What’s driving inflation if it’s not the supply chain?

- Share via

Commentators have generally offered two arguments about advanced economies’ performance since COVID-19 struck. The first is that the economic rebound has been surprisingly rapid, setting this recovery apart from the aftermath of previous recessions.

The second is that inflation has reached its recent heights because of unexpected supply-side developments, including supply-chain issues like semiconductor shortages, an unexpected shift from services to goods consumption, a lag in people’s return to the workforce and the persistence of the virus.

The first argument is more likely to be true than the second. Strong real (inflation-adjusted) GDP growth suggests that economic activity has not been significantly hampered by supply problems, and that the recent inflation is mostly driven by demand. Moreover, there is reason to expect demand to remain very strong, which means that inflation will persist.

To be sure, inflationary pressures reflect both supply and demand factors, the exact combination of which is unknowable. But when considering the economy as a whole, it is implausible that all the individual supply stories would add up to the inflation we have seen. It is far more likely that the increase in demand exceeds what the economy can produce, leading to higher prices.

Recall that policymakers largely protected or increased disposable personal income at a time when consumption possibilities were constrained through most of 2020. Considering those excess savings alongside the persistence of low interest rates through most of 2021, a rising stock market, pent-up demand and additional fiscal support, the magnitude of the increase in nominal GDP is not particularly surprising.

In the United States, discretionary fiscal stimulus totaled $2 trillion in the 2021 calendar year, but nominal GDP was only $1.6 trillion higher than it was in 2019. If anything, the surprise is that nominal spending was so constrained, and that saving rates remained so elevated.

We need to remember that all the supply-side stories are just different ways of saying that real output was constrained. According to one common story, consumption shifted from services to goods, and, because goods production is less responsive to market changes, it could not expand quickly enough. Another story is that labor supply was constrained by the pandemic and the policy response. And still other stories focus on particular markets, like the reduction in microchip production or the snarling of U.S. ports.

The problem with these accounts is not that they are false; it is that they miss the most important story in economies that have also experienced surprisingly strong real growth. Major economies have enjoyed faster recoveries than they did in the wake of the global financial crisis. In fact, the recovery in most countries was more V-shaped than anything we have seen in decades. Growth in 2021 greatly outpaced what forecasters had expected at the end of 2020, when forecasters were already optimistic about COVID-19 being eliminated.

Overall, the U.S. economy grew 1.6% annually from the end of 2019 to the end of 2021, which is only slightly lower than previous estimates of the economy’s potential. That is an amazing accomplishment considering all the headwinds the economy faced: lower immigration, premature deaths, reduced capital formation and high unemployment.

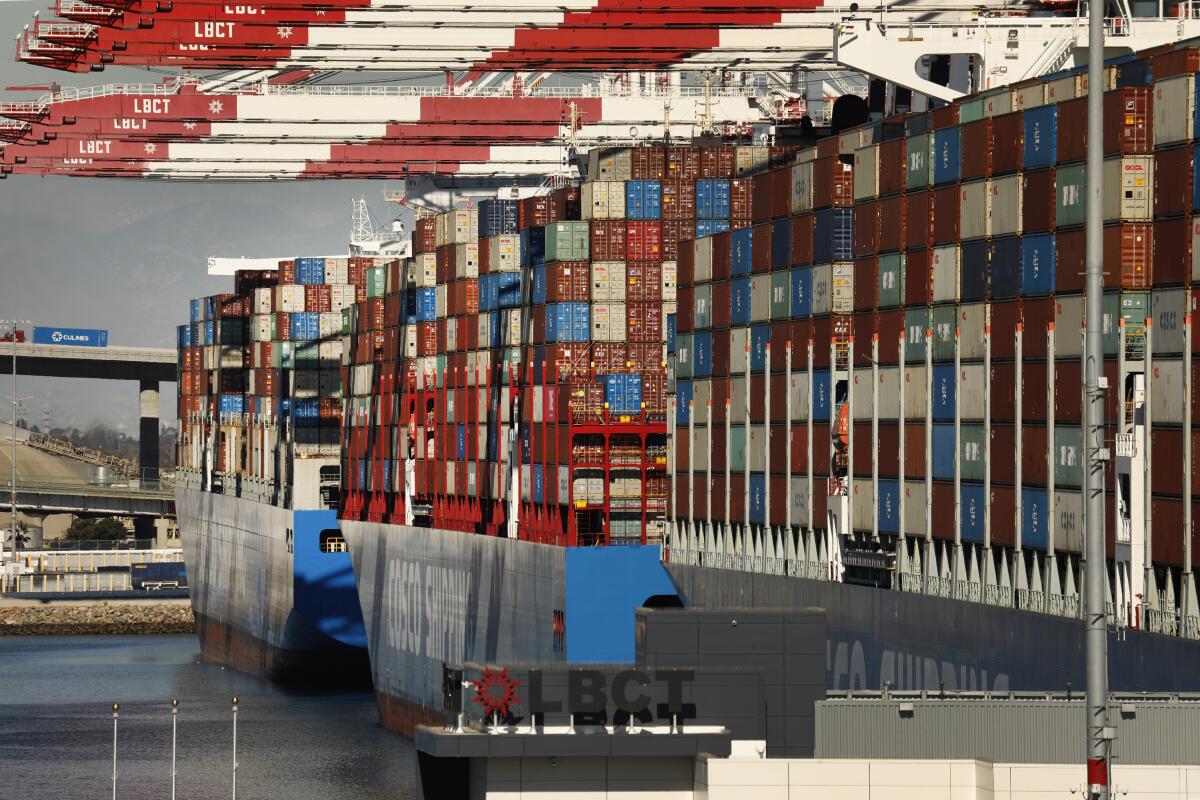

The point is not that there are no supply-chain issues. Ships really have piled up at ports, and manufacturers really are holding up production for lack of microchips. But this is not necessarily evidence of an adverse change in supply. If we gave every household millions of dollars, that, too, would lead to pileups at ports and overloaded manufacturers. The fact that quantities are up so much — judging by the volume at ports and the level of global microchip production — suggests that our problem is not mainly reduced supply but increased demand.

Looking ahead, there are some reasons to expect demand to cool, but these will need to be weighed in the balance. Fiscal support is winding down everywhere. Interest rates are starting to rise in the U.S. and in Britain, and will increase later this year in Europe as well. And equity markets have recently fallen back sharply.

But households still have substantial excess savings, and the overall stance of monetary policy remains accommodative, suggesting that demand will continue to be strong. Moreover, with Russia’s war in Ukraine, there is now a genuinely large supply shock boosting inflation in the form of higher oil and gas prices, especially in Europe. Combine that with the increase in inflationary expectations, and we should expect high inflation to stay with us for some time.

Jason Furman, a former chair of President Obama’s Council of Economic Advisors, is professor of the practice of economic policy at Harvard University’s John F. Kennedy School of Government and senior fellow at the Peterson Institute for International Economics.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.