When will coronavirus stimulus payments arrive? A primer on the federal relief plan

- Share via

Almost three weeks after the $2-trillion stimulus package authorized by the Coronavirus Aid, Relief, and Economic Security Act was signed into law, Americans are starting to receive stimulus payments that Congress hopes will energize the economy amid the COVID-19 pandemic.

On Saturday, the IRS announced in a tweet that the process of distributing the $1,200 checks had begun.

“The idea is if the economy is down, people don’t have as much money in their pockets. They’re very likely to spend that [stimulus check] money instead of saving it, so that money is going to help the economy,” said Till Von Wachter, a professor of economics and faculty director of the California Policy Lab at UCLA.

The new IRS site will let you check the status of your coronavirus stimulus payment and provide bank account details to receive faster payment.

“The hope is it is not only good for workers and families who may have extra expenses during this crisis, but it may also help to stimulate the economy by increasing demand.”

Before people can spend that money, however, it has to actually arrive in their bank accounts, and many have been wondering whether they will qualify for the aid package, how much money they might receive, and what steps they need to take to ensure their payments will be processed.

Here is a primer on how the stimulus checks will work, and whether you need to do anything to receive one.

When will my payment arrive?

According to an online post from Michigan Democratic Congresswoman Debbie Dingell, the IRS will make its first round of payments beginning this week to people who filed their 2018 or 2019 tax returns with direct deposit information. About 60 million checks are expected to be included in this wave.

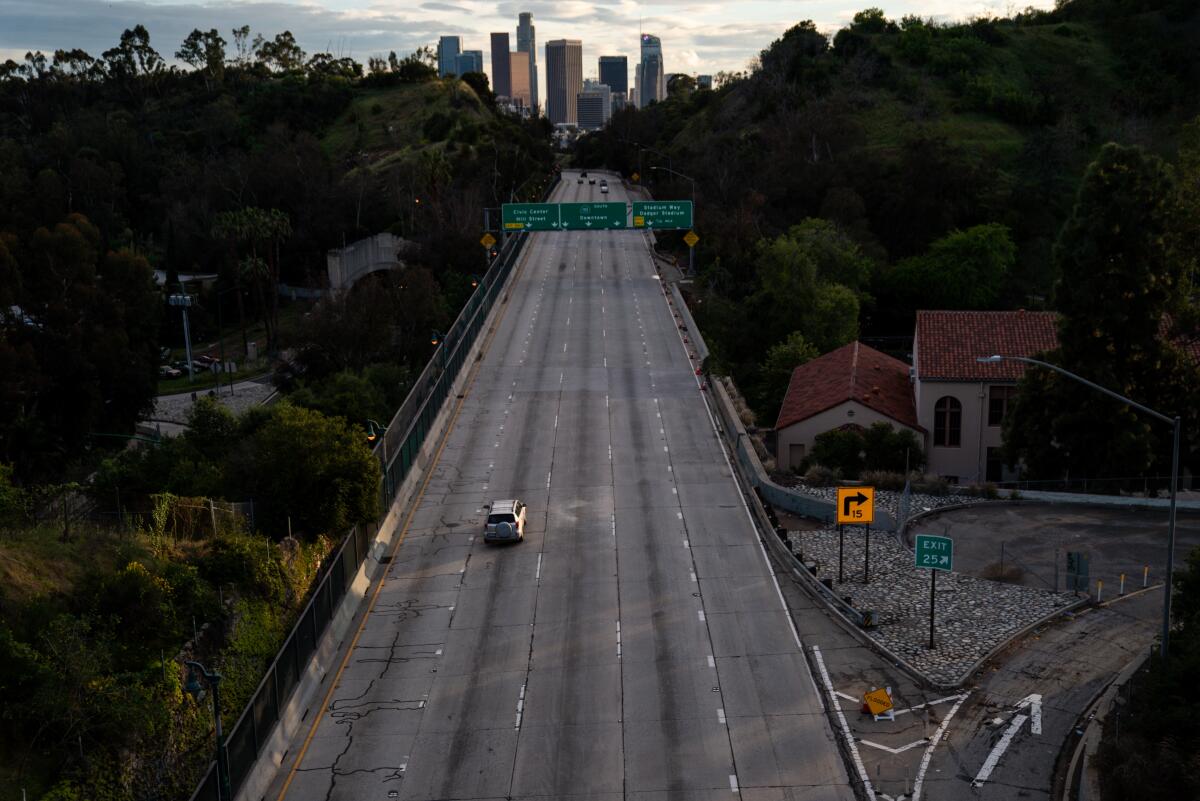

These are some of the unusual new scenes across the Southland during the coronavirus outbreak.

