The U.S. elected its 45th president on Nov. 8.

- See all of our maps: State-by-state results and the California races and propositions

- California votes to legalize recreational pot use; it has strong nationwide support

- Kamala Harris is elected California’s new U.S. senator.

- Find coverage of all the aftermath here

- Share via

Anti-Trump protesters hit the streets across the U.S.

Activists are not taking the idea of a Donald Trump presidency quietly. Hundreds of demonstrators across the U.S. hit the pavement during the day and evening Wednesday to protest the Republican’s electoral victory.

In Chicago:

In Philadelphia:

In Boston:

In New York:

In Seattle:

In Austin, Texas:

In Berkeley, Calif.:

In Des Moines, Iowa:

And in Los Angeles. You can read more about the California protests here.

- Share via

Measure to speed up the death penalty leads, while bid to end it fails

California voters on Tuesday defeated a ballot measure to repeal the state’s death penalty, and instead a proposition that aims to amend and expedite it narrowly leads.

The outcome concluded a closely watched ballot race to address what people on both sides of the debate have agreed is a broken system.

Proposition 62, which would have replaced capital punishment for murder with life in prison without parole, garnered 46.1% of the vote.

Proposition 66 intended to speed up executions by designating trial courts to hear petitions challenging death row convictions, limiting successive petitions and expanding the pool of lawyers who could take on death penalty appeals.

With all precincts reporting, it currently has the approval of 50.9% of voters, but provisional and other ballots remain to be counted.

The outcome reflects similar findings by a USC Dornsife/Los Angeles Times poll, which found California residents, like the nation, remain very much divided on capital punishment, even as public opinion has shifted against the practice over the past 40 years.

This year, proponents of the measure to “amend not end” the death penalty system centered their campaigning efforts on emotional appeals from law enforcement and crime victims, who urged voters not do away with what they called the “last defense” against the “worst of the worst in society.”

But death penalty opponents, a diverse group of crime victims, celebrities and Silicon Valley entrepreneurs, argued the system could not be fixed. They pointed to a costly appeals process, the arbitrary application of the punishment and its impact on poor and minority communities.

Times staff writer Liam Dillon contributed to this story.

FOR THE RECORD: 11:11 a.m. This story and headline has been corrected to reflect that the Associated Press has not called the race for Proposition 66.

This story was originally posted at 6:31 a.m.

- Share via

Republican Cunningham wins tight state Assembly race to hold a GOP seat

Republicans have held on to the 35th Assembly District on the central coast, with GOP candidate Jordan Cunningham defeating Democrat Dawn Ortiz-Legg, according to the Associated Press.

Cunningham led Ortiz-Legg 54.6% to 45.4% with all precincts reporting.

The two were running to replace termed-out Assemblyman Katcho Achadjian (R-San Luis Obispo), who ran for Congress but was knocked out in the June primary.

The Republicans’ 5% voter registration advantage four years ago is now at just 1.5%, with a significant number of Latino and Asian registered voters.

Times staff writer Liam Dillon contributed reporting.

- Share via

Proposition 51, the $9-billion school bond, wins

California voters have approved Proposition 51, a $9-billion bond for school construction projects across the state.

The measure was leading 53.9% to 46.1%, according to election returns at 5 a.m. Wednesday, and the Associated Press has called the victory.

State funding to help finance repairs and new school facilities across California had run dry, and Proposition 51 will refill the pot. School construction needs billions of dollars every year, according to the nonpartisan Legislative Analyst’s Office. With the new cash infusion, the state will once again match local district funding for construction projects.

Proposition 51 had a more difficult campaign than many might have expected. Critics of the measure, notably Gov. Jerry Brown, had argued that Proposition 51 unfairly prioritized larger more, affluent areas because the state handed out the money on a first-come, first-served basis to districts that already had matching funds. And public polls in the fall showed the measure not reaching majority support among voters.

But school bonds are popular. Eighty percent of local measures pass, according to the League of California Cities, and the previous four statewide school bonds were successful as well.

- Share via

Funding to house L.A.’s homeless has strong lead

Backers of a bond measure that would provide housing for many of the city’s homeless were optimistic as early ballot counts favored the measure, which needs a two-thirds majority to pass.

With 50% of precincts reporting early Wednesday morning, Measure HHH had captured 76% of the vote.

“We earned our wings tonight,” 8th District L.A. City Councilman Marqueece Harris-Dawson said on Tuesday night. “We completely lived up to the title City of Angels.”

Supporters of the measure, including city officials, gathered on the 30th floor of a downtown skyscraper.

“Looking good so far,” said 14th District Councilman Jose Huizar. “It reflects all we had seen in our polling and talking to people. I think it looks excellent.”

The measure asked Los Angeles city voters to approve general obligation bonds that would raise money to build housing for chronically homeless people. The city would borrow up to $1.2 billion over 10 years for construction projects to provide “safe, clean, affordable housing for the homeless and for those in danger of becoming homeless.”

The average annual cost over the 29 years the bonds are being repaid would be $9.64 per $100,000 of assessed valuation. That would be $32.87 on a home valued at the median of $341,000.

The measure would not nearly move all the city’s homeless into housing, but supporters have argued that it is an important early step.

- Share via

Assemblywoman Catharine Baker, one of most targeted Republicans of the Legislature, keeps her seat

Assemblywoman Catharine Baker (R-Dublin) has held on to her seat in a closely watched race against Democrat Cheryl Cook-Kallio in the East Bay.

With nearly 95% of precincts reporting, Baker was leading, 56%-44%, against Cook-Kallio.

Early in the campaign, Baker, who is a social moderate and fiscal conservative, was identified as one of Assembly Democrats’ top Republican targets to pick off on their quest for a Democratic super-majority.

Cook-Kallio, a former Pleasanton City Council member, was one of four California legislative candidates endorsed by President Obama.

The contest was one of the most expensive legislative races this election cycle, with party spending on both sides nearing $2.8 million and independent expenditures just under $2 million in the final days of the campaign.

- Share via

Protests erupt across California after Trump wins: ‘Not my president’

The election of Donald Trump to the presidency sparked protests early Wednesday across California, with many demonstrations concentrated around college campuses.

Shortly after Trump delivered a victory speech in New York City, a crowd at the UC Santa Barbara marched near the campus, with some chanting, “Not my president. Not my president.”

- Share via

Assemblyman David Hadley, one of the most targeted Republicans in California, is in for a long night

Assemblyman David Hadley (R-Manhattan Beach) was in a car on his way home early Wednesday morning after an election night party in Redondo Beach.

With 42% of precincts reporting, Hadley was lagging behind challenger Al Muratsuchi, 53% to 47%.

But the race is still close to call and both candidates will likely have to wait until later Wednesday, or perhaps even later, to know whether Hadley will keep his seat.

“I have vague memories of refreshing my browser at 2:30 and 3:00 in the morning in 2014,” Hadley said. “I have a sneaking suspicion I’ll be doing that again tonight.”

Democrats had hoped to turn Hadley’s L.A. County coastal district blue as part of a strategy to regain a super-majority in the Assembly. As of early Wednesday morning, nearly all of those key targets Democrats had hoped to win were too close to call -- including Assembly District 65, where Assemblywoman Young Kim (R-Diamond Bar) and Democrat Sharon Quirk-Silva were separated by 1%.

“We’re still watching and we’ll see how we do,” Hadley said of his race, noting that the 2014 results showed he fared much better in certain parts of the district than others. “We just want to see more precincts in first.”

Assembly Democrats had tried to tie Hadley to Donald Trump during the campaign, despite the fact that he had said he would not vote for the Republican nominee.

On Friday, Hadley revealed that he had cast a ballot for Gary Johnson for president, saying Johnson “appeared to be the third-party nominee with the best chance of showing dissatisfaction with the two major party nominees.”

- Share via

Legislature will have to pass bills under new transparency rules set by Proposition 54

California voters have approved a significant change of the rules in how proposed laws are approved by the Legislature, overwhelmingly supporting a new mandate for public review of legislation before any final vote.

Proposition 54, which will impose a three-day waiting period before lawmakers can take action on the final version of bills, appeared headed for an easy victory on election night. As of early Wednesday, it was winning with 64% of the vote.

The change in legislative rules was long discussed in the state Capitol but failed to gain momentum until the initiative written by a former GOP legislator and bankrolled by a wealthy Bay Area activist.

In addition to the three-day delay for public review of most bills, Proposition 54 will also impose new rules requiring that video of legislative hearings and debates be posted online. It also removes a ban on using video from legislative proceedings in campaign commercials.

- Share via

Rep. Grace Napolitano wins 10th term, defeating scandal-plagued Roger Hernandez

Democratic Rep. Grace F. Napolitano won her bid for a 10th term in Congress, after a campaign that saw her opponent, state Assemblyman Roger Hernendez (D-West Covina), effectively end his campaign in August after a judge granted his ex-wife’s request for a domestic-violence restraining order against him.

