Spanish-speaking audiences are a huge streaming market. Do media companies understand it?

- Share via

This is the May 4, 2021, edition of The Wide Shot, a weekly newsletter about everything happening in the business of entertainment. Sign up here to get it in your inbox.

Media executives often extol the importance of reaching Spanish-language audiences, and if a flurry of recent investments and deals is any indication, Latino and Hispanic viewers are becoming a key part of the streaming wars.

For the record:

7:27 a.m. May 5, 2021An earlier version of this article said Univision acquired Grupo Televisa. Univision acquired Televisa’s content assets.

Netflix spent $200 million to produce content in Mexico last year, an amount expected to increase in 2021, and has also invested significantly in Spain. Disney, which launched Disney+ in Latin America in November, has said it plans to make 70 original programs for the region. WarnerMedia will be investing heavily in Latin American markets with HBO Max.

Univision in March launched PrendeTV, a free, ad-supported streaming service for the U.S. Hispanic market. Last month, Univision acquired Grupo Televisa’s content and media assets, which were valued at $4.8 billion, in a move to create a Spanish-language supergiant as competition ramps up.

On a smaller scale, Hemisphere Media Group sees a growth opportunity in its Los Angeles-based streaming service Pantaya, which focuses on Spanish-speakers in the U.S. and has about 900,000 subscribers. Miami-based Hemisphere in April paid Lionsgate $124 million for the 75% of Pantaya it did not already own, with the aim of growing it by investing in content.

“There’s so much more we can do, and the opportunity is so much greater,” Hemisphere CEO Alan Sokol told me. “We’ve set a stated goal of 2.5 to 3 million subscribers by 2025. But honestly we feel that’s a conservative goal and that the opportunity is two to three times that.”

It’s easy to see why streamers and studios see a gold mine. Latinos consistently accounted for a disproportionate amount of moviegoing before the pandemic, yet they are severely underrepresented onscreen and behind the camera, including at Netflix, as my colleague Fidel Martinez has written in his newsletter, the Latinx Files. (You can subscribe here.) In the U.S., the Latino and Hispanic population continues to grow, surging past 60 million in 2019.

And high-quality Spanish-language movies and shows have proved they can cross over with English-speaking audiences and other populations. The crime series “Money Heist” earned a modest audience when it originally ran on Spanish TV, said creator Álex Pina, but once it went global through Netflix its viewership exploded, with its themes and characters’ Dalí mask iconography resonating everywhere from Argentina to Saudi Arabia.

Pina still sees the show’s international success as a bit of a mystery, but theorizes that the idea of conveying a popular genre — the perfect heist — through a specific cultural lens gave the material a new spin.

“These days, viewers often feel that series repeat themselves,” he said in an email. “‘This crime scene rings a bell, I’ve seen it elsewhere. And that police officer looks familiar as well.’ It becomes complicated to create brand new characters, so our Latino gaze, as applied on our fiction, has also added some freshness for other cultures.”

The show’s fifth and final season hits Netflix this year. Pina’s success led to the March launch of Netflix’s “Sky Rojo,” a pulpy action series he co-created about three prostitutes who flee their pimp.

The interest of the big streaming companies in international markets has been a boon for Latino and Hispanic audiences that for years have been left with what entertainment industry consultant Santiago Pozo calls “the scraps” of the film and TV business.

“The streamers have provided freedom for Hispanic creators,” said Pozo, who sold his Hispanic film marketing business Arenas Group last year. “Now you don’t have to create something that fits the model of Televisa.”

Still, companies face challenges when creating streaming services and content for Latino and Hispanic markets. The U.S. Hispanic “market,” for example, is really a fragmented set of audiences, including Cuban Americans in Miami and Mexican Americans in Los Angeles, that encompass a multitude of cultural touchstones and sensibilities.

Pantaya — a play on the Spanish word for “screen” — is an interesting case study. The service, which courts U.S. audiences for whom Spanish is their primary language, has content deals with the major studios in Mexico and has had some success with originals, such as the sexually provocative dramedy series “El Juego de las Llaves,” which gets its second season this fall.

