Court Halts Suits Against 3rd Parties in Stock Fraud

- Share via

WASHINGTON — The Supreme Court, overturning nearly a half-century of legal precedents, ruled Tuesday that defrauded investors may not sue lawyers, accountants, bankers and other third parties who “aided and abetted” a stock scheme.

The 5-4 decision reinterprets the landmark Securities Exchange Act of 1934 to limit liability to those who directly perpetrated a fraud.

The surprise decision, unless reversed by Congress, will make it virtually impossible in many instances for defrauded investors to recover significant sums of money when they have been cheated by a deceptive investment scheme.

Typically, the crooked promoter of the investment is penniless, having spent or squandered the funds gained through fraud. For example, California investors won a $1.5-billion judgment against former savings and loan mogul Charles H. Keating Jr., but it was uncollectible because he had no money left.

The financial recoveries have usually been obtained by lawsuits against others who have deep pockets, most often lawyers and accountants hired by the perpetrator of the fraud.

“This is a very dark day. It means untold thousands of investors in cases around the country will lose their day in court,” said Joseph Cotchett, a San Francisco lawyer who was the lead counsel for a class-action suit on behalf of 23,000 California investors who purchased the bonds fraudulently sold by Keating’s American Continental Corp.

The investors received $260 million from lawyers, accountants, appraisers and others who worked as advisers to Keating. Although those settlements are not affected by Tuesday’s decision, the Supreme Court ruling would make it almost impossible to effectively pursue future cases in federal court, Cotchett said. Neither plaintiffs’ nor defense lawyers believe that the decision will end most pending litigation, though it will likely cause numerous cases on appeal to be sent back to lower courts.

Lawyers will have to sort out case-by-case whether professionals participated in frauds and are still liable or whether they will be dropped from pending suits because they were so-called secondary wrongdoers as aiders and abettors under federal law.

This is the second time in two years that the high court has moved to shield accountants, lawyers and investment bankers from damage verdicts in cases of massive fraud.

Last year, on a 7-2 vote, the high court said defrauded investors cannot bring a civil anti-racketeering suit against outside advisers on the theory that the Racketeer Influenced and Corrupt Organization Act, known as RICO, applies only to people who are involved in the “operation or management” of a fraudulent enterprise.

Still, most securities fraud claims are filed under the Securities Exchange Act. In the wake of the stock market crash of 1929, Congress made it unlawful “for any person, directly or indirectly . . . to use or employ, in connection with the purchase or sale of any security . . . any manipulative or deceptive device,” such as a misleading stock offering.

Private investors were given the right to sue to seek monetary recoveries. Without further guidance from Congress, securities law has been developed almost entirely in the lower federal courts.

In decisions dating from the mid-1940s, judges have upheld private lawsuits against not only the principal parties in a failed investment scheme, but also those who aided and abetted the schemes. For example, an accountant who endorsed a misleading prospectus or an appraiser who put a phony value on property could be sued.

Then, judges said it was important to demand that all those who knowingly participated in a fraudulent scheme join in paying damages to those who were cheated.

This wide-net approach to securities law gained public attention in the late 1980s when hundreds of lawsuits were filed against lawyers, accountants and bankers after the collapse of the savings-and-loan industry. Plaintiffs said these white-collar professionals played key roles in the failure of the institutions and should pay for the losses they caused.

But the leaders of accounting and law firms decried this “explosion” of litigation. They said they should not be handed a “virtually limitless liability” simply because they have deep pockets.

Apparently, their complaints found a sympathetic ear at the high court. Last year, after squelching the civil RICO suits against accountants and lawyers, the justices agreed to hear an obscure case involving $15 million in housing bonds sold by a Denver bank.

Rather than rule on the issue raised in the appeal, the justices said they wanted to consider whether the 1934 law creates “an implied private right to action for aiding and abetting violations,” as everyone had assumed for decades. The answer Tuesday was “No.”

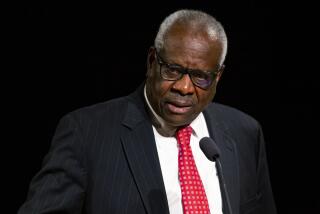

Justice Anthony M. Kennedy said it covers only those who engage in manipulation or deception, not those who “aid” or “abet” their efforts. Chief Justice William H. Rehnquist and Justices Sandra Day O’Connor, Antonin Scalia and Clarence Thomas joined the opinion in Central Bank of Denver vs. First Interstate Bank.

In dissent, Justice John Paul Stevens faulted the majority for conservative “activism” by first rewriting an appeal and then using it to overturn decades of settled law. “We should leave it to Congress to alter” the law if legislators disagree with the prevailing legal standard, he said.

Not surprisingly, Tuesday’s decision was welcomed by the securities industry and the accounting profession.

Investors “will have their day in court, but they will have to sue wrongdoers, not simply people who have insurers or a large bank account,” said Theodore B. Olson, who represents the Securities Industry Assn. “Many times the accountants or underwriters are named in the suits when they really did not engage in the practice. But they are listed simply because they are the deep pockets.”

The American Institute of Certified Public Accountants applauded the ruling as “important progress in curbing abuses of the federal securities laws.”

Lawyers who represent defrauded investors say they will be able to seek damages from accountants and lawyers only if they can show they played a principal role in the scheme.

“In some cases, they are the primary violators. But this is a major change in the law. It adds a real hurdle,” said Jonathan Cuneo, general counsel for the National Assn. of Securities and Commercial Law Attorneys.

“This creates the need for Congress to strengthen the law to protect investors,” he added.

Times staff writer James S. Granelli in Orange County contributed to this story.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.