This is Essential Politics, our daily look at California political and government news. Here’s what we’re watching right now:

- Former NFL player Rosey Grier has dropped out of the race for California governor

- Angered by his decision to block a bill on single-payer healthcare, a group of activists has launched an effort to recall Assembly Speaker Anthony Rendon from office.

- Rohrabacher faces hostile crowd during panel about Russia and Trump at Politicon in Pasadena

- How 2018 could be the year of the rookie in California’s pivotal congressional races

Be sure to follow us on Twitter for more, or subscribe to our free daily newsletter and the California Politics Podcast. Also don’t miss our Essential Politics page in Sunday’s California section.

- Share via

Questions over Russia, healthcare dominate Rep. Eric Swalwell’s town hall at Livermore high school

Over the shouts of a lone heckler at a packed Livermore town hall, Northern California Rep. Eric Swalwell on Saturday once more called for the creation of an independent commission to investigate Russian interference in the 2016 election.

“If we do anything, we should make sure that the 2018 election is more secure than the 2016 election,” Swalwell said, drawing a round of applause from the audience.

Roughly 500 people filled the seats at a Granada High School gym, many of whom were attending a town hall for the first time amid concerns over what they said they view as a tense and divisive political climate in Washington. The event was organized to address questions from constituents about jobs, healthcare and what Swalwell called efforts to protect democracy.

It came days after special counsel Robert S. Mueller III convened a criminal grand jury to investigate the presidential election, focusing on Donald Trump Jr.’s meeting with a Russian lawyer who promised damaging information about Hillary Clinton.

Questions over the Russia probe and GOP efforts to kill the Affordable Care Act dominated the discussion.

Swalwell, a Democrat from Dublin who serves on the House Intelligence Committee, has started a web page detailing the alleged Russian ties of Trump administration officials. He said Mueller’s investigation did not eliminate the need for an independent commission.

The congressman said there was no evidence Russian actors had changed votes. But intelligence reports had shown President Vladimir Putin influenced the election through “a multifaceted attack” that he said included hacked emails and the spread of fake news through social media trolls.

“What we know the Russians did do is that they went into a number of state election voter databases,” he said. “We don’t know why. You could speculate that they wanted to show that they could at least get in, and that it would sow discord or sow doubt when the result came out.”

The event was largely free of the protests and rambunctious tactics that have overtaken recent town halls in California. One man in the audience shouted questions at Swalwell as he spoke about Russian interference, yelling, “Get over it. He won.” But he was soon silenced by the audience.

Swalwell also fielded questions about his efforts to ease college debt and build the Future Forum, a group of young Democratic members of Congress focused on student loan debt and homeownership.

On healthcare, Swalwell called for a “Medicare for all” system, saying lawmakers needed to continue to expand access and reduce costs. Constituents quizzed him on who would pay for such a plan.

- Share via

Advocacy groups want to reverse a state housing rule they say disrupts the schooling of migrant farmworkers’ children

More than 30 community organizations and advocates are working to reverse a California state agency rule that requires migrant farmworkers to clear out of subsidized housing at the end of a growing season and move more than 50 miles away.

They say the outdated regulation from the California Department of Housing and Community Development, known as the “50-mile rule,” forces children to switch schools twice a year, causing most to fall behind and drop out. But state agency officials say support for the rule has been just as strong to regulate the limited supply of migrant farmworker housing.

The debate comes as California is struggling with a shortage of homes driving its affordability crisis, and a labor shortage in the fields that has brought new temporary guest workers to towns and cities along the state’s coastal agricultural belt.

- Share via

Inquiries about immigration status will be barred in most civil liability cases under a new California law

Gov. Jerry Brown signed a bill Monday that makes a plaintiff’s immigration status irrelevant to the issue of liability in civil cases involving consumer protection, civil rights, labor and housing laws.

Assembly Bill 1690, written by Assemblyman Mark Stone (D-Scotts Valley), prevents inquiries into a person’s immigration status in civil court, unless there is clear and convincing evidence that such a query is necessary to comply with federal immigration law.

The legislation, which was backed by the Consumer Attorneys of California, immigration rights groups and several public policy centers, was meant to clarify current state law, which states that all civil protections, rights and remedies are available under state law, except if banned by federal law.

The new bill prohibits legal inquiry into a person’s immigration status if they bring forth a claim to enforce state labor, employment, civil rights or housing laws.

Supporters pointed to federal court decisions that have found that allowing legal discovery into immigration status would deter plaintiffs from pursuing claims with a likelihood to win in court. It had no noted opposition and largely sailed through the Assembly and Senate chambers.

- Share via

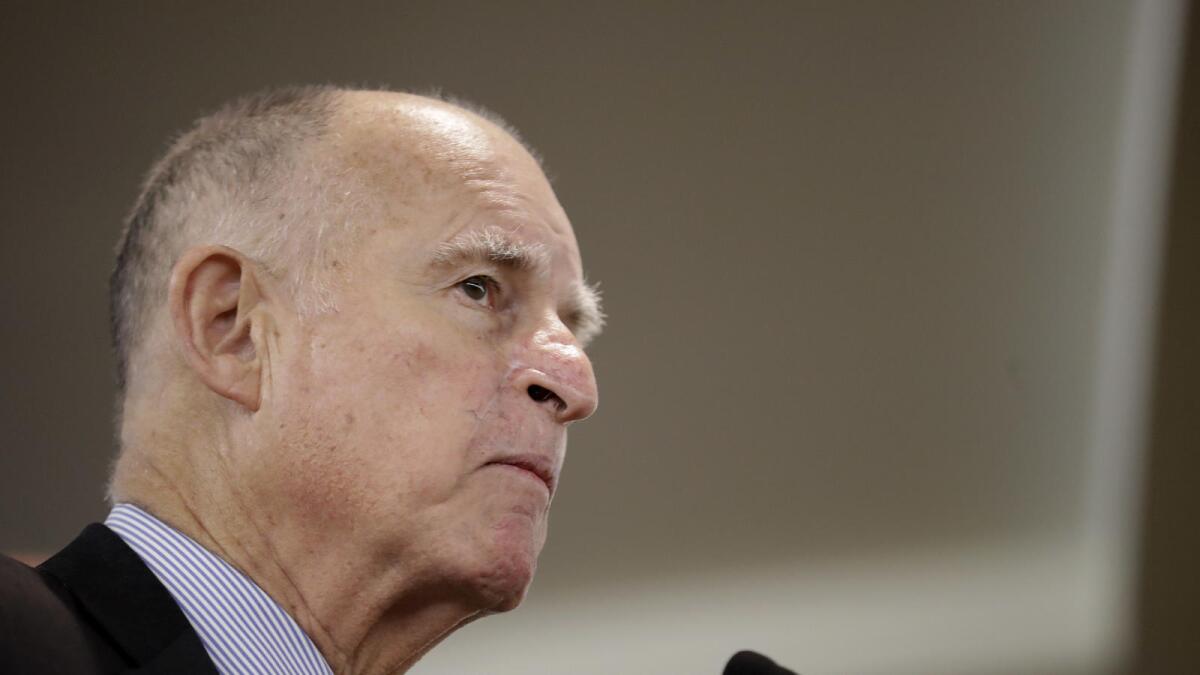

Gov. Jerry Brown vetoes a bill that would make it a crime to ‘willfully release’ helium balloons

Dozens of legislative proposals have been rejected by Gov. Jerry Brown through the years over his lament that there are too many laws, and now added to that list is the danger of high-flying helium balloons.

Brown vetoed Assembly Bill 1091 on Monday, a bill that would have made it a crime to “willfully release” balloons made of Mylar or another “electrically conductive material.”

A legislative analysis of the bill offered statistics from utility companies showing how often in recent years Mylar balloons have resulted in power outages or surges. The metallic finish on the balloons can conduct electricity. Last month, a balloon briefly knocked out power to 2,800 utility customers in Huntington Beach.

Brown’s veto message doesn’t deny that there is a problem — rather, that it’s not a problem to be solved by a state law.

“Criminal penalties are not the solution to every problem,” the governor wrote.

Brown’s rejection of the bill follows a small but noticeable trend of proposals he has vetoed for a stated belief that there might be too many laws. Even so, he has issued fewer vetoes than most any governor in modern times. In 2016, Brown vetoed only 15% of the proposals sent to his desk by the Legislature.

- Share via

Gov. Brown signs bill making it easier to create bike lanes — but not that much easier

It might sound strange that one of the main impediments for bike lanes in California is a state environmental law, but it’s true.

The California Environmental Quality Act requires new projects to take into account effects on car congestion, and doing so has stymied bike lanes up and down the state for more than a decade.

Gov. Jerry Brown on Monday signed legislation allowing cities to continue sidestepping provisions of CEQA when planning for new bike lanes or painting them on roads. But the measure, Assembly Bill 1218 from Assemblyman Jay Obernolte (R-Big Bear Lake), doesn’t do much to address the problem.

Obernolte’s bill extends for three years — until 2021 — CEQA exemptions for bike lane projects that have been on the books for the past few years. Cities have taken advantage of the exemptions only three times, according to a legislative analysis of the bill. Bicycle advocates have said the measures don’t go far enough because they still require cities to complete costly traffic studies and hold public hearings.

Instead, cyclists have pinned their hopes on forthcoming regulations changing how congestion is measured under CEQA to fix the bike lanes problem. The Brown administration began writing those regulations in 2013, but they’ve been repeatedly delayed and aren’t expected to be complete until next year.