The Associated Press called the race with Napolitano claiming 63.1% of the vote to Hernandez’s 36.9%.

Baldwin Park City Councilwoman Susan Rubio gave graphic testimony detailing abuse she said she suffered during her relationship with Hernandez.

Hernandez faced a swift political backlash after the restraining order was issued, including the loss of several endorsements as well as all of his committee assignments in the Assembly.

He called it quits after returning to the Legislature from medical leave.

Hernandez had long odds even before news of the accusations broke, and he relied largely on attacking Napolitano for not living in the 32nd Congressional District.

Napolitano suffered a stroke in February but vowed to keep campaigning for a 10th term, saying that “my ability to do my job is not at risk.”

- Share via

Burbank airport terminal replacement measure has wide lead in early returns

A measure to allow the replacement of the aging, cramped and seismically deficient Hollywood Burbank airport was dominating in early voting results Tuesday.

With 31% of the precincts reporting, 72% of voters backed Measure B.

If approved by a majority of voters, Measure B will permit the construction of a 14-gate replacement terminal at what was formerly known as Bob Hope Airport in a plan supported by both airport officials and a majority of the Burbank City Council.

Opened 86 years ago, the Burbank airport terminal is considered outdated and obsolete, so close to the runway it does not meet federal safety standards. It also is vulnerable to heavy damage in a major earthquake.

Airport and Burbank city officials have openly feuded about the terminal’s future for decades, and this agreement would finally pave the way for a replacement.

A rejection of Measure B would likely result in an ongoing legal battle between the airport and the city, and the airport authority could attempt to build a terminal of the same size in a less favorable area, one that would force the demolition and replacement of the general aviation terminal.

- Share via

Putin sends Trump a congratulatory telegram

- Share via

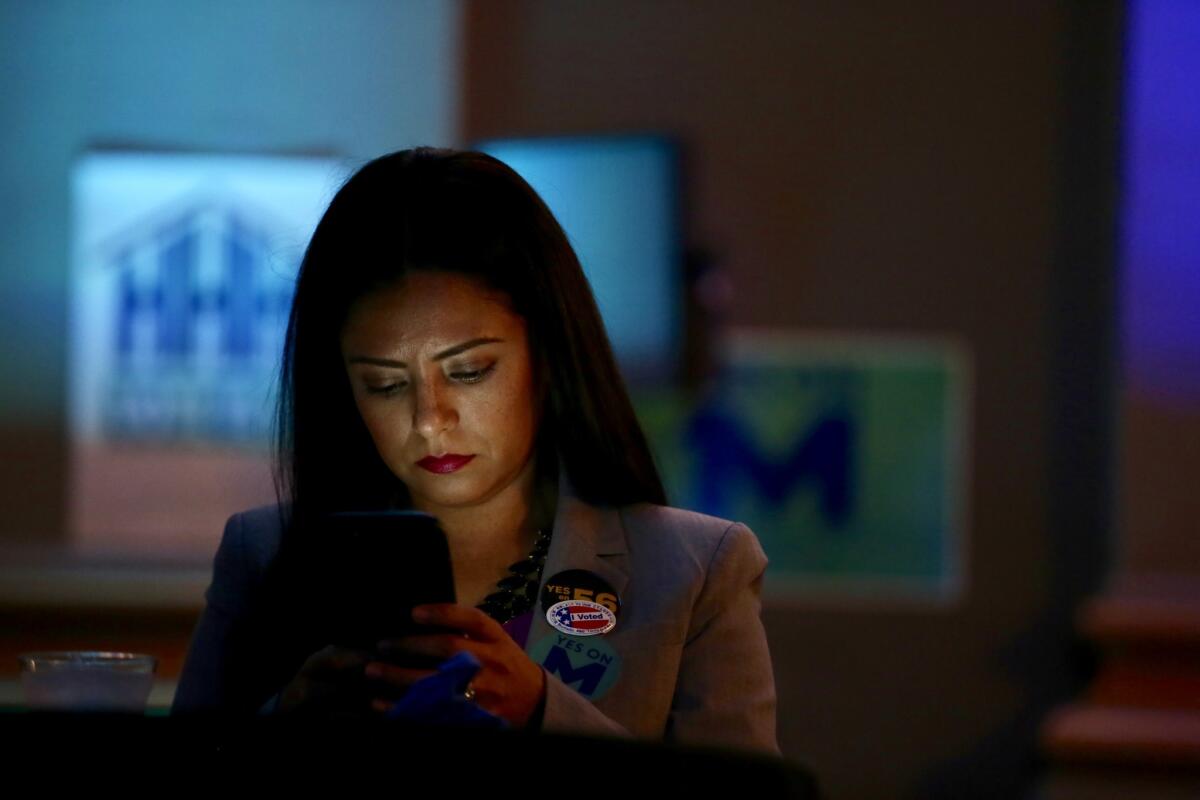

Lead increases for tax hike to expand L.A. Metro mass transit

An ambitious measure to dramatically expand Los Angeles County’s mass transit system widened its lead Wednesday morning as election officials counted ballots into the wee hours of the night.

With 46% of the precincts reporting, 68.82% of voters gave a thumbs-up to Measure M, as of about 12:45 a.m. Wednesday. That’s above the 66.67% threshold it needs to win.

On Tuesday night, Measure M backers were optimistic they would pull off a win.

“I’m superstitious. I don’t ever declare victory until the end,” said Los Angeles Mayor Eric Garcetti. But, he added, early results looked “very promising.”

Metropolitan Transportation Authority board member Jackie Dupont-Walker, the agency’s only voting director who is not an elected official, said she was hopeful that the measure would pass.

“I’m feeling good,” she said, adding that she had spent the last few days crisscrossing the county, talking to transit riders along the Expo Line and the Silver Line busway.

Garcetti also spoke optimistically about Measure HHH, an ambitious measure to tackle the homeless problem in Los Angeles.

“People said here, solve the problems that we face every day,” Garcetti said, referring to both Measure M and Measure HHH, the proposed $1.2-billion bond to build housing for L.A.’s homeless. “That’s a very strong message coming from Los Angeles and coming from the West Coast.”

- Share via

Bay Area soda taxes headed to victory

Soda tax measures were headed to victory in Bay Area cities in early returns.

The measures, on the ballot in San Francisco, Oakland, and the East Bay suburb of Albany, would place a penny-per-ounce tax on sodas and other sugar beverages. The measures require a majority vote to pass.

In San Francisco, Proposition V was ahead 62% to 38%, with all precincts reporting. Oakland’s Measure HH had an identical tally, with 62% backing the measure, with 85% of the precincts reporting. And in Albany, 71% of voters were backing Measure O1, with all precincts reporting.

A study published in August reported that after Berkeley’s first-in-the-nation soda tax, Measure D, passed in 2014, lower-income residents reduced their consumption of sugar-sweetened beverages by 21% compared with the pretax days.

Opponents, led by the American Beverage Assn., have called the measures an “unfair grocery tax.”

Soda taxes proposed in El Monte and Richmond in 2012 failed by wide margins.

- Share via

L.A. measures to revise rules for utility and police pensions too close to call

A measure to revise the oversight and operations of Los Angeles’ city-owned water and power utility slipped behind in returns late Tuesday night.

Edging into positive territory was a measure that would allow airport police officers to join the pension plan of other city police officers and firefighters.

With 25% of precincts reporting, Measure RRR, to reform the Department of Water and Power, was opposed by 50.9% of voters. The total includes a partial count of mail-in ballots.

Measure RRR is a long and detailed, but not sweeping, set of changes to the utility. Supporters say it would give the DWP more independence in a way that would make the municipally owned utility “more accountable, transparent and responsive,” as described in the city’s official ballot argument.

Backers were concerned about the possible impact of a disclosure days before the election. It came to light that the measure would allow Fred Pickel, the executive director of the city’s Office of Public Accountability, to be appointed to a second five-year term in his $276,000-a-year job as watchdog over the DWP. It also would double the minimum budget of his small department.

Pickel was responsible for submitting the wording of the ballot summary for voters and did not include these details.

Measure backers say it’s important to boost Pickel’s budget to ensure his independence and insulate him from political meddling.

The measure is endorsed by Mayor Eric Garcetti, the City Council and DWP management, who hope it will streamline operations at the roughly $4-billion-per-year department that keeps the lights on and faucets flowing for millions.

Opponents agree that the DWP, which has been plagued by controversy, needs reform. But they argue the ballot measure would be a step backward, allowing elected officials to avoid responsibility for missteps by the department and DWP managers.

Measure SSS sought to consolidate the pension systems of two police forces serving Los Angeles, and it was narrowly ahead.

