El Monte says councilman owes about $70,000 on loan he says he paid

- Share via

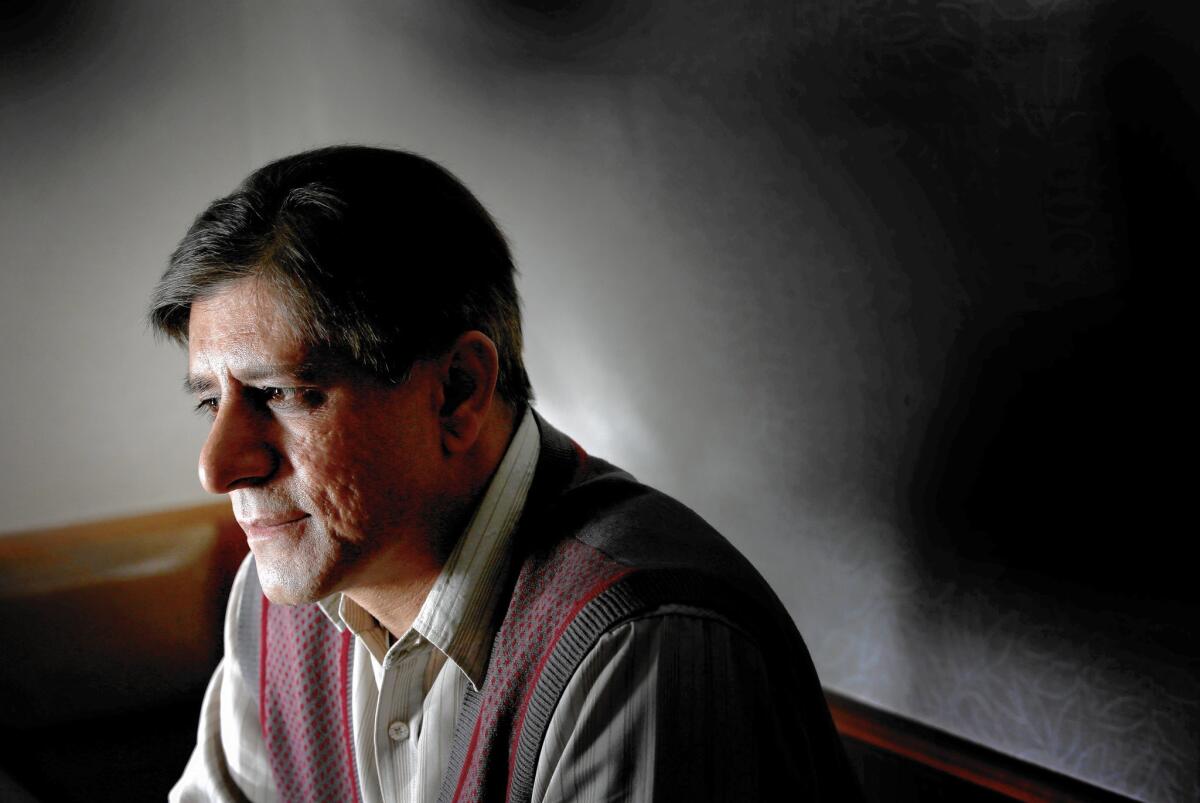

El Monte was facing budget cuts and work furloughs for employees four years ago when Bharat “Bart” Patel ran for City Council, campaigning on a platform of fiscal responsibility.

“The city’s money matters will get the same heavy scrutiny my successful business gets,” Patel, now El Monte’s mayor pro tem, said on his campaign site.

But now the city that Patel serves says the politician needs to show some fiscal responsibility and pay what he owes on a loan El Monte gave him in the mid-1990s to renovate his motel business. City officials say their records show the mayor pro tem owes about $70,000, including interest.

Patel, a certified public accountant, disputes that, saying El Monte is rife with shoddy accounting. He said he repaid the loans last August but learned in February that the mix-up had led to an inquiry by the Los Angeles County district attorney’s office.

Jane Robison, a spokeswoman for the district attorney, said the office received a complaint regarding the councilman that is under review.

“I feel like I’m being ramrodded over here,” Patel said. “This is incompetence, and now you have politics pushing the issue.”

City officials said the issue is straightforward.

“The history and details surrounding that loan are included in city documents,” El Monte City Manager Raul Godinez said in a statement. “Based on those records, the balance of the loan principal is $55,000.”

It’s not unusual for cities to provide loans. But because it involves taxpayer money, the practice can lead to financial and political headaches.

“With any loan, there’s some risk, and sometimes they can get a little complicated, a little difficult and messy,” said David Duggan, Western director for the international city-county management association. “At the end of the day, it needs to be transparent, professionally managed by staff or a bank.”

The stark disagreement between the El Monte mayor and city officials was sown back in 1995, when Patel received the first of two loans totaling $307,585 to renovate his motel at 12040 E. Garvey Ave. He secured the loans by deed of trust.

The promissory notes show he borrowed $252,585 in 1995 and $55,000 in 1996, the same year he was going to begin payments on the first loan.

But Patel ran into money problems, and by February 1997 he asked the city to amend the master loan agreement and postpone bill payments.

At the time, Patel was a new business owner and a member of the chamber of commerce, the property maintenance commission and the Planning Commission. He was also a campaign donor.

Patricia A. Wallach, who served on the council at the time, said Patel’s background didn’t play a factor in the council’s decisions.

“We thought he was being responsible and needed a little help,” Wallach said. “Obviously, we wouldn’t have done it if we thought he couldn’t pay it back.”

City residents showed up at City Hall to support a restructured payment plan for Patel.

Memos, letters, contracts and invoices show that the city spent almost a decade dealing with Patel over the two loans.

During that time, the city amended the agreement twice, created new payment arrangements and extended the billing date for the second loan while deferring interest on it.

In the last 20 years, Patel has made payments to just one of the loans — the larger, first one, according to city records. He paid off that loan last August.

But the city said that upon further examination it learned that Patel had not made payments on the $55,000 loan since 2010, when he was scheduled to begin making payments.

City officials don’t know why the account was overlooked but say the town’s fiscal crisis at the time may have played a role.

In 2009, the San Gabriel Valley suburb, with a population of 116,000, saw a decline in revenues, decreasing funds from the state and faced a deficit of $12 million.

The town lost about 30% of its workforce and contemplated bankruptcy. Three years later, it even considered a soda tax to make up for the loss of revenues.

But Patel said that’s no excuse for the city not doing a better job of keeping track of documents and financial records.

“It’s incompetence,” he said. “They take no responsibility.”

Documents provided by the city show that Patel would have to make a payment of $33,000 to be current on the loan.

In March, Patel submitted two letters with state political forms he’s required to submit each year. One letter, dated 1997, is from the city stating that the loans were consolidated into one. The second is from a firm saying a loan was paid off.

City officials say there are no records to support that the loans were consolidated. They say the two loan agreements were placed under one master agreement, which spelled out payment plans for both loans.

Meanwhile, Patel is running for reelection in November. He said he paid his debt and owes nothing.

ruben.vives@latimes.com

Twitter: @latvives

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.