Yet the streaming service, which had $46 million in revenue last year, hasn’t reached huge subscriber numbers. Its target market of “unacculturated/bi-cultural adults” is estimated at 39 million people, yet only 40% of them are even aware of the service, according to the firm’s slide show, a stat that represents both “a problem and an opportunity,” according to Sokol.

But is the big-budget Spanish-language content on Netflix and other streamers, plus all the dubbed and subtitled shows that are available, more appealing to the people Pantaya wants to reach?

Despite the challenges, Sokol sees the company’s experience with content specifically for U.S. Spanish speakers as an advantage. “Netflix has a much bigger checkbook than we do, but we are very focused on what we do,” Sokol said. “We have a much deeper pool of films and series than anybody else by far. I think that’s where our advantage lies.”

Stuff we wrote

— Big news from the office! After a five-month search, the Los Angeles Times has named Kevin Merida as its top editor and tasked him with transforming the paper into a digital force. Since 2015, Merida has been editor in chief of the Undefeated, the award-winning ESPN division that plumbs the intersection of race, culture and sports, writes Meg James. Plus: a Q&A with the new boss.

— After a Times investigation, the Hollywood Foreign Press Assn. vowed to make sweeping changes, but the group behind the Golden Globes has struggled to make good on its promises. Stacy Perman dives into the trouble with the HFPA’s response to external pressures following stories that pointed out its lack of Black members. The nonprofit on Monday proposed new reforms in the wake of criticism.

— Media company Nexstar launched NewsNation on the belief that people wanted an “unbiased” alternative to Fox, CNN and MSNBC. Apparently, they didn’t want that at all. And that’s not the firm’s only problem, according to Stephen Battaglio’s story.

— Will this Los Angeles alley, a little-known piece of Hollywood’s silent era history, ever get its due? “Here in this alley, which runs east to west from Cosmo Street to Cahuenga Boulevard, Charlie Chaplin’s Little Tramp first found an abandoned baby in ‘The Kid,’” writes Nita Lelyveld. “Down this alley, Buster Keaton, chased by a pack of policemen, makes his thrilling escape by grabbing one-handed onto a moving car in ‘Cops.’”

— No vax, no problem? Studios and entertainment industry unions extended to June 30 the return-to-work agreement first established last fall, reports Anousha Sakoui. The extension will not change the safety measures that the industry has adopted, including requirements regarding social distancing, the creation of safety zones and rigorous testing. Also, there are no new provisions requiring vaccinations.