- Share via

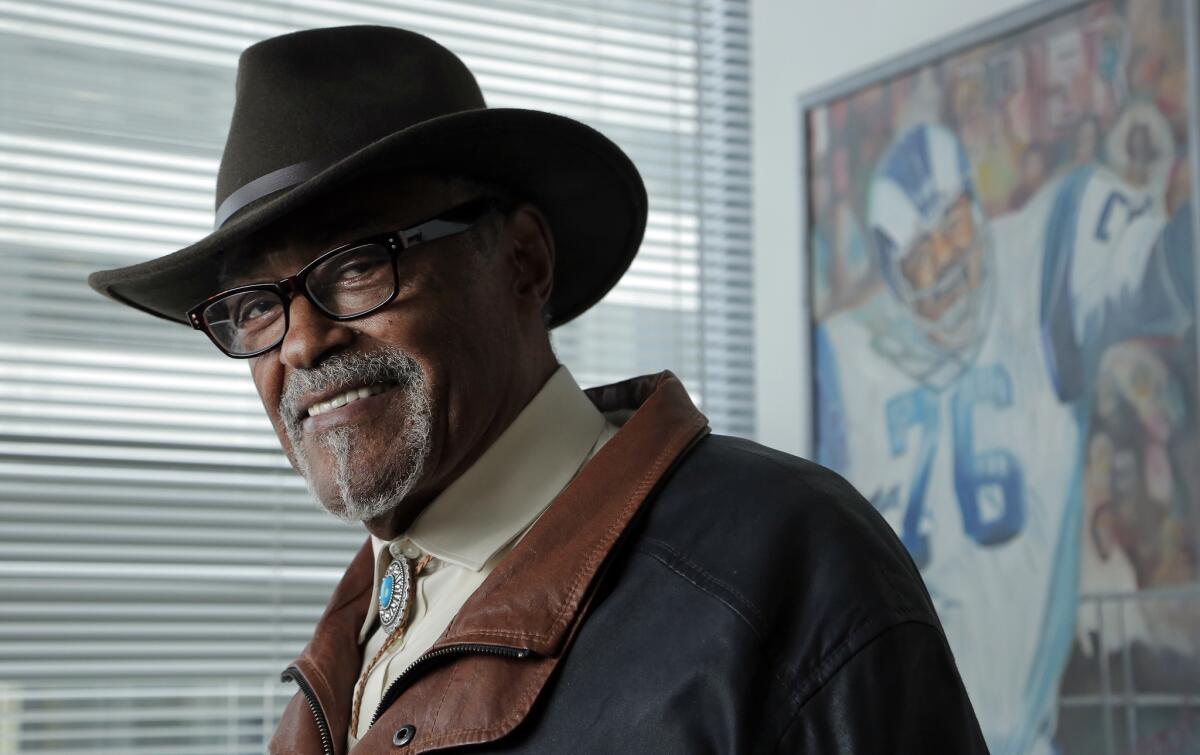

Former football star Rosey Grier takes a pass on the California governor’s race

Former Los Angeles Rams football legend Rosey Grier has dropped his bid for California governor.

“I decided not to run for governor in January, after much prayer, research and counsel,” Grier said in an email Monday.

Grier, a member of the famous “Fearsome Foursome” defensive line, announced he was running in January but he never officially filed for office or actively campaigned.

Grier, a Republican who lives in west Los Angeles, has an eclectic political history. He supported the presidential bids of Democrat Jimmy Carter as well as Republican Ronald Reagan.

Grier was serving as an aide to the presidential hopeful Robert F. Kennedy when he was gunned down by Sirhan Bishara Sirhan outside the ballroom of the Ambassador Hotel in Los Angeles in 1968. Grier grabbed Sirhan’s leg and gun hand after the shots were fired.

Grier faced long odds in the race for governor, which has already attracted a list of top Democratic candidates, including Lt. Gov. Gavin Newsom, former Los Angeles Mayor Antonio Villaraigosa and state Treasurer John Chiang.

The Republicans in the race include Assemblyman Travis Allen (Huntington Beach) and a Rancho Santa Fe venture capitalist John Cox.

See our list of who’s running and who’s still on the fence in the governor’s race.

- Share via

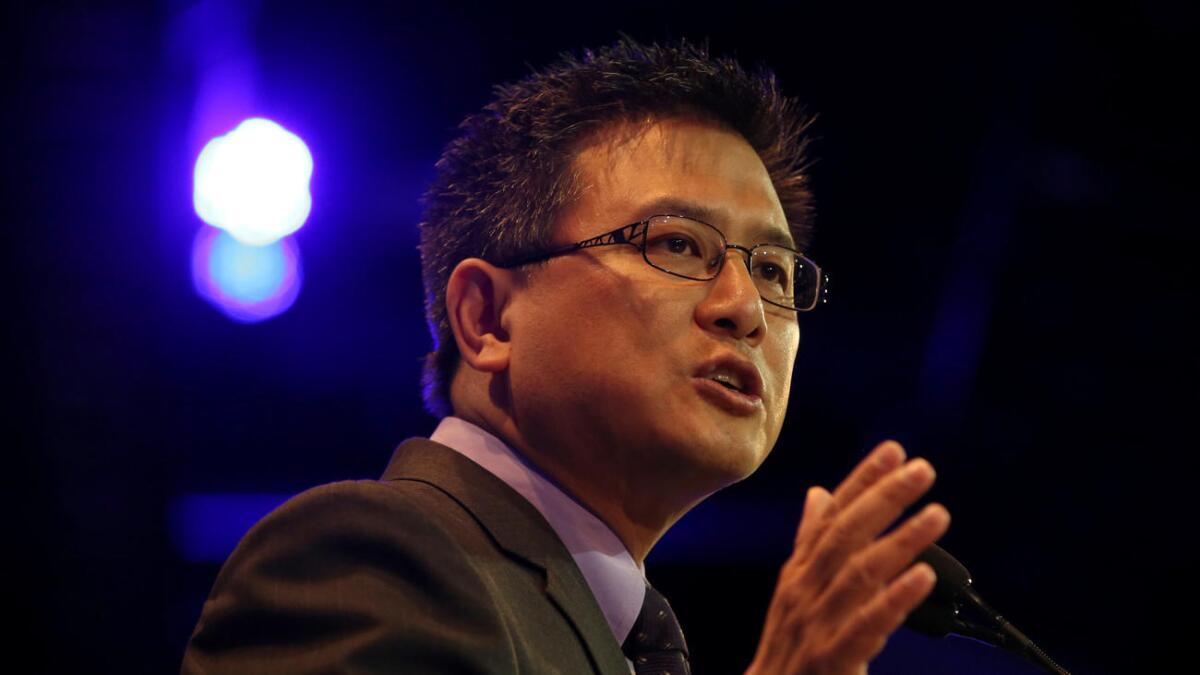

John Chiang: The no-drama contender for California governor in the era of Trump

It took decades for John Chiang to hustle into the top ranks of California politics, and he relished all the schmoozing along the way.

On the Lunar New Year, Chiang turned up at a firecracker party in Westminster. Weeks later, he awoke early for a cattlemen’s breakfast in Sacramento. When the Fresno Rotary Club sought a luncheon speaker, Chiang made time.

His nonstop networking has paid dividends. He won five elections in a rout, most recently for state treasurer in 2014.

Yet to many Californians, Chiang is just a vaguely familiar name, often mispronounced. (It’s Chung, not Chang.) It shows up on ballots, somewhere near the middle.

But now that he’s running for governor, Chiang is competing on a much bigger stage. Voters pay close attention to the top of the ticket, appraising character and personality.

For the first time in his career, the way that Chiang’s reserved, low-key demeanor comes off on television will matter — all the more so in a race against two of the state’s most charismatic politicians.

- Share via

Political Road Map: There’s little on the horizon when it comes to ballot measures in 2018

In the wake of last November’s super-sized ballot, which sparked the most expensive ballot measure election in California history, the political arena where initiatives are crafted has been in the midst of a summer of stagnation.

Consider where things stood at the same point in 2015. Then, there were 31 initiatives gathering signatures in hopes of landing on the November 2016 ballot. Out of that came 17 propositions that ultimately made it to voters.

By contrast, there are only five initiatives now in the signature-gathering phase. Nine others are awaiting a formal vetting.

- Share via

Today’s newsletter: On healthcare fallout, and one of the hopefuls aiming to be California’s next governor

Today’s Essential Politics newsletter highlights our best work from the last few days, along with stories from around the Web we’ve noticed.

The newsletter comes out Mondays, Wednesdays and Fridays.

Are you a subscriber? Sign up below.

- Share via

Nancy Pelosi raises more than $25 million for Democratic efforts to retake the House

House Minority Leader Nancy Pelosi’s reelection campaign said she has raised $25.9 million for House Democrats’ bid to retake the chamber in 2018, with the majority of the money going to the Democratic Congressional Campaign Committee.

Long known as a fundraising powerhouse, San Francisco’s Pelosi has seemed invigorated with her new role of opposing President Trump.

Since joining House leadership in 2002, Pelosi has raised $593.8 million for Democrats, according to her campaign spokesman Jorge Aguilar.

The 124 fundraising events she’s held in 22 cities this year garnered $1.2 million from a New York City fundraiser in March, nearly $2 million from a fundraiser in San Francisco and nearly $1.5 million from a Los Angeles fundraiser, both in April.

Aguilar said the haul “demonstrates the growing enthusiasm for House Democrats to retake the House.”

Though none of them has raised more than $50,000, Pelosi has attracted a handful of challengers for 2018, including Democratic challenger Stephen R. Jaffe, a supporter of former Democratic presidential candidate Bernie Sanders who has criticized Pelosi for raising money from corporations and special interests.

