Chinese stocks surge, halting severe drop for at least one day

<p>China is a long way from Greece and the high-profile debt troubles of the Eurozone, but its stocks have been taking a far worse beating in recent days. But these problems aren’t a surprise to some people.</p>

- Share via

Chinese share prices soared Thursday, temporarily halting a huge drop in China’s stock market over the last month that’s raised concern about the outlook for the world’s second-largest economy and the spillover effect on global markets.

Sign up for our free weekly business newsletter >>

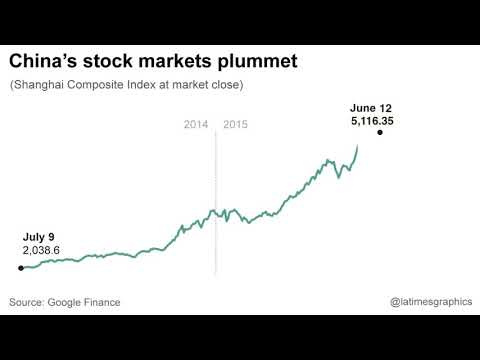

The benchmark Shanghai Composite Index jumped 202.13 points, or 5.8%, to 3,709.33 for its biggest one-day gain in six years. But the index is still down 28.2% from a record high it reached June 12.

As the world focused on Greece’s debt woes in recent weeks, the rout in the Chinese stock market caught some by surprise. In hindsight, though, a reversal was not unexpected given the astonishing run-up in Chinese share prices.

Here’s a guide to understanding the sell-off and its possible impact:

Why did prices suddenly soar Thursday?

It appeared that emergency steps taken recently by China’s government were gaining some traction. Among other moves, Beijing halted some selling by big shareholders, eased loan restrictions for stock buying and attempted to crack down on short selling, where traders try to profit from falling prices.

But it will take more than one day’s trading to see if the steps are indeed effective and there’s a more bullish mood in China.

Just how bad was China’s market turmoil?

It’s been severe. Before Thursday’s rebound, the Shanghai index had plunged 32% from its June 12 record, meaning nearly one-third of the market’s total value had been wiped out. And many stocks simply didn’t trade due to a lack of buyers. Market volatility isn’t new in China, but this decline has been pronounced.

What led up to the collapse?

China’s stock market displayed many of the signs that it had reached a speculative “bubble.” A year ago, the Shanghai index stood at 2,038.61. It then more than doubled over the next 12 months, reaching its record close of 5,166.35 on June 12.

Stocks kept rising despite a number of red flags, including a slowdown in China’s economy and the fact that share prices had become exceptionally rich compared with many of their companies’ underlying earnings.

One reason: A growing number of working-class Chinese families bought stocks to cash in on the rally and often did so by buying on margin, a term for borrowing money and using the stocks as collateral.

Has the drop affected other markets?

It has rattled some stock exchanges elsewhere, mostly in Hong Kong and other Asian markets, but seems to have had a limited effect on U.S. stock markets so far. Wall Street’s benchmark Standard & Poor’s 500 index is down about 1% in the last month.

China’s sell-off has been felt in commodities and other markets. Crude oil prices had tumbled $10 a barrel in the last month, to about $51.50, partly amid growing concern that China’s stock-market woes will further dampen Chinese demand for oil.

But as China’s stock market rebounded Thursday, so did crude-oil prices, with light, sweet crude gaining 2.5% to about $53 a barrel on the New York Mercantile Exchange.

Analysts also fret that China’s economic engine could sputter further, causing problems generally for economies around the globe and specifically for U.S. exports to China. Foreign investors also might shy away from Chinese stocks for an extended period if share prices don’t recover.

Twitter: @PeltzLATimes

ALSO:

NYSE: Trading halt wasn’t caused by cyberattack

United blames travel-snarling system outage on router problem

With Fed poised to act, here’s how investors can prepare for higher rates

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.