It would move new hires at the L.A. Airport Police Division into the same pension plan as other police and fire department employees in the city. It also would allow current airport officers, about 500 in all, to buy their way into this pension fund. Currently, airport police are part of the city’s general pension system for municipal workers.

With 25% of precincts reporting, 50.2% of voters cast ballots in favor of the measure. The total also included a partial count of mail-in ballots.

- Share via

Longtime Silicon Valley Rep. Mike Honda loses seat to fellow Democrat in bitter rematch battle

Fremont Democrat Ro Khanna has defeated eight-term Rep. Mike Honda (D-San Jose) in their bitter, intra-party matchup in Silicon Valley.

Honda, a longtime progressive voice in the Bay Area, was believed to be one of California’s most vulnerable congressional incumbents after he received fewer votes than his challenger in June’s primary.

Khanna, who also challenged Honda in 2014, argued that Silicon Valley voters needed a change in leadership.

An ongoing ethics investigation into whether Honda had improperly used his official resources for political purposes, as well as the loss of key endorsements like President Obama’s, clouded Honda’s campaign.

The race quickly became California’s most expensive congressional campaigns and had grown increasingly nasty, with Honda filing a lawsuit in the final weeks of the race, alleging that Khanna’s campaign manager had illegally accessed proprietary campaign data.

A spokesman for Honda’s campaign declined to comment, saying the campaign would be releasing a later statement Wednesday.

- Share via

Trump’s first address as president-elect is a call for unity after a divisive campaign

After waging a fiercely divisive campaign that ultimately netted him the White House, Donald Trump called for unifying Americans early Wednesday.

“Now it’s time for America to bind the wounds of division,” he told cheering supporters at a Manhattan hotel.

“To all Republicans and Democrats and independents across this nation, I say it is time for us to come together as one united people. It’s time. I pledge to every citizen of our land that I will be president for all Americans.”

Trump said he received a call from Democratic nominee Hillary Clinton conceding the race and congratulating him on his win.

He said he, in turn, told her she had fought hard, and in his speech, he only praised the former rival he regularly referred to as “Crooked Hillary” on the campaign trail.

“Hillary has worked very long and very hard over a long period of time, and we owe her a major debt of gratitude for service to the country,” Trump said. “I mean that very sincerely.”

In his 15-minute speech, Trump said he planned to focus on growing the nation’s economy, embarking on infrastructure projects that would put millions of Americans to work and caring for the nation’s veterans. There was no mention of mainstays of his campaign rhetoric, such as building a wall along the southern border and making Mexico pay for it or ripping up trade deals.

Instead, he pledged to work with other nations.

“We will seek common ground, not hostility. Partnership, not conflict,” Trump said.

- Share via

Measure to restrict Santa Monica development trails in early returns

An initiative in Santa Monica that would create one of the strictest slow-growth measures in the region is trailing in early returns.

If passed, Measure LV would require voter approval for most development projects taller than 32 to 36 feet. That threshold would cover many new apartment and condo developments, as well as office and retail projects.

Without the growth limits Measure LV would impose, backers say more developers will tear down existing housing and build even more luxury developments that could price out Santa Monica’s renters.

Pro-growth groups, meanwhile, argue more development is needed to address the region’s soaring rents and shortage of housing units.

With 9% of the precincts reporting, Measure LV is trailing, with 55.72% of the voters opposed.

The growth limit measure comes as more developers seek to take advantage of the new Expo Line and the city’s bustling downtown area. Urban planners are increasingly favoring this kind of multi-use development to foster walkable neighborhoods and encourage residents to ride bikes or take mass transit rather than drive.

- Share via

Early lead for Bay Area transit measures backing BART renovation and extension to San Jose

Bay Area measures that seek to restore BART and extend the commuter rail system to downtown San Jose were ahead Tuesday in early returns, both of which require a two-thirds vote to pass.

In Santa Clara County, Measure B asked voters to raise the sales tax by half a cent for every dollar spent to fund a host of freeway and transit improvements, including funding to bring BART to downtown San Jose, raising more than $6 billion over the next three decades. Measure B was garnering 71% support with an estimated 44% of the ballots counted.

Voters in San Francisco, Alameda and Contra Costa counties were deciding the fate of Measure RR, a $3.5-billion bond measure to rebuild the core systems of the aging electric train service, which has been plagued with ancient, faulty power systems and water leaks that have weakened steel rails so much they crack during the commute. With 76% of the precincts reporting, Measure RR was garnering 70% of the vote.

In San Francisco, voters were considering Propositions J and K, which would increase the sales tax rate by three-quarters of a penny for every dollar spent and set aside about $100 million a year to pay for repairs, upgrades and infrastructure improvements to Muni and about $50 million to provide services to the homeless. Those measures require a majority of votes to pass.

- Share via

Trump won. Tell us how you’re feeling

- Share via

Democrat Lou Correa elected Orange County’s next congressman

Lou Correa will be Orange County’s newest congressman, the AP projects. Correa prevailed in his fight against fellow Democrat, Garden Grove Mayor Bao Nguyen, in his race to replace Rep. Loretta Sanchez (D-Orange) in the 46th Congressional District.

As of midnight Wednesday, Correa was leading by a wide 70-30 margin, with 48% of precincts reporting.

Correa, a veteran politician who has represented the area in the state Senate and Assembly, lost narrowly in a 2014 bid for a seat on the Orange County Board of Supervisors.

High Vietnamese American turnout was a key factor in that race and was expected to help Nguyen, who fled Vietnam with his parents as a baby.

Nguyen eked out a surprise victory in the June primary, marking the first time Republicans have been shut out of a congressional race in Orange County.

The race was expected to be a test of the ethnic loyalties of the diverse district’s Vietnamese and Latino voting blocs.

Correa had earned the endorsement of Sanchez and many other establishment Democrats, while Nguyen said he was relying on a grass-roots strategy and appealing to millennials and supporters of Bernie Sanders, who carried the district in the June primary.

- Share via

Democrat Salud Carbajal defeats Justin Fareed in race for open Central Coast House seat

Democratic Santa Barbara County Supervisor Salud Carbajal won an expensive race against Republican Justin Fareed to replace outgoing Democratic Congresswoman Lois Capps in the Central Coast.

The Associated Press called the race late Tuesday with Carbajal leading with 55.2% of the vote to Fareed’s 44.8%.

The two survived a crowded primary contest and fought a bitter battle through the fall with Carbajal spending $2.5 million while Fareed dropped $1.8 million for his effort.

Though Democrats have a large eight-percentage point advantage in the district, outside Republican groups swept in to attack Carbajal, hoping that Fareed — a 28-year-old former House staffer and strong fundraiser — could find success with his outsider status.

Carbajal and a Democratic super PAC launched a series of ads on television attacking Fareed for comments he made supporting Donald Trump, causing headaches for Fareed’s campaign, which later tried to argue that he never really endorsed Trump.

Carbajal had the support of Capps and House Minority Leader Nancy Pelosi, while Fareed had the backing of House Speaker Paul D. Ryan.

- Share via

Twitter reacts to the reality of President-elect Trump

In keeping with the volatile emotions of the evening, Twitter is continuing to churn out reactions to election results that have confirmed Donald Trump as President-elect.

The tweets take two decidedly different tones, with some feeling as though the election results suggest something abysmal.

Even Captain America was bummed.

Of course, where some Twitter users saw rain, others saw a rainbow and their reactions were as exuberant as could be expected.

- Share via

Hillary Clinton concedes defeat in private call to Donald Trump

Hillary Clinton has conceded defeat to Donald J. Trump, ending her quest to make history as the nation’s first female president.

Clinton did not speak publicly, as Tuesday night turned to early Wednesday morning on the East Coast. But as Trump addressed his supporters, the president-elect announced he had spoken with his former rival.

“She congratulated us,” Trump said, “and I congratulated her and her family on a very, very hard-fought campaign.”

“We owe her a major debt of gratitude for her service to our country,” he added.

The former secretary of state, like many in her party, entered election day confident in a victory that would have ensured Democrats retained the White House for a third consecutive term.

But Trump, the real estate magnate turned reality television star, demonstrated unexpected strength in Rust Belt states that had been the foundation of President Obama’s two victories.

The White House did not comment on whether Obama would also call Trump.

- Share via

Mike Pence: ‘This is a historic night’

Vice President-elect Mike Pence thanked the American people for “placing their confidence” in him and President-elect Donald Trump, capping off an upset victory in Tuesday’s election.

“This is a historic night; the American people have spoken,” Pence said. “America has elected a new president.”

- Share via

Proposition 56, a $2-per-pack boost to tobacco taxes, is approved by voters

After voters twice turned back attempts to raise the state’s tobacco tax over the last decade, California looks poised to pass Proposition 56, which would increase the cigarette tax by $2 per pack.

