Another effort to tax ‘extreme wealth’ in California is launched in Legislature

- Share via

SACRAMENTO — A handful of Democrats in the state Legislature are pushing again for a tax on “extreme wealth” in California, a move they say could bring the state billions in revenue by raising taxes on households worth $50 million.

But if last year is any indication, the legislation faces an uphill battle.

The new bill by Assembly Member Alex Lee (D-San Jose) reintroduces a proposed tax hike for the state’s richest residents, potentially affecting about 15,000 Californians, or 0.07% of taxpayers. The proposal would apply a 1% tax on those with a net worth of at least $50 million and a 1.5% tax on those worth more than $1 billion.

The proposal is projected to bring in more than $22 billion a year in state revenue, according to an analysis by professors at UC Berkeley and UC Davis.

The bill, which would go into effect next year for billionaires and in 2025 for eligible millionaires, would go to the voters for approval in 2022 if it passes the Legislature. The proposal requires voter approval of a constitutional amendment because it would exceed the state’s tax rate limits of 0.4%.

Lee’s legislation would not constitute an income tax, but a tax on assets and “all wealth” whether it has “been realized as income or not,” he said. Lee pointed to reports of some of the richest people in the world avoiding income taxes as the reasoning behind the approach.

“There’s a whole other category of wealth where you just own things and can leverage more wealth out of your existing wealth and we’ve seen how that can be evaded,” Lee said in an interview Thursday. “We want the obscenely ultra rich to be paying their fair share.”

California’s wealth gap is no secret: The state is home to the largest share of the country’s billionaires and also the highest poverty rate.

Californians voted to increase taxes on those earning more than $250,000 a year in 2012 and extended that increase in 2016, but despite a Democratic supermajority in the Legislature, a wealth tax like Lee’s has faced criticism.

Last year, an identical attempt by Lee didn’t even make it to legislative committee hearings.

A 2020 bill by Assembly Member Miguel Santiago (D-Los Angeles) that would have raised taxes on Californians earning at least $1 million in order to fund schools and other government services also failed. A pitch by Assembly Member Luz Rivas (D-Los Angeles) to boost taxes on wealthy corporations to benefit homeless Californians didn’t make it far, either.

Gov. Gavin Newsom, who has focused a large share of his budget on helping people in poverty, has also avoided the idea of increasing taxes on the wealthy.

California’s progressive tax structure already makes the state budget disproportionately dependent on the wealthiest. Even in a business-crushing pandemic, the state is facing another record-high budget and surplus thanks in large part to capital gains income as the rich became richer, resulting in more tax revenue.

But supporters of AB 2289, including the California Federation of Teachers, say that’s not enough.

“California billionaires have increased their wealth astronomically since the beginning of the pandemic, while regular working families have struggled to pay their bills,” CFT President Jeff Freitas said in a statement. “It’s time we took care of each other, and not just watch billionaires fly into space.”

The California Taxpayers Assn. quickly opposed the new legislation on Thursday, saying that it would cause top earners to move away and would have a negative impact on state revenue.

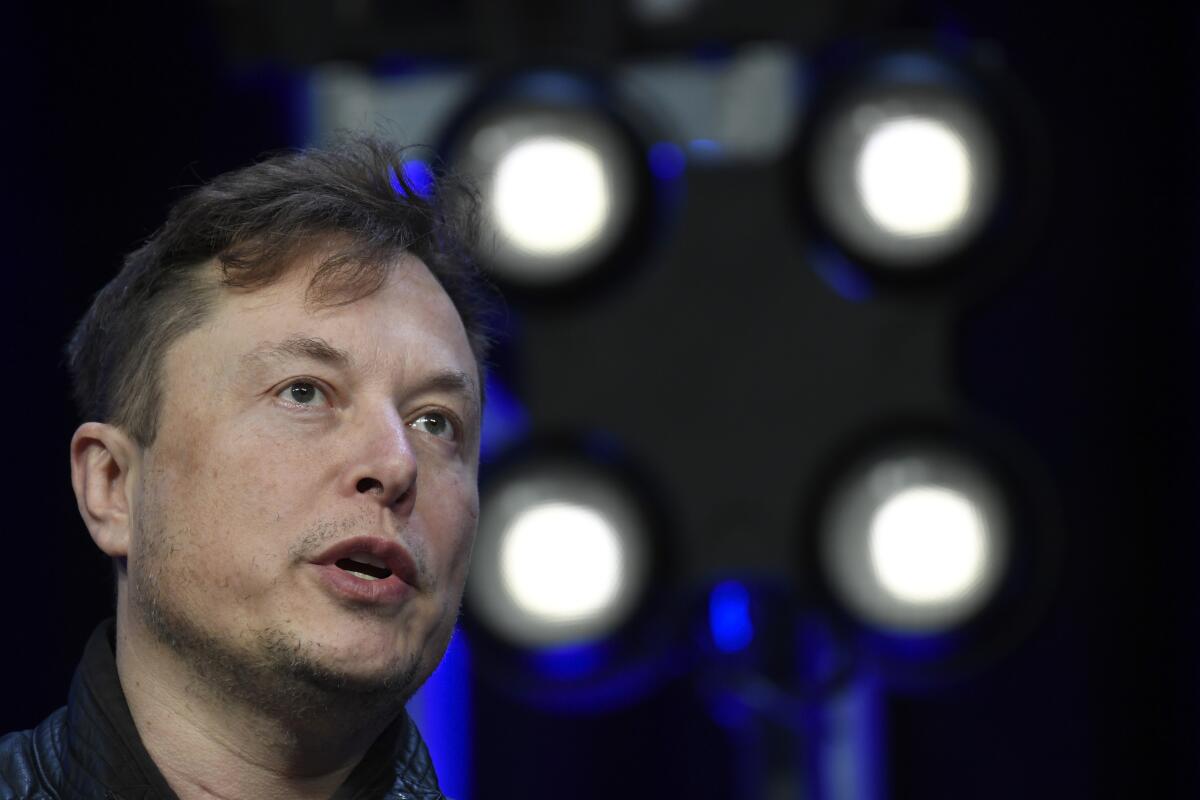

Tesla Chief Executive Elon Musk last year moved the company headquarters from Palo Alto to Texas, where taxes are much lower.

A report by the nonpartisan California Policy Lab found that there’s “little evidence that wealthy Californians are leaving en masse,” but the threat of such a loss remains.

“The new-and-not-improved proposal will prompt more wealthy Californians to pack their bags and move — a bad idea considering they represent a major portion of our tax base,” California Taxpayers Assn. President Robert Gutierrez said in a statement. “If high earners leave — and they will to avoid the tax hike as well as the headache of having to annually appraise everything they own, anywhere in the world — the taxpayers left in California will be asked to pay more.”

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.