Pelosi was reelected in 2016 with 80% of the vote.

- Share via

From Times Opinion pages: Why Dianne Feinstein shouldn’t run again

At age 84, Dianne Feinstein is the oldest of the 100 U.S. senators. And the word, both in Washington and around California, is that she plans to run for reelection next year to a six-year term that will end when she’s 91.

The problem with yet another Feinstein candidacy is partly a matter of image. Ever since the tea party landslide of 2010 wiped out a generation of Democratic up-and-comers, many of the party’s central figures — Barack Obama decisively excepted — have been disproportionately older. Some of those Democrats have flourished with age: Sen. Bernie Sanders, technically an independent, has led a rebirth of the American left; Rep. Nancy Pelosi remains the most accomplished legislative leader Congress has seen in many decades; Rep. Maxine Waters has become the bubbe of the anti-Trump activists; and Jerry Brown, in his second go-round as California governor, has become the nation’s commander-in-chief in the fight against climate change.

- Share via

Rep. Dana Rohrabacher faces hostile crowd during panel about Russia and Trump at Politicon

Rep. Dana Rohrabacher on Sunday braved a crowd of politically engaged Southern Californians for a panel called “From Russia with Trump.”

It started with boos for the congressman and went downhill from there.

“Let’s avoid outright hostility,” moderator Vince Houghton told the audience in the Civic Auditorium at the Pasadena Convention Center, where the Politicon convention was held this weekend.

Rohrabacher (R-Costa Mesa) said he appreciated being able to speak with people “who obviously don’t like me” on the topic, one from which he has not backed down even as he’s been in the headlines for his pro-Russia positions.

The crowd wasn’t having it. They heckled him. “Shame on you!” they shouted. They called for “town hall meetings” in his district, 50 miles from the convention. They called him “paranoid.” They hissed and they laughed.

Organizers for Politicon, in its third year, said more than 10,000 attended. Not everyone there was liberal, but this was an event which featured a popular panel on impeachment and where fans stood in long lines to take photos with MSNBC hosts.

The moderator didn’t ask Rohrabacher about his own ties with Russia, or about his informal nickname: Russian President Vladimir Putin’s favorite congressman.

“There are some bad guys in Russia and Putin is one of them,” he said, adding there also are “bad guys” in the United States. Then he compared Putin to “Mayor Daley and his gang,” presumably a reference to the late Chicago politician known for hardball tactics.

When he was shouted down, the congressman warned, “It’s usually fascists who don’t let somebody talk.”

Rohrabacher went after familiar targets, including President Obama, Hillary Clinton and the Clinton Foundation. A man in the crowd shouted, “Fox News talking point!”

When it came to special counsel Robert S. Mueller III’s probe into Russia’s meddling in the U.S. elections, Rohrabacher questioned the intelligence unearthed in the investigation and brought the conversation back to Clinton’s controversial campaign emails. “They were not making up emails,” he said. “All they were doing was releasing information that was accurate.”

The congressman said he’s learned not to trust American intelligence until he can verify it, and cited the reports of weapons of mass destruction during the Iraq confict to back up his point.

“You’ve got to be skeptical and you’ve got to ask for proof before you just accept something,” he said.

Rep. Ted Lieu (D-Torrance) didn’t shy away from going after his colleague.

“You can believe Trump’s CIA director, Trump’s NSA director, Trump’s director of national intelligence. Or you can believe Dana Rohrabacher,” Lieu said. The crowd applauded.

Rohrabacher scored a point on the rest of the panel when he challenged if they had actually been to Russia. When they admitted they had not, he boasted of his work for President Reagan and his role as chairman of the “emerging threats” subcommittee in the House.

“We have people here who are advocating policy and they have not been to Russia,” the congressman said.

Acknowledging the political leanings of the audience and his fellow panelists, Houghton took a moment at the close of the panel to thank Rohrabacher for showing up in front of such an unfriendly crowd.

“He is on an island up here right now ... he has done an exceptional job,” the moderator said.

UPDATE

7:30 a.m.: This post was updated with information about the convention size.

This post was originally published at 3 a.m.

- Share via

2018 could be the year of the rookie in California’s congressional races

Mai Khanh Tran came to the U.S. as a child refugee, worked as a janitor to put herself through Harvard University and is a two-time breast cancer survivor. But she describes the months-long process of deciding to run for Congress as an “agonizing” time.

“I am leaving a very nice, private life that I’ve worked very hard to build and to be at a position where I can now take it easy and enjoy my family,” said Tran, a pediatrician who lives in Yorba Linda and has announced a run against Rep. Ed Royce (R-Fullerton). “It’s going to be a year and a half of work that’s not in my comfort zone.”

This is Nguyen’s first time running for office — she’s one of more than two dozen candidates who have never run for office before but have announced bids in California’s 13 most competitive congressional races.

Many of them say the election of President Trump, a first-time candidate who rode his reputation as a political outsider to the highest office in the nation, spurred them to run.

Most are concentrated in Orange County, where four of California’s seven most vulnerable Republican House members are based. But newcomers to politics are popping up on both sides of the aisle. The 2018 roster includes scientists, businessmen, doctors, veterans and at least one lottery winner.

- Share via

California Politics Podcast: A formal resistance might be forming inside state Democratic ranks

California Democrats found themselves in the springtime facing a bitter battle for the party leadership. Now it appears the loser in that contest may be forming a new faction inside party ranks.

On this week’s California Politics Podcast, we discuss this week’s announcement by Kimberly Ellis, who, while continuing to challenge the results of the state party chair’s race, is suggesting that she and other liberal activists are digging in for the long haul.

We also discuss the departure of a Republican hopeful from the 2018 race for governor, as well as how a group of Democratic state legislators has asked gubernatorial hopefuls to sound off on the issue of affirmative action.

I’m joined by Times staff writers Melanie Mason and Liam Dillon.

- Share via

Single-payer healthcare supporters take first step to launch recall against California Assembly Speaker Anthony Rendon

When Assembly Speaker Anthony Rendon (D-Paramount) halted a measure to establish single-payer healthcare in California, the bill’s most dedicated backers immediately called for him to be removed from office.

Now, more than a month later, single-payer advocates have taken the first formal step to follow through on their threat, giving Rendon’s office this week notice of intent to circulate a recall petition.

Rendon’s move to stop the single-payer bill — which he called “woefully incomplete,” noting it passed the state Senate without a method to pay for it — was the catalyst for the outcry.

“If we recall the Assembly speaker, maybe someone else [will be] willing to push this bill, to get it out of the rules committee and send it to the Assembly to get a vote on it,” said Jessica Covarrubias, a proponent of the effort. “Maybe that will help everyone get healthcare.”

Covarrubias, a 27-year-old law student from South Gate, described the recall campaign as “literally a grassroots effort.” She first learned of the recall campaign when single-payer activists, incensed by Rendon’s action, launched a door-knocking drive to inform voters in his district.

The notice, which proponents mailed on Tuesday and was received by Rendon’s office Friday, was signed by 60 people; at least 40 signatures must be deemed valid, belonging to registered voters of his Southeast Los Angeles County district. It was filed by Stephen Elzie, an Irvine-based USC law professor who is acting as an attorney for the effort.

“Assemblymember Rendon trusts in the fair-minded voters of his district to see through the misleading and false allegations made by the recall’s petitioner, who doesn’t even live in Southeast Los Angeles,” said Bill Wong, a spokesman for Rendon.

The recall effort faces tough odds. As the powerful Assembly speaker, Rendon has been a robust fundraiser, ending 2016 with more than $1.2 million in the bank. Other labor groups, including unions representing construction workers and grocery clerks, publicly sided with the speaker’s decision to shelve the single-payer bill and could serve as as a well-financed cavalry should Rendon face a heated campaign to oust him.

Still, this week’s step forward in the recall effort underscores how activist anger over Rendon’s decision continues to simmer weeks after the measure, SB 562, was blocked.

Last week, the California Nurses Assn., which sponsored the legislation, paid for two mailers to be sent in Rendon’s district, assailing his move as “holding healthcare hostage” and “protecting politicians, not people’s healthcare.” Both mailers encouraged recipients to call or visit Rendon’s office to voice their displeasure, although the flyers stopped short of calling for a recall.

Michael Lighty, policy director for the nurses’ group, said the union was not involved with the recall effort, focusing instead on pressuring Rendon to let the single-payer bill move forward.

- Share via

Former Assemblywoman Ling Ling Chang plans to challenge Sen. Josh Newman if recall measure qualifies

After losing a close race last year for the state Senate, former Republican Assemblywoman Ling Ling Chang said Friday that she plans a rematch against Democratic Sen. Josh Newman of Fullerton if pending petitions qualify a recall measure for the ballot.

Chang, a Diamond Bar resident, lost to Newman by less than 1% of the vote last year, and said she thinks he is vulnerable because of the recall drive by Republicans critical of his vote for a gas-tax increase.

Chang noted that she voted to stop tax increases during her two years in the Assembly.

“By contrast, Josh Newman voted to raise gas and car taxes by $52 billion and increased the cost of living for the average [Senate District] 29 family by $300 a year,” Chang said in a statement. “I’m running for state Senate and support the recall because we can’t afford three more years of Josh Newman.”

The California Republican Party has turned in more than 100,000 signatures to put a recall measure on the ballot, while 63,500 of them have to be verified as district voters for the measure to qualify.

If the measure qualifies, voters will be asked to answer whether Newman should be recalled and which candidate should replace him if the recall passes.

Chang’s name and others, including Republican Fullerton Mayor Bruce Whitaker, would be on the ballot as candidates to fill the Senate seat.