Proposition 56 leads 62.4% to 37.6% in late returns, according to the secretary of state’s office.

“Smoking is the number one cause of avoidable death in the state of California,” said Democratic donor Tom Steyer, who was the co-chairman of the Proposition 56 campaign. “We had a broader coalition to support the idea of pushing back against the tobacco companies and raising the cigarette tax than ever before. We believe that that kind of broad coalition works against organized and concentrated economic interests when we stick together and when we all turn out and vote.”

The nonpartisan Legislative Analyst’s Office estimates that Proposition 56 could raise at least $1.3 billion a year, with most of the money going toward the state’s Medi-Cal health care program for low-income residents.

The campaign was one of the most expensive in the state this year, with tobacco companies pouring in more than $70 million to fight the tax hike. In television advertisements, the companies criticized the measure as a payoff to the health care industry, which financed much of the Yes on 56 campaign.

But in contrast to failed efforts to raise the tobacco tax in 2006 and 2012, proponents of the tax hike were able to raise significantly more funds to promote Proposition 56.

Currently, California’s cigarette tax is $0.87 per pack, which ranks 37th in the country, according to the Campaign for Tobacco-Free Kids, and it hasn’t been raised in almost 20 years. Along with cigarettes, other tobacco products including smokeless tobacco and cigars will see a corresponding tax increase. And for the first time, the growing e-cigarette industry will need to pay tobacco taxes.

- Share via

Barger holds early lead in 5th District supervisor race for northern L.A. County

Kathryn Barger held a solid early lead in the race to replace Los Angeles County Supervisor Michael D. Antonovich, who represents northern Los Angeles County.

With 28% of precincts reporting, Barger claimed 62% of the vote, while her opponent, Darrell Park, received 38%. The total includes a partial count of mail-in ballots.

Barger, a moderate Republican, is Antonovich’s longtime chief of staff, and started working for Antonovich as an intern 28 years ago. She also has the backing of four of the county’s five supervisors and of powerful labor groups, including the Los Angeles County Federation of Labor.

Her opponent, Park, has campaigned heavily on his Democratic Party affiliation. Park is a green energy entrepreneur and former staffer in the White House Office of Management and Budget under Presidents Bill Clinton and George W. Bush.

Antonovich, a Republican who has held his seat on the Board of Supervisors since 1980, is being forced out by term limits that were approved by voters in 2002. He is seeking election to the state Senate.

- Share via

At New Beverly Cinema, dozens hide out to escape political reality

“This seemed like a good way to hide out in a dark hole and await the apocalypse,” Connor Weber reasoned, standing below the the theater marquee.

The 28-year-old took a drag on his cigarette. He was one of a few dozen who had shown up at the New Beverly Cinema on Tuesday night to escape the chaos of election night, paying $8 for a double bill of “Shampoo” and “The Candidate.” Like most at the theater, he had an ‘I Voted’ sticker still affixed to his shirt; he said he had gone to the polls to write his own name in the presidential candidate slot. “I’m pretty politically disillusioned,” he said with a sigh.

About 120 people — mostly men — came to the Quentin Tarantino-run venue on Tuesday. Mike Schlereth, a 33-year-old from North Carolina who voted for Hillary Clinton, thought it seemed like a good alternative to watching the news. Still, he was distressed by how close the race between Clinton and Donald Trump was at 9:45 p.m., when there was a brief break between the two films. “It’s a little worrying,” he said. “I’m gonna try to turn my phone off.”

Nearby, a group of three friends who described the theater as their church lamented how well Trump was doing. “Jesus,” 34-year-old Christopher Stefanic said, shaking his head. “I’d rather relate to the stories that were presented when America was great.”

“Yeah, if the election doesn’t go the way I want, at least I can get some entertainment out of it,” agreed his buddy, Jeremy Warner, also 34. They were both wearing buttons that had been handed out at the screening with pictures of Robert Redford on them. “I Voted for ‘The Candidate,’ ” the pins read. “New Bev 2016.” Inside the lobby, employees had affixed a handwritten list of updated results to the popcorn machine. Those who purchased concessions were also encouraged to tip by putting their spare change into glasses for Clinton, Trump or Redford.

Bill Steele, 52, had intended on coming to the screenings to stave off his anxiety. But he found himself distracted during “Shampoo.”

“For about an hour, I was able to escape the anxiety, because it’s a great film,” he said. “But really we’re just pushing off the inevitable.”

- Share via

O.C. Supervisor Andrew Do ahead of Michele Martinez in contentious race

Incumbent Andrew Do has an early lead over challenger Michele Martinez in the race to be the Orange County supervisor for the 1st District, with 56% of the precincts reporting and Do leading with 56.4% of the votes.

The contentious race is likely to come down to the district’s respective turnout in its large Vietnamese-American and Latino communities. The two emerged as the top vote-getters in a heated June primary race, with Do winning 38% of the vote and Martinez 34%, according to the final tally.

If Martinez wins, she would be the only Democrat on an otherwise all-Republican board. A Santa Ana councilwoman, she is trying to become the first person from her city to represent the 1st District on the Board of Supervisors.

Experts say the competition between Do and Martinez reflects the changing demographics of central Orange County, where candidates must look well beyond traditionally white voters to win — and where they increasingly have to leverage their cultural connections to many of the residents they seek to represent.

Countywide, the 1st District is the most liberal district, with Democrats boasting a 13-percentage-point lead over Republicans in voter registration, according to the Registrar of Voters.

The district spans Garden Grove, Santa Ana, Westminster and parts of Fountain Valley, and it includes 209,000 registered voters, according to Political Data Inc. Among them, 43% are registered Democrats and 30% are Republicans; 37% of the voters are Latinos and 25% are of Vietnamese descent.

- Share via

Donald Trump is projected to be the nation’s 45th president in a stunning upset

Donald Trump shocked the political establishment Tuesday, triumphing over not just Hillary Clinton but large parts of his own party’s hierarchy, to be projected the winner of the presidency in one of the biggest upsets in U.S. political history.

Trump’s victory, which defied most preelection polls and the opinions of the nation’s foreign policy, financial and cultural elites, resulted from a massive outpouring of votes in rural areas and small towns across the country, overturning Democratic calculations that their dominance of urban America would seal their victory.

- Share via

Measures to increase fire patrols in the Hollywood Hills and Santa Monica mountains leading in early returns

Two tax measures that would enable more ranger and fire patrols in increasingly popular areas along the Hollywood Hills and Santa Monica mountains is leading in early voting results.

Measure FF calls for an annual $15 tax on developed parcels of land that are within a special hillside district covering parts of Woodland Hills, Encino and Tarzana. Measure GG would impose a $35 tax on similar parcels west of Griffith Park but east of the 405 Freeway. Only voters in these districts saw these two measures on their ballots.

Both measures require a two-thirds vote to pass.

With 7% of the precincts reporting, Measure FF is leading, with 75.44% of voters in support. Measure GG is similarly leading, with 8% of precincts reporting and 81.26% backing the initiative.

It is important to beef up ranger and fire patrols in these areas, such as the seven-mile unpaved section of Mulholland, park officials said. Visitors to these quiet, mostly residential areas have increased because of apps such as Waze and social media photos that have made these off-beaten paths more widely known, they said. The chances of car exhaust sparks or a carelessly tossed cigarette in these under-patrolled, tinder-dry areas have become an increasing concern.

- Share via

L.A.’s Measure SSS, which would consolidate police pension systems, narrowly trails in early returns

A measure to consolidate the pension systems of two police forces serving Los Angeles was trailing narrowly in early returns Tuesday night.

Measure SSS would move new hires at the L.A. Airport Police Department into the same pension plan as other police and fire department employees in the city. It also would allow current airport officers, about 500 in all, to buy their way into this pension fund. Currently, airport police are part of the city’s general pension system for municipal workers.

With 13% of precincts reporting, 50.2% of voters cast ballots against the measure. The total also included a partial count of mail-in ballots.

If this measure passes, eventually all the police officers in the city’s three separate police departments — LAPD, the L.A. Port Police and the airport officers — would be members of the same pension fund, receiving comparable retirement benefits. They are already paid on the same salary scale.

Critics pointed out that the police and fire system allows for retirement at 50 and other more-generous pension terms. Moving the airport employees into it would increase the financial burdens on an already strained system.

- Share via

Yorba Linda water board incumbents who backed rate hike losing badly in recall election

Water board members in a northern Orange County suburb who backed a water rate hike in the midst of intense drought were trailing badly in a recall election.

The Yorba Linda Water District’s board attracted the ire of the Yorba Linda Taxpayers Assn. when the district unanimously raised bills by $25 a month. The battle has transformed the sleepy suburb into a cautionary case study for other California water suppliers coping with a decrease in water sales during drought.

