Californians living in wildfire-prone areas losing homeowners insurance following historic blazes

State receives uptick in complaints from rural residents facing insurance rate hikes, policy cancellations

- Share via

When Stan Caplan built his retirement home on the ridge of a majestic chaparral-covered hillside in an affluent gated community in Rancho Santa Fe, he wasn’t thinking much about insuring his property against wildfire.

Today, the issue has been consuming the 70-year-old Texas transplant. In June, he received a letter in the mail that his homeowner’s insurance was being canceled because of the “increased frequency of catastrophic wildfires in California.”

Since then, he said he’s been through numerous brokers and rejected by dozens of insurance carriers. He said just one company offered him a policy — but for an eye-popping $24,000 a year with a $100,000 deductible.

“I feel violated,” Caplan said. “There needs to be a solution. This is something that the state needs to address.”

Following several years of massively destructive blazes, insurance companies have been canceling policies and raising rates throughout rural parts of California, according to government officials and industry experts.

“I refer to it as a quiet crisis,” said Brian Crumbaker, an independent agent based in Carlsbad with Brightway Insurance. “People don’t understand or realize just how difficult this is going to be in the next few years.”

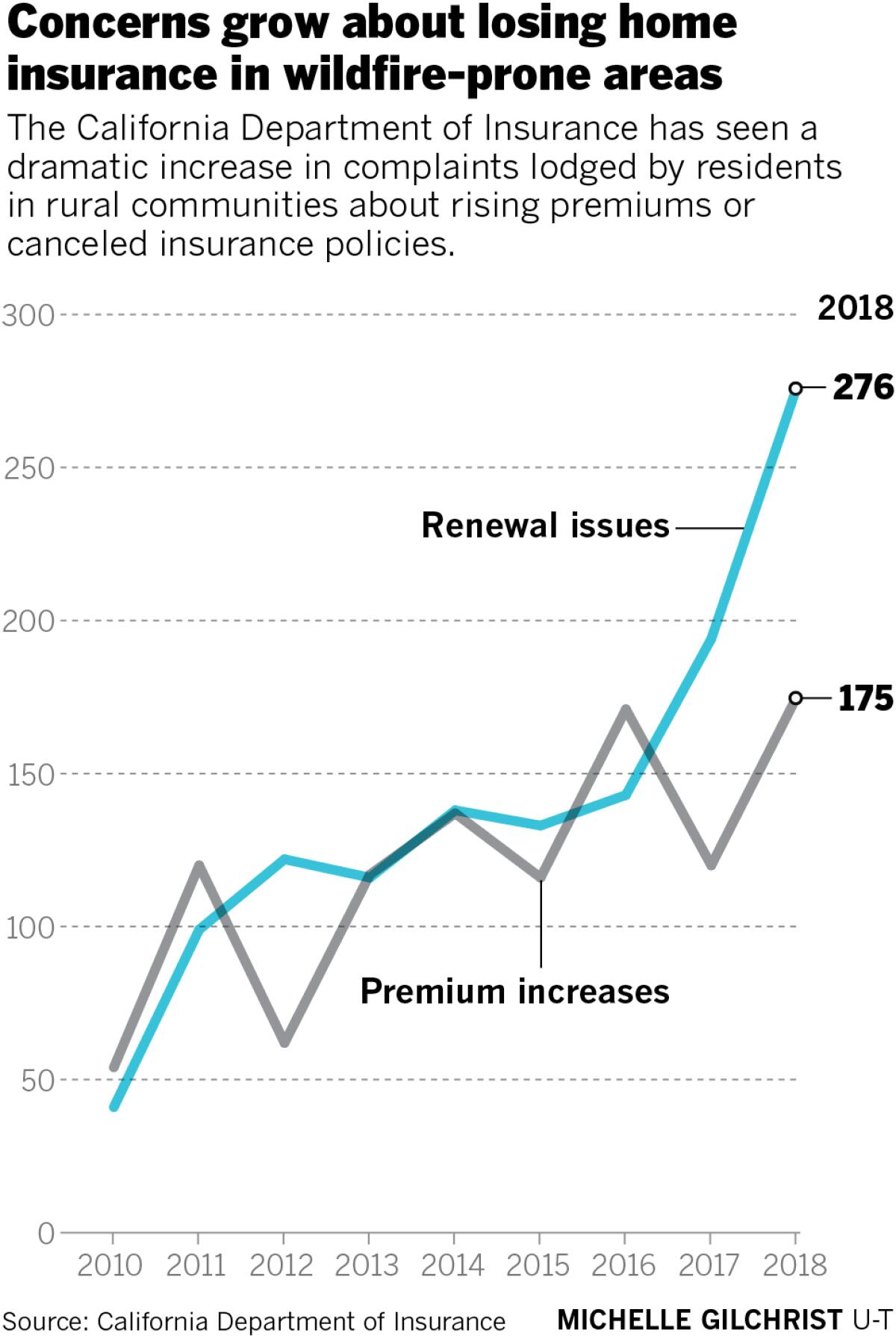

Complaints lodged with the state by rural residents facing a loss of insurance has nearly doubled in the last two years and increased by more than 570 percent since 2010, according to data from the California Department of Insurance.