After that, a second round of payments will be made — “hopefully within 10 days,” Dingell wrote — to Social Security recipients who did not file tax returns but provided direct deposit information in their other benefits forms, which Dingell said should cover nearly 99% of Social Security beneficiaries.

A third round of payments will begin the first week of May, when the IRS will start mailing paper checks to those for whom the government does not have direct deposit information. Dingell said the checks would be mailed “in reverse adjusted gross income order — starting with people with the lowest income first.” Reportedly 5 million paper checks will be issued each week.

Also, there is still time for those who haven’t yet filed their taxes or who typically don’t have to. The IRS economic impact payments will remain available throughout 2020.

Am I eligible, and how much money will I receive?

According to the IRS, you must be a U.S. resident with a work-eligible Social Security number to receive the $1,200 payment (or $2,400 to married couples who file joint tax returns).

Full payments are distributed to those with an adjusted gross income of up to:

- $75,000 for individuals.

- $112,500 for head of household tax filers.

- $150,000 for married couples who file their taxes together.

A reduced payment of varying amounts will be distributed to those with an adjusted gross income between:

- $75,000 and $99,000 for individuals or married couples who file their taxes separately.

- $112,500 and $136,500 for head of household filers.

- $150,000 and $198,000 for married couples who file their taxes together.

Anyone who exceeds those upper limits will not be eligible. Also, anyone who was claimed as a dependent on someone’s return — i.e. children, students, older dependents — is not eligible either.

A detailed list of eligible recipients can be found on the IRS website.

For recipients in the “reduced payment” group, the payment will be reduced by $5 for each $100 of adjusted gross income they report above the $75,000, $112,500 and $150,000 thresholds, according to the IRS website. For example, if an individual has an adjusted gross income of $85,000, their stimulus check will be $700.

Here’s how to file for unemployment benefits if you’ve lost work because of the coronavirus outbreak. Read this explainer for eligibility requirements and how the program works.

Do I need to do anything to receive a check?

For most people, no. The IRS is determining eligible recipients through 2019 federal tax returns. For people who have not yet filed their 2019 taxes, the government will look at their 2018 returns instead.

From there, the stimulus checks will be automatically deposited into the same bank accounts used on the filed return. Once a payment is made, the IRS will also mail a letter of notice to the taxpayer’s last known address within 15 days.

If your bank account information has changed since your last tax filing, you can give the IRS your updated banking information online.

People for whom the IRS does not have bank account information will be mailed paper checks to the address used on their tax return.

What if I’m on Social Security or don’t file annual taxes?

Some people, such as Social Security recipients or those with little or no income, aren’t required to fill out annual tax returns. In those cases, the IRS is using other methods to determine eligible recipients and issue payments.

Most won’t have to do anything extra. For people who are already receiving Social Security retirement benefits, Social Security Disability Insurance benefits, or Railroad Retirement and Survivor Benefits, the IRS will use whatever bank account or address was included in those forms to issue the new $1,200 payment.

However, people who haven’t filed taxes in 2018 or 2019 and are also not on Social Security will have to do some work. Last week, the IRS set up a non-filers application (which can be accessed here) to ensure information from that segment of the population is collected and used to distribute the stimulus checks.

If you have extra food, here’s how you can help local food banks or pantries. If you are struggling to buy food, this guide has information for you.

What if I have kids?

If a person is eligible for a stimulus check, they will also receive an additional $500 for each of their qualifying children under the age of 17. For children with divorced or unmarried parents, the additional $500 payment will be sent to the parent who claimed the child as a dependent on their 2019 tax return.

These rules have seemingly excluded most of one group from receiving payments: older high school and college students who still count as dependents of their parents. For normal filing tax returns, parents can claim their children as a dependent if they are under 19 years old or a student who is under the age of 24. But under the CARES Act, any dependents between 17 and 24 are too old to qualify for the $500 payment.

Is this a one-time payment?

For now, yes. If there is to be another wave of similar economic relief payments, Congress will have to pass new legislation.

Whether direct stimulus checks would be included again is unclear. According to Von Wachter, the CARES Act addresses many short-term needs through expanded unemployment benefits and loan programs for small businesses in addition to the stimulus checks.

But if the economy continues to struggle for an extended period, “a Phase 2 might involve a bit more belt-tightening,” Von Wachter said, and require different actions from the government.

Is my stimulus check taxable? Will I have to pay it back?

Some good news here: No, it does not count as taxable income. And you do not have to pay it back — those online rumors are false. It’s simply a bit of extra money at a time most people can use it.

Trying to get a handle on how California is reopening and what it means for you? Our guide includes updates and tips for remaining healthy and sane.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.