With 36% of the precincts reporting, all three incumbents seeking to stay on the five-member Yorba Linda Water District were losing. About 70% of voters voted to recall two board members, Gary Melton and Robert Kiley.

And the board’s president, Ric Collett, appeared to be losing his bid for reelection, coming in last place in a field of four candidates, where only the top two finishers would secure a new term on the board.

A fourth incumbent board member, Michael Beverage, said he would not seek another term. The vacant seat is up for grabs between a candidate aligned with the incumbents and a challenger angry at the rate hike.

The Yorba Linda Taxpayers Assn. is backing a slate of four candidates: Al Nederhood and Brooke Jones to replace the board members targeted by the recall, and Benjamin Parker and John Miller for the open seats.

Nederhood and Jones were leading in their races to replace the incumbents, garnering 51% and 72% of the vote so far, respectively, against candidates who are allied with the board incumbents.

For the two open seats, the leaders in that race were Miller, backed by the tax association, and Hall, aligned with the board incumbents. If the results hold up, the outcome would give the tax association-backed candidates a 3-to-2 majority.

- Share via

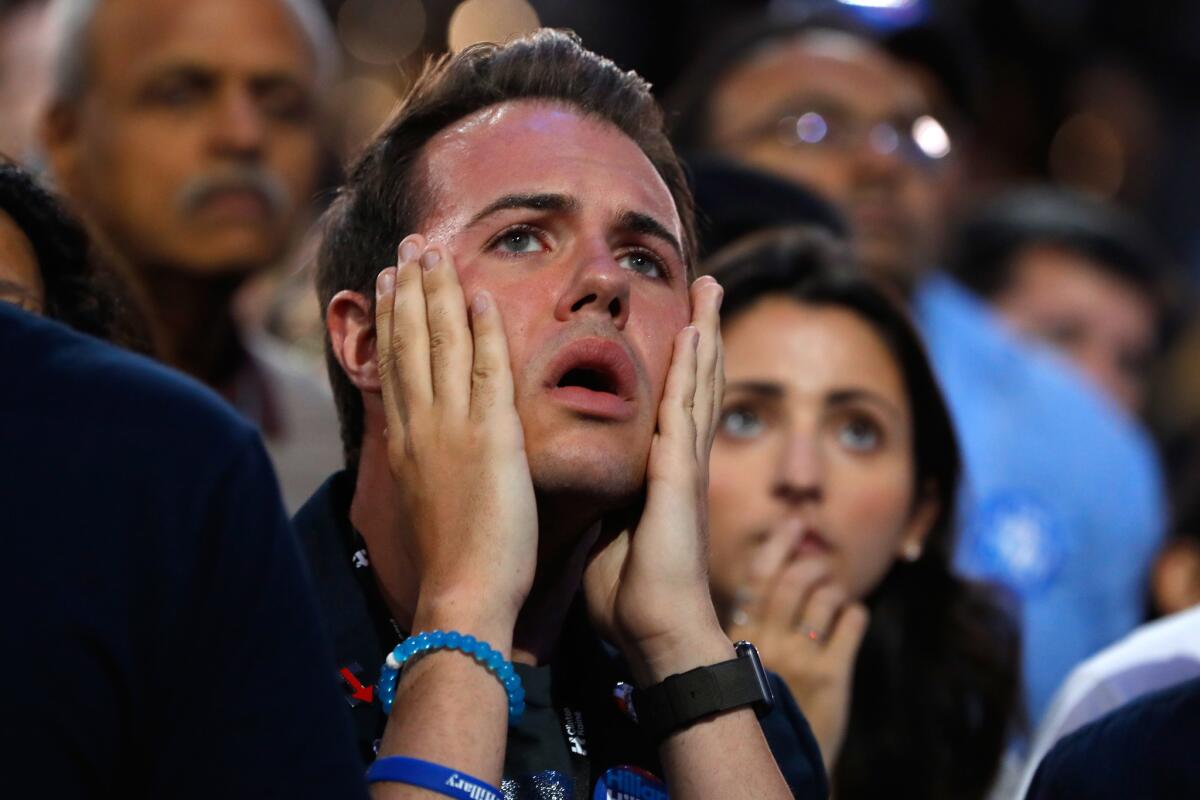

Some supporters hold out hope after Hillary Clinton declines to concede

The 2000 recount that ended in Al Gore’s defeat is a painful memory for Democrats, but some at Hillary Clinton’s election night party found comfort in the thought after she declined to concede early Wednesday.

“That’s the right thing to do,” said Judy Aronson, 56, of Tenafly, N.J. “It’s so close in every single state.”

She added, “Hopefully it won’t take six weeks like it did in 2000.”

Her husband Mark, also 56, agreed.

“We lived through 2000 where they called states and reversed states,” he said. “We’ve been there before.”

- Share via

Where some of California’s competitive House races stand

As the votes began to come in Tuesday night, Rep. Steve Knight of Lancaster opened up a nearly 10-point lead on Democrat Byran Caforio in a seat Democrats were eager to take from Republicans.

Democratic Santa Barbara County Supervisor Salud Carbajal was leading Republican former House aide Justin Fareed in the race to replace Rep. Lois Capps (D-Santa Barbara).

And the race to replace Rep. Janice Hahn (D-San Pedro) was tight after a bitter campaign between fellow Democrats state Sen. Isadore Hall (D-Compton) and former Hermosa Beach City Council member Nanette Barragán.

- Share via

California’s new senator has a message for potential President Donald Trump

California’s newly elected U.S. senator, Kamala Harris, gave a defiant victory speech Tuesday night aimed at Donald Trump, who appears to be inching toward victory.

Flanked by family and friends on stage at her election night celebration in a downtown L.A. dance club, Harris vowed to fight for gun control, abortion rights and worker rights, and to address climate change and the Black Lives Matter movement.

“Whatever the results of the presidential election tonight, we know that we have a task in front of us. We know the stakes are high,” Harris told a cheering crowd inside Exchange LA. “When we have been attacked and when our ideals and fundamental ideals are being attacked, do we retreat or do we fight? I say we fight!”

Harris also praised rival Rep. Loretta Sanchez and her own parents, saying they prove the American dream is still in reach.

- Share via

L.A.’s Measure RRR, on reforming DWP, holds narrow lead

Early vote totals gave a slim lead to Los Angeles’ Measure RRR, which would revise oversight and operations of the city’s water and power utility.

With 8% of precincts reporting, the measure was supported by 50.5% of voters. The total includes a partial count of mail-in ballots.

Measure RRR is a long and detailed, but not sweeping, revision to the operation and oversight of the Los Angeles Department of Water and Power.

Supporters say the measure would give the DWP more independence in a way that would make the municipally owned utility “more accountable, transparent and responsive,” as described in the city’s official ballot argument.

Backers were concerned about the possible impact of a disclosure days before the election. It came to light that the measure would allow Fred Pickel, the executive director of the city’s Office of Public Accountability, to be appointed to a second five-year term in his $276,000-a-year job as watchdog over the DWP. It also would double the minimum budget of his small department.

Pickel was responsible for submitting the wording of the ballot summary for voters and did not include these details.

Measure backers say it’s important to boost Pickel’s budget to ensure his independence and insulate him from political meddling.

The measure is endorsed by Mayor Eric Garcetti, the City Council and DWP management, who hope it will streamline operations at the roughly $4-billion-per-year department that keeps the lights on and faucets flowing for millions.

Opponents agree that the DWP, which has been plagued by controversy, needs reform. But they argue the ballot measure would be a step backward, allowing elected officials to avoid responsibility for missteps by the department and DWP managers.

- Share via

Rep. Loretta Sanchez on the outcome of the U.S. Senate race: ‘I don’t believe that yet’

Rep. Loretta Sanchez was smiling and seemed upbeat as she greeted supporters in Santa Ana on Tuesday, hours after the Associated Press had called the U.S. Senate race for her opponent, Kamala Harris.

Despite the projections, Sanchez said, she would not concede the race yet.

“Actually, the Associated Press already said that my opponent has won,” Sanchez told the crowd, gathered in a campaign office-turned-party venue. “But I don’t believe that. I don’t believe that yet.”

Sanchez thanked her supporters, friends and family for their efforts and for getting voters engaged in the campaign.

“We jumped in this race to give the people of California a choice,” Sanchez told them. “Even if we don’t make it over the line tonight ... never underestimate Loretta Sanchez.”

- Share via

Hillary Clinton won’t concede tonight

Hillary Clinton’s campaign chairman said early Wednesday in New York that she would not concede the presidential race yet.

“It’s been a long night, and it’s been a long campaign, but we can wait a little longer, can’t we?” top aide John Podesta said to a dispirited crowd at the Javits Center.

“They’re still counting votes, and every vote should count. Several states are too close to call, so we’re not going to have anything more to say tonight.”

