Column: Taking the economy’s pulse, one pawn ticket at a time

Transactions at Elliott Salter’s West Hollywood pawnshop offer a window onto the economy.

- Share via

You’ve heard of the Dow Jones industrial average and the S&P 500.

Now here’s another index for tracking the markets:

The Elliott Salter Pawn Shop Index.

To enter the shop on Santa Monica Boulevard in West Hollywood, you have to stand at the gate and pull a string, which rings a buzzer, which grabs the attention of the man who has been running this place for 50 years.

Elliott Salter buzzes you through and now you’re in a museum of novelties and once-prized possessions that had to be hocked by people who came up short at the end of the month. You’re standing under model airplanes, electric guitars, horns, violins, gems, jewels, a mounted bobcat and a rubber chicken.

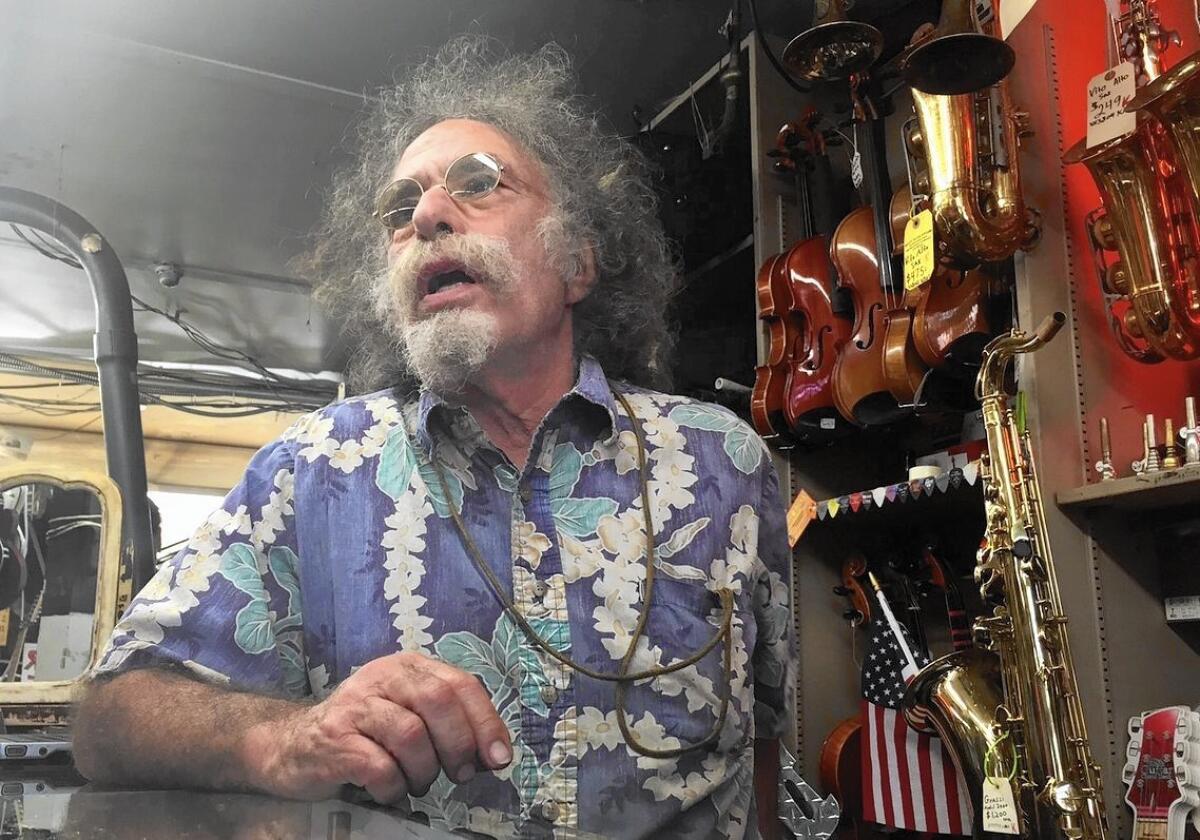

The conductor of this clutter is 71, and if you put a Hawaiian shirt and wire rim glasses on Albert Einstein, you would have a cousin of Salter. He may not be quite as smart as Einstein, but he has discovered an irrefutable theory of survivability.