Newman campaign spokesman Mike Roth responded: “This is political opportunism to the extreme - just 8 months after voters fired Ms. Chang she’s betting her political future on them believing the bucket of lies they’ve been fed about the recall.”

Updated at 6:20 pm to include a comment from Mike Roth.

- Share via

Anthony Scaramucci cancels weekend appearances at Politicon convention in Pasadena

New White House Communications Director Anthony Scaramucci was going to be among the hottest draws at Politicon, a two-day political convention in Pasadena this weekend.

But on Friday, organizers announced that he had canceled his appearance at the event — shortly after a profanity-laden interview emerged in which he trashed his new White House colleagues.

Organizers of Politicon downplayed the cancelation, pointing to several other guests, including Chelsea Handler and Ann Coulter, who are still scheduled to appear, and poked fun at Scaramucci’s recent tirade.

“At least now we don’t have to worry about violating any local obscenity laws!” they said in a statement.

Scaramucci had been scheduled to take part in three sessions: an hourlong interview, a panel about the likelihood of World War III and a panel about what the United States will look like after President Trump leaves office.

- Share via

Here’s why a big Bay Area housing project won’t get built

Lots of California politicians, business leaders, housing activists and others want 4,400 new homes built on 640 acres right outside the city of San Francisco.

But none of them gets to decide what happens on the land. Instead, it’s under the control of the city of Brisbane, whose residents are wary of a project that could triple the city’s population from its current 4,700. Beyond that, California’s tax system ensures the city would earn a lot more revenue if it rejected housing and instead approved more commercial or hotel development on the site.

These reasons, state officials say, show why California is struggling to meet its vast housing affordability problems.

- Share via

Volkswagen gets green light for charging stations under settlement plan

California regulators approved on Thursday the first phase of Volkswagen’s plan to install electric vehicle charging stations around the state.

The plan, which will be carried out by a subsidiary called Electrify America, is part of a much larger, multibillion-dollar settlement over the automaker’s cheating of emission rules.

Thursday’s decision by the Air Resources Board green lights the first $200 million of the company’s required $800-million, 10-year investment.

The vote came only after Electrify America modified its spending plan to increase the number of charging stations in disadvantaged communities.

“It’s been a long process, but I hope you feel like it’s been worth it,” said Mary Nichols, the board’s chair. “We certainly feel like we’ve gained a lot of confidence that it will be a success.”

Volkswagen’s investment could become an important part of the state’s efforts to increase the number of zero-emission vehicles on the road. It’s estimated that the company’s spending will provide up to 8% of the necessary charging infrastructure in coming years.

This post has been updated to correct the day of the Air Resources Board’s decision.

- Share via

California’s tax board members aren’t happy about how new disclosure rules are being applied

Members of California’s Board of Equalization objected Thursday to a broad interpretation of a new state law requiring that they disclose their private meetings with taxpayers who are engaged in appeals.

A state attorney said ex parte communications must be disclosed on currently pending matters — even if they occurred before the enactment of the new law on July 1. Tax board members said they did not track who they and their staff talked to before the law took effect.

“No one is prepared to go back,” said Board of Equalization Chairwoman Diane Harkey. “We want to make sure we have no liability here. This is an impossible situation.”

The dispute led the panel on Thursday to delay action by three hours on several tax appeals, while attorneys found a way to temporarily allow the hearings. In the end, each board member announced whether he or she recalled any communications with the taxpayer whose appeal was being heard.

Board member Jerome Horton said attorneys whom he has consulted with disagree that the law applies retroactively.

However, since a reorganization signed into law by Gov. Jerry Brown, the board currently does not yet have its own attorney. The reorganization shifted most of the board’s responsibilities and employees to a new agency.

“The frustrating part for me is that this reorganization was supposed to be seamless and it is anything but seamless,” said Board Vice Chairman George Runner.

- Share via

Watchdog panel’s support for lifting some donation limits is likely boost to state senator facing recall

A watchdog commission appointed by Democrats opted Thursday to support lifting the limits on donations to officials targeted by recalls — just as a Democratic state senator is facing one.

The change must be finalized at a future commission meeting. The limits still apply until that happens.

Going against the recommendation of its attorney, all but one Fair Political Practices Commission member voted in support of allowing larger contributions than have been allowed in the past.

The change could be a big boost to freshman state Sen. Josh Newman, being targeted for ouster for voting to raise the gas tax.

FPPC attorneys must still draft a new legal opinion subject to public comment and approval by the panel. The attorneys had issued a memo continuing the long-held position that candidate-controlled committees to fight recalls are subject to a $4,400 contribution limit.

Richard R. Rios, an attorney for Senate Democrats, said it is “unfair and creating a playing field that is not level,” to limit contributions to Newman’s committee, while large contributions can be made to the recall.

Commissioner Maria Audero said her reading of the law is that the limit that applies to candidates running for office should not be applied to their committees fighting recall.

“I think the argument that ‘It is so because that is the way we have been doing it’ really has no validity,” she said.

Commissioner Brian Hatch also said that the law, as he reads it, does not limit contributions. He said he regretted it had been interpreted that way in the past.

“Hopefully here today we are going to correct these past injustices,” Hatch said.

Commission Chairwoman Jodi Remke voted against reversing the 15-year-old legal posture setting limits.

Citing the makeup of the commission -- which was appointed by Democrats— and the timing in the middle of a recall targeting a Democrat, Remke said the reversal in favor of Newman “could be considered political, potentially impacting the public’s perception of the integrity of the commission.”

The vote was 3-1.

“I believe that the longstanding commission interpretation is correct,” Remke told her colleagues. “I do not believe there is a sound basis to reverse our decision.”

Carl DeMaio, a Republican activist involved in the recall, denounced the panel’s vote. “With this action to decimate campaign finance rules in favor of big money in politics, California Democrats show they are breaking and bending all the rules to keep power,” said DeMaio, a former San Diego City Councilman.

Updated 1:18 pm to clarify that the contribution limits still apply until a final vote approves the changes.

Updated at 3:40 pm to include comment from DeMaio.

- Share via

Rep. Dana Rohrabacher accused of violating Russian sanctions by backer of Russian sanctions law

Financier Bill Browder has accused Rep. Dana Rohrabacher of violating federal sanctions by using information provided by Russian officials to try to convince Congress to overturn those sanctions.

Browder filed a complaint with the Treasury Department’s Office of Foreign Assets Control this week saying Rohrabacher and his staff member, Paul Behrends, violated the Magnitsky Act by taking information from a sanctioned Russian official and using the information to try to change the act.

The act is named for attorney Sergei Magnitsky, who died in prison after accusing several prominent Russians of stealing $230 million in taxes. Browder, who was Magnitsky’s boss, persuaded Congress to pass the Magnitsky Act in 2012. It prevents more than 40 prominent Russians involved in the affair from traveling to or banking in the U.S. The act infuriated Russian President Vladimir Putin, who retaliated by halting U.S. adoptions of Russian children.

The complaint relies heavily on a recent Daily Beast report about a memo Rohrabacher received detailing complaints about Magnitsky and Browder during a 2016 meeting in Moscow with a high-ranking Russian justice official who was among those sanctioned under the act.

Congress was considering expanding the act at the time, and there was an intense lobbying effort by a handful of people with Russian ties on Capitol Hill to have Magnitsky’s name removed from it.

In the complaint, Browder alleges Rohrabacher and Behrends “provided services to one of the central figures targeted by the Magnitsky Act” because they got information from the Russian official and used it to try to change the law.

In a statement responding to the complaint, Rohrabacher said he questions why Browder doesn’t want the congressman to get information from multiple sources.

“Anyone who knows me understands that I am the Member of Congress least likely to take directions from government officials, especially foreign government officials. Because of some grotesquely misleading headlines, Mr. Browder flatters himself by claiming that I contemplated conducting a hearing all about him. Perhaps he protests too much,” Rohrabacher said.

Browder testified before the Senate Judiciary Committee on Thursday and called out Rohrabacher as part of Russian efforts to sway Congress to get rid of the Magnitsky Act. It’s unusual for a sitting member of Congress to be called out by a witness on Capitol Hill, but senators didn’t react to the statement.

“We know for sure that part of their campaign was running around Capitol Hill. One of the people that they were able to convince to go along with them is a member of the House of Representatives from Orange County, Dana Rohrabacher, who they have met with on a number of occasions and who has been effectively touting, or spreading their propaganda around the House of Representatives,” Browder said.

- Share via

Adam Schiff, President Trump and the serendipity of slander

The road to elected office can be long and winding and is not always paved with the best of intentions.

Some politicians — think of the Kennedys, or the Bush family — are born to the trade. Others are borne by tragedy.

Former Santa Barbara Rep. Lois Capps succeeded her husband when he fell dead of a heart attack. Former New York Rep. Carolyn McCarthy was spurred to run when her husband was killed and her son gravely wounded in a mass shooting on the Long Island Rail Road.

Typically, though, the ascension is more methodical, one rung after the next, often with a pinch of right-place, right-time fortune thrown in for good measure.

Lately that bit of luck has visited itself upon Adam B. Schiff, in the form of Russian meddling and a president who hurls tweets like poison thunderbolts.

- Share via

The cannabis industry has a clear favorite in the race to be California’s next governor

The fundraising dinner for Gavin Newsom in Salinas was in most ways a typical night for a political candidate. Local business leaders paid up to $5,000 for a chance to talk with the man aiming to be California’s next governor over cauliflower bisque, strip steak and Meyer lemon pudding cake.

The hosts that March evening were in the agriculture business, in a region known for its lettuce, grapes and strawberries. But they left their signature dish off the menu: candy infused with marijuana.