- Share via

Hillary Clinton gets 71% of the vote in Los Angeles

Los Angeles voters heavily favored Hillary Clinton in the 2016 presidential race.

According to exit polls, 71% of Angelenos who cast ballots chose Clinton, compared with just 24% who said they voted for Trump.

- Share via

Need an election night refresher, America? We’ll catch you up

The Times’ Christina Bellantoni and Anthony Pesce tell you what’s happened nationally and in California on election day.

- Share via

California voters approve gun control measure Proposition 63

Following a year marked by a series of mass shootings, voters on Tuesday approved Proposition 63, which toughens California’s already strict gun control laws.

The initiative outlaws the possession of ammunition magazines that hold more than 10 rounds, requires background checks for people buying bullets, makes it a crime not to report lost or stolen guns, and provides a process for taking guns from people upon their conviction for a felony.

The measure was proposed by Lt. Gov. Gavin Newsom, who late Tuesday called the vote “historic progress to reduce gun violence.”

“It was a repudiation of the National Rifle Assn. and the gun lobby. They lost badly,” Newsom said in an interview. “It’s a very important initiative because I think it’s the beginning of a national debate on relinquishment (by felons) and ammunition background checks that will I think will have a very significant impact on reducing gun violence in this country.”

During the campaign, Newsom argued more laws are needed to keep guns out of the hands of criminals and terrorists following a series of mass shootings in the United States.

Tuesday’s vote came nearly a year after two terrorists killed 14 people in San Bernardino. The Proposition 63 campaign ads also cited a mass shooting at an Orlando nightclub that killed 49 people in June and the 2012 massacre that left 20 children and several educators dead at Sandy Hook Elementary School in Newtown, Conn.

The opposition, which includes the National Rifle Assn., argued it would create a burden on gun owners but that criminals will find a way to get around the new law.

Opponents also said Newsom was using the ballot measure to raise his profile ahead of his campaign for governor in 2018.

“Prop. 63 is another attempt by Newsom and his 1%, elitist friends to attack law-abiding Californians,” said Craig DeLuz, a spokesman for the Stop Prop 63 Committee. “They want to replace the ‘War on Drugs’ with ‘The War on law-abiding gun owners’ so they can continue locking up young black and Latino men.”

With the NRA focusing more of its resources in other states where gun control had more opposition, the campaign against Proposition 63 was outspent. Supporters raised close to $4.5 million, while opponents were able to raise about $868,000.

- Share via

“Millions” fear their liberties will be threatened under a Trump administration, McMullin warns

The people filed out of here, heads shaking a bit. A couple posed next to a sign that said “Decision 2016” and had their selfies snapped - thumbs turned downward.

Their man had lost – not the whole election – but the state of Utah.

Evan McMullin’s bid for the presidency was always a long-shot. He wasn’t even on the ballot on all 50 states. And yet, the believers waved flags, hugged each other as they said their goodbyes and clung to the only thing they had left – that they stood on their principles.

McMullin said as much when he spoke for about 10 minutes – well past 10 p.m. when many of the families who had come to watch saw their sleepy kids curl up on the floor or snooze in cribs – and told them Donald Trump and Hillary Clinton would never be for them.

But Trump drew most of McMullin’s fire.

“We are all human beings created equal,” he said. “We all have liberty to pursue happiness in the way we want.

“But tonight there are millions of Americans, I’m sad to say, who are in fear that their liberties will be challenged and threatened under a Trump Administration that has made a campaign of targeting people based on their race, their religion and gender. This is why a new conservative movement is necessary.”

At one point a voice in the crowd shouted out “2020” and McMullin laughed it off and pivoted to the theme he’s been hammering home in recent days – the continuation of the movement.

It’s unclear what that movement is, but McMullin told the crowd that “the Republican Party can no longer be considered the home of conservatives” and said “we are not going away.”

But for the night, at least, when McMulliln exited the stage, the night wasn’t theirs. Not even in Utah.

- Share via

Asian markets slump in reaction to Trump gains

Asian markets nosedived on Tuesday as Donald Trump won key states in the U.S. election and appeared headed toward the presidency.

Shares dropped in every market throughout the region, with Japan’s Nikkei index plunging as much as 5.3% by mid-afternoon. Hong Kong’s Hang Seng index fell to 2.6%, while the Korea Stock Exchange dropped 2.9%.

The numbers reflected rattled markets and uncertain investors worldwide, as swing states started flashing red by the late morning. A Trump victory would mark the second political hit to financial markets since the Brexit vote in late June.

One stock benefited. Wisesoft, a Chinese stock whose name “Chuan Da Zhi Sheng” sounds like “Trump Wins Big,” jumped the most in five months, according to Bloomberg News.

- Share via

Janice Hahn holds early lead in 4th District supervisor race to succeed Knabe

Janice Hahn was ahead in early results in the race to replace Los Angeles County Supervisor Don Knabe, who represents southern Los Angeles County.

With 19% of precincts reporting, Hahn was winning with 55% of the vote, while Steve Napolitano was pulling in 45%. That total also includes a partial count of mail-in ballots.

U.S. Rep. Hahn, a Democrat from San Pedro, faced a tough fight with rival Napolitano, a Republican and former Manhattan Beach councilman who has worked for Knabe for 12 years. If elected, Hahn would be the fourth labor-backed liberal on the officially nonpartisan five-member board — constituting a supermajority that could make it easier to approve tax and salary matters favored by the county’s most powerful unions. Knabe and Michael D. Antonovich — the two Republicans on the board — are being forced out by term limits.

Knabe, a resident of Cerritos, was first elected to the Board of Supervisors in 1996.

- Share via

Loretta Sanchez supporter on her defeat: ‘That’s a shame, but I’m not surprised’

Sitting at tables decorated with red, white and blue centerpieces, supporters of Orange County Rep. Loretta Sanchez had no idea her race for U.S. Senate had already been called, and not in her favor.

They chatted, mostly in Spanish, over bottles of Jarritos soda and waited for the Mexican food buffet to open up.

Sanchez’s election night party was held at a Santa Ana campaign office she shared with Lou Correa, the Democrat she’d endorsed to take her place in Congress. A bank of cameras separated a smattering of tables from an empty stage.

Sanchez’s race was one of the first in California to be called. Correa, on the other hand, appeared to be winning by a large 70-30 margin in early returns.

Yvonne Gonzalez Duncan, 69, was incredulous when she was told the Associated Press had the Senate race in favor of Atty. Gen. Kamala Harris. “That’s unbelievable. I mean, 20 years of experience,” she said before trailing off and shaking her head. “We were hoping to have ... a Latina senator. It’s a shameful thing for California that we don’t.”

Edwin Power, a Sanchez supporter and a former neighbor of hers, was more subdued. “I can believe that,” he said of the news that Harris had won. “That’s a shame, but I’m not surprised. She would have had to plant herself in Northern California and picked up a lot more funding to overcome the situation she was in.”

- Share via

Trump campaign manager on how they upended expectations

- Share via

L.A. County tax measure for parks leading in early results

A Los Angeles County ballot measure asking voters to tax themselves for park improvements is leading in early voting results.

With 14% of the precincts reporting, Measure A is leading with 70.19% of voters in support of the ballot initiative. It requires a two-thirds vote to pass.

Measure A, if passed, would impose a county tax on improved property, at a rate of 1.5 cents per square foot of building area – about $22.50 a year for a 1,500-square-foot house – and bring in $94.5 million a year, without an end date.

It would replace a county tax that passed in 1992 but expired last year, and another one adopted in 1996 that sunsets in two years. Those taxes have been the primary source of parks funding not just in the county’s system but for most of the region’s 88 cities.

The initiative is the county’s second recent attempt at persuading voters to tax themselves to pay for parks, recreation, open spaces, neighborhood recreation and senior centers, and other cultural amenities. A proposed $23 parcel tax for park projects had failed narrowly in 2014.

In preparation for the second attempt, county officials commissioned a study of open space needs throughout the county, which found large disparities in park access. Countywide, there was an average of 3.3 acres of parkland per 1,000 residents. Communities in Central and South Los Angeles, southeast county areas and parts of the San Fernando and San Gabriel valleys had the most park-poor areas.

- Share via

New York was the center of the political universe, but much of the city was glum as Trump pulled ahead

The Empire State Building was illuminated in red, white and blue, with election results projected along the side of the building for the city to watch the action live. Times Square had a dozen competing screens projecting news of the election. Much as they do on New Year’s Eve, crowds gathered in suitably colorful attire — mostly red, white and blue — in hopes of celebrating with their compatriots.

All eyes were on New York on election day, with the presidential candidates holding dueling election parties 15 blocks apart in midtown Manhattan, and thousands of their supporters cheering them on.

- Share via

Measure CC, to raise $3.5 billion for L.A. community college construction, holds lead in incomplete returns

Early results late Tuesday night were positive for Measure CC, a $3.5-billion construction bond for the Los Angeles Community College District.