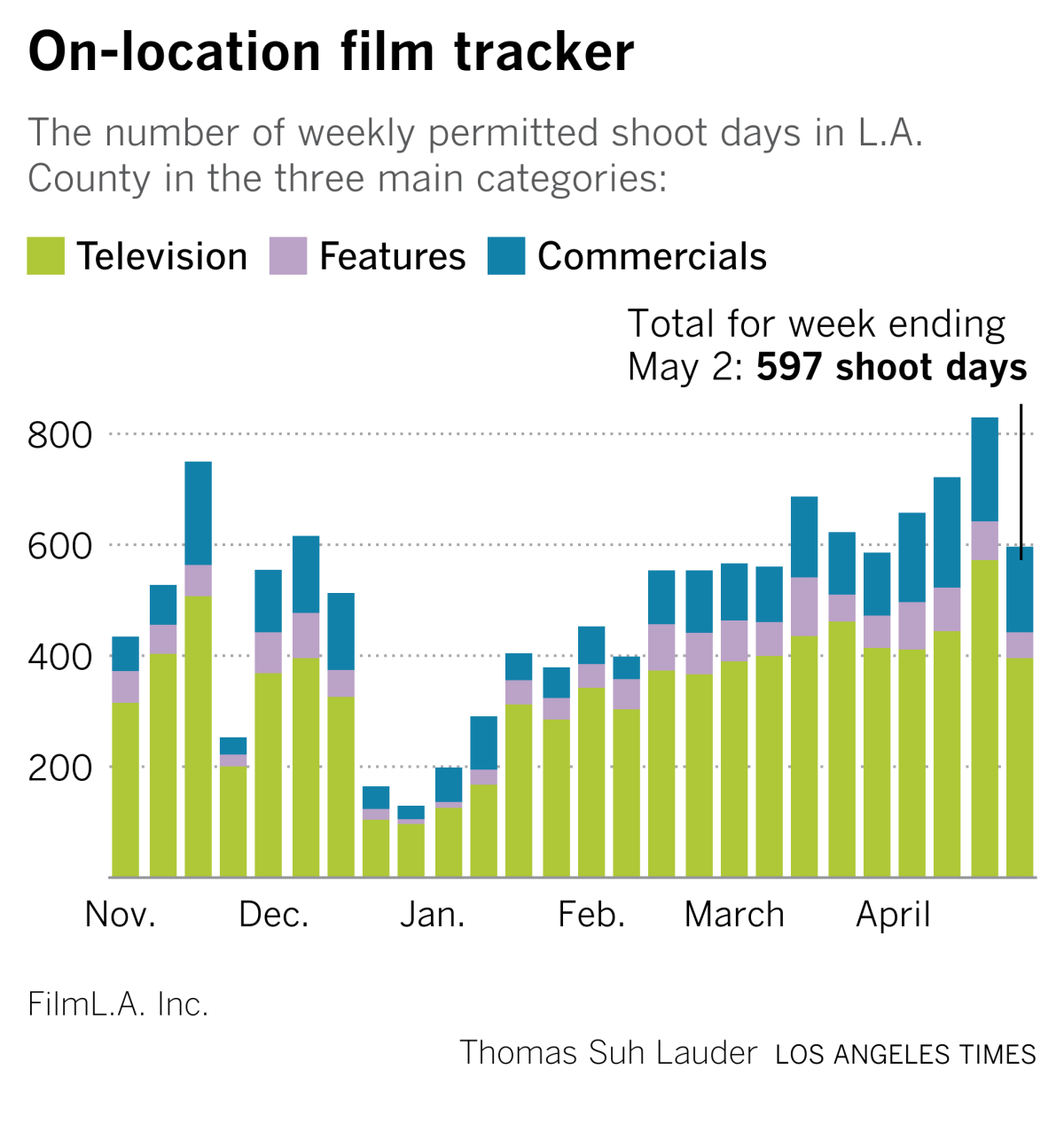

While shoot days in greater Los Angeles are up significantly since January, they declined last week, according to FilmLA data, a reminder that the industry’s recovery still has a ways to go.

Endeavor’s IPO

They finally did it. Endeavor’s stock market debut was highly anticipated, not least because it symbolized a chance at redemption for CEO Ari Emanuel after the company canceled its 2019 offering. And Round 2 for the UFC owner seemed to go fine. The stock rose 12% to $30.81 Monday, up significantly from its listing price of $24.

“We’re playing the long game,” Endeavor President Mark Shapiro told me Thursday afternoon. “This story isn’t about today, it’s about about the next couple years and us executing on our growth strategy.”

The company has $511 million in the bag from its IPO, along with $1.8 billion from private placements.

Perhaps most significantly for its future, Endeavor took full control of UFC, a cornerstone of its sports and entertainment strategy.

In 2019, UFC (plus Professional Bull Riders and Euroleague basketball) accounted for 20% of Endeavor’s revenue and 56% of adjusted earnings before interest, tax and other factors. The sports leagues accounted for an even higher percentage of sales and earnings in 2020, when other parts of the business were hobbled.

Ahead of the previous IPO attempt, investors were confused by Endeavor’s eclectic mix of assets (MMA, bull riding, talent representation). Owning all of UFC, instead of just half, should help clear things up. “We’ve got a cleaner narrative altogether,” Shapiro said.