California will soon have open sales of recreational marijuana, and it needs to decide how to regulate its newest cash crop. Hoping to influence those decisions, the cannabis industry is seeking access to the state’s political leaders.

One candidate in 2018’s open race for governor is actively inviting their support. The industry is responding by following a conventional political playbook and pouring money into the lieutenant governor’s campaign to replace Gov. Jerry Brown.

- Share via

California targets pollution with new law, but many activists remain unsatisfied

Two months ago, Gov. Jerry Brown was in Bell Gardens to tour some of the area’s polluted neighborhoods and hear from activists about their environmental concerns.

On Wednesday he was back in town to sign legislation intended to improve air quality and public health, but some of the same activists he met with haven’t been satisfied.

“It’s a slap in the face,” said Angelo Logan, a member of East Yard Communities for Environmental Justice, which protested outside the ceremony.

The legislation is part of a broader deal to extend California’s cap-and-trade program for reducing greenhouse gas emissions, a key part of the state’s policies on climate change.

Assemblywoman Cristina Garcia (D-Bell Gardens) defended the measure by saying a new effort on air quality would ensure disadvantaged neighborhoods aren’t left behind during the battle against global warming.

“It’s good that we think about our global community … but we need to make sure that communities like this are not left behind,” she said.

- Share via

Women gaining political power in California cities as they’ve lost it elsewhere

While women have lost ground in California’s legislature and its congressional delegation, the state has seen a small increase in women serving on city councils over the past two years, a new report found.

Women now account for 31% of the members on California city councils, up from 29% in 2015. Women also serve as mayor in 28% of the state’s 482 cities.

The report was released Wednesday by California Women Lead, a nonpartisan organization dedicated to increasing the number of women in elected office.

Here are some of the report’s other notes:

- The number of women in California’s congressional delegation, including the 53 House members and two senators, decreased from 22 in 2015 to 19 in 2017.

- The number of women in the California Legislature decreased from 31 in 2015 to 26 in 2017.

- In California’s 10 largest cities, only one has a woman serving as mayor: Libby Schaaf in Oakland.

- There’s just one city with an all-female council — Blue Lake in Humboldt County. Fifty-six cities have all-male councils.

- Of California’s eight statewide offices, only one is held by a woman: Controller Betty Yee.

- California has been represented by female Democrats in the U.S. Senate since 1993: Dianne Feinstein since 1992; Barbara Boxer from 1993-2017; and newly elected Kamala Harris.

- Share via

Race for Rep. Dana Rohrabacher’s Orange County seat is now rated a toss-up by election prognosticators

Nonpartisan analysts say the race for Dana Rohrabacher’s House seat representing Orange County is now a toss-up.

Rohrabacher (R-Costa Mesa) faces more than 10 opponents in the 48th District, most of them Democrats. He is running for a 16th term in the 2018 midterm election.

Rohrabacher joins Reps. Darrell Issa of Vista, Steve Knight of Palmdale and Jeff Denham of Turlock among California Republican incumbents whose chances of reelection are rated toss-ups, according to analysts for Larry J. Sabato’s Crystal Ball at the University of Virginia Center for Politics.

Democrats are keeping a close eye on the race, which was previously considered to be leaning Republican, and have officially proclaimed it a battleground for 2018. Rohrabacher’s 2016 win with 58% of the vote could make the seat tough to flip, but Democrats are hoping to capitalize on the district’s narrow backing of Hillary Clinton over Donald Trump.

In his analysis of potentially competitive races, Crystal Ball managing editor Kyle Kondik calls the Orange County race “intriguing, both because of changes in the district and the quirkiness of the incumbent himself” and says national focus on Russia might be a hindrance to Rohrabacher.

“While Clinton did better in some other Republican-held area seats, CA-48 may be one place where the Trump campaign’s potential connections to Russia may have salience given Rohrabacher’s often-expressed warmth toward the Kremlin,” Kondik says.

Rohrabacher, chairman of the House Foreign Affairs Subcommittee on Europe, Eurasia, and Emerging Threats, has long been known for encouraging improved relations with Russia, something that’s made him an outlier in the Republican Party.

Rohrabacher’s name has also come up as the investigation into Russia’s meddling in the 2016 election has heated up. He had multiple interactions with several of the people with Russian ties who attended a Trump Tower meeting with Trump’s eldest son, Donald Trump Jr., and other campaign officials in June 2016.

Rohrabacher’s most recent fundraising quarter, in which he had $406,616 in the bank at the end, was paltry compared with what some of the other target Orange County incumbents raised.

- Share via

Emily’s List is putting Republicans ‘on notice’ and seven of them are in California

It’s not just the national Democrats who have a wish list of Republican incumbents they’d like to unseat in 2018.

Emily’s List, the group that aims to elect women who support abortion rights, has identified 50 congressional and Senate seats nationwide as part of their “On Notice” program to flip seats in the midterm election.

The group has identified seven California Republicans, the largest number of any state. They all occupy seats the Democratic Congressional Campaign Committee has also prioritized. They are:

10th District: Rep. Jeff Denham (Turlock)

22nd District: Rep. Devin Nunes (Tulare)

25th District: Rep. Steve Knight (Palmdale)

39th District: Rep. Ed Royce (Fullerton)

45th District: Rep. Mimi Walters (Irvine)

48th District: Rep. Dana Rohrabacher (Costa Mesa)

49th District: Rep. Darrell Issa (Vista)

Emily’s List says the roster of priority seats is their biggest ever and that the incumbents who hold them have built “appallingly anti-woman, anti-family records.” A statement announcing the 2018 targets points out their votes to repeal the Affordable Care Act and to allow states to defund Planned Parenthood.

Last year, the only California incumbent the group put “on notice” was Denham. This year, the group has already endorsed challengers in two Republican-held districts: pediatrician Mai Khanh Tran, who is running against Royce, and UC Irvine law professor Katie Porter, who’s up against Walters.

While no women have filed to run in the districts occupied by Denham, Nunes or Issa, Emily’s List spokeswoman Julie McClain Downey says they are still recruiting female candidates for those seats.

“We are planning on expending resources in these districts,” Downey said. “Given the environment that we’re in and the increase of women running for office and the excitement we’re seeing, we have targeted the largest contingent to date.”

- Share via

Californians show broad support for state’s climate goals in new poll

Public support for the state’s battle against global warming remains strong and growing, according to a new poll from the nonpartisan Public Policy Institute of California.

Seventy-two percent of California adults back last year’s law requiring the state to reduce greenhouse gas emissions to 40% below 1990 levels by 2030. Fifty percent said climate policies would create more jobs, the highest level since the question was first asked seven years ago.

A majority of Californians said they didn’t know anything about the state’s cap-and-trade program, which lawmakers recently voted to extend until 2030. But once they were read a description of cap and trade, 56% said they supported the program, another record high for the poll.

“Most Democrats and independents and sizable percentages of Republicans are in favor,” said Mark Baldassare, president of the Public Policy Institute of California.

Even though a majority of Californians also expect gasoline prices to increase, the results indicate that Gov. Jerry Brown and lawmakers are on firm political ground as they push forward with ambitious goals to reduce greenhouse gas emissions.

Both the governor and the Legislature have a 51% approval rating on environmental issues.

The poll included 1,708 Californian adults, and it was conducted from July 9 to July 18. The margin of error is plus or minus 3.4 percentage points.

- Share via

President Trump’s voter fraud panel asks again for data from California — and again the answer is no

For the second time in less than a month, California’s chief elections officer has refused to hand over data to President Trump’s voter fraud commission, arguing on Wednesday that the inquiry is still part of an “illegitimate” exercise.

“I still have the same concerns,” Secretary of State Alex Padilla said. “I can’t in good conscience risk the privacy of voters in California with this commission.”

The Presidential Advisory Commission on Election Integrity, which met for the first time last week, originally asked for the information from California and other states on June 29. A federal court refused last week to block the commission’s request, though as many as 21 states have insisted they won’t hand over details on voter names, addresses and political party affiliations.

“I want to assure you that the Commission will not publicly release any personally identifiable information regarding any individual voter or any group of voters from the voter registration records you submit,” said Kris Kobach, the vice-chairman of the panel and Kansas secretary of state, in the letter to Padilla on Wednesday.

But Padilla insists that while his office does provide some voter information to academics, journalists and political campaigns, state law gives him the power to refuse any request. And in an interview with The Times, he said it is unclear who the commission or its staff would share the information with once it has been submitted.

“He can say that all he wants,” Padilla said about Kobach’s written promise to secure the data. “But the commission has failed to articulate how it would do that.”

Padilla also pointed out that the commission released the email addresses of those who submitted public comments in the wake of last week’s meeting.

“The privacy violations have already begun,” he said.

The panel was established in the wake of the president’s unproven allegations of widespread fraud in last November’s election. Padilla said he’s asked the commission to provide proof to back up Trump’s comments, and has yet to receive a response.

- Share via

Rep. Darrell Issa complained to city officials about protesters outside his office, records show

Protesters have been showing up at GOP Rep. Darrell Issa’s Vista office weekly in the months since President Trump took office. Though Issa has come out to greet them a few times, he’s also made some phone calls and sent a letter to the city to complain about the protesters, records uncovered by the San Diego Union-Tribune and CBS 8 show.

The congressman and his staff have said that they respect the group’s right to assemble but that the gatherings have impeded work of other businesses in the building — some of which also complained about the protests. They also were concerned about noise. In one voicemail Issa left with the city, he complained that protesters were “sitting on sidewalks and they’re clearly violating their permit.”