In the pawn business, you do OK when times are good, because people have money in their pockets and they can finally buy the Fender Stratocaster in the window. And you do OK when times are bad, because people need to hock clothing, cameras and TV sets to pay the power and water bill.

So where are we now? Good times or bad?

“It’s cyclical, but what I’ve noticed is that more people are working, but it’s minimum-wage jobs,” Salter said. “I don’t wanna get into my rant, but unregulated capitalism is a really tough thing. It’s like unregulated communism. In theory it’s a good idea, but in practice it doesn’t always work. People are definitely making less than they need to get by, rent’s insane and money isn’t worth anything.”

Among the customers who rang the bell Tuesday morning with bags on their shoulders and hunger in their eyes were Paul and Dan. They opened a backpack and pulled out an old camera and some lenses for Salter’s inspection.

He eyeballed the goods and offered 30 bucks.

Deal.

Paul and Dan told me they are without roofs over their heads at the moment, and they go digging through trash for discarded items. Thirty dollars was one of their biggest paydays ever, and I asked what they planned to do with their windfall.

“Eat,” said Paul.

Where?

“Oki-Dog,” they said. Fast food at its finest, with prices so low you can circle back again for dinner.

“Sometimes I don’t have money for a $70 parking ticket,” said a female customer who hocks jewelry when she gets into trouble like that. “If Elliott gives me $70, and I have to pay him back $80 next week, that’s still better than the $70 ticket turning into $140 because I couldn’t pay it.”

But the way it works is that if customers don’t claim their items and pay the interest on them within four months, or renew the loan, they belong to Salter.

Not everybody who walks in the door is a hardship case. Salter said a lot of his people don’t understand the concept of managing money. He didn’t name names, but right after I got there, in walked a guy hocking some Louis Vuitton bags

“I’m a shopaholic,” he confessed. “I’m here because I always spend more than I can bring in.”

Then there are those who make investments that haven’t paid off yet, so they need a little help. Kim Amadril, a freelance writer, walked in with her son, Gabriel Niles, who is in a band with two siblings. The band is called Gateway Drugs.

I’m not in the music business and may be out of touch, but I’m wondering if a name change might be a gateway to more gigs.

“It’s hard to pay rent, it really is,” said Niles, and food, electricity and gas aren’t cheap either.

“And the landlord just raised the rent, unethically,” said his mother, who told me she believes in the band and is happy to support it. So she brought in some jewelry and her son brought in some guitars a while back, and the loan has kept Gateway Drugs on tour.

SIGN UP for the free Great Reads newsletter >>

Cathy McMichael, who’s on disability from a retail sales job, came into the shop to pay interest on a loan for a bracelet she hocked. She’s always able to pay her rent, she told me, but the car payment can push her over the edge, and car repairs are a killer. So she’s a regular at the pawnshop.

Max Dabestan, a medical assistant at an urgent-care center, came in to pawn his laptop. He said it’s tough to get through the month on pay that’s not much higher than minimum wage, and he needed $40 to get to the Valley, visit his brother and get some food.

Dave Ingber, one of Salter’s employees, said he’s seen a definite surge in business related to an economy that works for folks at the top, but not for mom and pop.

“People move here and things are a lot more expensive than they anticipated,” he said. “They’re not used to that and they end up coming into a place like this.”

David Hrobowski, an antiquities and jewelry dealer, stopped by the shop about noon. When the global economy changed, he said, people of means were able to adapt quickly. Others, he said, are still finding their way.

“I came in to hock a pair of cuff links,” Hrobowski said. “I’ve been in this business now for 30 years, and I’m working harder for less money.”

Salter spotted him $500 for the cuff links, and Hrobowski left with just what he needed to cover his bills.

The Dow rose sharply Tuesday on positive financial indicators in China.

The Elliott Salter Pawn Shop Index was flat, as living-wage jobs remained scarce, bills piled up and Angelenos scoured attics and garages for goods to pawn.

Twitter: @LATstevelopez

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.