With 8% of precincts reporting, the measure was securing nearly 72% of the vote, better than the 55% majority needed to pass. The early totals also included partial vote-by-mail counts.

Supporters argued that the money is necessary to complete renovation efforts that began with earlier bond measures. Projects to be completed include earthquake-safety upgrades and better access for disabled students.

“I have to think that voters are going to support Measure CC,” said Joanne Waddell, president of Local 1521 of the American Federation of Teachers, which represents 5,000 faculty members on the nine college-district campuses.

“We’ve been transforming our campuses and this will take us to the next step in that transformation. Our students deserve this.”

Opponents pointed to problems that arose with the spending of money from bond measures adopted in 2001, 2003 and 2008, which residents are still paying off, and questioned why more money is needed. Past projects were beset by mismanagement, waste and nepotism, as The Times detailed in 2011.

College officials insisted their efforts have improved and are overseen by new and professional leadership, with better accountability measures.

One of the district’s biggest changes was to strip away from individual college presidents the power they formerly had over design and construction, and to centralize that authority with the district’s administration.

- Share via

Measure to build new San Diego stadium for Chargers failing badly

A San Diego ballot measure to increase hotel taxes and build a new downtown football stadium for the Chargers was losing badly Tuesday.

With about 20% of the precincts reporting, 61% of voters were opposing Measure C, and 39% of voters signaled support. Measure C requires a two-thirds majority to pass.

Drafted by the Chargers and backed by San Diego’s mayor, Measure C would increase hotel taxes from 12.5% to 16.5% and use the money to build a city-owned downtown football stadium and convention center. Opponents say tax money is better used for other purposes.

A competing proposal, Measure D, would also raise hotel taxes, but by a lesser amount, but prohibits public money for a stadium. But that measure was also losing badly, with 60% of voters opposed.

The city attorney says Measure D also requires a two-thirds vote, but a lead author of Measure D argues that only a majority vote is required.

In January, the San Diego Chargers said the team would not move to Inglewood for the 2016 season and would redouble efforts to reach a deal to remain in their hometown.

A failure to reach a deal could result in the Chargers moving to the Los Angeles market.

- Share via

Hillary Clinton can still win the popular vote, thanks to California

Barring a late rebound in Wisconsin, Michigan and Pennsylvania, Hillary Clinton appears unlikely to get 270 electoral college votes to become president.

But, like Al Gore, she may be on track to still earn more votes across the country.

Here’s why.

The states with the most vote still left to count are primarily those on the West Coast, with notoriously slow-counting California chief among them. As of 10:20 p.m. Pacific Time, Trump’s popular-vote lead over Clinton was just over 1.3 million votes.

But less than a third of California’s precincts have reported so far. Only 10% of precincts in Los Angeles County are in.

In 2012, President Obama netted more than 3 million popular votes out of California. Should Clinton end up with a similar tally, or even shy of that, she could still end up topping Trump in the popular vote.

- Share via

San Francisco measure to allow 16-, 17-year-olds to vote slightly ahead in early returns

A measure that would lower the voting age and allow 16- and 17-year-olds to vote in municipal elections in San Francisco was leading in early returns Tuesday.

With 40% of precincts reporting, Proposition F was supported by 53.71% of voters.

If approved, those teenagers would be allowed to vote for school board and community college board members, and for local candidates and local ballot measures. The city controller estimated the number of registered voters would probably increase by up to 1%, if 16-year-olds and 17-year-olds vote at the same rate as the general population.

Supporters say Proposition F would encourage improved civic participation — the earlier someone starts voting, the more likely they are to vote for the rest of their life, they argued.

Opponents say adolescents shouldn’t have the privilege of voting, as many of them don’t have the daily responsibilities that adults do.

- Share via

Gary Johnson to supporters: ‘There is going to be a third voice in this country’

From the outset of his campaign, Gary Johnson was the longest of long shots.

But in a tight race between Hillary Clinton and Donald Trump, Johnson netted several hundred thousand votes in key states.

In New Hampshire, where Trump and Clinton were only 4,000 votes apart, Johnson received 25,000 votes, based on preliminary returns.

During an election night party in New Mexico, where he served as governor from 1995 to 2003, Johnson thanked supporters.

“We have a lot to celebrate, a lot to celebrate. This is a celebration,” Johnson said.

In Michigan late Tuesday night, the race between Clinton and Trump was being decided by less than 100,000 votes, and Johnson received nearly 150,000 votes.

“There is going to be a third voice in this country” moving forward, Johnson told his supporters.

- Share via

Missouri governorship passes to Republican candidate

The previously Democratic governorship of Missouri passed into Republican hands, with Democratic State Atty. Gen. Chris Koster losing out to Eric Greitens, a onetime Navy SEAL who served in Iraq and Afghanistan.

- Share via

Republicans retain control of Senate as a conservative wave takes shape

Republicans kept control of the Senate on Tuesday, retaining the majority after Democratic challengers failed to win key elections in battleground states.

Just one Republican incumbent senator lost, in Illinois, while several others pulled through in Florida, North Carolina, Pennsylvania and Wisconsin.

The race in New Hampshire remained too close to call, and Louisiana pushed to a December runoff but it is set to remain Republican.

- Share via

Voters approve Proposition 55, which extends higher income tax rates for the wealthiest Californians

The wealthiest Californians will continue to pay higher income taxes as voters look to have approved Proposition 55.

In returns as of late Tuesday night, the measure led with more than 61% of votes counted.

“California voters have once again stood up for our children and schools in approving Proposition 55 to protect critical funding for education and keep vital services intact,” Jennifer Wonnacott, spokeswoman for Yes on 55, said in a statement.

Proposition 55’s passage means that single-filers earning more than $263,000 and joint-filers making more than $526,000 will pay a 10.3% tax on their income through 2030. Those making more than $1 million will pay the highest rate of 13.3%. The nonpartisan Legislative Analyst’s Office has estimated that the higher tax rates will raise $4 billion to $9 billion a year, depending on the economy and stock market.

Voter approval of Proposition 55 continues the state’s reliance on the wealthiest Californians to fund a significant amount of services. The richest 1.5% of taxpayers paid $33.9 billion in income tax revenues last year, a substantial portion of the day-to-day operating budget.

The higher tax rates were first implemented in 2012 when voters approved Proposition 30 during a time of severe budget crisis. Under the measure, those rates were set to expire in 2018.

Since Proposition 30 passed, the state’s revenues have improved dramatically, but Gov. Jerry Brown warned of future deficits unless Proposition 55 was approved.

- Share via

Pat Toomey holds on to his Senate seat in Pennsylvania

Pennsylvania Sen. Pat Toomey successfully beat back a challenge by Democrat Katie McGinty to claim his second term.

The Republican had fought for most of the general election against a strong Democratic headwind in the state, as many of the moderate voters who determine Pennsylvania elections sided with Hillary Clinton and McGinty.

Seeking not to further alienate them, Toomey throughout the race declined to say whether he would vote for his fellow Republican Donald Trump, instead lamenting the choice facing voters in the presidential race.

He and allies, including a conservative super PAC, also leveled a fusillade of advertising at McGinty critical of taxes she had advocated as an aide to Democratic politicians.

One of his most controversial moves came at the end of the campaign, when Toomey, who had regularly criticized President Obama, launched an ad featuring positive statements that Obama had made about his actions on a failed measure to expand background checks.

The ad prompted a rare rebuke from the president, who said Toomey, 54, was trying to “have it both ways by telling different people what he thinks they want to hear.”

- Share via

California passes Proposition 52 to make Medi-Cal funding program permanent

Californians have chosen to make permanent the hospital fee program that helps fund Medi-Cal, the state’s subsidized healthcare program for low-income residents.

Early election returns show the measure passing with more than 70% of the vote. Proposition 52 will hobble state lawmakers’ ability to change or end the hospital fee program.

Through the program, hospitals pay to generate a federal contribution to Medi-Cal that results in a net benefit to the hospitals. During the fiscal year that ended in June 2016, the program generated $4.4 billion in federal funding for Medi-Cal.

The Legislature first authorized the program in 2009. Now, changes to the program will require voter approval or a two-thirds majority vote by state lawmakers.

- Share via

How did the weakened Voting Rights Act impact election results?

How did the newly weakened Voting Rights Act impact election results?

In short, it’s very hard to know yet.

Tuesday election was the first since a monumental Supreme Court ruling in 2013 struck down key part of Voting Rights Act, leading to sweeping changes in voting rules across a swath of Southern states and several other districts or states that had historically discriminated against minorities.

Those changes included new voter ID requirements, as well as closing or changing locations of hundreds and likely thousands of polling sites, shifts that used to require federal approval.