“Let me be clear: this isn’t about me or my office,” he wrote in a follow-up June 21 letter to the city of Vista. “I can handle a little heat from some protesters.”

Issa, one of California’s most vulnerable Republicans, sent the letter after the city had reportedly declined to take action because it said protesters weren’t violating the terms of their permit.

- Share via

California has too much pot, and growers won’t be able to export the surplus

A leader of California’s marijuana industry warned Wednesday that the state’s cannabis growers produce eight times the pot that is consumed in the state so some will face “painful” pressure to reduce crops under new state regulations that will ban exports after Jan. 1.

ALSO: Candidate Gavin Newsom dominates donations from growing pot industry aiming for influence

Some marijuana growers will stay in the black market and continue to illegally send cannabis to other states, which is also not allowed under federal law, said Hezekiah Allen, executive director of the California Growers’ Assn.

“We are producing too much,” Allen said, adding state-licensed growers “are going to have to scale back. We are on a painful downsizing curve.”

He said some marijuana growers may stop, while others just won’t apply for state permits.

Allen made his comments to the Sacramento Press Club during a panel discussion that also included Joseph Devlin, chief of Cannabis Policy and Enforcement for City of Sacramento, and Lori Ajax, chief of the state’s Bureau of Medical Cannabis Regulation.

Devlin said estimates he has heard put California production at five times the state consumption; one consultant in the audience said the number may be 12 times what is consumed in the state.

Ajax agreed with Allen that some cannabis cultivators may have to scale back while others may never apply for a state license.

“For right now, our goal is to get folks into the regulated market, as many as possible,” Ajax said. But, she added, “There are some people who will never come into the regulated market.”

Those people, she said, will eventually face enforcement actions for growing marijuana without a state license.

Medical marijuana use was approved by California voters two decades ago. Voters in November approved the legal sale and possession of an ounce of marijuana for recreational use.

- Share via

Watch: Gov. Jerry Brown signs second piece of landmark climate change legislation

- Share via

Minnesota Sen. Amy Klobuchar heads to L.A. for fundraiser with Hollywood players

Amid speculation about a potential future presidential bid, Democratic Sen. Amy Klobuchar of Minnesota is headlining a Los Angeles fundraiser for her reelection campaign on Sunday.

Donors are being asked to contribute up to $5,400 to attend the afternoon reception at the Brentwood home of Andy Spahn, an advisor to some of the entertainment industry’s biggest political contributors, and his wife, Jennifer Perry.

Paul Begala and James Carville, former top advisors to President Bill Clinton, are billed as special guests.

Hosts include Hollywood titan Jeffrey Katzenberg, director J.J. Abrams, “Lost” co-creator Damon Lindelof, Universal Film Chairman Jeff Shell, and producers Paul Junger Witt and Susan Harris.

Klobuchar is running for a third Senate term in 2018, but she is frequently mentioned on lists of potential Democratic presidential candidates for 2020. She has stoked such speculation by courting Democratic activists and visiting states that are critical in the nominating process, such as Iowa.

- Share via

On politics, says Schwarzenegger, ‘I mostly argue with myself’

Former Gov. Arnold Schwarzenegger, who made a political career out of not toeing the party line of his fellow Republicans, said it’s largely a function of having grown up in a country with very different views on social and economic policy than those in the United States.

“I mostly argue with myself,” Schwarzenegger said on the Politico “Off Message” podcast that published on Tuesday. “There’s the Austrian Arnold and the American Arnold, right?”

The two-term governor said his embracing of after-school programs, which he convinced voters to fund with taxpayer dollars in a 2002 ballot initiative, did not necessarily fit with his otherwise Republican principles about families taking care of their own children.

“The reality out there is a little different,” he said.

Schwarzenegger was on hand Tuesday for Gov. Jerry Brown’s signing of an extension of the state’s cap-and-trade climate program in San Francisco. It was Schwarzenegger who, along with legislative Democrats, championed the original program in 2006.

The former governor again insisted in the podcast that he has no interest in any political job open to him, confirming his announcement earlier this year of being disinterested in running for the U.S. Senate. He’s barred by the Constitution from running for president, and by term limits from running again for governor.

“I would have liked to stay on being governor,” he said. “Because the funny thing is, when you get into this, is you realize very quickly that you want to continue staying on, because you can never get everything done that is on your checklist.”

- Share via

Backers of another shot at a ‘Calexit’ ballot measure can now gather signatures

Supporters of a plan for California to become independent from the United States are now allowed to gather signatures for their ballot measure.

On Tuesday afternoon, Atty. Gen. Xavier Becerra’s office released an official title and summary for the initiative, now called the “California Autonomy From Federal Government” initiative.

The proposal, scaled back from an initially more aggressive version, would direct California’s governor to negotiate more autonomy from the federal government, including potentially putting forward a ballot measure to declare independence.

The initiative wouldn’t necessarily result in California exiting the country, but could allow the state to be a “fully functioning sovereign and autonomous nation” within the U.S.

Backers of the plan, known informally as “Calexit” have 180 days to collect nearly 600,000 valid signatures for the initiative to go on the 2018 ballot.

The initiative’s fiscal analysis says it would cost the state at least $1.25 million a year for an advisory commission to assist the governor on California’s independence plus “unknown, potentially major, fiscal effects if California voters approved changes to the state’s relationship with the United States at a future election after the approval of this measure.”

The earlier effort for a more aggressive ballot measure was pulled by its backers less than three months after it got the green light to start gathering signatures.

- Share via

Rep. Adam Schiff tries to raise money off Trump’s critical tweet

House Select Intelligence Committee ranking Democrat Adam B. Schiff is using the spotlight from a President Trump tweet that deemed him “sleazy” to raise some campaign cash.

Trump on Monday morning used Twitter to call out Schiff as “sleazy” and “totally biased,” saying he spends too much time on television. It again turned attention toward the Burbank Democrat who is helping to lead the House investigation into Russian attempts to interfere with the 2016 election.

Schiff responded on his official House Twitter account, saying the comment was “beneath the dignity of the office.” Within hours, his campaign Twitter account was promoting an ad asking people to “chip in” and “Stand with Adam.”

We won’t know what he raised from the targeted Twitter ads until the next campaign finance reports are filed in October, but Schiff has raised $840,339 since the beginning of the year and had $2.57 million in the bank as of June 30.

His reliably Democratic seat isn’t considered to be at risk in the 2018 midterm election. But for high-ranking members of Congress, the ability to raise funds, and donate to more vulnerable members, is a way to demonstrate their power.

The money could also help fund a potential run for the U.S. Senate if California’s Sen. Dianne Feinstein retires. Schiff is high on the list of Democrats considered interested in running for the seat.

- Share via

California’s secretary of state sticks to his refusal to give data to President Trump’s voter fraud panel