Insurance industry representatives have readily acknowledged the situation, pointing to the sizable loses companies have endured over the last few years as a result of wildfire.

In 2017 and 2018, blazes — most notably the Camp Fire in Paradise — resulted in more than 124,000 claims valued at about $26 billion in losses, according to state figures.

“This is a huge sticker shock,” said Mark Sektnan, vice president of state government relations with the American Property Casualty Insurance Association, which represents many of the state’s largest insurance companies. “Insurers are having the same reaction (as residents) as we realize how much more risk there is than we all thought.”

All the state-backed insurance companies in California are required to pay into what’s known as the California FAIR Plan (Fair Access to Insurance Requirements). However, FAIR Plan premiums can be higher than the average policy and only cover up to $1.5 million in losses.

In the past five years, FAIR Plan enrollment has seen an uptick in rural areas by more than 11,500 policies. Because this coverage of last resort largely focuses on fire damage, residents often purchase a separate “wraparound” policy in order to get more complete coverage.

As a result, many people, with or without the FAIR plan, are paying significantly higher rates to insure their homes than ever before.

Nancie Froning said she had been paying around $1,230 a year to cover her home in Escondido. However, in May she received a notice of nonrenewal, giving her the state-mandated 45 days to find another carrier.

Froning was able to secure insurance through another company only to have that policy canceled in July. Now she said she may have to pay as much as $3,300 a year to get coverage.

“It’s not fair but what do we do?” said the 62-year-old. “It’s literally highway robbery.”

Government officials said they’re looking at several different ways to address the situation, such as working with the insurance industry to develop standards by which homeowners can improve their chances of getting covered.

Many companies now use third-party software, such as FireLine by Verisk, to assess wildfire risks based on topography, wind and vegetation.

However, state authorities would also like more insurance companies to take into account homes that use fire-resistant building materials, as well as ongoing efforts by residents to maintain defensible landscaping.

“We should not be afraid to engage in a conversation on potential statewide standards for fire mitigation and what insurers would be required to do if we have standards,” said California Insurance Commissioner Ricardo Lara. “We need a joint effort by local governments, state policymakers, and the industry to keep insurance available for all.”

Houses in fire-prone areas are required by state law to meet specific building codes and maintain about 100 feet of defensible space, which includes regularly clearing dead vegetation and pruning back low-hanging trees.

While homeowners can be fined for not following the rules, a recently Union-Tribune investigation found that the California Department of Forestry and Fire Protection rarely issues citations for defensible-space violations.

A few insurance companies are starting to take a more nuanced approach to assessing wildfire risk.

The Colorado-based Sage Underwriters recently hired Alexandra Syphard as their chief scientist to assess property risks from wildfire. Syphard, based in La Jolla, is one of the top researchers in the country on the topic and has published well-regarded scientific papers on the role of defensible landscaping in preventing structure damage.

“What we’re doing is trying to bring a much more rigorous and granular approach to assessing risk than what’s traditionally been done,” she said. “There are a lot of houses out there that aren’t at as much risk as some people think they may be.”

At the same time, industry experts said that many companies are trying to dump policies in areas where they fear they have too many policies in one general location. That way, losses would be limited for any one company if an entire neighborhood is destroyed by wildfire.

“The thinking is insurance companies should insure one house on every block, not every house on the block,” said Joel Rahm, a San Diego-based agent with Wateridge Insurance Services.

However, he added: “There are a lot of companies that are non-renewing entire zip codes.”

In many cases, other insurance companies are stepping in to pick up those residents who recently had a policy canceled.

Jim Bennet lives near Mission Trails Regional Park in the city of San Diego. He said he recently found out his policy would not be renewed but quickly secured another policy at a similar rate.

“Maybe we were just extremely lucky, but it turned out to be only a minor inconvenience for us,” he said.

However, Ramona resident Deanna Palmer wasn’t so fortunate. She recently found out that her homeowner’s insurance was being canceled.

Her home is located in a remote area along a dirt road, nestled between brush-covered hills. She pays someone to maintain her landscaping, and she said the fire department recently praised her during a defensible space inspection for maintaining the property so well.

Her carrier offered her a substitute policy through a subsidiary for more than $4,000 a year, up from the roughly $1,300 she had been paying.

“When I got it, I thought, ‘Oh my gosh, how am I going to do this?’” said the 76-year-old, who cares for her adult daughter with Down syndrome. “I’m on social security. $4,000 a year is a big chunk.”

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.