Studies and some court rulings have said that ID laws have disproportionately impacted racial minorities, a group that tends to vote Democratic.

The Supreme Court ruled over the summer that new North Carolina voting rules targeted black Americans with “almost surgical precision.”

A preliminary report from the nonpartisan Election Protection Coalition said voters faced numerous obstacles on Tuesday, including incorrect enforcement of voter ID laws.

The group said it logged 35,000 complaints from round the country for alleged voter intimidation, long lines and other problems.

But voting experts say that doesn’t necessarily mean -- at least not yet -- that the new ID rules and other changes affected election results.

The reason: it’s impossible to know who or how many people didn’t vote because of new voting restrictions, and it’s also difficult to say how they might have voted.

“It’s difficult to make a direct link between the results that we’re seeing so far and the Voting Rights Act,” said Nicole Austin-Hillery, director of the Washington, D.C. office of the Brennan Center for Justice. Austin-Hillery said she was concerned that voter ID rules may have had a “chilling effect on voters” showing up at the polls.

On the presidential level, the Southern states that made up the largest area impacted by changes to the Voting Rights Act are states that have voted Republican for decades.

Still, civil rights groups said Tuesday’s election showed why it was necessary to fully reinstate the Voting Rights Act.

“We will learn more in the coming days about the specifics of the challenges faced by voters around the country, but we already know the truth: The Voting Rights Act is vital and necessary to protect our elections,” said Sherrilyn Ifill, president of the NAACP Legal Defense and Educational Fund, Inc.

“Voters were confused because of changes to their polling places and a lack of accurate information provided to them by their state officials,” she said in a statement.

“In jurisdictions formerly covered by the Voting Rights Act, voters saw 868 polling places closed, forcing too many people to travel as far as 25 miles just to be able to vote,” said Ifill, who monitored voting sites in Alabama, where new ID laws were used.

This year “should go down in history as the only presidential election of the modern era without the full protections of the Voting Rights Act,” she added.

- Share via

How the USC/L.A. Times poll saw what other surveys missed

For most of the last four months, the USC/L.A. Times Daybreak tracking poll has been the great outlier of the 2016 campaign -- consistently showing a better result for Donald Trump than other surveys did.

In light of Tuesday’s election returns, the poll now looks like the only major survey to see the wave coming.

Most of the summer and fall, the poll’s results have been about 6 percentage points more favorable to the Republican than the polling averages. As of Tuesday morning, the poll’s final forecast for the election showed Trump leading by a little over 3 points, 46.8% to 43.6%.

The poll’s findings caused dismay — even outrage — among some readers, especially Democrats, who have denounced it and often criticized The Times for running it.

- Share via

Garcetti ‘optimistic’ about passage of L.A. Metro tax measure

An ambitious measure to raise the Los Angeles County sales tax and dramatically expand the mass transit system took an early lead Tuesday night in early and absentee voting, just passing the two-thirds threshold needed for victory with 9% of precincts reporting.

The early tally showed 67.28% of voters favored the half-cent sales tax increase. That’s above the 66.67% threshold it needs to win.

“I’m superstitious. I don’t ever declare victory until the end,” said Los Angeles Mayor Eric Garcetti. But, he added, early results looked “very promising.”

Metropolitan Transportation Authority board member Jackie Dupont-Walker, the agency’s only voting director who is not an elected official, said she was hopeful that the measure would pass.

“I’m feeling good,” she said, adding that she had spent the last few days criss-crossing the county, talking to transit riders along the Expo Line and the Silver Line busway.

But the early returns went essentially unnoticed at the initiative’s downtown victory party.

About 100 transit advocates, politicians and public employees gathered at the Farmers and Merchant Bank event space, holding cocktails in plastic cups and staring at CNN on a large projection screen, watching the results come in for the presidential race.

Garcetti spoke optimistically also about Measure HHH, an ambitious measure to tackle the homeless problem in Los Angeles.

“People said here, solve the problems that we face every day,” Garcetti said, referring to both Measure M and Measure HHH, the proposed $1.2-billion bond to build housing for L.A.’s homeless. “That’s a very strong message coming from Los Angeles and coming from the West Coast.”

- Share via

When reality sets in

Hillary Clinton had been leading all along. Or that’s what the polls said for months, and thus what the poll-tracking sites said for months. That’s part of the story of tonight: the mood of mild certainty that had rippled through Clinton supporters’ friend circles and their Facebook feeds. It had given Democrats the deceptive feeling of a tailwind as they glided out of the final years of the Obama administration. That’s all gone now.

- Share via

What’s going on in America? Here’s an update

The L.A. Times’ Mark Barabak and Michelle Maltais catch you up on the latest election results.

- Share via

A look back at the career of Joe Arpaio, ‘America’s toughest sheriff’

The path he started on years ago led Joe Arpaio to a red-lit stage in July, his hand outstretched as thousands cheered “Trump! Trump! Trump!”

Never before had a presidential candidate so embraced the man who calls himself “America’s Toughest Sheriff,” a founding father of the strong-borders movement whose hardened views on immigration seemed to square up perfectly with those of the Republican nominee. Donald Trump gave Arpaio a full five minutes in front of the Republican National Committee.

It marked what probably was the last major national appearance of Arpaio’s political career.

- Share via

Proposition 51, the $9-billion school bond, leads in early returns

Proposition 51, a $9-billion bond for school construction and repairs, has a lead in early returns.

The measure leads with 52.4% of the statewide vote. Proposition 51 had struggled in public polls throughout the fall. It never trailed, but hadn’t reached majority support. The state’s four most recent school bond measures passed, and school bonds in general tend to see strong support.

- Share via

Rep. David Valadao wins a third term, beating son of labor rights icon Dolores Huerta

Rep. David Valadao won a third term representing the Central Valley’s 21st District, holding 58.3% of the vote with nearly two-thirds counted.

The race between the Hanford Republican and Democratic attorney Emilio Huerta, the son of labor rights icon Dolores Huerta, was one of the more closely watched in the state.

Democrats hoped Huerta’s name recognition would turn the tide and that the district’s nearly 75% Latino population would be spurred to vote by Republican presidential nominee Donald Trump’s comments about Mexicans and immigrants.

But Valadao announced in June that he could not support Trump because of his rhetoric and would not back Democrat Hillary Clinton either. He was able to keep the race focused on local issues, particularly the agricultural area’s water needs, a topic he’s focused on in his first two terms.

The district covers a vast stretch of the Central Valley from Bakersfield north into Kettleman City and Wood Ranch.

Valadao is known in Washington for repeatedly pushing water legislation focused on funneling more water to San Joaquin Valley growers by reducing the amount used to support endangered fish populations.

Democrats and environmental groups say the plan would override federal legal protections for salmon, migratory birds and other fish and wildlife. California’s U.S. senators and Bay Area House Democrats oppose the plan, which has passed the House a number of times but hasn’t moved in the Senate.

- Share via

California will bring back bilingual education as Proposition 58 cruises to victory

Public schools in California will have more power to develop their own bilingual and multilingual programs after voters on Tuesday approved a measure repealing English-only instruction across the state.

With nearly 21% of 24,849 precincts reporting, Proposition 58 appeared to coast to victory, with 73% support among voters. Twenty-seven percent of voters sought to defeat it.

Proposition 58, the product of 2014 legislation written by Ricardo Lara (D-Bell Gardens), overhauls key parts of a 1998 law that requires students to take classes taught only English, unless parents sign a waiver requesting otherwise.

But it preserves a portion of the statute mandating that all students become proficient in English, no matter what program they choose.

Supporters of the measure lauded its approval, saying the bureaucratic red tape around multilingual education is harmful to students in a global economy, where the most sought-after employees speak more than one language.

But opponents of the measure, most notably Silicon Valley multimillionaire Ron Unz, who wrote the original English-only Proposition 227, have said the new law would be a return to the problems of the past, when bilingual programs were failing to teach Spanish-speaking students English.

The vote comes as less than 5% of California public schools now offer multilingual programs, though there are now 1.4 million English learners — about 80% of whom speak only Spanish.

- Share via

Despair at Clinton’s election party in West Hollywood

- Share via

Burbank airport terminal replacement measure leading in early mail-in votes

A measure to allow the replacement of the aging, cramped and seismically deficient Hollywood Burbank airport was dominating in early vote-by-mail ballots counted Tuesday.

The early “yes” vote clocked in at 75.78% of the vote. But no ballots cast at Tuesday’s polls had yet been counted.

If approved by a majority of voters, Measure B will permit the construction of a 14-gate replacement terminal at what was formerly known as Bob Hope Airport in a plan supported by both airport officials and a majority of the Burbank city council.

Opened 86 years ago, the Burbank airport terminal is considered outdated and obsolete, so close to the runway it does not meet federal design safety standards. It also is vulnerable to heavy damage in a major earthquake.