- Share via

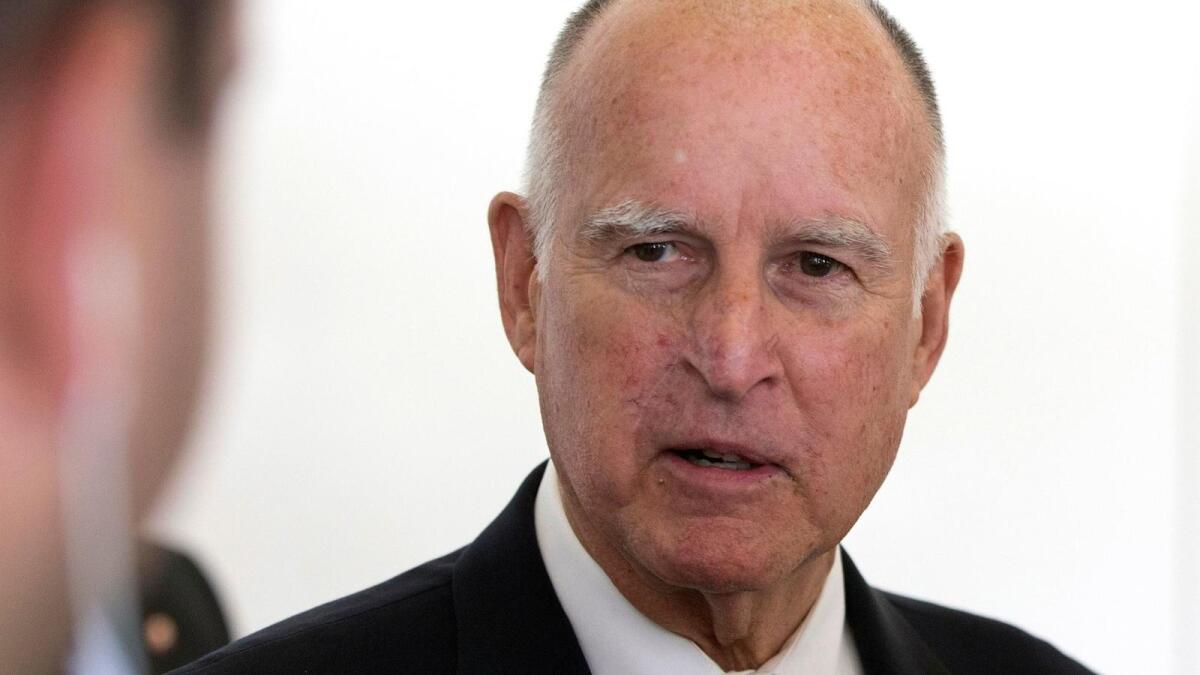

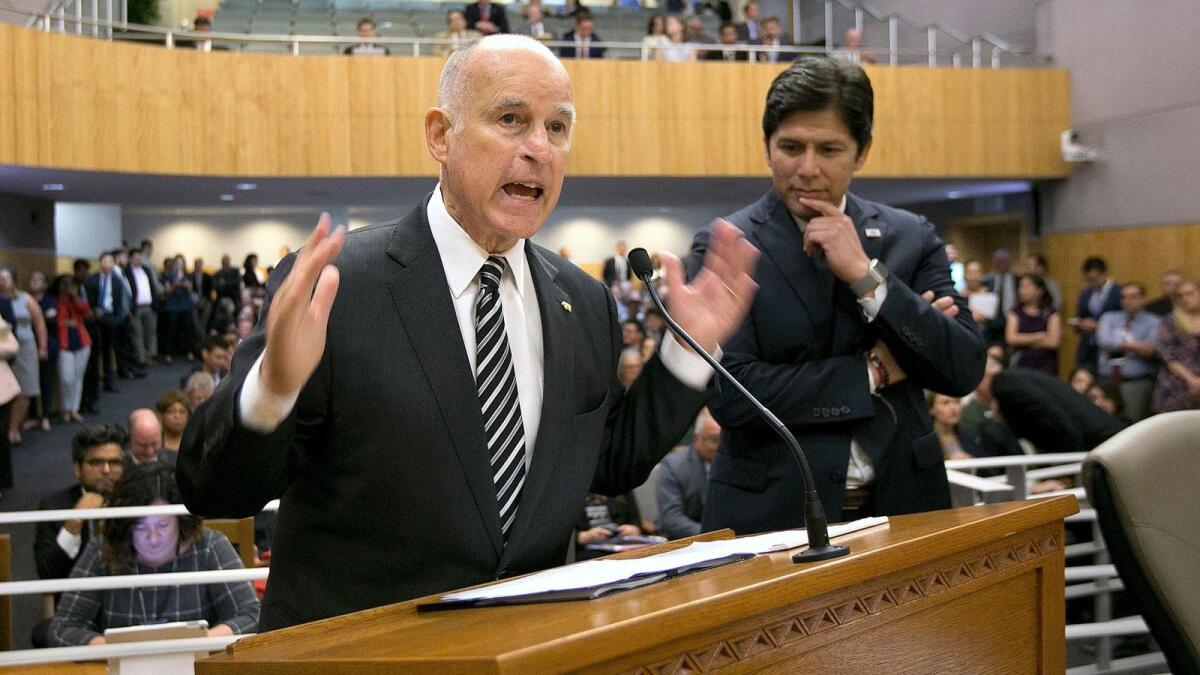

Gov. Jerry Brown signs climate change legislation to extend California’s cap-and-trade program

Gov. Jerry Brown signed legislation on Tuesday to extend California’s cap-and-trade program, solidifying the state’s battle against global warming as President Trump withdraws from the fight in Washington.

The legislation, Assembly Bill 398, will keep cap and trade operating until 2030 rather than letting it expire in 2020. The five-year-old program, the only one of its kind in the country, requires companies to buy permits to release greenhouse gas emissions.

“You’re here witnessing one of the key milestones in turning around this carbonized world into a decarbonized sustainable future,” Brown said.

It was the same location used by former Gov. Arnold Schwarzenegger in 2006 when he signed Assembly Bill 32, which provided the foundation for cap and trade. Schwarzenegger, a Republican, joined Brown on Tuesday, providing a bipartisan display of continuity.

Cap and trade was hotly debated in Sacramento, with some environmental activists fearing the new legislation wouldn’t be stringent enough and some conservatives warning about increased costs for Californians. But Brown pieced together a broad coalition to pass the legislation, winning over several Republicans, national environmental groups and major business organizations.

- Share via

As candidates for governor are pressed on affirmative action, Antonio Villaraigosa says it’s vital to California

Gubernatorial candidates, who have been pressed to offer their thoughts on affirmative action by Latino and black state lawmakers, began to weigh in Monday evening.

Antonio Villaraigosa, the former mayor of Los Angeles, gave the most concrete response.

“Mayor Villaraigosa agrees with both caucuses that keeping this issue at the forefront is vital to the future of California,” a campaign spokeswoman said in a statement. “He went to UCLA on an affirmative action program and was on the frontline against Prop. 209. Villaraigosa believes California can’t truly be progressive unless we’re all making progress together, which means we must support and expand programs that lift more families into the middle class.”

Villaraigosa was responding to a questionnaire sent to six Democratic and Republican gubernatorial candidates about affirmative action and the ramifications of a 1996 voter-approved law that banned it in publicly funded institutions of higher education.

The letter by the chairmen of the Latino and black legislative caucuses, which was mailed Friday, injects a potentially volatile racial issue that has previously splintered California Democrats into the 2018 contest.

The questions also raise a divisive 2014 effort to repeal the ban on affirmative action.

While polling shows that Democratic voters tend to favor efforts to increase opportunities for underrepresented minorities, schisms emerged between Latino and black lawmakers, and their Asian American colleagues, when Democrats tried to repeal the ban. It was ultimately shelved.

A spokesman for GOP candidate John Cox used the letter to poke the Latino caucus for not being inclusive. (The caucus has come under fire for not including Republican Assemblyman Rocky Chavez of Oceanside.)

“We did not receive this questionnaire from the caucuses, but suggest that the Latino caucus take the first step towards greater diversity by allowing Republicans to join their closed caucuses,” spokesman Matt Shupe said.

Representatives for Lt. Gov. Gavin Newsom and former state schools chief Delaine Eastin, both Democrats, said they had not yet received the letter, while the campaigns for Democratic state Treasurer John Chiang and Republican Orange County Assemblyman Travis Allen did not respond to requests for comment.

- Share via

Special election date set to replace Jimmy Gomez in the Assembly

- Share via

Latino, black state lawmakers press California gubernatorial candidates on affirmative action

Latino and black state lawmakers are calling on gubernatorial candidates to publicly state their opinion about affirmative action, injecting into the 2018 contest a potentially volatile racial issue that has previously splintered California Democrats.

“Each of our caucuses, as you may know, is driven by a mission to further the interests of all Californians through advocacy for programs and policies that promote diversity and empowerment. To that end, we would appreciate your candid thoughts and official position on affirmative action and related topics,” wrote state Sen. Ben Hueso and state Assemblyman Chris Holden, the chairmen of the Latino and black legislative caucuses respectively, to the six most prominent gubernatorial candidates.

The candidates are being asked to describe their views on affirmative action, their thoughts on the ramifications of the 1996 law that bans its use at publicly funded colleges and universities, their track record on diversity and equity efforts, and specific proposals they would try to enact on such matters in schools, state government, businesses and nonprofits if elected governor.

A 2003 report by the University of California found that implementing race-neutral admissions policies led to a “substantial decline” in the proportion of black, Latino and American Indian students entering the system’s most selective institutions.

The question raises a 2014 effort led by Latino and black Democratic members of the Legislature to repeal the ban on affirmative action. While polling shows that Democratic voters tend to favor efforts to increase opportunities for underrepresented minorities, schisms emerged on racial lines in the party when state lawmakers tried to repeal the ban.

The measure quietly sailed through the state Senate before it caught the attention of Asian American activists, who vocally argued that their children would be harmed if affirmative action were reinstated.

On popular Chinese-language social media networks, some said the number of Asian students admitted to UC schools would be slashed, called the measure the “Yellow Peril Act” and compared it to the Chinese Exclusion Act of 1882, which restricted Chinese immigration.

The activism worked – Asian American senators who supported the move expressed new reservations, and others in the state Assembly vowed to oppose it, leading then-Assembly Speaker John Perez to shelve it.

The caucuses’ letter was mailed Friday to Democrats Gavin Newsom, Antonio Villaraigosa, John Chiang and Delaine Eastin, and Republicans John Cox and Travis Allen. Some of those campaigns did not respond to a request for comment on Monday, while others said they had not yet received the letter or were formulating a response.

- Share via

Kimberly Ellis to contest ruling that upheld her loss in race for California Democratic Party chair

The drama and division over the California Democratic Party chairperson’s election does not appear to be ending anytime soon.

Kimberly Ellis, who narrowly lost the race to lead the party, announced Monday that she planned to appeal a party committee’s affirmation of the election results two days ago, a potential precursor to a lawsuit.

“While I, perhaps more than anyone, want immediate closure, I also understand my tremendous responsibility to the thousands of delegates and supporters who are counting on us to see this through to its final conclusion. No doubt, this is not the easier path, but often times the righteous one is not,” she wrote in a fundraising plea to supporters. “To turn away now would be a betrayal to my own sense of integrity and ethics.”

The election took place during the state party’s annual convention in May, and longtime Democratic activist Eric Bauman was declared the winner. Ellis’ campaign has repeatedly contested the results, reviewed every ballot cast and called into question the validity of hundreds of votes.

On Saturday, the party’s compliance review commission held an all-day hearing in Sacramento to determine the fate of 355 ballots deemed questionable. In the end, 47 votes were invalidated — 25 for Bauman and 22 for Ellis. That action, however, did not change the outcome of the election. Bauman won by 1.9%

Ellis, a Bay Area Democrat, called the review an “inherently biased process” and said she would file an appeal within 12 days, though she said she didn’t expect the commission to overturn its decision. She alleges that the six-member commission includes several Bauman supporters. The members were appointed by former chairman John Burton.

The bitter campaign exposed schisms in the state Democratic Party that echo the divide between Hillary Clinton and Bernie Sanders’ supporters during the 2016 presidential primary. Some party leaders worry that the infighting will hobble the party, which dominates California politics and is at the center of the opposition to President Trump.