Endeavor is making a big bet on the violent sport, despite the obvious risk of serious injury to its athletes. The league recently packed a Jacksonville, Fla., arena with 15,000 people for UFC 261. Emanuel says UFC NFTs are coming too. Risk-taking is very much on-brand.

Number of the week

Universal Music Group, the world’s largest music company, is now worth $53 billion, according to a report from Goldman Sachs, representing a 47% increase from the previous valuation of $36 billion posited in last year’s report. That’s a huge leap. So what does Goldman Sachs cite to support its assessment? The growth of streaming, of course.

“As the world’s largest music entertainment company, we see Vivendi’s UMG as a major beneficiary of the secular growth of music streaming, and improved monetization of music content through new licensing opportunities, technological innovation and regulatory changes,” reads the report by analyst Lisa Yang.

Goldman’s “Music in the Air” report is good news for French conglomerate Vivendi, UMG’s parent company, which is preparing to spin off the recorded music giant as a publicly traded entity by the end of the year.

UMG can take advantage of streaming’s growth because of its relationships with companies like Spotify and Apple Music and its robust catalog, with artists including The Weeknd, Justin Bieber and Drake. UMG accounts for 11 of the top 20 artists most played on Spotify, according to the Goldman Sachs report. The bank estimates paid streaming services will grow to 1.28 billion global subscribers in 2030, versus 443 million in 2020.

‘You’ve got sale!’

Verizon has given up on its media business, announcing Monday that it will sell AOL and Yahoo to private equity firm Apollo Global Management for $5 billion. That’s about half the combined $9 billion Verizon paid for the assets over two years beginning in 2015. The shrunken valuation isn’t much of a surprise. Verizon wrote down the value of the media units by half in 2018.

Verizon will retain a 10% stake in the properties, which will be rebranded as Yahoo.

Though Verizon CEO Hans Vestberg hailed the deal as “an incredible milestone for the Verizon Media team,” the sale marks an inauspicious end to the mobile firm’s media foray as it chooses to instead focus on its 5G network. There were growing signs that Verizon’s interest in being a media conglomerate was waning. Over the last several years, it shuttered go90, sold off Tumblr and, more recently, unloaded HuffPost to BuzzFeed.

It’s not the first time a company has tried to combine media with technology and hardware. Comcast and AT&T are making much more ambitious bets on the idea that controlling both content and “the pipes” would give them big advantages in their industries. Verizon clearly decided it couldn’t, or didn’t want to, compete in that space.

More stories from the web

— How is Netflix combating “decision fatigue?” Josef Adalian goes under the hood of Netflix’s Play Something feature. (Vulture)

— Spotify’s “moonshot” guy enters the spotlight with Kerry Flynn’s interview of Máuhan “M” Zonoozy, the Swedish music and podcast giant’s head of innovation. “What’s happening now is you’re collapsing the concept of linear radio into digital,” Zonoozy says. (CNN)

— The fascinating saga of inspirational online media guru Rachel Hollis. “The best-selling author and motivational speaker built a blockbuster business sharing her ‘authentic’ self. Then things got a little too real,” reads the New York Times subhead.

— Hollywood’s China problem rears its head again. Chloé Zhao’s historic best director Oscar was a cultural moment in the U.S., but her win was censored in China, her birth-country, because of long-ago comments that were critical of the country. Zhao is the director of Marvel’s “The Eternals,” which Disney surely hopes will do well in China, notes opinion writer Sonny Bunch. (WaPo)

Finally ... a shameless plug!

The Los Angeles Times has launched a new daily podcast called “The Times,” hosted by Gustavo Arellano. It’s free, so sign up to hear it on Spotify or wherever you listen to audio. I’m biased, of course, but the show has an excellent flow, and kicks off with perhaps the most essential L.A. topic, homelessness.

ONE FOR ME: French metal quartet Gojira returns with a new album, “Fortitude.” This song is going onto my running playlist immediately.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.