Op-Ed: Beware the fine print — a GOP tax cut for small businesses is more like a giveaway for the rich

- Share via

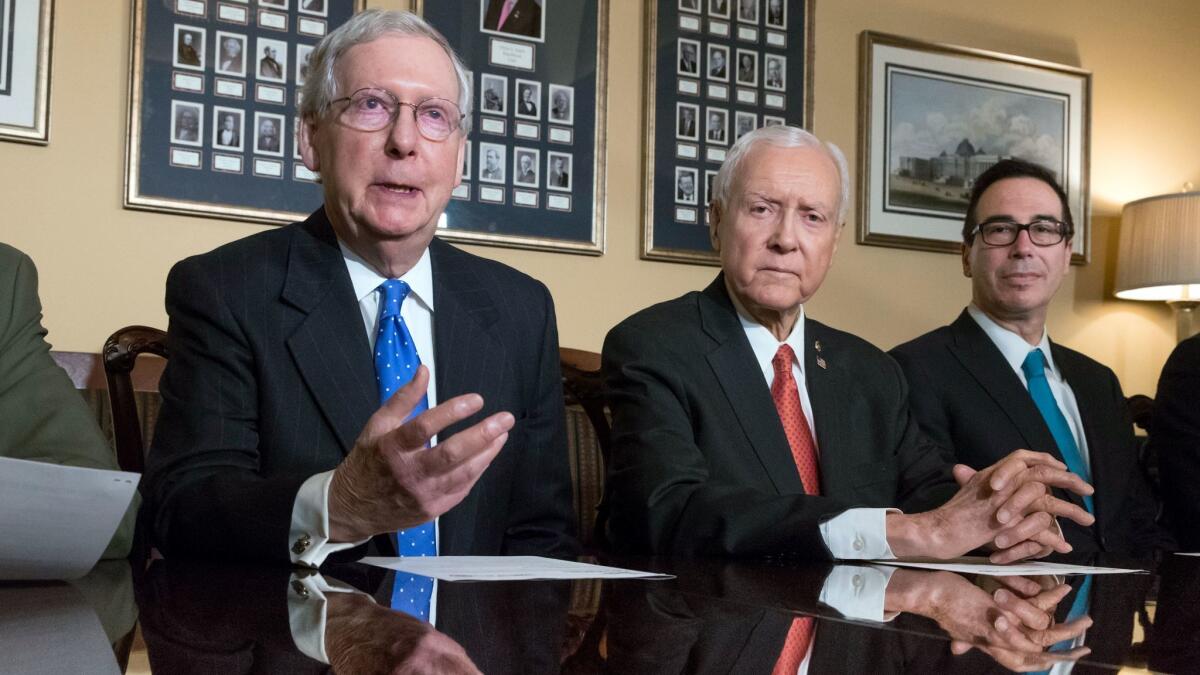

The competing House and Senate tax bills differ in important respects, but they have this in common: a predilection to shower benefits on the very wealthy. The extraordinary reduction in the corporate tax rate to 20% is one obvious example. But the proposals’ true perversity, and the real object of the drafters’ munificence, is fully revealed only by reading the fine print. Take for instance their proposals to reward “pass-through” income with special discounted tax rates.

Certain kinds of businesses — partnerships and “S” corporations — are allowed to “pass through” their profits to their owners, who then report the revenue as personal income and pay tax accordingly. The upper rate used to be the top individual rate, 39.6%. Under the House plan, the pass-through maximum rate would drop to 25% for qualifying owners. The Senate is less generous, but still would offer a rate no greater than 32%. Either way, it sounds like welcome tax relief for hardworking entrepreneurs, right? Actually, the proposals plant a massive kiss on the mugs of the idle rich.

First, the big picture: Both tax bills would add roughly $1.7 trillion to our national debt over 10 years, according to the nonpartisan Congressional Budget Office. The House bill would reserve only about $230 billion of that in cuts for wage earners, and those cuts would flow mostly to high-income taxpayers. The Senate bill would be a bit more generous to workers, but even there, the number would only be about $350 billion.

Rather than encouraging small business, the pass-through tax rate is a boon for Wall Street wheelers and dealers.

Claims that the tax reform would yield impressive trickle-down wage growth for regular folks have been fiercely contested by many economists. These economists are right, but their critique misses a more fundamental point: If middle-class wage growth is the goal, give the middle class the bulk of the benefits and let the growth effects trickle up.

In both the House and Senate bills, the most egregious giveaway is the special discounted tax rate for qualifying pass-through businesses. It would cost all of us about $450 billion in foregone tax revenues over the next 10 years. And it wouldn’t deliver what’s promised.

Congress wants us to believe that lowering the pass-through tax rate would grow America’s small businesses by encouraging entrepreneurial risk-taking and new hiring. The House press release crows about providing “Main Street job creators” with “the lowest tax rate on small business income since World War II.”

But the discounts aren’t really aimed at small businesses. They go to any business, large or small, that happens to be organized as a partnership or an S corporation, as long as it isn’t a service business. (That is, it would go to the owner of a muffler shop, but not an accountant who has her own firm. Why the government wants to subsidize muffler shops over accounting firms is a discussion for another time.)

Nor are these proposals targeted to encourage growth. If that were the goal, they would apply to incremental revenue increases year over year, not to all business earnings. They also would include service businesses, since that is where the economy has grown over the last few decades. Under the proposed rules, without growing an iota or adding any new jobs, profitable firms can throw income into the hands of already affluent owners, who would be able to pay tax at the discounted rate.

But here’s the most perverse part. The House bill allows completely passive investors in eligible businesses to get the discounted tax rate on all their pass-through income. Bizarrely, the same isn’t necessarily true for hard-working owner-entrepreneurs who risk everything to build and run the qualifying companies. The House bill substantially limits the amount of their income that would be eligible for the new rate. The Senate bill is less clear on the details but also offers considerable benefits to passive investors.

In the end, the discounted pass-through rate would benefit investors much more than entrepreneurs — and that was probably the plan all along.

What’s more, the pass-through tax rate is a boon for Wall Street wheelers and dealers. It applies to owners of Wall Street financial vehicles such as real estate investment trusts and master limited partnerships. These aren’t businesses like a new restaurant or a tech startup. They just allow the wealthy to put their money into publicly traded portfolios of things such as property holdings and gas transmission pipelines, and to receive the substantially discounted pass-through tax rate for their troubles.

Forget “Main Street job creators.” Discounted tax rates on pass-through income would trigger a frenzy of new Wall Street engineering to create more investment products for the affluent. It is difficult to imagine a bigger waste of nearly half a trillion dollars.

Edward Kleinbard, a professor at the USC Gould School of Law, was chief of staff for Congress’ Joint Committee on Taxation.

Follow the Opinion section on Twitter @latimesopinion and Facebook.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.