necessary to fight the spread of the virus are unprecedented. In a normal economic recession, the pain usually comes in waves, with losses in one part of the economy spilling over into another. This time, huge parts of the economy were shut down almost overnight by government order.

“It’s an artificial closing,” President Trump said Thursday, predicting again that the economy would bounce back once the virus is under control. Trump also disclosed he had taken a second test for the virus and again was negative.

As recently as February, the U.S. jobless rate stood at a 50-year low of 3.5%. The economy had generated 273,000 net new jobs for the second straight month.

That’s all history now. Some experts said even the latest jobless claims figure almost certainly understates the number of people hoping to file.

The 6.6 million new claims from the last week represents Americans who tried to get benefits and got through, but not those who tried and failed, said Michele Evermore, senior policy analyst at National Employment Law Project, a New York think tank that advocates for low-wage workers and the unemployed.

“This is a system that is designed for recessions, but this is just a bigger crash than anybody expected, and of historical significance,” she said.

The government’s report Friday on the national unemployment rate will cover March and represent the first full month of data since COVID-19 cases began to mushroom in the U.S.

But it’s expected to capture just a glimpse of the reality as both the jobless rate and employment numbers were based on surveys conducted in the second week of the month — before the wave of lockdowns that prompted mass business closings and layoffs across the nation.

Analysts expect the government to report a jobless rate of about 4% for March, even though real unemployment, based on extrapolations from jobless benefit applications, is at least 10%.

Layoffs are expected to keep rising in coming weeks, to a total of as many as 20 million lost jobs. Unemployment could hit 15% or higher this spring; that’s 1 in 7 workers in the nation.

Friday’s report is also likely to show a loss of 50,000 to 100,000 jobs in March, a fraction of the actual cuts but still ending what had been a decade-long period of uninterrupted employment growth. Employers have added jobs for 113 straight months, with growth last year averaging about 175,000 a month.

Weekly unemployment claims data are a more timely indicator of changes in the labor market. And those numbers are expected to keep growing by the millions in the next few weeks.

In the week ending March 28, California led the way with more than 878,000 people applying for benefits, followed by Pennsylvania, New York and Michigan.

Economists said the best way the government can help now is to provide more of the same cash and credit that was offered in the $2.2-trillion relief bill, to help households and businesses weather the storm until the economy reopens.

The aid includes about $150 billion to states for public health spending, unemployment insurance programs and other needs. Giving more to states would go a long way, economists said.

“Something we learned from the 2008 crisis response was the value of giving money to state and local governments — that they are often an excellent sort of first line of response, because they can respond nimbly. They know what the problems are on the ground. And that is money you can get out quickly and it can get into the economy, into the hands of people who need it quickly,” said Christina Romer, former chair of the Council of Economic Advisors in the Obama administration, speaking this week to Freakonomics Radio.

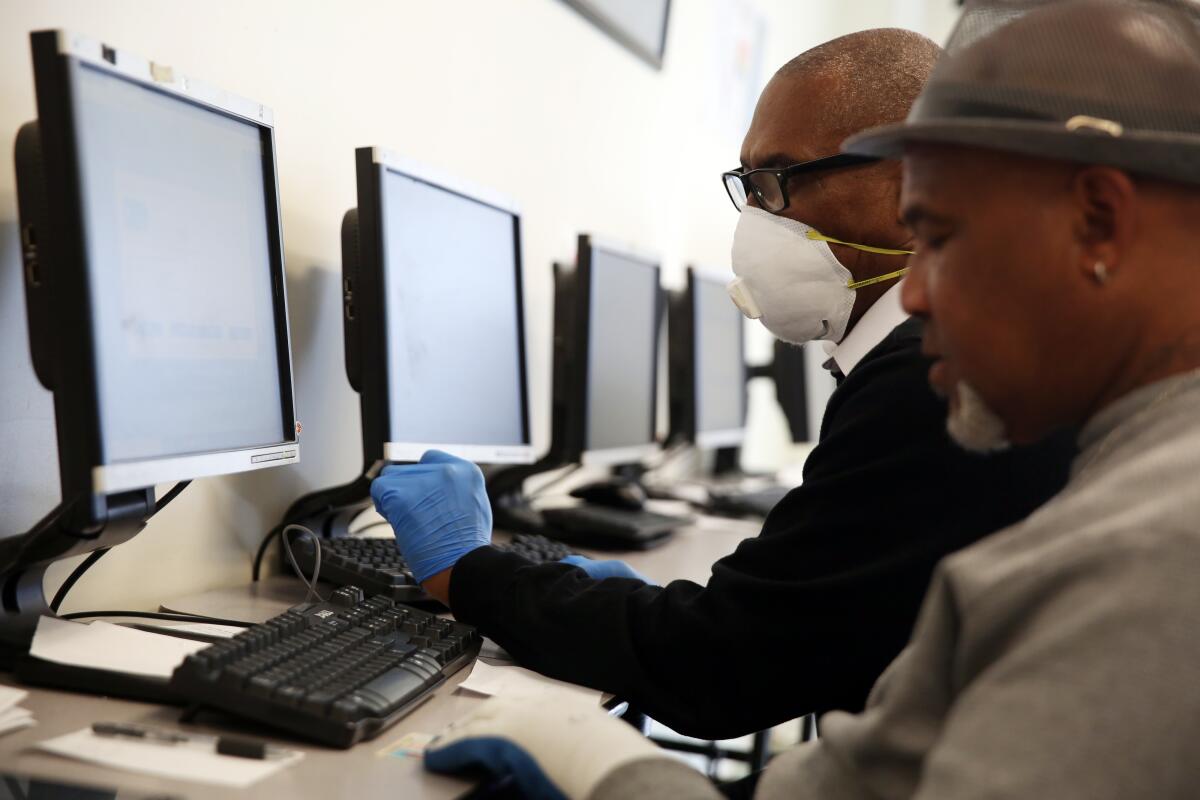

Michael Klein, a former Treasury Department economist who teaches at Tufts University’s Fletcher School, called for more targeted aid to vulnerable groups, such as those working in lower-wage jobs at supermarkets and warehouses, and as cleaning staff at hospitals.

“They’re facing a potential tremendous danger and doing incredibly important work, so people can still get groceries at a time like this,” he said of supermarket cashiers and clerks. “So there’s a case to be made for hazard pay for these kinds of workers.”

Times staff writer Noah Bierman contributed to this report.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox twice per week.

You may occasionally receive promotional content from the Los Angeles Times.