Ellis did not mention a lawsuit in Monday’s email to supporters, though she has previously indicated one was likely. She also warned state party officials that she and her supporters will remain active in trying to reshape the party.

“What happens next rests on a lot of shoulders because this progressive movement to redefine what it means to be a Democrat is not going away…because we are not going away,” Ellis wrote. “We’re going to organize for progressive policies and around candidates who share our vision and be vocal against those who don’t. We all agree that Democrats need to come together; the question is what are we truly fighting for? No more same old, same old. We must have the courage of our convictions for a bigger, better, bolder vision for California – and the rest of our nation.”

FOR THE RECORD

4:30 p.m.: A previous version of this post said Bauman won by less than 1%. He won by 1.9%

- Share via

Al Gore praises Gov. Jerry Brown for climate change victory while touting new documentary

Former Vice President Al Gore has been promoting a new documentary, “An Inconvenient Sequel” — the follow-up to his Oscar-winning film about climate change, “An Inconvenient Truth.” The media tour brought him on Monday to San Francisco, where he was interviewed on stage during an event organized by the Commonwealth Club.

California lawmakers just approved extending the cap-and-trade program, the centerpiece of the state’s global warming battle. Gore noted the victory for Gov. Jerry Brown.

Gore said he was optimistic that the United States could meet its climate goals under the Paris accord, despite some research suggesting otherwise.

Some of the questions and answers drew laughs from the crowd at the Marines’ Memorial Theater.

- Share via

Watch live: Former Vice President Al Gore talks about climate change in San Francisco

- Share via

At Comic-Con, California treasurer John Chiang explains what infrastructure repair has to do with superhero movies

Comic-Con is, at its root, an escapist event for fans and obsessives of pop culture. This year it made room for public policy wonks as well.

In a lively panel called “Who Cleans Up the Mess?” at the conference Saturday morning in San Diego, a collection of politicians and civil servants looked at how civic life would be different if the dazzling superhero battles seen in blockbusters year after year came to life.

Among them was California Treasurer and gubernatorial candidate John Chiang, who used “X-Men” footage as a jumping-off point to talk about the need for infrastructure repair, and a scene of Tobey Maguire‘s Spider-Man damaging high-rises while trying to stop a runaway train to talk about the need for more affordable housing.

Another panelist, former California State Assemblyman Nathan Fletcher, referenced his military training in first restoring communications, order and human needs in crisis areas. And California Insurance Commissioner Dave Jones looked at the potential for a homeowner’s recovery.

- Share via

Early fundraising numbers show some congressional candidates building war chests, others with a long way to go

California’s congressional races are pivotal to Democratic efforts to flip the House, and there are already more than 60 candidates in more than a dozen battleground districts for the 2018 election.

Political insiders and donors are looking at the most recent campaign finance reports for indicators of who has fundraising ability. A strong early fundraising figure can deter potential rivals or draw support from the national political parties. Weak fundraising can encourage new opponents to enter the race.

- Share via

Major Democratic donor hosts Sen. Kamala Harris in the Hamptons as speculation mounts about her political future

Speculation over California Sen. Kamala Harris’ political ambitions was stoked over the weekend by her appearance at the Hamptons home of major Democratic donor Michael Kempner, a top bundler for former President Obama and bankroller for liberal causes across the country.

“So great hosting Senator Kamala Harris @kamalaharris at our Hamptons summer home today,” he wrote in a private Instagram post that featured a picture of Harris, her husband, Douglas Emhoff, and Kempner and his wife, Jacqueline. “She’s a star!”

Kendall Glazer, granddaughter of billionaire Malcolm Glazer, the late owner of the Tampa Bay Buccaneers football team and the Manchester United soccer team, replied, “Yes she is!!”

Harris’ appearance at the Hamptons event comes as rumors swirl that she is pondering a 2020 presidential run. Harris and her team have tamped down on talk of her future, arguing that she is focused on her new Senate job that she was elected to in November.

But notable events in recent months, including her speech at the women’s march on the day following President Trump’s inauguration in January and repeated interruptions by male colleagues during Senate hearings earlier this year, have thrust Harris into the spotlight.

And the former California attorney general’s visit with Kempner is sure to add fuel to such speculation. Kempner has been a top fundraiser for Obama, Hillary Clinton, the Democratic National Committee, Senate and congressional candidates, and state parties and politicians across the country.

He was among Obama’s top bundlers, raising more than $4.5 million for the former president’s campaigns and aligned Democratic efforts between 2007 and September 2012, according to the New York Times.

- Share via

California’s Rep. Adam Schiff gets a Trump nickname: ‘Sleazy’

President Trump on Monday morning criticized the Democratic leader of the House investigation into Russian attempts to interfere with the 2016 election, calling Burbank Rep. Adam Schiff “sleazy” and “biased.”

Schiff is the highest ranking Democrat on the House Select Intelligence Committee, which is examining whether the Trump campaign assisted in Russia’s efforts. The committee is meeting behind closed doors Tuesday to hear from Trump’s son-in-law, Jared Kushner.

The investigation has catapulted Schiff into the national spotlight. Schiff has become a frequent guest on cable and Sunday morning news shows, and has turned to Twitter, the president’s preferred medium, to respond directly to Trump.

It is not clear whether a particular Schiff comment angered the president. But Schiff was on CBS’ “Face the Nation” on Sunday morning to discuss Kushner’s anticipated testimony and whether Department of Justice Special Counsel Robert Mueller should look into Trump’s finances as part of the Russia investigation.

Trump told the New York Times last week Mueller would be crossing a line if he looked at the financial dealings of Trump’s business or his family.

Schiff pushed back on that in the CBS interview, saying Trump’s finances would fit the scope of the FBI special investigation into the Trump campaign’s ties to Russia.

“The president is clearly worried that Bob Mueller’s going to be looking into allegations, for example, that the Russians may have laundered money through The Trump Organization [the president’s company]. That is really something in my opinion he needs to look at. Because what concerns me the most is anything that could be held over the president’s head that could influence U.S. policy,” Schiff said.

- Share via

Dave Cogdill, who paid a political price for his role in ending the 2009 budget crisis, dies at 66

Dave Cogdill, a Central Valley Republican whose support for temporary taxes during the state’s economic meltdown ended his legislative career, died Sunday after battling pancreatic cancer, his family said. He was 66.

A real estate appraiser in Modesto, Cogdill served three terms in the state Assembly, and served as assessor of Stanislaus County after his departure from the Legislature. Since 2013, he has been the president and CEO of the California Building Industry Assn.

“He selflessly dedicated his life to his family and community,” said his son, David Cogdill Jr., in an emailed statement about his father’s death. “Throughout his life, he made such a difference in the lives of so many people.”

Cogdill was less than a year into his tenure as Republican leader of the state Senate when the state’s fiscal crisis, exacerbated by the national recession, forced lawmakers to consider a $42-billion deficit-reduction package in February 2009. The proposal included more than $14 billion in temporary taxes, embraced as a necessity by Democrats and Gov. Arnold Schwarzenegger but angrily denounced by most Republicans.

Cogdill helped craft the deal as one of the Legislature’s leaders, but found it a hard sell with his fellow GOP senators. Over the course of several days, no Republican in the Senate would join Cogdill in supporting the plan. Two other GOP senators ultimately agreed to the deal, which Schwarzenegger immediately signed into law.

Shortly after midnight on Feb. 15, 2009, a majority of members of Cogdill’s caucus fired him as leader during a heated closed-door meeting — during which reporters gathered in the hallway could hear the shouting. Cogdill calmly returned to his seat on the Senate floor as Sen. Dennis Hollingsworth (R-Murrieta) was announced as the Republican leader.

Three days later, Schwarzenegger praised Cogdill, telling reporters that the Republican “did what was right for the people.”

On Sunday, the former governor took to Twitter to praise his fellow Republican.

“Dave Cogdill was a fantastic friend, a great leader & a true public servant who put the people above all else,” Schwarzenegger wrote.

Gov. Jerry Brown echoed those comments, writing in a tweet that the late GOP leader “always put [California’s] interests above party.”

Cogdill did not run for reelection to the state Senate in 2010, and returned home to Modesto. That same year, he and the three other legislative leaders who crafted the multibillion dollar deficit package were awarded the Profile In Courage award by the John F. Kennedy Library Foundation.

“It’s an example for legislators across the country and also for Americans that we really need to solve the problems that our country faces,” said Caroline Kennedy, the late president’s daughter, in a 2010 television interview on the award presented to California’s four legislative leaders.

Cogdill is survived by his wife and two adult children.

Update July 24 9:51 a.m.: This story has been updated with comments from former Gov. Arnold Schwarzenegger and Gov. Jerry Brown. It was originally published at 10:21 a.m. on July 23.

- Share via

Eric Bauman confirmed as leader of California Democratic Party as rancor over close vote continues

After spending weeks sifting through allegations of vote stuffing and corruption, a California Democratic Party panel on Saturday affirmed the election of Eric Bauman as the party leader.

The decision is not expected to bring the bitter fight over the election to an end.

Bay Area Democratic organizer Kimberly Ellis, who lost the race for party chair to Bauman by just 57 votes, has indicated she will likely mount a court challenge.

She has accused the party’s six-member compliance review commission of being biased in Bauman’s favor, and Ellis’ political consultant dismissed Saturday’s hearing as “bad political theater” before it even started.

The bitter fight has exposed schisms in the state Democratic Party that echo the divide between Hillary Clinton and Bernie Sanders’ supporters during the 2016 presidential primary. Some of the state’s top Democratic Party leaders and activists worry that the internal feud may fracture the party, which dominates California politics, and hobble the state’s role in opposing the policies of President Trump and the Republican Congress.